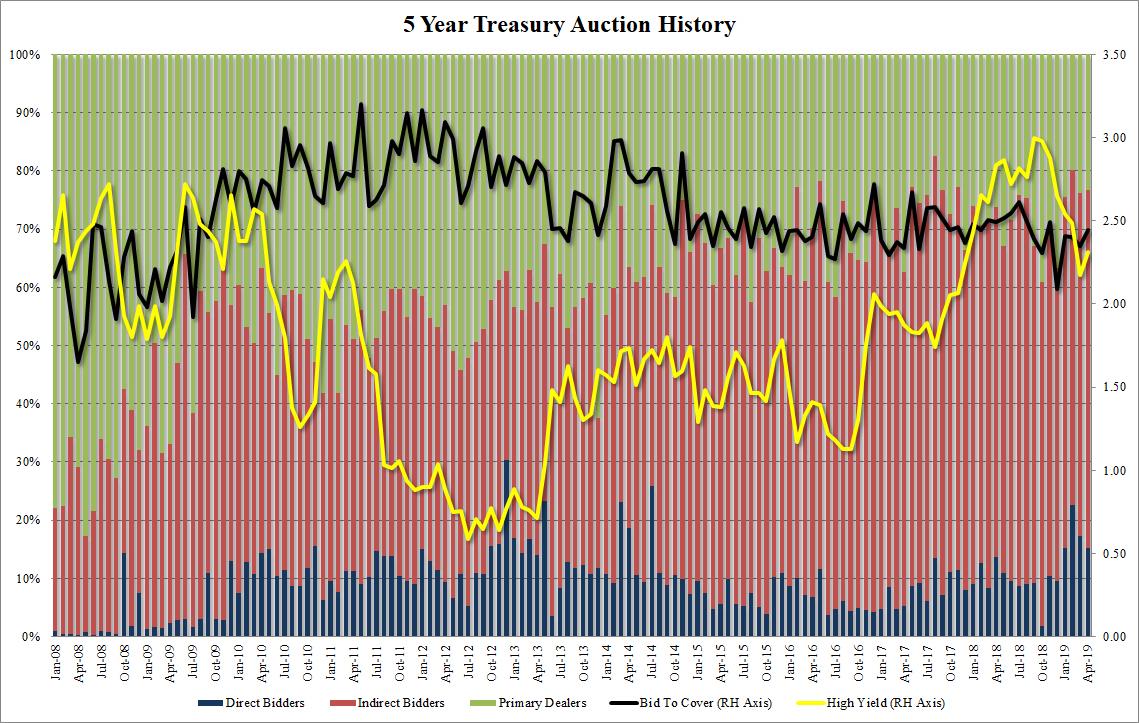

One day after the 2Y auction priced “on the screws”, or right on top of the When Issued, today’s $41 billion sale of 5Y notes was a mirror image in that regard, and while some strategists had expected today’s sale of 5Y paper would price on the weak side thanks to the sharp intraday jump in Treasury prices, that did not happen and instead the 5Y stopped at 2.315%, once again “on the screws” to the When Issued 2.325%. Today’s yield was a modest increase from the 2.172% in March if still the second lowest going back to December 2017.

The internals of the auction were surprisingly strong as well, with the Bid to Cover of 2.44 rising notably to the highest of 2019, and well above the 2.35 in March, which is also the 6 auction average. Meanwhile, fears about the disappearance of foreign bidders were greatly exagerated, with Indirects taking down 61.5% of the auction, up from 59.0% last month, and better than the 58.2% average. And with Directs fading modestly from 17.2% last month to 15.3% in April, Dealers were left with 23.3%, virtually identical to last month’s 23.8%

Overall, a strong 5Y auction which is surprising in light of today’s significant move lower in yields, and certainly boding well for next week’s 3, 10 and 30Y auctions.

via ZeroHedge News http://bit.ly/2VnQBqG Tyler Durden