With the S&P hitting all time highs, one would think that investors would finally get off the skeptical fence they have been sitting on since October, and – finally proving Marko Kolanovic correct – put their capital into the stock market.

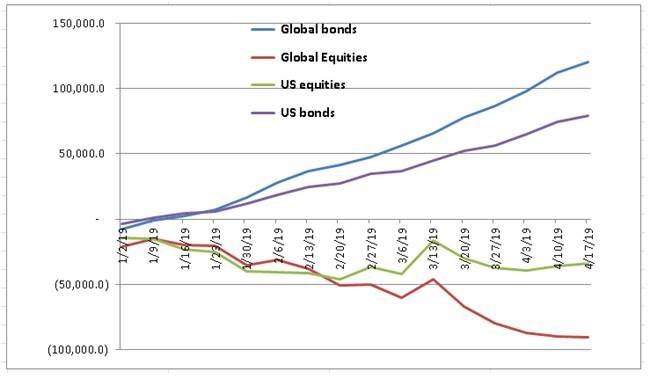

But one would be wrong, because for one more week, the most distinct trend of 2019 – professional investors taking money out of equity funds and putting it into bond funds – has continued, with EPFR reporting that last week another $4.4BN was redeemed from equities and $9.9BN was allocated into bonds, which as BofA’s Michael Hartnett puts it, means the “YTD greed is in credit funds (inflows to IG, HY, EM debt $109bn) not stocks (outflows of $95bn).” This is summarized visually below:

Putting the latest weekly fund flows in context: last week saw the biggest inflows into govt bonds in 3-months ($1.9bn), with the first High Yield & EM debt outflows since Jan 2nd; meanwhile, even as the US saw a notable $6.4 billion in outflows amid the total $4.4BN in outflows ($3.6BN in ETF inflows vs $7.9BN in mutual fund outflows), there was an equity rotation to “growth” via Tech $1.3BN and Healthcare $0.8BN, out of value via Financials & Energy.

To Hartnett, the bottom line is that “flows appear to continue to reflect rising investor conviction that central banks will never hike interest rates ever again.“

Another way of looking at fund flows, per BofA: institutions are long credit, while corporations are long stocks (i.e., their own stocks which they repurchase). To wit, since the global financial crisis (Mar’09) credit fund inflows amount to $1.2 trillion, while equity inflows are roughly half that, or $0.7tn (MF -$1.3tn, ETF +$2.0tn). But that doesn’t matter as the biggest buyer of stocks remain US corporations themselves, via stock buybacks, which are now $5.1 trillion since the financial crisis and counting.

And speaking of buybacks, we appear to have entered a phase which BofA calls the “Buyback bubble” – following a record year for buybacks, in the first quarter of 2019, US buybacks are already 22% higher YoY to an estimated $270BN, which to Hartnett is ironic for the following reason:

“the irony of 2019 is threat of populist policies in 2020s to reduce buybacks & inequality will likely increase buybacks in 2019 as corporations rationally front-run populist policies…another bullish equity catalyst.”

Of course, another record year of buybacks will only make the passage of populist, anti-buyback policies next year far more likely… just in time for the US economy to enter recession.

But while all of the above is generally known, the punchline of Hartnett’s latest weekly letter is the feedback the banker received from his recent London client meeting, which was as follows:

“robots outperforming humans; bullish humans are “frustrated” (have not made enough money), “paranoid” (quick to take profits, see China/EM price action this week), “exhausted” by trying to play contrarian in TIPS, value, Europe, banks, “clustered” happily more & more in tech & corporate bonds.”

Meanwhile, the prevailing bullish zeitgeist to BofA is an era of no inflation, no hikes, no inflows set to continue, despite a modest cycle still persisting in US & China, but no cycle in Japan or Europe (and trade war to engulf Europe in H2).

Poetic blurbs from Harnett aside, he has three distinct observations on prevailing market trends:

- End of China stimulus = start of competitive FX depreciations: China stimulus has caused green shoots in China but nowhere else; China signaling stimulus done, and the stimulus (thus far) not visible in Korea, Sweden, Australia, Germany and so on…investors now require insurance policy of +5% depreciations in KRW, SEK, AUD, EUR (Chart 2) to guarantee growth.

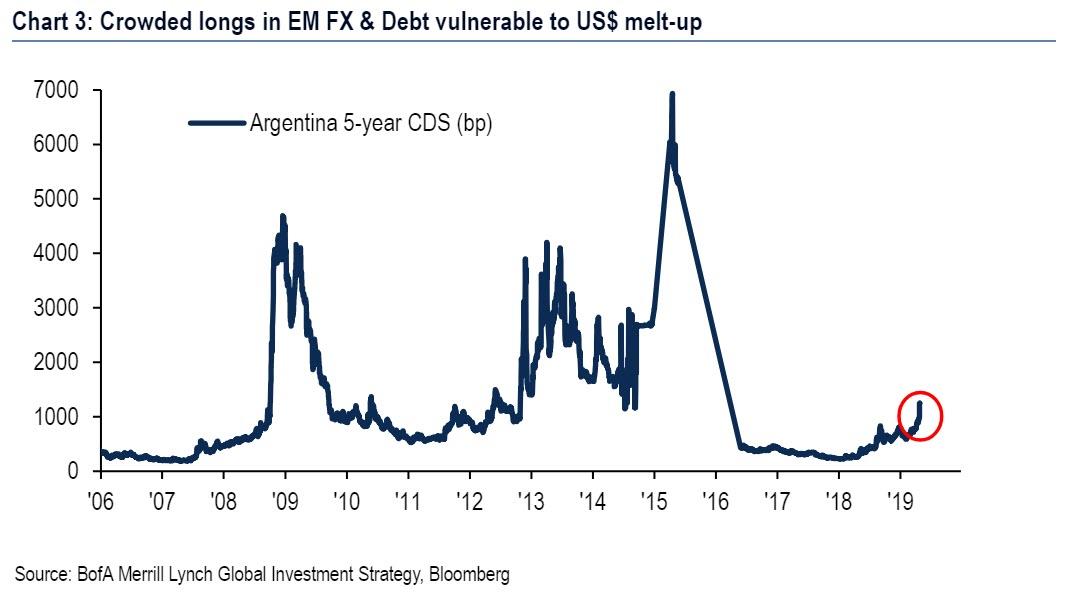

- Q2 loser is EM: debt & FX positions in EM very crowded and based on consensus of weaker US$; EM debt & equity inflows since Feb’16 $250b… note Argentina & Turkey fissures first signs of US $ melt-up pressure raising risk of contagious EM credit event (Chart 3).

Tactically, risk assets continue to rise led by “deflation winners” of credit, tech, US, all likely funded via profit-taking in EM; US$ appreciation signalling easing of global financial conditions hence global equities outside US will also likely remain bid.

So what about strategically? To Hartnett (and Kolanovic, and many others) a key variable remains when greed will once again dominate, and result in a burst of buying stocks, which has yet to emerge despite fresh all time highs in the S&P. To make that determination, BofA says to watch the “8s” for “greed shoots”, as the bank “waits for “greed shoots” before turning bearish”…

- >8 on BofAML Bull & Bear Indicator…currently 4.9 (Chart 1).

- >88% of MSCI global equity indexes hit “overbought” (i.e. >50 & 200-day averages)…currently 60%.

- >$800bn of US equity index delta-adjusted open interest…currently $431bn (was $837bn at Jan’18 highs, was -$980bn at Dec’18 lows).

In addition to euphoria surrounding the blow-off top, Hartnett believes that one thing that can stop the NASDAQ melt-up is the US dollar melt-up: US$ melt-up (e.g. to 1.00-1.05 vs Euro) to hurt US tech EPS is only thing stopping NASDAQ (note 59% US tech sales from overseas), and while the US$ is breaking up for now, it is nowhere close to dangerous level for tech, per Hartnett.

Ironically, whereas dollar strength could burst the current melt-up, it is dollar weakness that will eventually mark the end of the latest secular upswing, and as Hartnett concludes, “only once dollar appreciation ends in late-Q2 (gold & tech will be the tells) will combination of equity inflows, global growth upside surprises & rising bond yields trigger “big top” of Wall St., in our view.”

via ZeroHedge News http://bit.ly/2IM73v8 Tyler Durden