Analyst reactions to yesterday’s Tesla earnings are starting to trickle in and the initial reaction are, well, speechless.

Wedbush analyst Daniel Ives led the charge, calling Tesla’s quarter “one of top debacles” he had ever seen in 20 years of covering tech stocks on the Street. He slashed his price target to $275 from $365 and changed his rating from a buy to hold.

“Musk & Co. in an episode out of the ‘The Twilight Zone’ act as if demand and profitability will magically return to the Tesla story,” Ives said in a note to clients. “At this point the writing is on the wall that Tesla will likely have to raise over $3 billion of capital in the near term to sustain its capex and debt needs given its current profitability path, which is another black cloud over the name with an inexperienced CFO now at the helm,” he continued.

Having had enough of this shitshow, Ives refused to hold back: “We continue to feel robotaxis, insurance products, and other endeavors are distractions from the growing demand woes that are not being addressed which is a critical worry of ours at this juncture.”

Goldman Sachs also downgraded Tesla, slashing their price target to $200 (it already had the company at a Sell) and saying the “…results miss[ed] despite an already anticipated weak quarter.” David Tamberrino from Goldman mirrored some of our concerns about the company’s questionable guidance, especially as it related to capex spend:

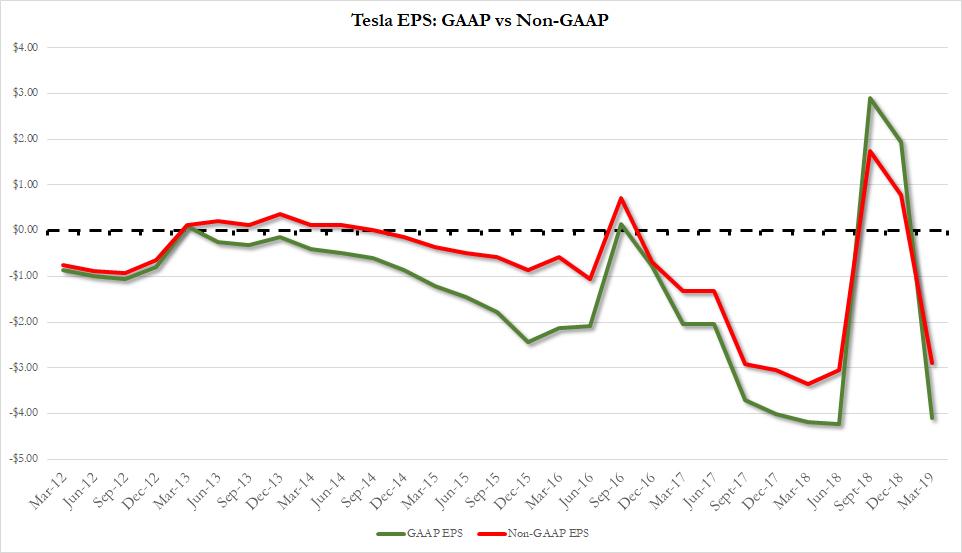

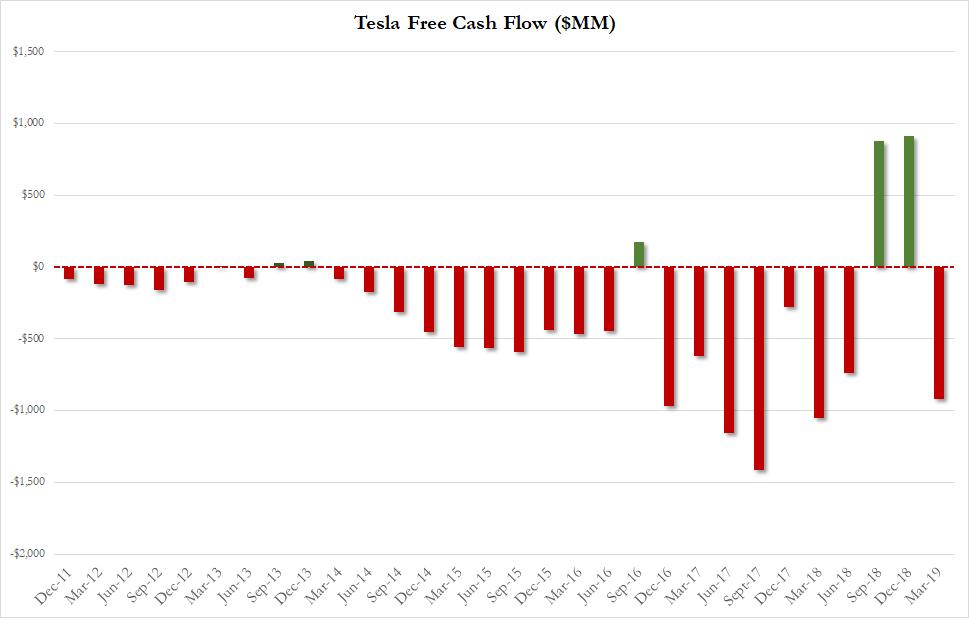

We believe the implied quarterly rate for 2H19 of 101k to 121k is aggressive; as such, our full year volume estimates still fall short of the low-end of the company’s guidance range. Ultimately, we believe the company’s ‘if we build it, they will come’ mantra likely requires incremental incentives (or some form of this) in order to entice incremental sales – which also will weigh on gross margins. Lastly, from a FCF perspective, with the anticipated ramp in capex, we do expect to see quarterly FCF burns later this year – which could make raising capital prudent ahead of this. We maintain our Sell rating and our 12-month price target declines to $200 (from $210).

We had questioned the company’s capex numbers in our writeup post-earnings yesterday:

And here some critical math (or maybe meth): after reporting just $280MM in CapEx, far below the $510MM expected, Tesla is now projecting to burn on average about $650MM in CapEx in the remaining 3 quarters, which would soak up virtually all of the remaining $2.2 billion in unrestricted cash (which plunged from $3.7 billion as of Dec. 31).

GS also took exception with customer deposits.

Customer deposits were down again, coming in at a $768mn balance at quarter end (down from $793mn at 4Q18 end). This comes as we have continued to see customer deposits trend down as the company has said they have been fulfilling Model 3 orders. However, we ultimately think the continued decline may indicate that the sustainable demand for TSLA products may not be as high as some investors initially anticipated. Further, with the Model Y now taking deposits, but the total amount down again sequentially we think this may be the harbinger of more demand softness to come for TSLA.

Among other notes, the investment bank also offered takes on why an uptick in orders may be difficult, and why a capital raise should be considered – mirroring sentiment from almost every analyst on the call yesterday.

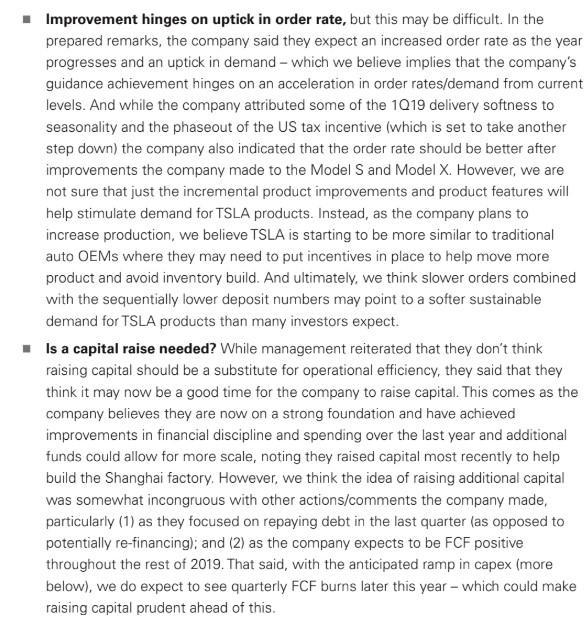

Despite the stock’s reaction, Tesla reported nothing less than a disastrous quarter yesterday after market. Earnings were close to the worst on record with the company reporting a loss of $2.90 in the quarter, more than double the estimated $1.30 share, on dismal revenue of just $4.54 billion, also far worse than the $4.84 billion expected. The EPS, charted, was clearly a disaster.

SLA’s cash declined by what may be a record $1.6 billion, with free cash flow (cash from operations less capex), coming it at a whopping $920 million, meaning that TSLA burned $10 million in cash every day.

What is curious is that Tesla’s cash burn would actually have been far worse because while the company reported Q1 capital expenditure of $279.9 million, the estimate was for nearly double that or $508.2 million, suggesting the company once again mothballed various expansion projects to mitigate the cash burn.

We also summarized the highlights from the company’s surreal conference call here, detailing the company’s new plans to… sell insurance, among other things.

via ZeroHedge News http://bit.ly/2IJ5QET Tyler Durden