In addition to preaching against the dangers of capitalism and warning that unless America can fix its growing inequality problems, it faces a “revolution“, Bridgewater’s Ray Dalio appears to have been reading the research reports by Michael Wilson.

As a reminder, one of the recurring themes laid out over the past year by the bearish Morgan Stanley chief equity strategist, is that with corporate – and especially tech – profit margins near all time highs, there is little opportunity to further “cut into the muscle” and boost earnings by further shrinking compensation costs, especially with wage growth now solidly above 3%. It’s also the main reason why Q1 earnings season is expected to see a drop in EPS despite continued growth in revenues.

Echoing these concerns in a Wednesday report, Bridgewater cautions that the major drivers of high U.S. corporate profit margins are unsustainable and “now under threat”, and will eventually result in much lower equity prices.

“Over the last two decades, U.S. corporate profit margins have surged and have contributed more than half of the excess return of equities relative to cash,” said the world’s largest hedge fund, according to Reuters. “Without that consistent expansion of margins, U.S. equities would be 40% lower than they are today.”

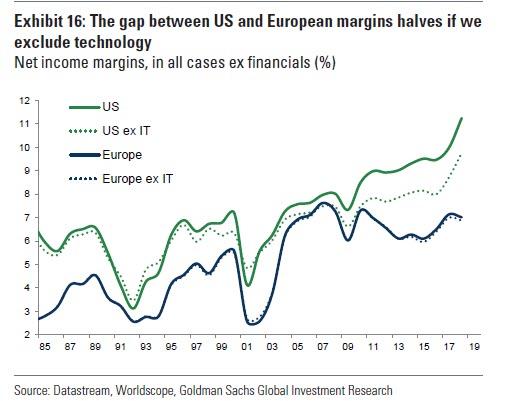

Reiterating many of the points we discussed in a February article, Bridgewater writes that over the last few decades almost every major driver of profit margins has improved, although as shown in the chart below this has largely been the result of much stronger US profit margins in general, and tech companies in particular.

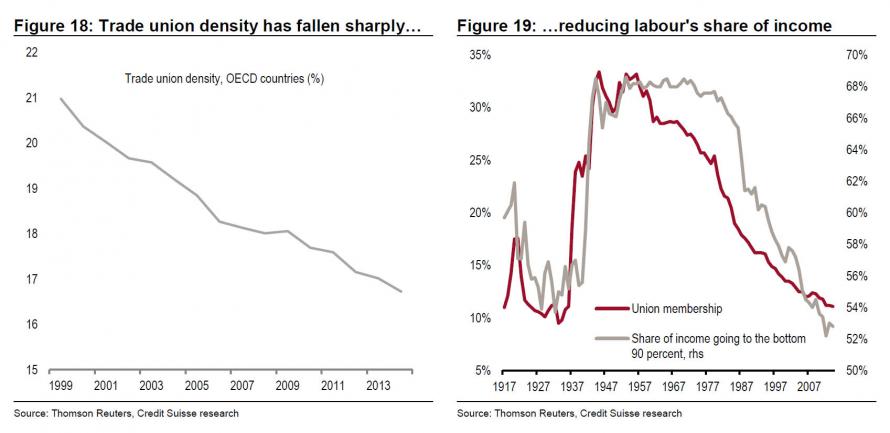

“Labor’s bargaining power fell, corporate taxes fell, tariffs fell, globalization increased, technology allowed for greater scale and lower marginal costs, anti-trust enforcement fell, and interest rates fell. These factors have produced the most pro corporate environment in history. Many of these drivers of high profit margins are now under threat.”

Looking ahead Bridgewater predicts that “some of the forces that supported margins over the last 20 years are unlikely to provide a continued boost,” and adds that “incentives for offshore production have been reduced as global labor costs have moved closer to equilibrium, with domestic costs and rising trade conflict increasing the risk of offshoring, while the potential tax rate arbitrage from moving abroad is now much smaller.”

More importantly, with much of the increase in net worth over the past decade being allocated almost exclusively to the 1%, this has led to a backlash against the very forces that made this margin expansion possible, as a result popular sentiment has begun to turn against the forces driving corporate profits, as well as against the companies that have benefited most.

“We are in the midst of a populist backlash against rising inequality and increasingly seeing a move toward more protectionism,” it said in the report. “Recent surveys show increasing animosity toward globalization and the power of companies more broadly and a bit more welcoming attitudes toward government regulation of firms.”

Bridgewater also spotlighted the growing discussion about taxing mega-profitable firms that have benefited from current government policies. For example, Europe’s potential “digital services tax” is explicitly designed to close the tax arbitrage by introducing a sales tax on online revenues from residents, the report said.

The ominous conclusion: “while the current impact of these proposed rules on the overall profitability of these tech giants is relatively small, they are a straw in the wind that the tide might be turning and that the multi-decade boost from favorable taxation policies is unlikely to be repeated.”

Whether Bridgewater is now trading in anticipation of a secular decline in profit margins remains unclear.

via ZeroHedge News http://bit.ly/2IpESlu Tyler Durden