While talking heads buy-the-dip because The ECB (et al.) will do whatever it takes, at least one ECB member is not as gung-ho about bailing out banks once again.

Governing Council member Klaas Knot, admittedly among the most hawkish members, warned that the European Central Bank’s new round of loans for banks needs to be “more conservative and less generous” than the previous one.

The ECB doesn’t “want to prolong dependence of the banking sector on longer-term funding from central bank any longer than necessary,” the Dutch governor said in a Bloomberg Television interview with Francine Lacqua at the International Monetary Fund gathering in Washington.

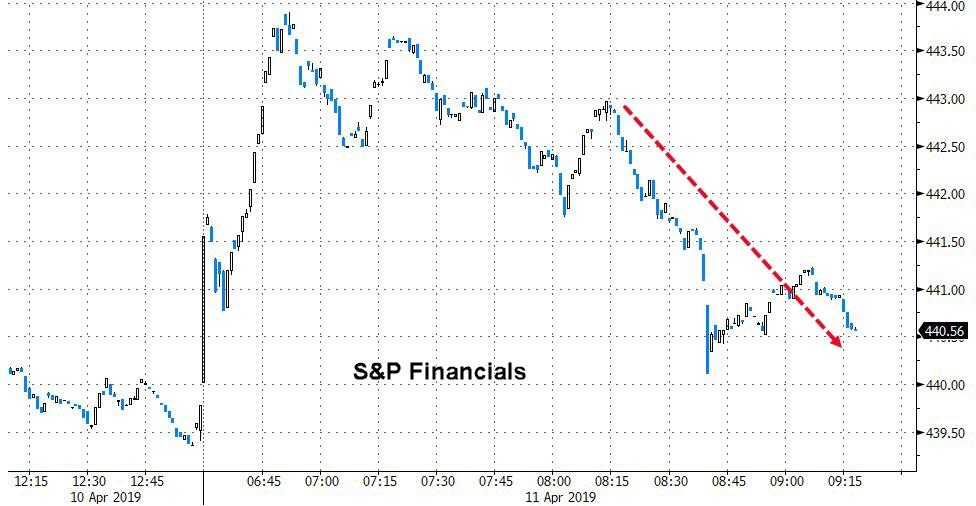

While European markets were shut by the time he spoke, there was a clear reaction in US stocks (contagiously)…

And EURUSD…

Knot also confidently proclaimed that:

“We were never out of ammunition,” he said. “If we need ammunition we can find ammunition.”

And as Bloomberg reports, the Dutchman also expressed his opposition to a potential move by the ECB to soften the effect of its negative interest rates on banks, insisting that the policy has actually stimulated credit growth.

“I would prefer stronger banks, but mainly for financial stability,” Knot said, adding that it was “a little bit outside the realm of monetary objectives.”

On negative rates, Bank of Italy Governor Ignazio Visco said,“we said that the side effects will be considered and obviously this is the time span that we have in mind.”

via ZeroHedge News http://bit.ly/2GfFpE5 Tyler Durden