While Tesla’s Q1 earnings announcement was devoid of any noticeably massive embarrassments, freak outs or assaults on analysts, the report and its associated conference call were simply just ugly. The company’s report was far worse than the already pessimistic estimates laid out by Wall Street and the conference call was a scripted and stuttering snoozefest.

Options sellers so far look like they will be the beneficiary of Wednesday night’s report. Tesla stock swung wildly in the after market session, touching lows near $250 and highs near $265, but ultimately settled just 0.16% off from where it closed the day session, $258.66.

Most notable is the fact that the company posted an astonishing $702 million loss for the quarter, despite telling journalists on their “secret call” about 7 weeks ago that the company might see a “slight loss” in the quarter.

Talk about an understatement.

Here are some of the additional lowlights from Tesla’s report and call, from Bloomberg:

- Tesla’s $2.90 a share loss more than doubled analyst expectations, which were for a loss of $1.30 a share.

- These were, again, estimates that had already come down significantly over the last few weeks.

- Gross margins fell as total sales tumbled.

- Excluding the sale of EV credits, Tesla’s margins were 20.2%, down from 24.3% in 4Q.

- The news that helped shares was the outlook buried at the tail end of the shareholder letter. In it, Musk foreshadowed a more rosy outlook on profits and cash flow than he had presaged on investor day.

- “Operating cash flow less capex should be positive in every quarter including Q2,” adding that, he expects to reduce losses in Q2 and get back in the black in Q3.

- Those results likely rely on hitting Tesla’s sales guidance of 360,000 to 400,000 vehicles, which Musk also affirmed despite a relatively low 63,000 cars sold in the first quarter.

- He said the low sales were largely the results of constraints from a supplier and long shipping lines of cars to Europe and China.

- On the analyst call, Musk hinted that a cash raise may be in the offing.

- He said there is some “merit to the idea of raising capital.” That makes sense since Tesla is trying to get the Model Y ready for production.

- Musk also touted an insurance product, which he hopes to launch in about a month.

- Because they are managing their legacy business so well already…

- Musk also said that he would prefer to take the company private but rued the fact that he probably cannot pull off a deal to do so. “I think the ship, that ship, has sailed,” he said

- If by “the ship sailing” he means “I can’t fake another buyout offer”, we think he’s right.

Why anyone takes Musk’s guidance seriously at this point is beyond us. Especially given the fact that it was just about six months ago, in October 2018 when Musk was telling people that sales of the Model 3 would make the business “sustainable”. “Sufficient Model 3 profitability was critical to make our business sustainable,” Musk said on Oct 24.

With Musk today claiming “we expect to return to profitability in Q3 and significantly reduce our loss in Q2,” one really good question remains: why does anyone trust a thing that comes out of this guy’s mouth? And furthermore, why are regulators allowing him to continue flapping his gums with whatever guidance is convenient at the time, regardless of whether or not it is rooted in any type of reality?

The company’s capex remains not indicative of a growth company:

“Hyper growth company” $TSLA pic.twitter.com/Zo7gL3PQhz

— “Elon Says” (@ElonBachman) April 24, 2019

And in terms of getting the insurance product off the ground, PlainSite tweeted out that the company has had the name “Tesla Insurance Services” registered since 2017. According to PlainSite, they have 1 registered agent working out of San Francisco. This compares to Geico, who has 499 agents whose names just begin with the letters A, B and C.

It has one (1) endorsed agent who works out of a shared office in San Francisco.

— PlainSite (@PlainSite) April 24, 2019

Of course, insurance is a great industry for playing accounting tricks and collecting cash up front – two things Tesla has been honing its expertise in. As an added bonus, PlainSite also Tweeted out during the call that the company was being investigated by the FTC:

Just received this. $TSLA is under investigation by the FTC. pic.twitter.com/Xhz5tAYtxi

— PlainSite (@PlainSite) April 24, 2019

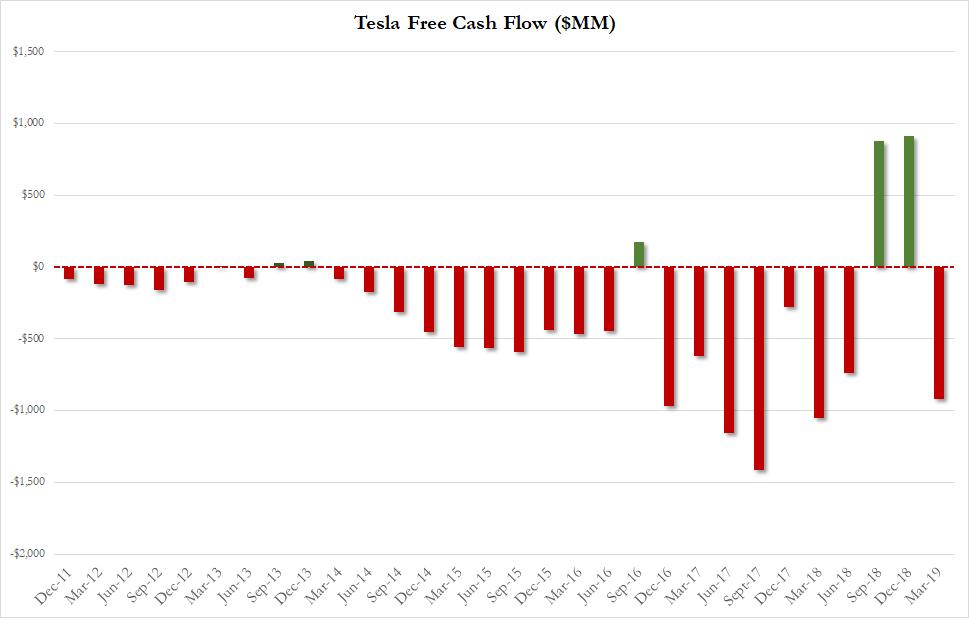

Meanwhile, speaking of reality, and as we pointed out earlier, Tesla burned $10 million in cash every day.

Other astute investors on Twitter made some cogent points after the call, as well

“Capital hasn’t been a constraint on growth”

-Guy making cars in a tent

— “Elon Says” (@ElonBachman) April 24, 2019

I am genuinely impressed that $TSLA stock is not down $20+ right now. These financial results are an unmitigated disaster–every single line of the financials.

— B Graham Disciple (@bgrahamdisciple) April 24, 2019

It’s the strangest thing; at Callahan Auto, if our sequential revenue drops 37%, our A/R balance tends to follow that decrease. At $TSLA, when revenue drops 37%, sequential A/R actually goes up $100,000,000. Huh. Zach better make some big calls to the deadbeat customers.

— ToolGrinder (@tool_grinder) April 24, 2019

I’ve never seen such blatant lying about quarterly guidance from a large company 1/3 of the way into a quarter as we saw this afternoon from $TSLA. It will use this fraudulent lie for a rushed cap raise and burn whoever participates to high hell. #AnotherLawsuitSecured$TSLAQ

— Mark B. Spiegel (@markbspiegel) April 24, 2019

There’s so much garbage in these numbers. If they deliver 90-100K cars in Q2, I’ll eat my shoes.$TSLAQ $TSLA

— TeslaCharts (@TeslaCharts) April 24, 2019

Try to spot the two quarters where the entire legal and accounting teams resigned. $TSLA pic.twitter.com/vwZXWV69X0

— “Elon Says” (@ElonBachman) April 24, 2019

The stock’s non-volatile reaction after hours may not be the victory bulls are claiming it to be so far. From this report, it seems clear that the company is still hellbent on slowly, but steadily, running into the reality check that Musk and his merry band of brothers desperately need.

via ZeroHedge News http://bit.ly/2vl81px Tyler Durden