Despite a slow start to the week, which sees most European markets closed on Monday, there should still be “enough to keep investors on their toes”, according to Deutsche Bank’s Craig Nicol. First and foremost, earnings season ramps up in the US with over 150 S&P 500 companies reporting including bellwether industrial and tech names in what is set to be the busiest earnings week this season, then Japan’s Abe meets President Trump at the White House, UK parliament returns from recess and Russia’s Putin meets China’s Xi Jinping. We’ll also have central bank decisions from the BoJ, BoC and Riksbank, while the data highlight is US Q1 GDP.

Starting with politics, UK parliament returns from Easter recess on Tuesday which, after a welcome quiet 10 days or so, brings with it the possibility of a reinvigorated barrage of Brexit headlines. The bigger headlines potentially lie on Friday though when Russian President Putin travels to Beijing to meet with Chinese President Xi Jinping, continuing into the weekend, and on the same day Japanese PM Abe meeting with President Trump at the White House. The discussions between the latter are likely to center around trade and North Korea with Japan’s foreign and defense ministers also due to meet their US counterparts.

Speaking of North Korea, on Wednesday Russian President Putin may meet with North Korean leader Kim Jong Un in Russia, even though the exact details are still to be confirmed. On Thursday, Japanese Finance Minister Taro Aso is scheduled to meet with US Treasury Secretary Mnuchin likely over provisions against currency manipulation. Finally, Thursday also marks the closing date for the European Parliament’s candidate list and nominations for next month’s election.

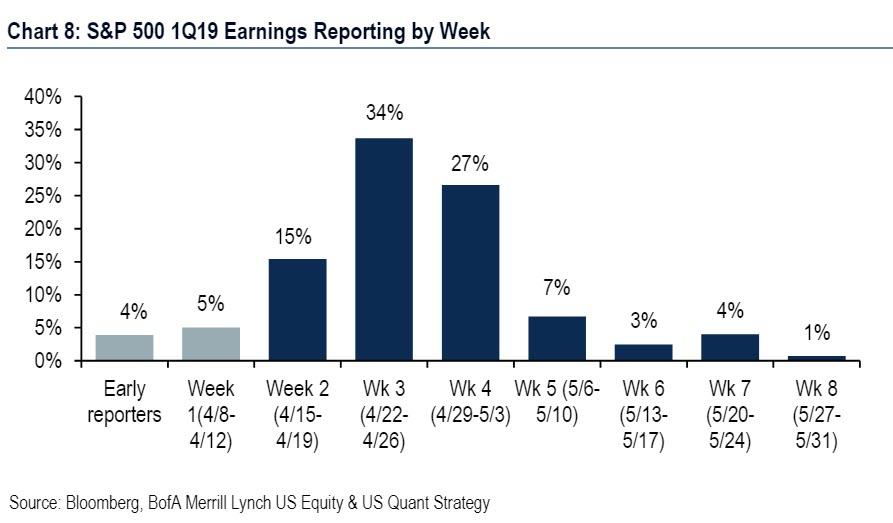

At a more micro level, earnings season will really ramp up next week with 153 S&P 500 companies due to report including some bellwether industrials and tech names. The bigger companies include eBay, Coca-Cola, Proctor & Gamble, Twitter and Verizon on Tuesday, Boeing, Caterpillar, Microsoft and AT&T on Wednesday, Amazon, Ford, Intel and 3M on Thursday, and Chevron and Exxon Mobil on Friday. As we type we’ve seen earnings reports from 77 S&P 500 companies, with 61 of those beating earnings expectations but only 38 beating sales expectations. In Europe we’ll also get results from Nokia, Credit Suisse, UBS, Barclays, Total and Sanofi.

Unsurprisingly, it’s not particularly busy for data next week. The highlight however comes on Friday when we get the eagerly anticipated advance Q1 GDP reading in the US. Following a revised +2.2% qoq saar reading for Q4, the consensus is for a slight slowdown to +2.0% qoq saar for Q1. That would still mark 20 consecutive quarters of positive quarterly growth. The Q1 core PCE will also be out on Friday as part of the GDP report, while other data in the US includes March existing home sales on Monday, preliminary March durable and capital goods orders on Thursday, and regional manufacturing reports from the Richmond Fed and Kansas Fed on Tuesday and Thursday, respectively.

Meanwhile, it’s very quiet for data in Europe this week with Germany’s IFO survey for April due on Wednesday and CBI survey data due in the UK on Thursday and Friday. The only data worth flagging in Asia is March industrial production and retail sales on Friday in Japan.

Speaking of Japan, the BoJ policy meeting is due on Thursday however it’s hard to see it being a particularly market moving event. No change in policy is expected, however headlines yesterday on Reuters did suggest that the BoJ is to forecast that inflation will fall short of its 2% target through the year ending March 2022. So an extension of inflation forecasts appears most likely at this stage however the market will also likely be on the lookout for any changes in forward guidance about keeping rates unchanged. It’s worth noting that on Wednesday we’ll also get the BoC decision and on Thursday the Riksbank decision. No change in policy is expected at either meeting.

Finally, other things worth watching next week include a scheduled speech from Larry Kudlow in Washington on Tuesday, UK Chancellor Hammond testifying on the Spring Statement on Wednesday to the House of Commons Treasury Committee, China holding its second Belt and Road Initiatives Forum on Thursday, Japanese PM Abe meeting with Tusk and Juncker in Brussels on Thursday, and the ECB’s de Guindos speaking in New York on Thursday.

Summary of key events by day:

- Monday: A very quiet start to the week with only US existing home sales data for March and the March Chicago Fed activity index due. Notable companies reporting include Halliburton.

- Tuesday: The 2018 government debt to GDP ratio for the Euro Area is the early data release, before Euro Area consumer confidence for March, the April Richmond Fed manufacturing index and March new home sales in the US are out. Earnings releases are due from eBay, Coca-Cola, Proctor & Gamble, Twitter and Verizon. Larry Kudlow is due to speak and the UK parliament returns from Easter recess.

- Wednesday: There’s no data of note in the US, while in Europe we’ll get April confidence indicators in France, the April IFO survey in Germany and March public sector borrowing data in the UK. We’ve also got earnings due from Boeing, Caterpillar, Microsoft and AT&T. Away from that we have the BoC decision, while Russia’s Putin may meet with North Korea’s Kim Jong Un. UK Chancellor Hammond will testify on the Spring Statement to the House of Commons Treasury Committee

- Thursday: The BoJ meeting will be the early focus for markets, before we get April CBI survey data in the UK and claims, March durable and capital goods orders, and the April Kansas City Fed manufacturing index data in the US. Earnings releases are expected from Amazon, Ford, Intel and 3M. Meanwhile, Japanese Finance Minister Taro Aso is scheduled to meet with US Treasury Secretary Mnuchin while Thursday marks the closing date for the European Parliament’s candidate list and nominations for next month’s election. Elsewhere, China will hold its second Belt and Road Initiatives Forum, Japanese PM Abe will meet with Tusk and Juncker in Brussels and the ECB’s de Guindos will speak in New York.

- Friday: The highlight should be the advance Q1 GDP reading for the US. Also due out is the final April University of Michigan consumer sentiment revisions, while data in Asia include March industrial production in Japan. In Europe we’ll get more CBI survey data in the UK for April. Chevron and Exxon Mobil are the earnings highlights. The big political event is a meeting between Japan’s Abe and President Trump at the White House, while Russian President Putin travels to Beijing to meet with Chinese President Xi Jinping

Finally, looking at just the US, the key economic data releases this week are the durable goods report on Thursday and the Q1 advance GDP estimate on Friday, according to Goldman which also does not expect any policy-related speeches by Fed officials, reflecting the blackout period ahead of the April 30-May 1 FOMC meeting.

Monday, April 22

- 10:00 AM Existing home sales, March (GS -3.5%, consensus -3.8%, last +11.8%): After a sharp rebound in February, we estimate that existing home sales decreased by 3.5% in March based on weaker regional sales data. Existing home sales are an input into the brokers’ commissions component of residential investment in the GDP report.

Tuesday, April 23

- 09:00 AM FHFA house price index, February (consensus +0.6%, last +0.6%)

- 10:00 AM Richmond Fed manufacturing index, April (consensus +10, last +10)

- 10:00 AM New home sales, March (GS -3.3%, consensus -3.0%, last +4.9%): We estimate that March new home sales declined by 3.3% following last month’s 4.9% rise, as mortgage loan applications were low in the prior month.

Wednesday, April 24

- No major economic data releases.

Thursday, April 25

- 8:30 AM Durable goods orders, March preliminary (GS +0.5%, consensus +0.7%, last -1.6%); Durable goods orders ex-transportation, March preliminary (GS +0.5%, consensus +0.2%, last -0.1%); Core capital goods orders, March preliminary (GS +0.5%, consensus +0.1%, last -0.1%); Core capital goods shipments, March preliminary (GS +0.3%, last -0.1%): We expect durable goods orders rebounded in March, but only slightly as aircraft orders remained fairly weak. We expect improving global growth and beneficial calendar effects to boost core capital goods orders.

- 08:30 AM Initial jobless claims, week ended April 20 (GS 205k, consensus 200k, last 192k); Continuing jobless claims, week ended April 13 (last 1,653k): We estimate jobless claims increased by 13k to 205k in the week ended April 20, following a 5k decline in the prior week.

- 11:00 AM Kansas City Fed manufacturing index, April (consensus +9, last +10)

Friday, April 26

- 08:30 AM GDP, Q1 advance (GS +2.4%, consensus +2.2%, last +2.2%); Personal consumption, Q1 advance (GS +1.7%, consensus +1.0%, last +2.5%): We estimate a 2.4% increase in the initial release of Q1 GDP (qoq ar). We expect the composition of the report to reflect further deceleration in personal consumption (+1.7%) and business fixed investment (+3.3%), but expect a boost from accelerating exports (+3.8%). We estimate that the government shutdown weighed on Q1 GDP growth by 0.4pp.

- 10:00 AM University of Michigan consumer sentiment, April final (GS 97.2, consensus 97.0, last 96.9): We expect the University of Michigan consumer sentiment index to edge up by 0.3pt from the preliminary estimate for April reflecting further stock market increases and firmer high-frequency consumer surveys. The report’s measure of 5- to 10-year inflation expectations stood at 2.3% in the preliminary report.

Source: Goldman, Deutsche Bank, BofA

via ZeroHedge News http://bit.ly/2US91jV Tyler Durden