All hope-filled eyes are straining at tonight’s data deluge from China for signs that confirm the PMI spike (and exports rebound) that fueled the latest leg higher in global stocks and bond yields.

Remember, the official narrative is that after a rocky start to the year, the roll out of targeted stimulus has boosted investment, bouyed consumption and helped the manufacturing sector.

Or put another way, thanks to unprecedented injections of credit and endless fiscal and monetary largesse, Chinese stocks have tracked aggressively higher, following China’s world-leading credit impulse back from the abyss…

And thanks to that resurgence of China’s credit impulse (in the face of a Fed that has talked a lot but done nothing), the divergence between US and Chinese macro data performance is at an extreme…

And yet – amid all this exuberant indication – China GDP growth is expected to slow in Q1.

The headliner…

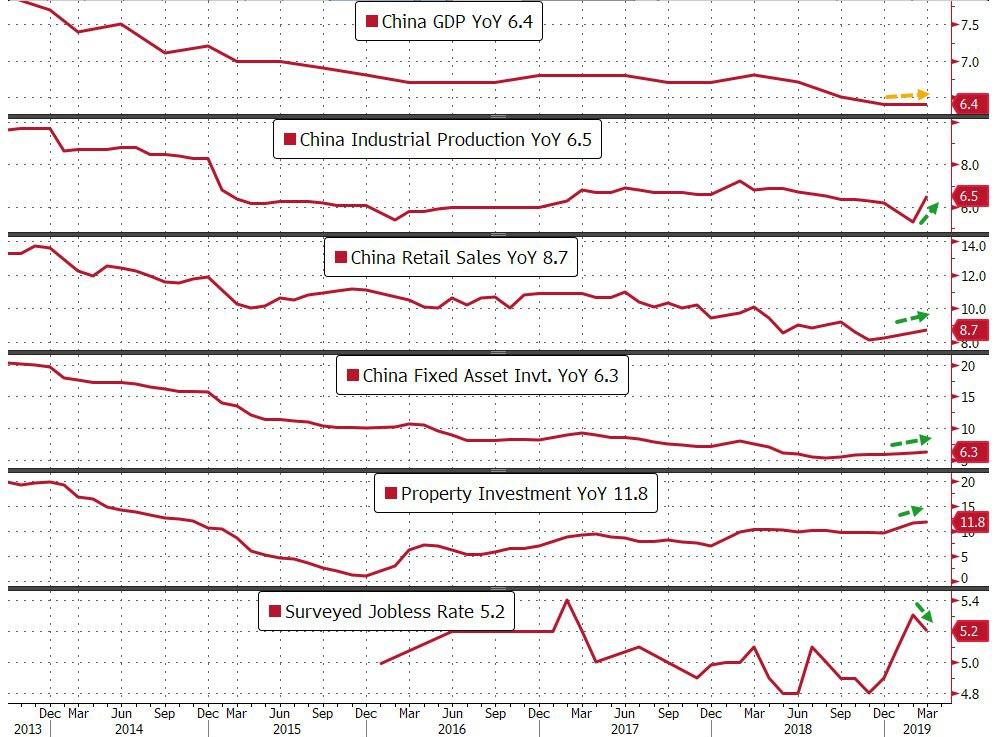

China Q1 GDP Growth YoY BEAT at +6.4% vs +6.3% expected (and +6.4% prior)

That is still equal to the weakest Chinese growth on record (at least 27 years), the same as the Q1 2009 plunge lows.

And the undercard:

China March Industrial Production YoY BEAT at +6.5% vs +5.6% expected (up from +5.3% prior)

China March Retail Sales YoY MEET at +8.3% vs +8.3% expected (up from +8.2% prior)

China March Fixed Asset Investment YoY MEET at +6.3% vs +6.3% expected (up from +6.1% prior)

China March Property Investment YoY ROSE to 11.8% from +11.6% YoY prior

China March Surveyed Jobless Rate FELL to 5.2% from 5.3% prior

Graphically…

All of which could be a problem.

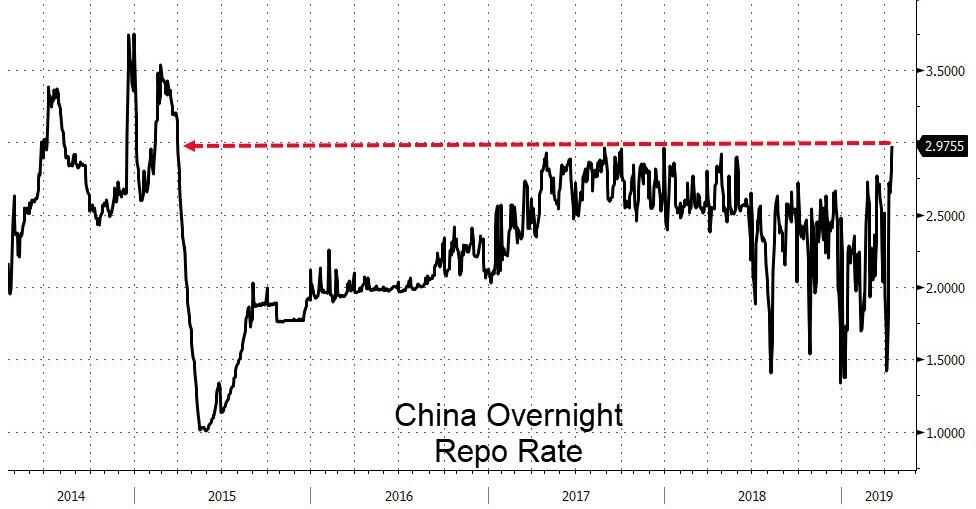

As Bloomberg notes, for China bonds, already the worst performer among the world’s debt markets this year, things may be about to get worse. The figures tonight on the economy confirm broad improvement for March. That’ll tend to help stocks and sap demand for the safety of government debt. What’s more, the PBOC is adopting a hawkish tone, emphasizing it plans to control excessive money supply amid signs of a recovery. Overnight repo rates just jumped to the highest in 4 years…

As Bloomberg notes, much of this year’s rally in bonds and stocks have to do with the PBOC re-opening liquidity tap. But China’s central bank is now stepping back. Here’s the timeline:

The much anticipated reserve ratio cut on April did not materialise; the PBoC skipped open-market operations for 18 days in a row; this morning, the new MLF PBOC offered is not enough to cover the retiring one.

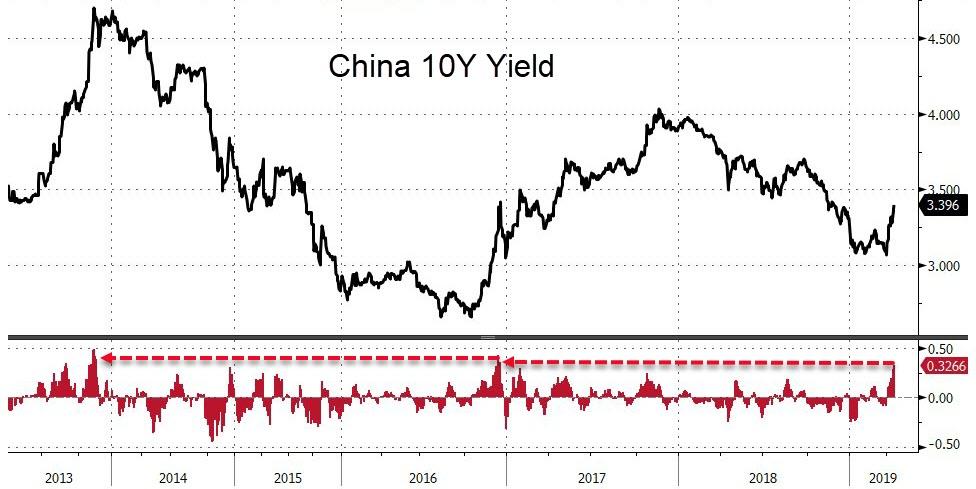

All of that suggests the government will have a tough time finding buyers for its 1- and 10-year bonds up for sale Wednesday.

And with Chinese yields accelerating at an extreme pace, we wonder if China’s unprecedented stimulus (record credit injections and endless fiscal and monetary promises) may be about to bite them in the arse as it appears there is at least one nation left with Bond Vigilantes still standing… who will stymie a fragile economic rebound with a soaring cost of capital and a vicious cycle that PBOC will struggle to escape – withdraw/slow stimulus chatter to avoid incendiary default-inducing rate spike (but face economic and equity market slump), or keep the pedal to the metal blowing bubbles around the world until it all goes pop.

In the immortal words of Britney Spears, “oops, they did it again.”

via ZeroHedge News http://bit.ly/2Uhs1Dm Tyler Durden