Jet Airways, once India’s largest airline by market cap, has been forced to immediately halt operations after Indian banks refused to furnish emergency funds, leading to a liquidity crisis that looks to have bankrupted the airline.

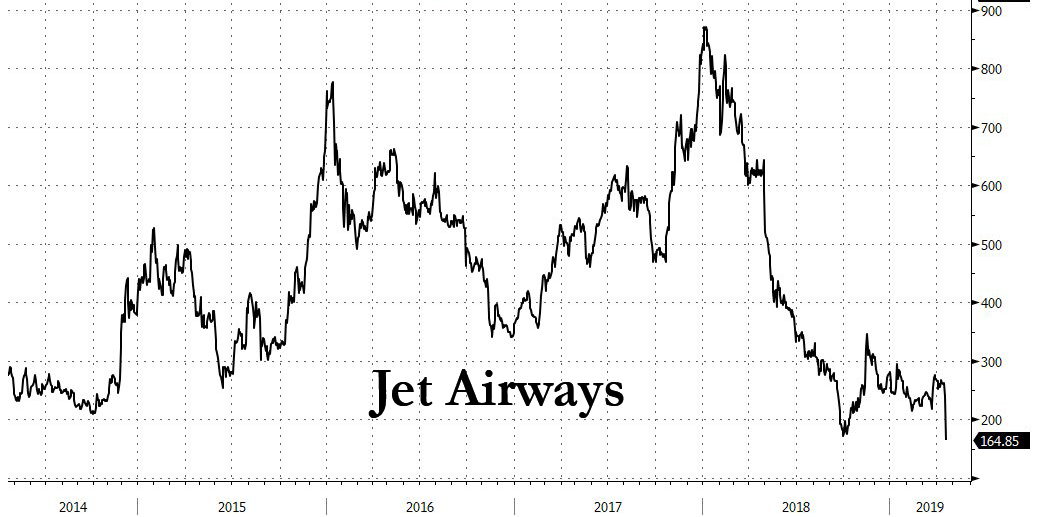

The Indian carrier said in a statement Wednesday that it would suspend all flights, capping weeks of speculation over the airlines fate. The news sent its shares plunging 34% in Mumbai on Thursday as bankruptcy appeared unavoidable.

In its statement, Jet Airways said it was informed by a consortium of government-run lenders on Tuesday that the airline’s request for emergency funds had been refused. The decision could create problems for Prime Minister Nahrendra Modi, who is in the middle of the ‘largest election in history’ as 900 million Indians take to the polls to decide whether a coalition led by his Bharatiya Janata party will remain in power (though early results suggest that it will, and if Modi truly felt vulnerable, he could always stir up some more trouble with Pakistan to shore up support). Modi’s opponents have latched on to his failure to create jobs and bolster India’s economy. If Jet does shut down, it would put 20,000 jobs at risk.

“Above all, the airline would like to express its sincere gratitude to all its employees and stakeholders that have stood by the company in these trying times,” it said in its statement.

At this point, the only way the airline could be saved would be if a private buyer swoops in to buy 75% of the company and recapitalize it. Jet’s banks are working with the company to find such a suitor, but whether it happens remains to be seen. Abu Dhabi’s national carrier Etihad Airways, which bought a 24% stake in Jet six years ago, has been rumored as a possible buyer, though it has problems of its own after losing about $4.9 billion in three years. Etihad said it would help accommodate passengers affected by Jet’s cancellations.

“We continue to work with Jet management, lenders and key stakeholders in the context of the lender-managed effort to restructure the company,” an Etihad spokesperson added.

Jet isn’t India’s only troubled airline. Air India, the country’s national carrier, is subsisting on billions in taxpayer money following an aborted privatization attempt last year.

With deep sadness and a heavy heart we would like to share that, effective immediately, we will be suspending all our domestic and international flight operations.

More: https://t.co/SaQ2iwIBRJ— Jet Airways (@jetairways) April 17, 2019

But there’s another dimension to Jet’s problems. In November 2016, Jet Airways ordered 75 Boeing 737 MAX 8s. Only a few of them have been delivered (Jet was the first airline to deploy the 737 in India). That could spell big trouble for Boeing, because most of those planes were still on back-order, and the fate of that order is now uncertain. This could amount to billions of dollars of lost revenue for Boeing at a time when new orders for the planes have stopped amid a global grounding of flights, forcing Boeing to cut back on production.

via ZeroHedge News http://bit.ly/2ItFcjf Tyler Durden