Authored by EconomicPrism’s MN Gordon, annotated by Acting-Man’s Pater Tenebrarum,

Learning From Other People’s Mistakes is Cheaper

One benefit of hindsight is that it imparts a cheap superiority over the past blunders of others. We certainly make more mistakes than we’d care to admit. Why not look down our nose and acquire some lessons learned from the mistakes of others?

Bitcoin, weekly. The late 2017 peak is completely obvious in hindsight… [PT]

A simple record of the collective delusions from the past can be quickly garnered from a price chart over time. Market peaks appear so obvious, after the fact. Perhaps with a little examination we can prevent some of our hard earned capital from being returned to dust.

Take bitcoin, for instance. What were those morons thinking who bought bitcoin at over $17,000 in late-2017? Why couldn’t they tell that a severe price collapse was imminent? Now, over 16 months later, their bitcoins are about $5,230 – or roughly 69 percent less than what they paid for them.

What’s more, if bitcoin doesn’t hit $1 million by the end of 2020, John McAfee – the cybersecurity guy – will have to eat his most private part on national television. Apparently, McAfee consulted his proprietary pricing model before making this outrageous claim. Maybe he should have back tested it a bit more before going public with his findings.

A few years ago in some or other jungle: John McAfee, tech entrepreneur and crypto maverick (here reportedly seen on the lam from authorities in Belize). Should he still be in possession of his private parts by 2021, you will know that you should have bought Bitcoin. [PT]

Still, we won’t count McAfee out just yet. He has 20 months left before his trade expires; anything can happen between now and then. And while it’s unlikely that bitcoin will hit $1 million anytime soon, with a little luck, bitcoin buyers from late-2017 will break even much sooner than the new era dot com believers of the new millennium did.

Down Beyond Measure

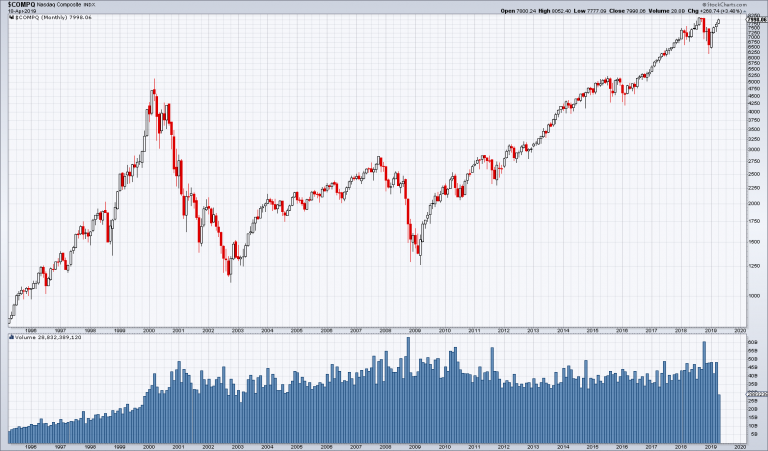

The savvy fellows who bought the Nasdaq in early-2000 at over 5,000 were in full agreement over one very seemingly obvious point. They all knew they were getting rich. But that was before the Nasdaq crashed over 75 percent and crushed their new era delusions into millions of tiny pieces. Yet things could have been much worse…

Sometime around early-2015 the Nasdaq eclipsed its early-2000 high, and it hasn’t looked back. After traversing a Grand Canyon sized bear market, the Nasdaq is about 60 percent higher than at the peak of the early-2000 dot com bubble. In fact, just this week the Nasdaq spiked back up above 8,000.

NASDAQ Index, monthly – the tech-heavy NASDAQ market is home to serial bubbles. [PT]

Wouldn’t it be nice if markets were always this forgiving?

Certainly, the erstwhile investors who bought the Nikkei in October 1989 at over 38,000 would like a do-over. They’re still down about 40 percent – nearly 30 years later. Factor in the opportunity cost of what these Nikkei investors missed out on over this time, and they’re down beyond measure.

Indeed, the significant wealth building years of several generations of Japanese investors have been lost. They’ll never get their investment potential or time back. There are some mistakes that there are no recovering from.

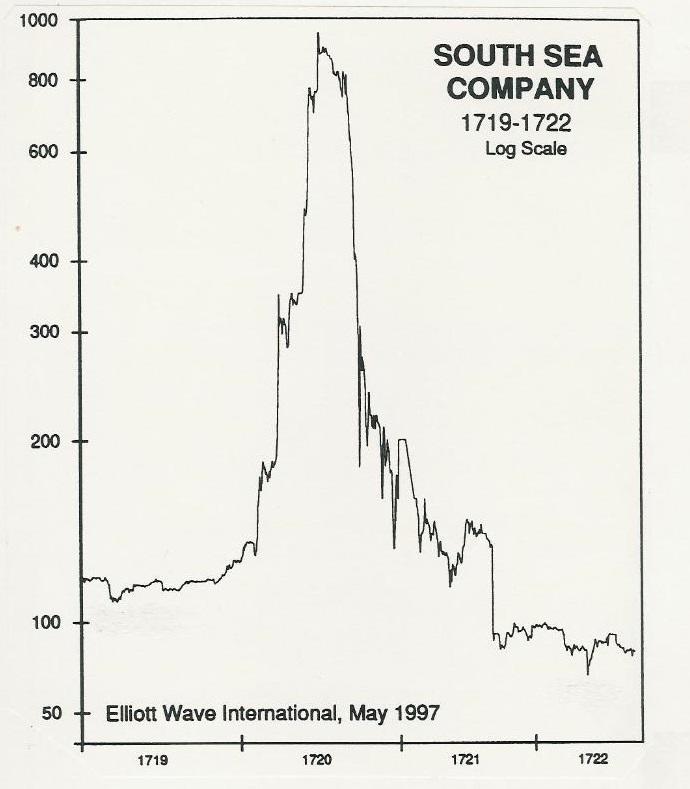

Many of the people who were long Japanese stocks in the late 1980s in the belief that they would “never fall” (this was indeed a popular notion at the time, based on the keiretsu system of cross-shareholdings) are long dead. Even those who are still alive have yet to see the Nikkei recover and regain its former bubble heights. Evidently, equities are not always a good long term investment. Note in this context that the Europe-wide secular bear market that followed in the wake of the South Seas and Mississippi bubbles only bottomed after 68 years (i.e., 68 years after the peak, the markets actually still made new lows). It is no wonder there is no equity culture in Europe. In fact, in many European countries retail investors still prefer savings books to stocks, even today when savings essentially yield nothing thanks to the unprecedented loose monetary policy of the ECB. [PT]

Should we feel sorry for them? Shouldn’t they have known that the market was grossly overvalued in the fall of 1989? Why did they lose their collective minds?

The rise and fall of the South Sea Company – even Isaac Newton lost a fortune speculating in the stock. [PT]

What Were They Thinking?

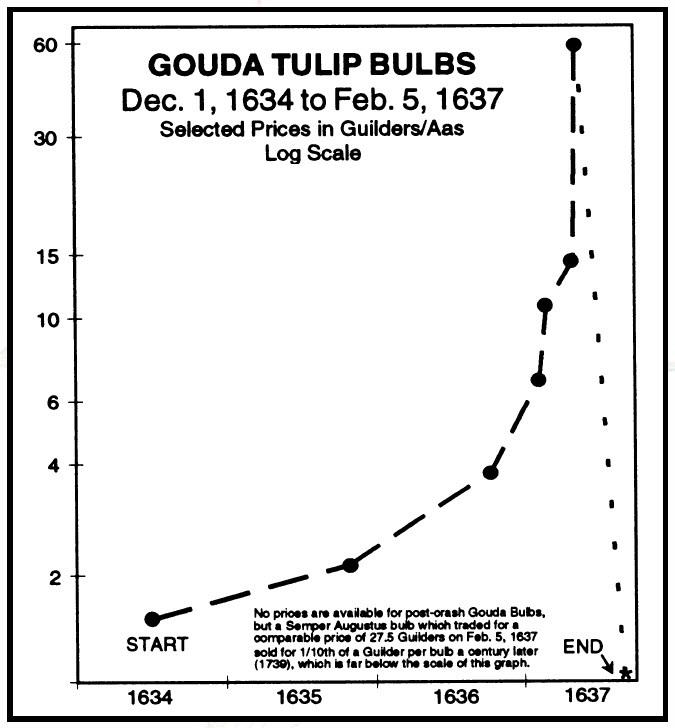

Yet the real “my name is mud” award goes to the enlightened speculators who bought tulip bulbs in the Dutch Republic in January 1637. At the time, a single tulip was trading for the price of an entire estate. One month later, the price of a tulip had collapsed to the price of a common onion.

By our rough calculation, tulip bulbs have remained at par with common onions for the past 382 years. It’s likely they’ll remain there for all eternity. But for a brief moment, roughly November 1636 to February 1637, people lost their minds in unison.

80 years before the South Seas Bubble, the Dutch tried their hand at a once-in-a-lifetime financial mania. They actually traded futures contracts on tulip bulbs over the counter. This bubble never came back and never will – a century after it had ended, tulip bulb prices were still down more than 99% from the peak. [PT]

Charles Mackay, in his 1841 book Extraordinary Popular Delusions and the Madness of Crowds, described the mania:

“Many individuals grew suddenly rich. A golden bait hung temptingly out before the people, and, one after the other, they rushed to the tulip marts, like flies around a honey-pot. Every one imagined that the passion for tulips would last forever, and that the wealthy from every part of the world would send to Holland, and pay whatever prices were asked for them. The riches of Europe would be concentrated on the shores of the Zuyder Zee, and poverty banished from the favoured clime of Holland. Nobles, citizens, farmers, mechanics, seamen, footmen, maidservants, even chimney sweeps and old clotheswomen, dabbled in tulips.”

What in the world were these tulip bulb speculators thinking? Certainly, they didn’t read the fine print in their prospectus; the part that reads past performance is not indicative of future results. But would it have even mattered?

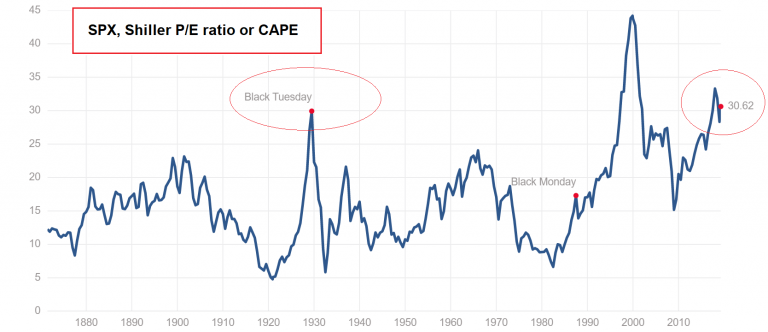

The current cyclically adjusted price to earnings ratio for the S&P 500 is at 30.62. That’s nearly double its average going back to the late-19th century. And for the first time in three years, corporate quarterly earnings for the S&P 500 are forecast to fall. Hence, the gap between price and earnings will be stretched out even further.

What can possibly go wrong when stocks are at a higher valuation than at the 1929 peak? [PT]

Clearly, U.S. stock markets have been rigged by the Federal Reserve. But the popular delusion of many of today’s stock buyers is that risk has been eliminated, and that the Fed can propel stocks higher forever. Thus you should buy stocks, and buy even more stocks… so you don’t miss out.

No doubt, future generations will smirk at our imbecility, and rhetorically ask: What were they thinking?

via ZeroHedge News http://bit.ly/2KSbE0I Tyler Durden