Just minutes after Bloomberg reported that ‘Flash Boys’-like trading manipulation is rampant on certain cryptocurrency exchanges, the entire crypto space tumbled on heavy volume.

According to a paper from researchers at Cornell Tech and several other universities, special arbitrage bots are anticipating and profiting from ordinary users’ trades on decentralized exchanges, which let them trade more directly.

“We have no idea what the extent of the malfeasance is on centralized exchanges,” he said in a presentation last week during a blockchain conference at Cornell Tech’s New York City campus.

“If we extrapolate from what we’ve seen on DEXes, it could well be on the order of billions of dollars.”

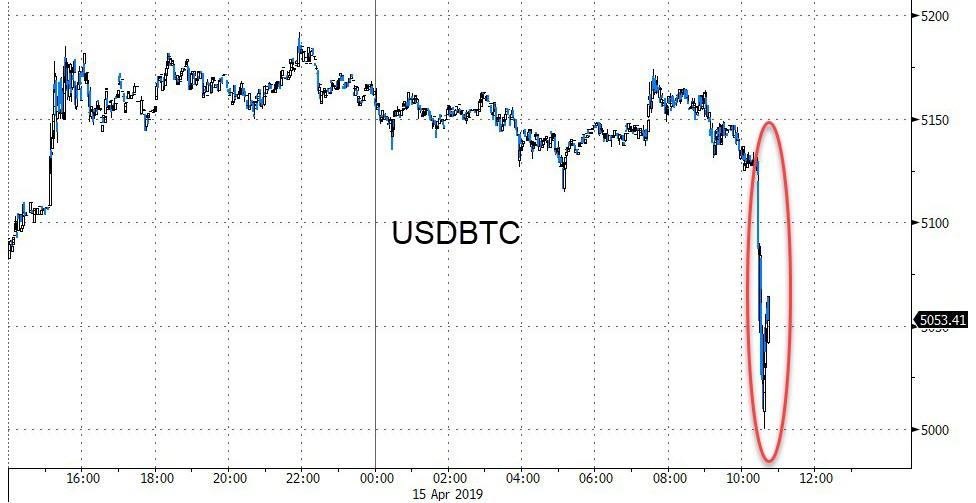

Bitcoin tumbled to exactly $5,000 before bouncing (nope, no algos here at all)…

As Bloomberg concludes, the study is the latest red flag in a market that has been beset by allegations of manipulation since its onset a decade ago, including a recent report that said nearly 90 percent of exchange volume was suspect.

Of course, when this occurs in the equity market space, as long as prices go up, no one worries.

via ZeroHedge News http://bit.ly/2VL6Nzt Tyler Durden