We couldn’t have dreamed up a more perfect headline if we tried.

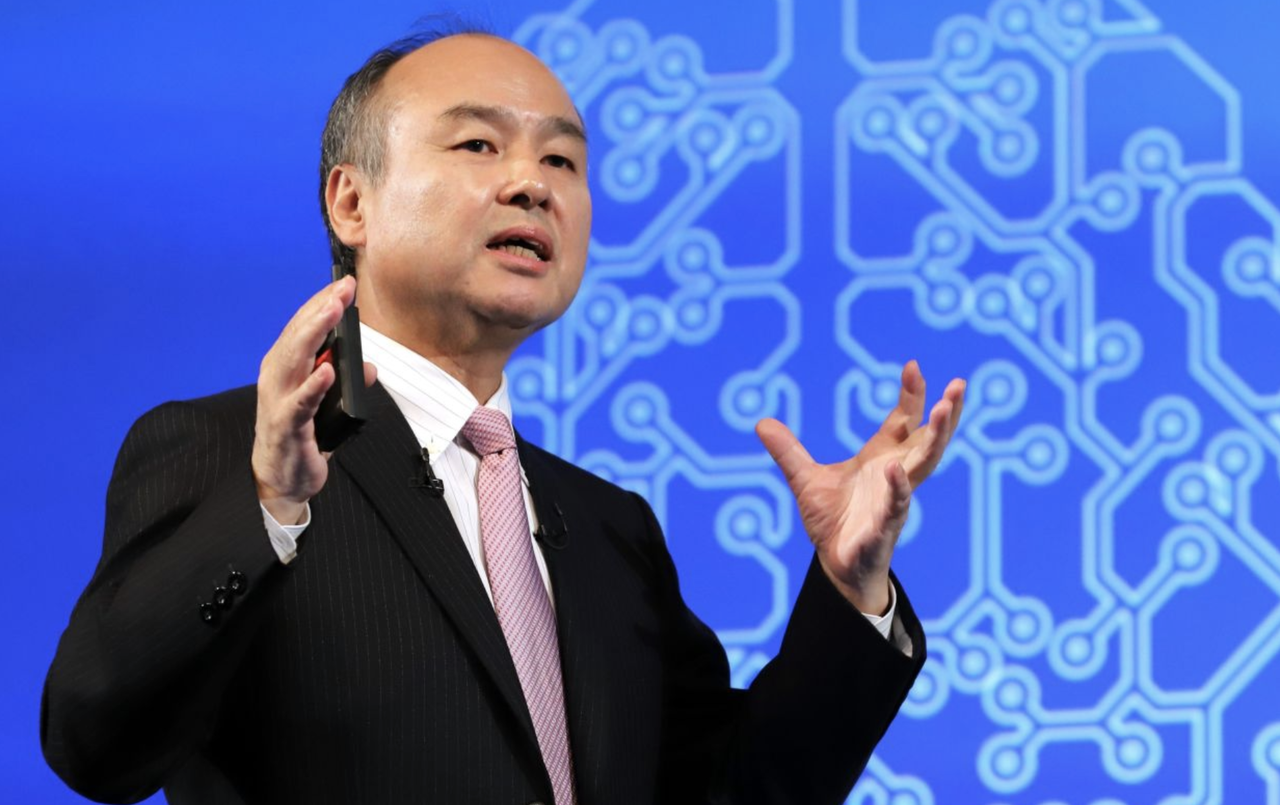

Last time we checked in with Soft Bank, the Japanese telecoms conglomerate/VC megafund, internal strife between Masayoshi Son and some of his ‘Vision Fund’ backers had spilled over into public view, as the fund’s backers questioned the prudence of the fund’s investments in Uber Technologies, WeWork and other Silicon Valley unicorns.

Since launching its $100 billion ‘Vision Fund’, Soft Bank and its Saudi backers have been credited with almost single-handedly inflating the value of Bay Area tech startups to levels that are difficult to justify by any metric. And following Lyft’s post-IPO flop, many have questioned whether Uber’s massive valuation is really warranted, considering the company’s apparent allergy to profits.

On Tuesday, the Wall Street Journal handed Masayoshi Son’s detractors even more grist for their attacks when it reported, citing anonymous sources whom we imagine just might have had an axe to grind with the legendary investor, that Masayoshi lost a staggering $130 million after buying bitcoin during the height of the 2017 bubble then dumping his stake in early 2018. The bet was made by Masayoshi Son personally, meaning the money he lost came from his vast $15 billion personal fortune. But still, the story uneniably undermines his reputation as a shrewd long-term investor.

The exact timing of Masayoshi Son’s initial buy-in, and the price at which he sold, weren’t disclosed.

Masayoshi Son, the billionaire founder of SoftBank Group Corp. made a huge personal bet on bitcoin just as prices for the digital currency peaked, losing more than $130 million when he sold out, according to people familiar with the matter.

Mr. Son, who launched the world’s biggest venture-capital fund on the strength of his long-term investing acumen, made the investment at the recommendation of a well-known bitcoin booster, whose investment firm SoftBank bought in 2017, the people said.

The investment came at the peak of the bitcoin frenzy in late 2017 after the digital currency had already risen more than 10 fold that year.

The exact size of the bet couldn’t be determined, but bitcoin peaked at nearly $20,000 in mid December 2017 and Mr. Son sold in early 2018 after bitcoin had plummeted, the people said.

For reference: Bitcoin traded at roughly $5,400 on Monday. If nothing else, the story shows that even some of the world’s most ‘sophisticated’ investors got caught up in the bitcoin frenzy, not unlike how luminaries from the business and political realms, including George Schultz and Henry Kissinger, got suckered into investing in Theranos without realizing that it was an outright fraud.

Mr. Son’s previously unreported loss shows that even some of the world’s most sophisticated and wealthiest investors got caught up in the frenzy. With a net worth estimated by Bloomberg LP at $19 billion, Mr. Son will hardly notice, though it dents his reputation as a patient and prophetic investor.

Masayoshi Son reportedly made the ill-fated bitcoin bet at the urging of Fortress co-chairman Peter Briger. Softbank completed its acquisition of Fortress in late 2017, taking on the firm’s amazingly profitable bitcoin holdings (Fortress under Briger’s direction bought into bitcoin way back in 2013, meaning that even at current prices, the firm has likely recorded a sizable on-paper profit).

Mr. Son was encouraged to make the investment by Peter Briger, the co-chairman of asset manager Fortress Investment Group, the people said. SoftBank bought Fortress in February 2017, inheriting the asset manager’s bitcoin reserves along with its more traditional investment funds.

Fortress under Mr. Briger first bought bitcoin in 2013, when it was still a fringe technology used mainly in the darker corners of web commerce. By the time the SoftBank deal was completed, its holdings were worth more than $150 million.

Mr. Briger declined to comment through a spokesman.

On its own, the story about Masayoshi Son’s soured bitcoin bet isn’t especially troubling. But with so much on the line for Soft Bank in the coming months, any reason to question his credibility could be a problem. Uber is expected to IPO next month at a valuation of $100 billion, which would hand Soft Bank a tidy profit. However, if Uber follows in Lyft’s footsteps, Soft Bank, which became the marginal buyer of Uber during several private investment rounds, would be dealt another embarrassing blow.

Furthermore, the DOJ is making noise about possibly blocking the Sprint-T-Mobile merger, which could create more problems for Soft Bank, which owns a controlling stake in Sprint.

To be sure, Masayoshi Son’s early investment in Alibaba leaves his lifetime record well in the black. But if the Saudis pull their support from the Vision Fund, it could erode public confidence in Masayoshi Son’s investing acumen, making it very difficult to recover.

via ZeroHedge News http://bit.ly/2PqLwbZ Tyler Durden