Just as China pulled a growth rabbit out of its hat of magic goalseeked economic tricks, leading to speculation that the global economy is turning and “green shoots” are starting to emerge, most of Wall Street’s professional investors were preparing for the worst, with two-thirds once again falling into the “secular stagnation” camp ahead of what is now a consensus call for a recession in the second half of 2020.

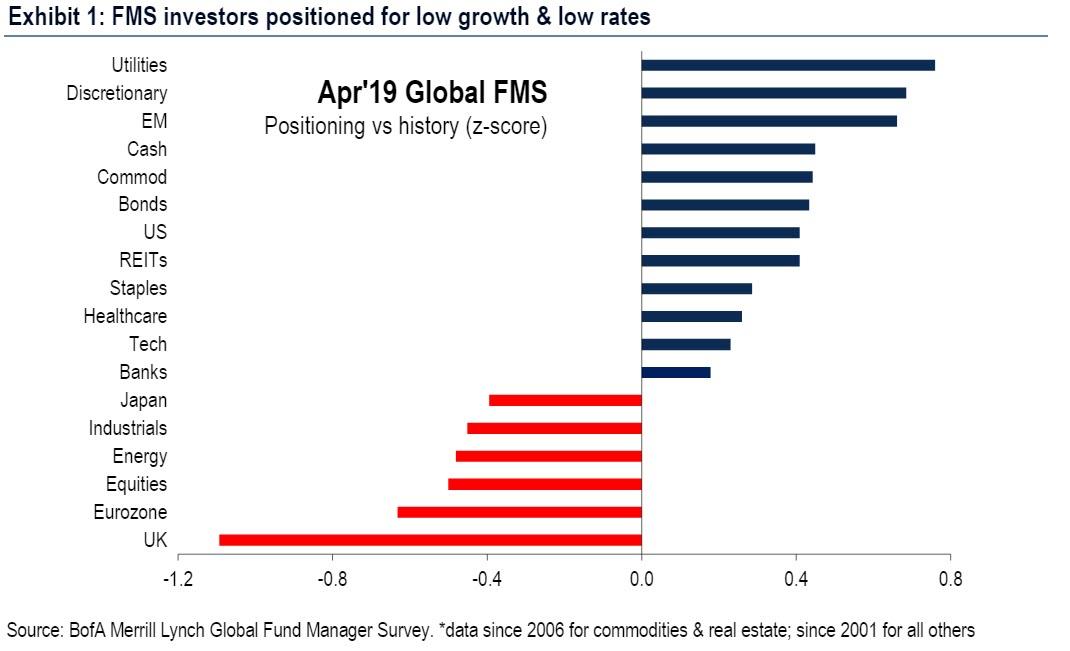

According to the latest monthly Fund Manager Survey conducted by Bank of America which polled 239 investing professionals with an AUM of $664 billion in the April 5-11 period, investors are now positioned for “secular stagnation” – even as they dipped their toe into risky assets – “They are long assets that outperform when growth and rates fall, like cash, EM and utilities, while short assets that require higher growth and rates, such as equities, the Eurozone and banks” said Michael Hartnett, chief investment strategist and organizer of the monthly Fund Manager Survey.

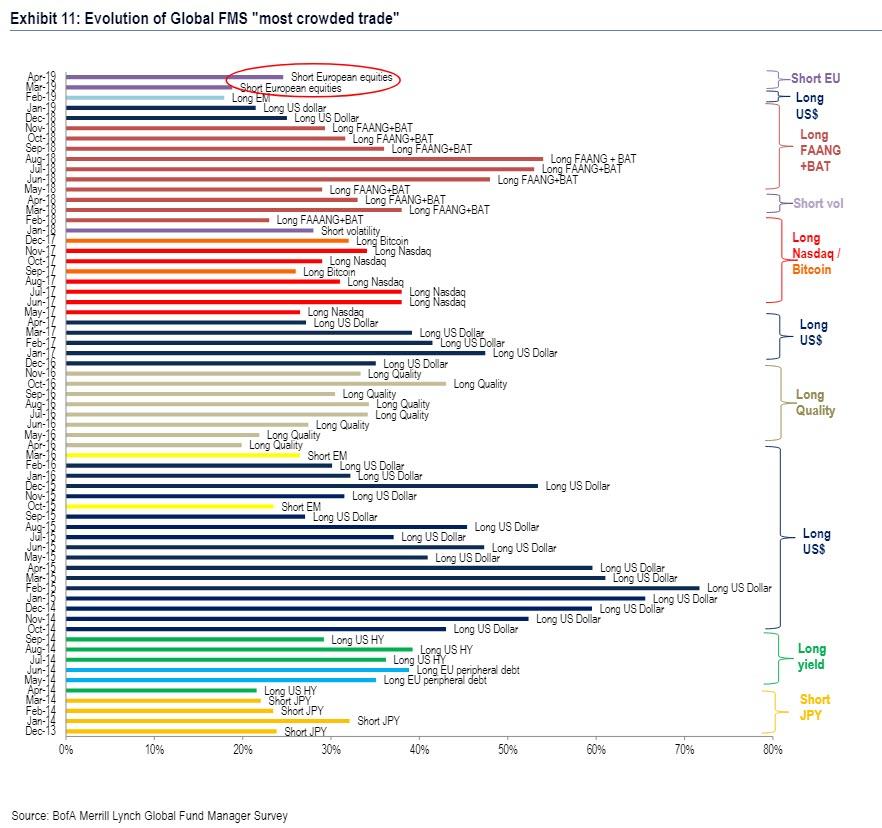

Indeed, for the second consecutive month, “Short European Equities” is seen as the most crowded trade on Wall Street (more below), just as European stocks are back to levels last seen in August 2018, as the “max pain” trade remains true to its name.

“FMS investors added a bit of cyclical risk this month but are still firmly positioned for secular stagnation,” said Michael Hartnett, chief investment strategist and organizer of the monthly Fund Manager Survey.

Here are the notable highlights from the April edition of the FMS:

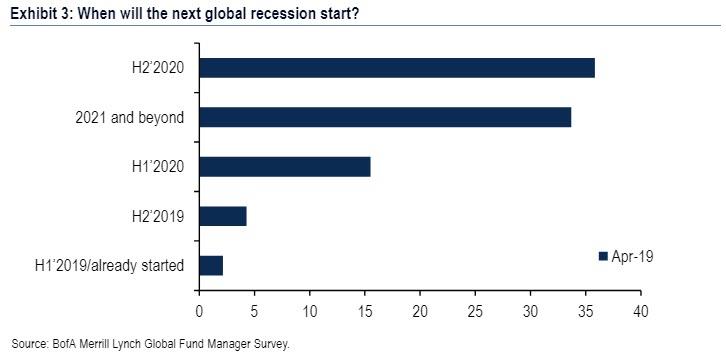

No recession: 70% of investors surveyed expect a global recession to start in the second half of 2020 or later…

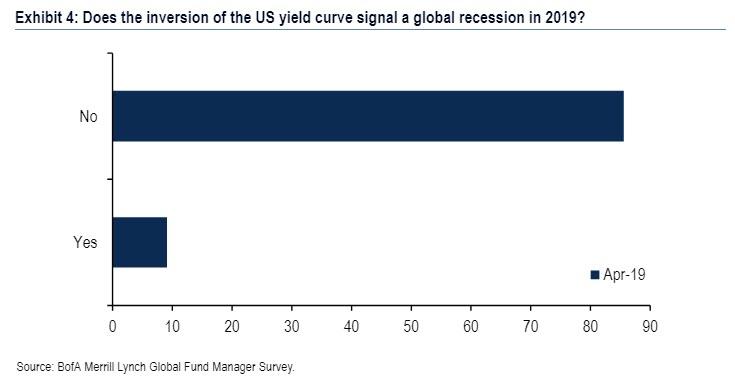

… yet somewhat paradoxically, a whopping 86% believe yield curve inversion does not signal an impending recession, which begs the question: if everyone is discounting the yield curve as a signaling mechanism, why is everyone so convinced that a recession is coming… and tied to that, why is everyone so certain that a yield curve inversion does not indicate a recession?

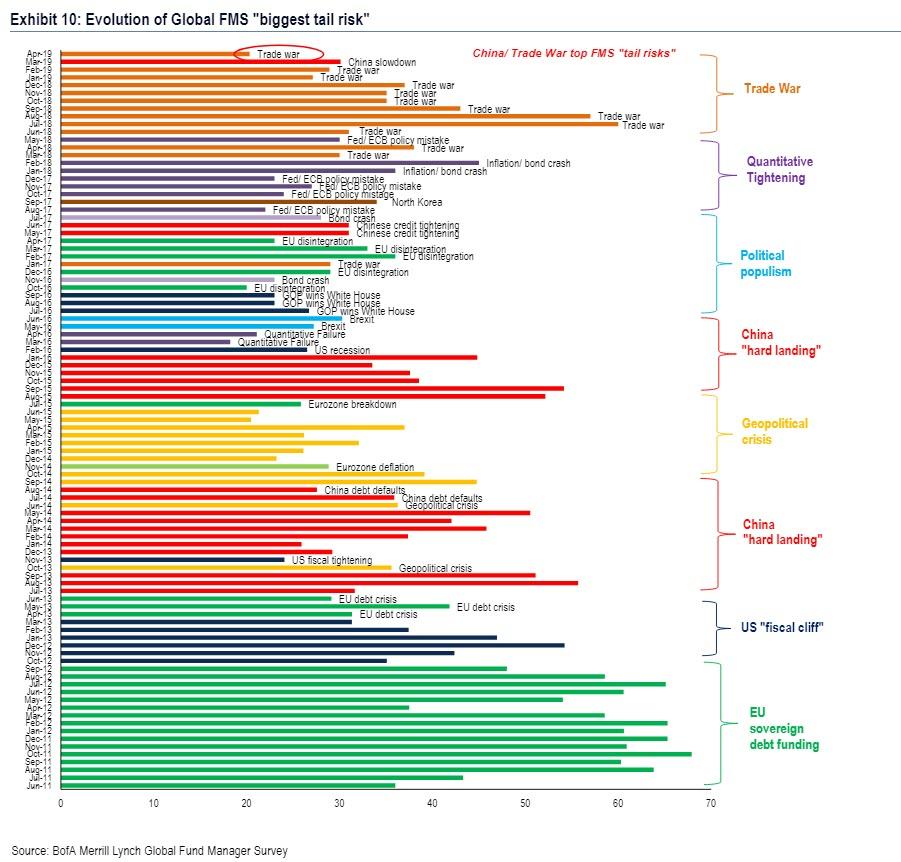

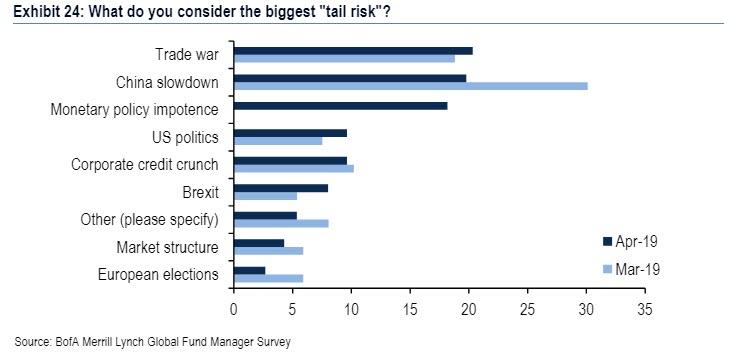

No boom: with the top 2 “tail risks” of trade war & China slowdown (albeit with a far small conviction than on prior months) keeping growth expectations low, positioning to equities and cyclicals remains well-below normal…

… and unlike March when investors were terrified by a Chinese slowdown, in April the two biggest “risk” are neck and neck, with Trade War just fractionally edging out China Slowdown as the biggest tail risk, with both getting 20% of the vote. The real tail risk – for both capital markets and western society in general – monetary policy impotence, came in third at 18%.

… while for the second consecutive month, “short European equities” remains the most “crowded trade” which judging by the impressive return of European stocks YTD would suggest that much if not all of the action is the result of another backbreaking short squeeze.

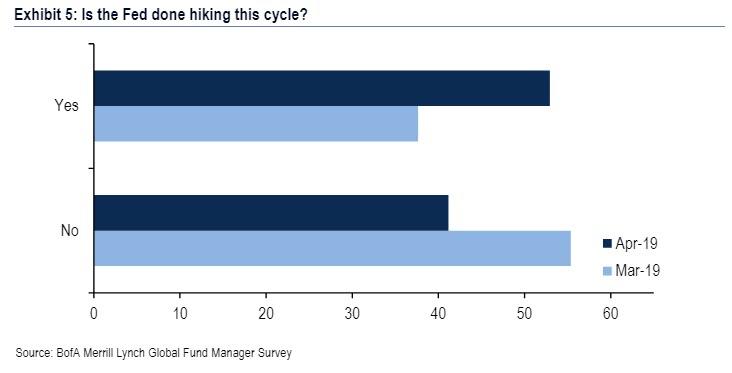

No hikes: a slim but distinct majority agree with Larry Kudlow that the Fed is done hiking interest rates this cycle (unclear if that extends to the rest of Larry Kudlow’s life)…

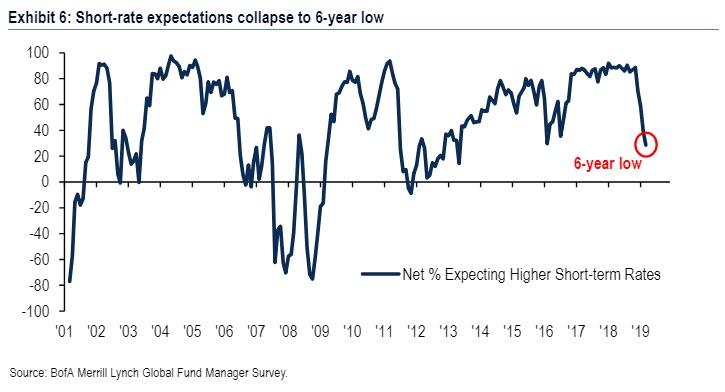

… while just 13% expect higher short-term global rates – the lowest level since August 2012.

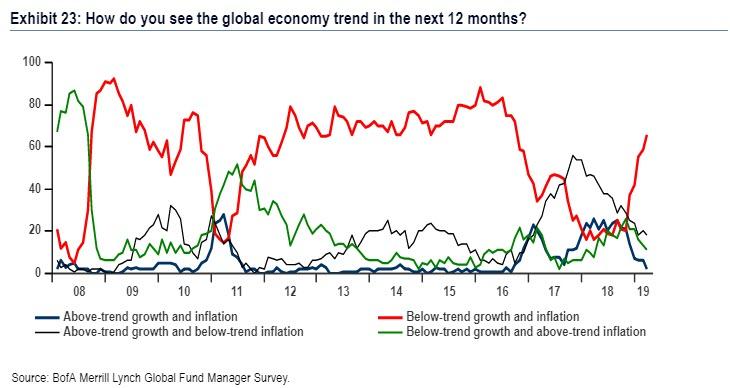

No growth… and yes to secular stagnation: 66% expect “low growth, low inflation” backdrop, the highest level since Oct’16; allocation to global bank stocks falls to lowest level since Sep’16.

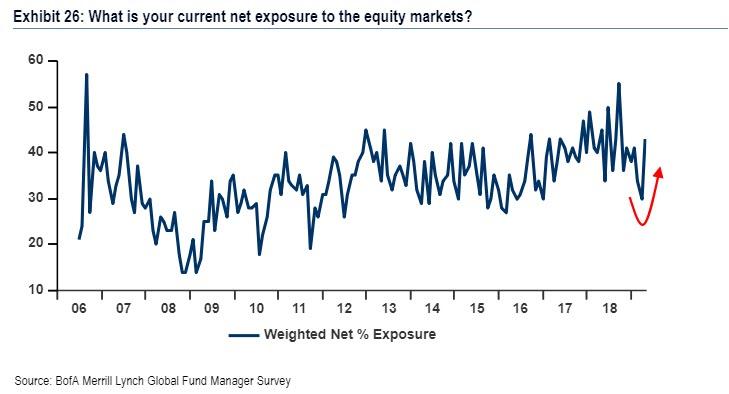

Of course, the now traditional cognitive dissonance exhibited by professional investors was again fully present in the latest FMS, and even though two thirds say they expect continued slowdown in the economy, there was a market rebound in those who are long stocks. According to BofA, “net 43% of FMS Hedge Fund investors said they are net long equities markets, up 13ppt MoM – March was the lowest since Dec’16.”

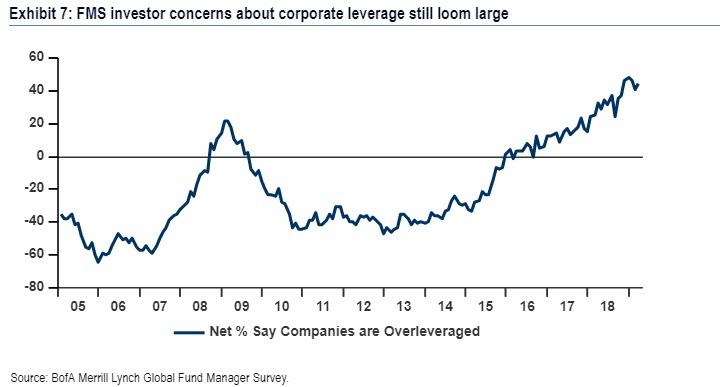

Adding to the confusion, despite allocating more cash to stocks, 44% said corporations are excessively leveraged; 43% say corporates should “improve their balance sheet”…

… and just 16% want more stock buybacks & dividends… even though as Goldman recently admitted, buybacks have been the sole source of equity upside for much of the past decade.

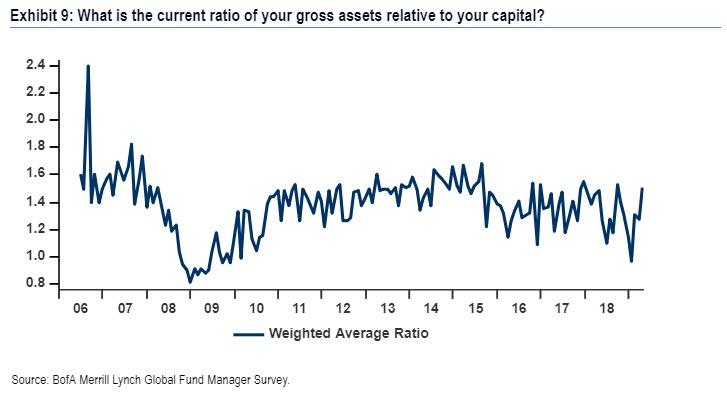

What is behind this seemingly conflicting posture of expecting even more economic pain coupled with allocating more assets to stocks (besides hope for rate cuts and/or QE4 at some point)? According to Hartnett the answer is simple: the infamous “Hedge funds chase” is on, and with 43% gross leverage (assets>capital) and net equity exposure (longs-shorts % capital) – both highest since Sept’18 – the “melt up” predicted by Larry Fink may be imminent.

So what should one do with this information? To BofA there are two conclusions:

- Contrarians should buy energy vs. utilities, buy Eurozone vs. EM, buy equities vs. cash, and

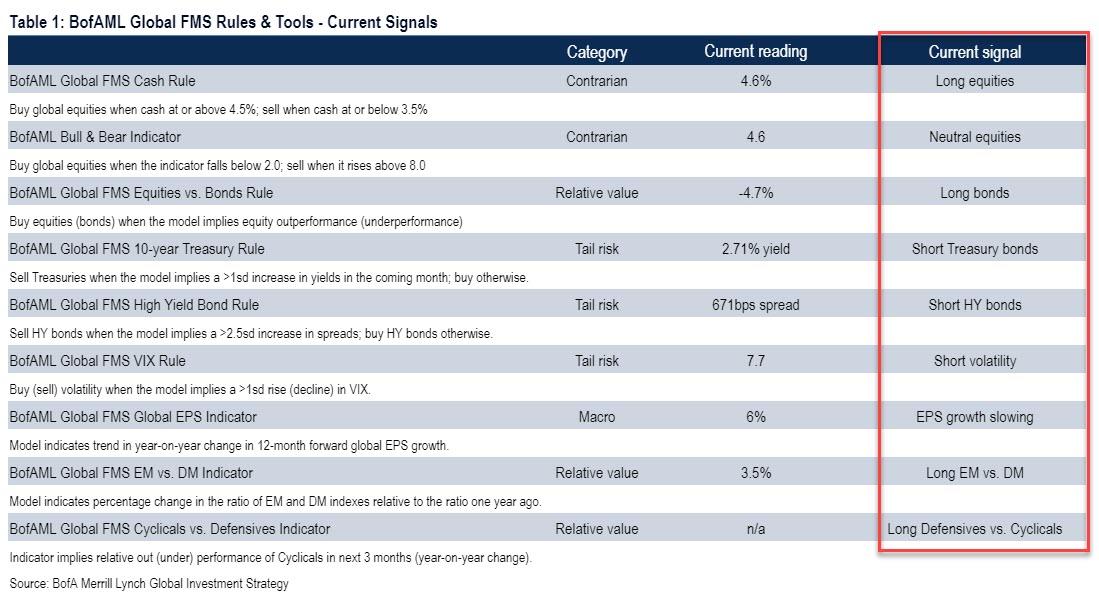

- BofA’s “Bull & Bear Indicator” is still neutral at 4.6; however other proprietary FMS rules are long risk assets and predict 2.75% on 10-year Treasuries.

More importantly, with positioning set to be whipsawed as investors rotate out of defensive sectors and into cyclicals, the question is whether VIX, which earlier today dropped below 12, sliding to the lowest level since last August, will finally rebound, or whether it will keep shrinking and, in a repeat of 2017, slump into the single digits as central banks reassure investors that there are no risks left.

via ZeroHedge News http://bit.ly/2VRjAQE Tyler Durden