Authored by Iliya Zaki via Hackernoon.com,

On April 10th, IMF launched a tweet poll asking “How do you think you will be paying for lunch in 5 years?”. The choices include cash, cryptocurrency, a mobile phone, and bank card. The choice of Cryptocurrency received 56% of the 37,000 votes and the next choice was via mobile phone with 27%. Therefore, could IMF’s poll serve as a clue to what lies in the future: Mass Adoption of Cryptocurrencies? The potential of Crypto Payments being the main method of payments is very real.

We would like to hear from you. ⬇

How do you think you will be paying for lunch in 5 years? #IMFmeetings #DigitalPayments

— IMF (@IMFNews) April 10, 2019

Merchants Accepting Crypto Payments Are Increasing

Kaspersky’s money report 2018 survey found 13% of people have used crypto payments. The study collected responses from more than 12,000 consumers in 22 different countries. There is an increasing number of businesses offering cryptocurrency as a payment method. Businesses include retailers and food outlets that accept crypto payments. Vitaly Mzokov, Head of Verification, Growth Center at Kaspersky Lab said:

“Despite a fall in cryptocurrency prices, there is still a strong desire for digital transactions amongst consumers. Our consumer research has found that 13% of people have used cryptocurrency as a payment method, which was surprising to see.”

The image above is from Coinmap and it shows that there are more than 14,600 establishments that are accepting Crypto Payments.

Strong Case For Crypto Payments

Mobile contactless payments such as Apple Pay, Google Pay, and Samsung Pay is on the rise. According to Statista, the number of NFC (near field communications) mobile payment users more than tripled from 53.9 million to 166 million from 2015 to 2018. Adoption for NFC mobile payment took a while but in just 6 years, we have gone from having just 5 million users in 2012 to 166 million. With 27% of the voters choosing mobile phone, the numbers above do make sense. Remember our article about crypto wallets in Samsung Galaxy S10? Samsung is the first mover in the space and there is a high likelihood that others will follow. Therefore, we can assume that phone companies are laying out a strong foundation that can launch crypto payment adoption.

Facebook and WhatsApp

In another article, we discuss a possible involvement from WhatsApp with Crypto paymentswith third-party crypto wallet developers, Wuabit. Whatsapp has 1.5 billion users in 109 countries. The most popular countries include India, Brazil, Mexico, Russia, and many other countries. They can become a major force in driving crypto adoption due to the sheer number of users and reputation in developing countries.

Wuabit is set to launch the public beta test this month. According to their Medium articles, Wuabit targets WhatsApp as the first instant messaging platform because of its popularity worldwide. Soon, they will work on integrating Facebook messenger, Telegram, WeChat, and Viber. Wuabit also plans on extending the service to other popular Crypto projects such as Litecoin, Bitcoin Cash, and Ethereum. Thus, making WhatsApp a real payment solution in the future.

Coinbase

Coinbase launched a new payments service for users to “send money internationally for free.” Can we assume Coinbase is also building the infrastructure to Crypto payments? Furthermore, the San Francisco-based cryptocurrency exchange is launching a Visa card in the UK that will let users pay with Bitcoin, Ethereum and Litecoin.

“Coinbase Card supports all crypto assets available to buy and sell on the Coinbase platform, meaning they can pay for a meal with bitcoin, or use ethereum to fund their train ticket home,” Zeeshan Feroz, the head of Coinbase’s UK arm, said in a blog post.

Crypto Payments Ready to Develop in Latin America

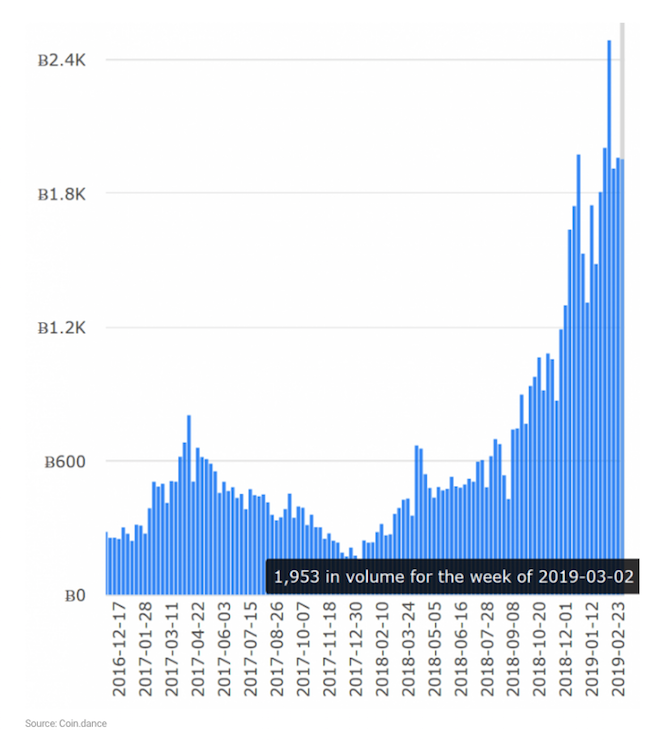

Crypto adoption in Latin America has reached an all-time high with 8,000 transactions logged since the start of 2019. While much of the world is still battling its way through a long crypto winter, South American traders appear committed to the cryptocurrency cause. Digital tokens are seen as the most effective way out of economic and political turmoil. The Venezuelan financial crisis and international sanctions have resulted in citizens abandoning the bolivar in favor of other currencies. However, it seems that rather than turn to foreign currencies, thousands are instead choosing cryptocurrencies. CoinDance stats also show trading has shot up in neighboring Columbia since the start of the year.

Meanwhile, in Argentina, CoinDance’s LocalBitcoin data reveals that trading volumes have hit 2019 high. With a volume of over 8.5 million, it is the second highest weekly trading volume ever. As per an Argentinean cryptocurrency expert speaking to news outlet La Verda, some 20,000 people in the country currently own cryptocurrencies. If true, this means that a relatively small group of citizens are doing the majority of the country’s trading. Can Latin America benefit from a new monetary system that integrates Crypto payments seamlessly?

The popularity of Cryptocurrencies in Latin America presents an opportunity to build crypto payment solutions. Therefore, the environment is ripe for visionaries to develop a new monetary system.

There is, in fact, a project seeking to build a blockchain-based monetary system that can no doubt challenge the traditional system.

Introducing MoneyFi

The MoneyFi platform is a communication channel for cross border currency remittances based on digital assets trading. Users will be able to remit money via the MoneyFi App that uses its native cryptocurrency token “Nemoo” for settlement. The App is integrated into an existing infrastructure consisting of a global ATM processing network that will facilitate newly developed fiat-crypto hybrid ATMs. MoneyFi is a venture subsidiary structured as Special Purpose Vehicle under the Odyssey Group headquartered in Miami (USA).

The Odyssey Group, founded by Sebastian Ponceliz 2014 in the United States, is a retail banking support organization active in the US, Argentina, Spain, and Italy. The company provides Vending Machines (1,000+ deployed) and traditional ATMs (1000+ deployed) with their proprietary Octagon Network, a transaction processing platform that manages its ATM network. Odyssey has recently acquired an Argentinian Bank and a Credit Card Manufacturer to expand its operations.

MoneyFi seeks to address not only the growing demand for better remittance systems but the need to have a stable crypto payment solution in Latin America. It seems that they are targeting the entire payment ecosystem that includes merchants, consumers, and banks.

At the moment, there aren’t much information regarding the project that can be found. However, as time progresses, the company behind the project will divulge more information.

via ZeroHedge News http://bit.ly/2IT1QAH Tyler Durden