The gap between global money-supply-fueled equity exuberance and macro- and micro-economic data has never been greater…

Nothing to see here.. move along…

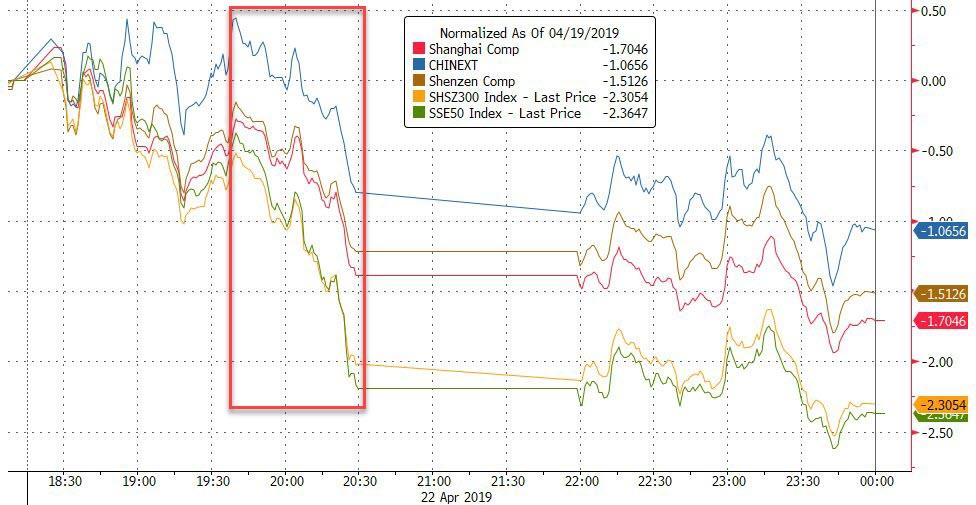

With Europe away, volumes were the lightest of the year as China tumbled…

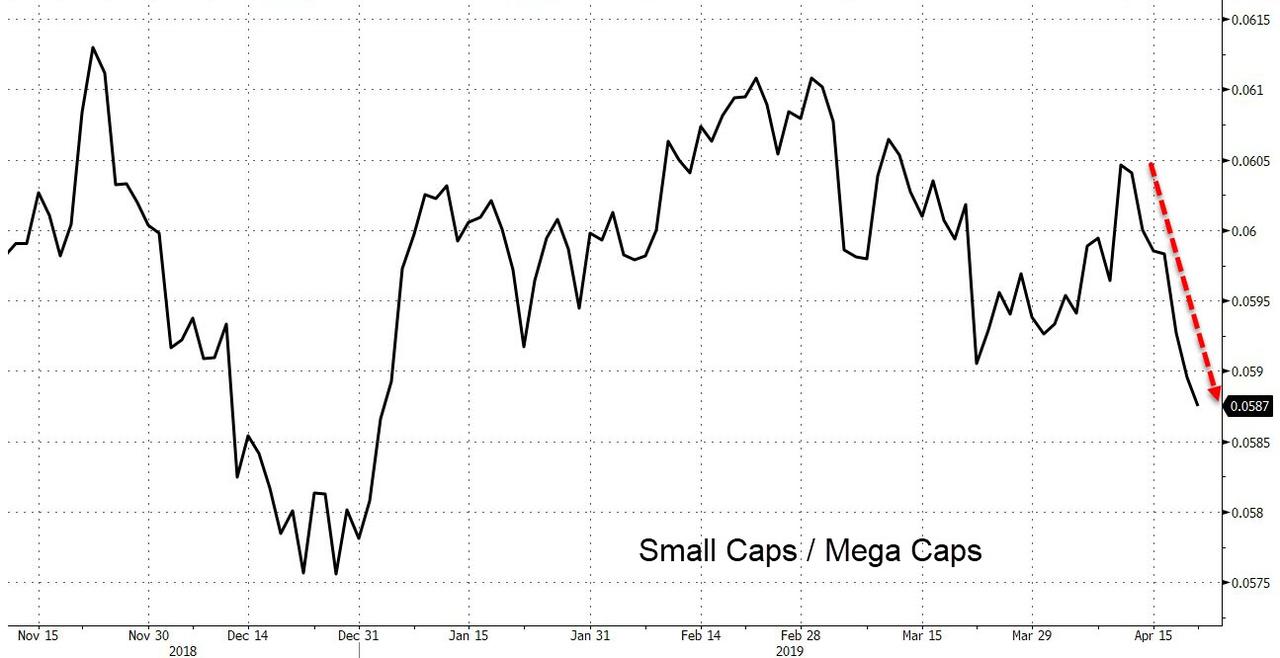

US Small Caps were the biggest laggard today and Nasdaq led, barely closing green…a buying-panic began at 1530ET which made things look a little better…

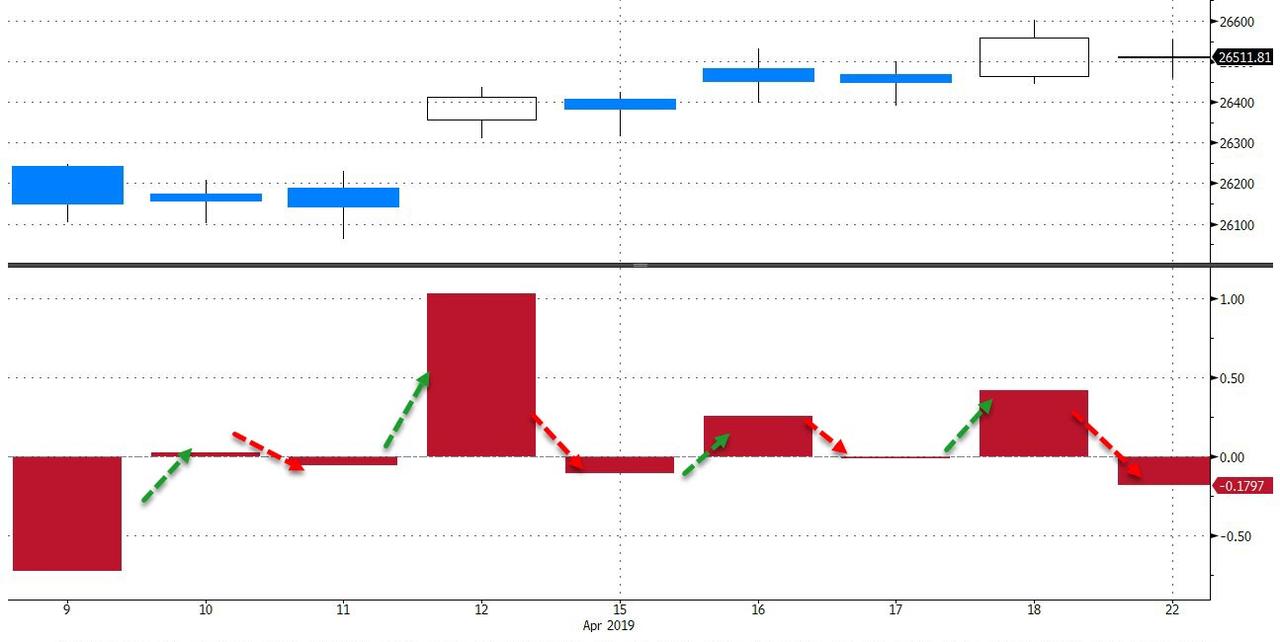

NOTE – it seems the machines forgot that EU was closed as they rallied the market into the “EU Close”.

This is the 9th straight session of oscillating gains and losses for The Dow.

Small Caps have now underperformed Mega Caps for seven straight trading days…

But 2900 is all that matters for the S&P 500 traders…

(last 6 days closes for the S&P 500 – 2907, 2906, 2907, 2900, 2905, 2906)

Treasury yields were higher on the day, despite equity weakness (long-end underperformed)…

30Y remains below 3.00%…

The yield curve steepened further…

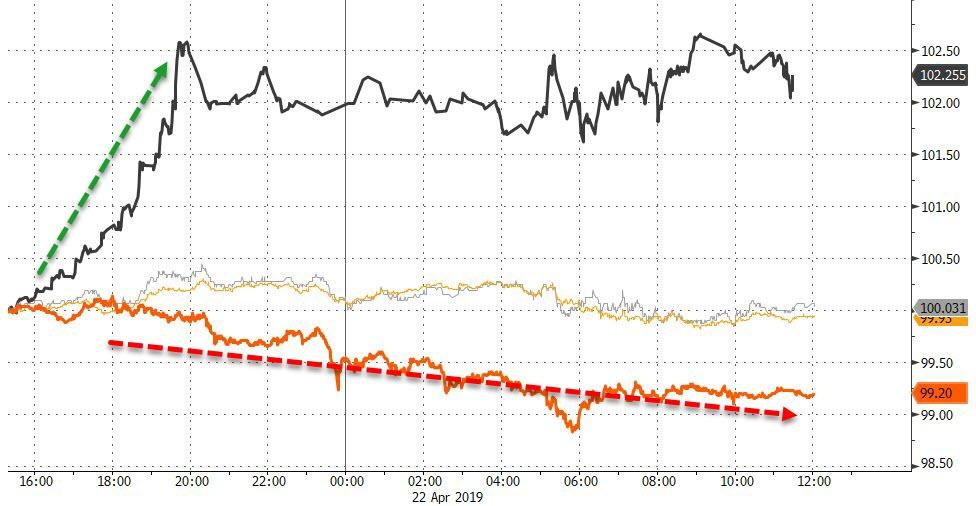

The Dollar flatlined for the second day as most of the world remained on Easter holiday…

Bitcoin is holding gains after some notable selling across cryptos on Saturday…

PMs trod water along with the dollar but crude spiked as copper was dumped…

WTI soared overnight – smashing through a significant technical level – on the back of Trump Iran waiver headlines…

But tried and failed to break $66 twice…

Finally, this morning’s dismal housing data sent US Macro Surprise Index to its lowest since June 2017…

Because nothing says record high stocks like the worst macro economy in two years and worst relative to the world.

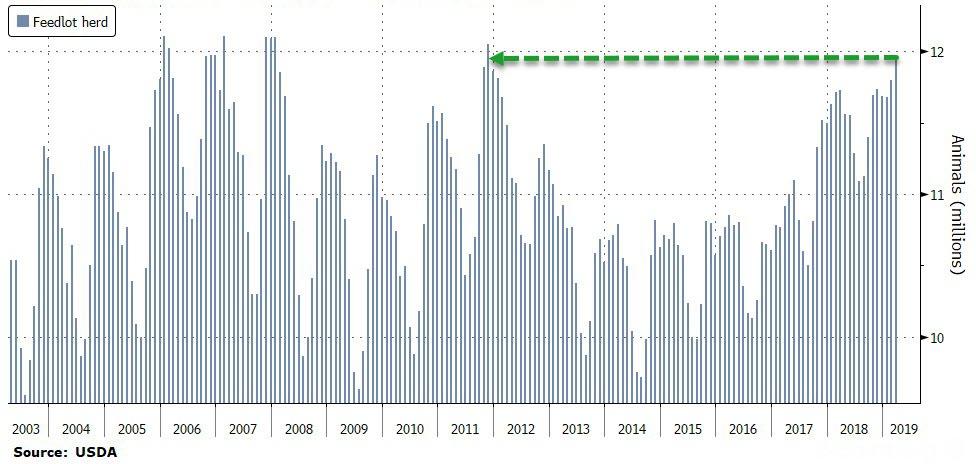

We’re gonna need more cowbell (but no more cows)…

AOC will not be happy!!

via ZeroHedge News http://bit.ly/2KWvGah Tyler Durden