Was there any “good news” in today’s release of March containerboard and box data? If so, BMO’s Mark Wilde – and the market – missed it.

As the Canadian bank’s analyst wrote in an urgent dispatch, “markets have deteriorated rapidly” as box demand tumbled 3%, operating rates fell to 86.4% and exports slumped 19% y/y (containerboard and box shipments are a coincident indicator of trade momentum, and the latest data is quite simply a dire signal for global trade). As BMO points out, even with big production cut, “inventories fell less than the seasonal norm” and risk has increased that North American prices will follow sharp erosion in global prices.

What happened?

Following the release of the latest, March figures by the American Forest & Paper Association and the Fibre Box Association for containerboard mill and downstream corrugated box plants (impacting such producers as IP, WRK, PKG, and GEF), the market was in shock.

The reason: box demand was much weaker-than-expected, amid continued global trade war fallout. Furthermore, actual and “average week” shipments were down 3% y/y, far less than even the more bearish estimates of 1-2.5% growth. Putting the number in context, this was sthe worst comp since January 2016 – when global markets were in a post-China devaluation bear market – and when blended box volumes fell 3.2%. “With an uptick in March ISM index, we expected some strength” BMO writes… but it did not get it, suggesting the ISM index – and broader expectations of a global economic “green shoot” – has been wildly wrong.

Some more details, courtesy of BMO:

- Overall mill operating rates fell to their lowest levels in almost a decade. March’s 86.4% was below a very weak February (89.5%). Anything below 92-94% to be “buyers’ market” territory. Linerboard was at 84.0%, medium at 92.5%.

- Exports fell sharply again, -18.9% y/y to 354.2k tons. Offshore prices have been under increasing pressure since last autumn. Trade paper pricing is down ~$75-100/ ton; spot transactions have been reported at much lower levels

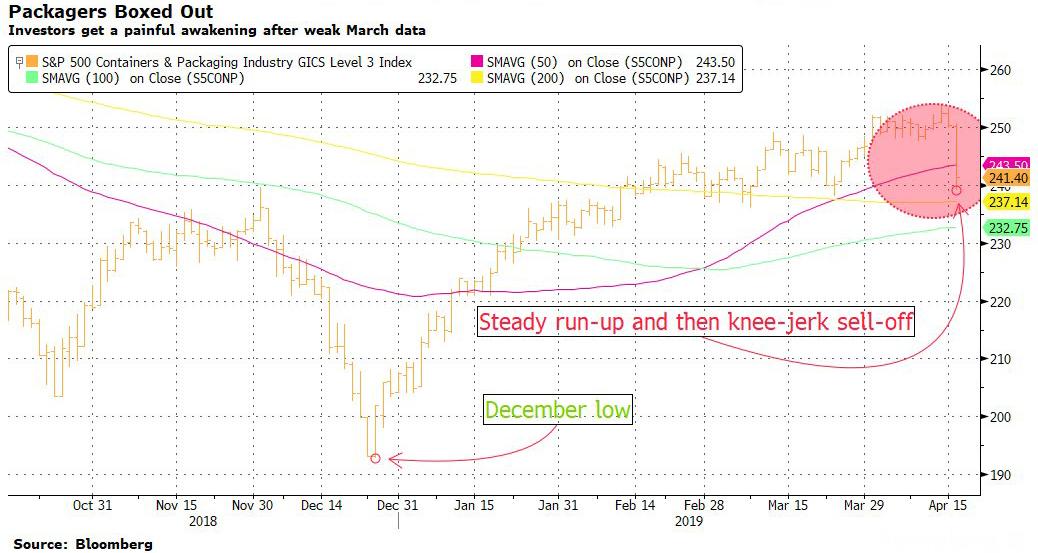

The containerboard news shocked traders and within an hour of the market open wiped off more than $3 billion in industry market-cap. According to Bloomberg, while the S&P 500 Containers & Packaging Industry Index (S5CONP) had bounced back from its December 26 low and was up about 24 percent throughMonday – and had been trading above all its major daily moving averages – following the release of the March data – a leading indicator to global economic strength, or in this case lack thereof – the index dropped as much as 4.5 percent Tuesday, and fell below its 50-day moving average for the first time since early January. It was the worst single day for the benchmark since mid-December, and trading volume was above average too.

As Bloomberg explains this morning, although lower March prices had been reported by the industry journal Pulp & Paper Week, that had also been flagged in dispatches last month; so hope was brewing in the sector that cuts were likely the bottom and it wouldn’t get much worse: “We expected pricing to hold at current levels,” BofAML analyst George Staphos wrote in a note, citing macro/sector trends and the packagers’ efforts to manage their supply-demand.

Alas, it did get much worse, and the shoe dropped Tuesday, when box shipment data was released for March, and as explained above, came in much weaker than investors expected. A decline in box shipments is the main takeaway from the March box data and “it’s hard to spin that number as anything other than disappointing,” according to Seaport Global analyst Mark Weintraub.

Packaging investors now await the next big catalyst, the latest containerboard pricing data from Pulp & Paper Week set to be released post-market on Friday. The consensus among analysts right now is that that’ll show still another price cut.

“Do prices go down next weekend? We don’t see it as a fait accompli but the risk definitely got higher,” Weintraub said.

Of course, should the containerboard carnage continue, while investors in the sector will likely be facing even greater losses, the bigger question is what does this dismal data – which suggests that any economic “green shoots” have been a mirage – mean for the global economy. Spoiler alert: with demand for boxes, and thus shipments, trade and logistics collapsing, the answer is “nothing good.“

Keep a close on FedEx for yet another profit warning.

via ZeroHedge News http://bit.ly/2IlaQza Tyler Durden