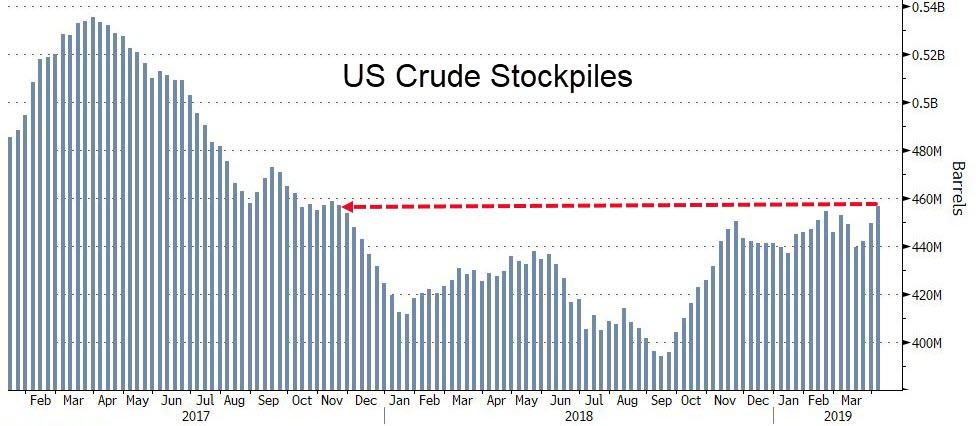

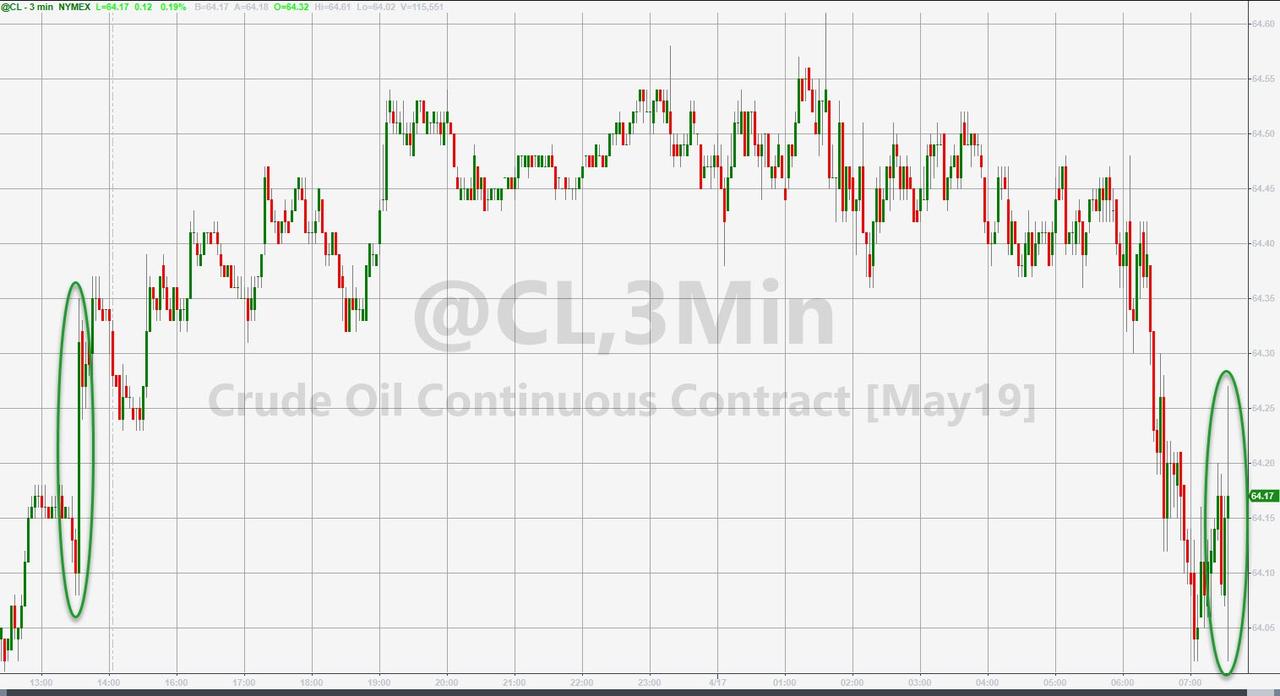

WTI has erased the overnight gains following API’s surprise crude draw despite ‘good’ news from China on growth overnight as all eyes are focused once again on inventories already at the highest since 2017.

“As long as the products look like they’re still trending strong and it looks like demand is still there, prices will be supported,” says Ashley Petersen, an analyst at Stratas Advisors

API

-

Crude -3.096mm (+2.3mm exp)

-

Cushing -1.561mm

-

Gasoline -3.561mm – 9th draw in a row

-

Distillates +2.33mm

DOE

-

Crude -1.396mm (+2.3mm exp)

-

Cushing -1.543mm

-

Gasoline -1.174mm – 9th draw in a row

-

Distillates -362k

Inventories fell across the board in the energy complex with DOE confirming (though less so) API’s reported surprise crude draw and gasoline’s 9th weekly draw in a row.

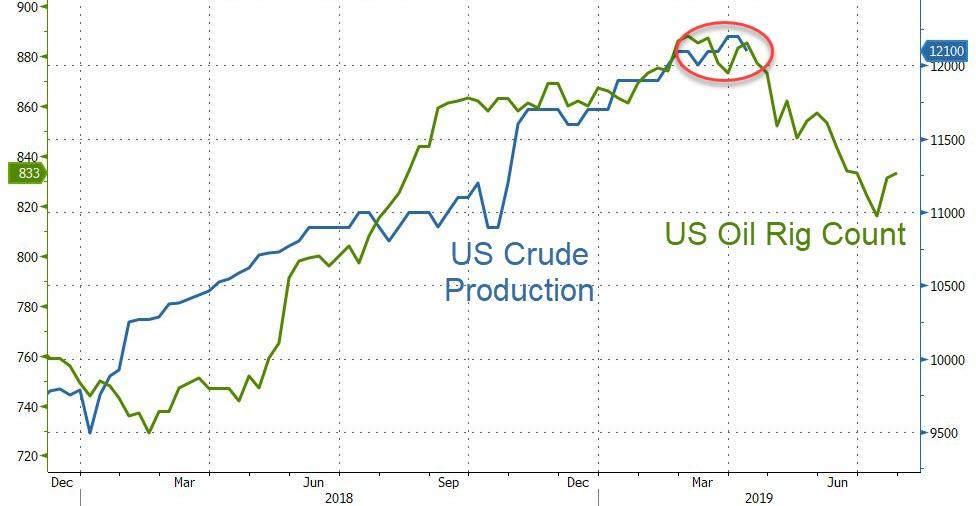

US Crude production dipped modestly last week (and rig counts resurrected – though that will have only a lagged effect).

WTI hovered just above $64 ahead of the DOE data, but algos were not entirely enthused despite the draws across the board…

Bloomberg Intelligence’s Senior Energy Analyst Vince Piazza notes that optimism for global crude benchmarks is driven by expectations for strength in demand and product draws. We highlight sustained U.S. crude production despite waning economic growth and our long-held concerns about global demand. Prolonged levels above $60 a barrel in the U.S. likely invite acceleration in well completions, even amid pressure for capital discipline. OPEC output shrinking about 534,000 barrels a day in March helped tighten balances, yet discipline must be sustained to maintain the market’s constructive tilt.

via ZeroHedge News http://bit.ly/2Xi9Saj Tyler Durden