Reuters spoke with dozens of drivers, regional operators, and industry officials across the U.S. to assess the performance of the U.S. trucking sector. What they discovered was an industry that slumped in late 2018, with accelerating deterioration into April.

Reuters noted that the decline in freight rates and hauling is not an indication of an immient recession, but as we have explained earlier this week, it’s a tariff hangover that currently plagues the U.S. economy.

The slowdown in trucking has been uneven nationwide, with declining orders and miles in the Midwest and Southwest, with a slight uptick on the West Coast, economists and regional officials said.

Trucking accounts for 70% of U.S. shipment tonnage, and is the primary means of transportation for manufacturing, construction and retail sectors, all of which have shown weakness in 1Q19. The primary cause for the decline is the sugar high in economic activity last summer, caused by threatened tariffs on Chinese goods, has passed, and the market is now readjusting to much slower freight volumes and prices.

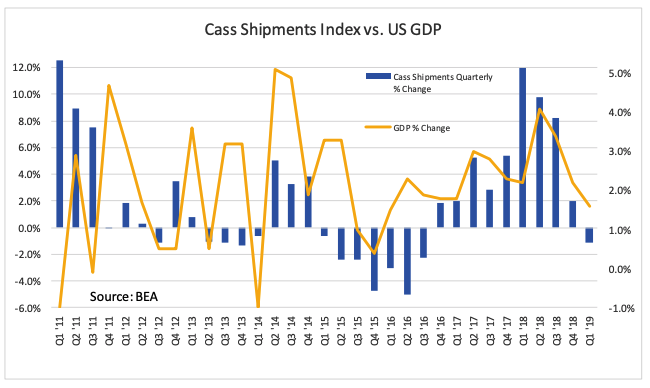

The ACT Research index of truck carrier volumes fell into negative territory in November for the first time since the summer of 2016. It bounced slightly into positive territory in January but returned to negative territory the following month. The weakening index mirrors a soft first quarter for GDP, which is expected to be 1.5% to 1.8% range.

“Clearly, the economy is slowing down,” Kenny Vieth, president of ACT Research, said in an interview. “When the economy moderates, the trucking industry can be exceptionally worse than the overall economy because of the deep cyclical trend that characterizes the industry.’

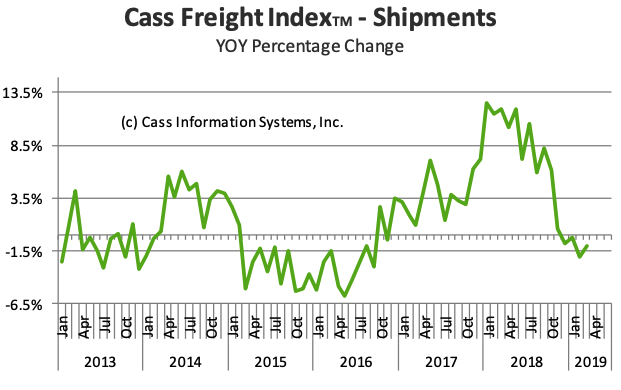

The Cass Freight Index, a measure of American freight volumes and expenditure, has been down for the fourth consecutive month y/y.

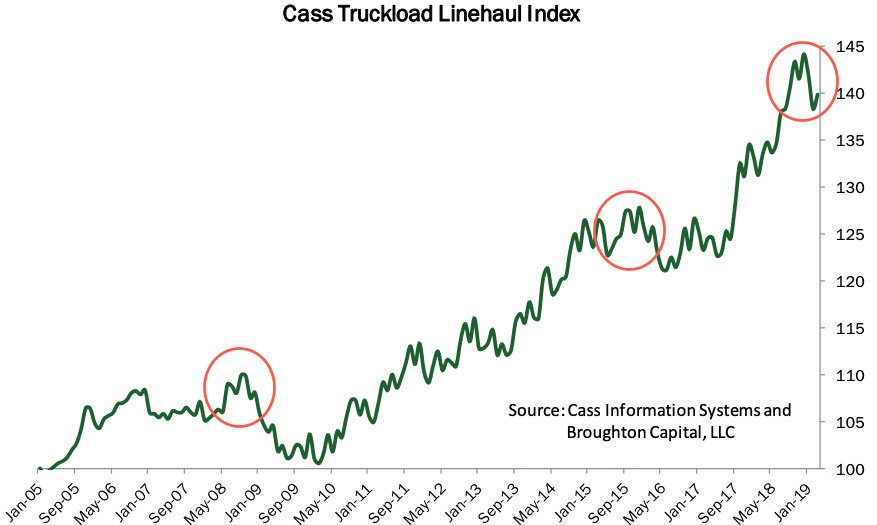

The Cass Freight Index Report for March 2019 suggests that the U.S. economy is rapidly slowing, first visible in the shipping complex last year.

“The Cass Freight Index was one of the first freight flow indicators to turn positive (in October 2016) and confirm our prediction of a recovery in the U.S. economy. Beyond our concern that the Cass Freight Shipments Index has been negative on a YoY basis for the fourth month in a row. Bottom line, the data in coming weeks will indicate whether this is merely a pause in the rate of economic expansion or the beginning of an economic contraction.”

Reuters spoke with 47 out of 50 state trucking associations, most said freight activity across Illinois, Wisconsin, Ohio, and Tennessee, had slowed.

Bobby Holland, vice president and director of Minneapolis-based U.S. Bank Freight Data Solution, said freight volume in the Midwestern and Southeastern part of the country has declined. In the Midwest, export tariffs on crops have crushed farmers whose supply chains into China have disappeared overnight. Holland also said retaliatory tariffs on the auto industry has also hurt freight volumes.

Spot rates for freight have hit their lowest levels since 2017, averaging $1.85 per mile in March, according to DAT Solutions, a freight exchange company.

The economic slowdown is starting to get noticed. Last month, Covenant Transportation Group Inc. warned of weak 1Q19 earnings, indicating its freight rate revenue per tractor fell 5% y/y.

“The truckload freight environment has been weaker this year from late January through mid-March,” CEO David Parker said last month.

Analysts have downgraded eps estimates for J.B. Hunt Transport Services Inc., Covenant and service company Knight-Swift Transportation Holdings Inc. by 9%, 40%, and 5% respectively.

“There’s no doubt that we have been seeing a deceleration in volumes,” said Bob Costello, chief economist for the American Trucking Associations (ATA). “This is an indication that the economy is decelerating.”

Wolf Richter provides great analysis of the trucking slowdown:

Largest US Trucking Company Details U-Turn of Trucking Boom. J.B. Hunt: “Volume, or lack thereof, is obviously the main story.” The inventory pile-up hurts. And the driver shortage is ending.https://t.co/ybRUUYsIcv pic.twitter.com/NNbiqiwLl7

— Wolf Richter (@wolfofwolfst) April 16, 2019

via ZeroHedge News http://bit.ly/2UtZZVt Tyler Durden