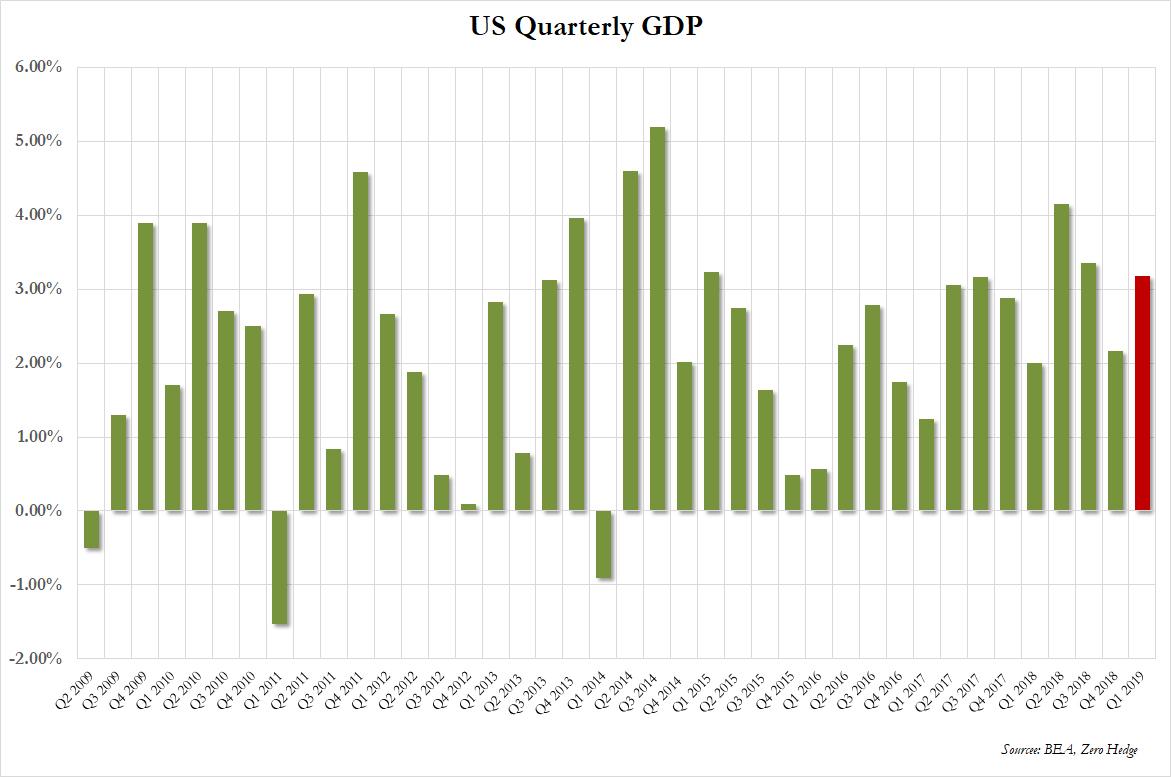

With the Atlanta Fed forecasting Q1 GDP of as little as 0.5% about 6 weeks ago, traders were shocked when moments ago the BEA reported a GDP print that at first glance many though was a misprint: at 3.2%, Q1 GDP came in 50% higher than the 2.3% expected, and was the highest Q1 GDP (which is not only the weakest quarter of the year, but also a quarter notorious for its residual seasonality) since 2015.

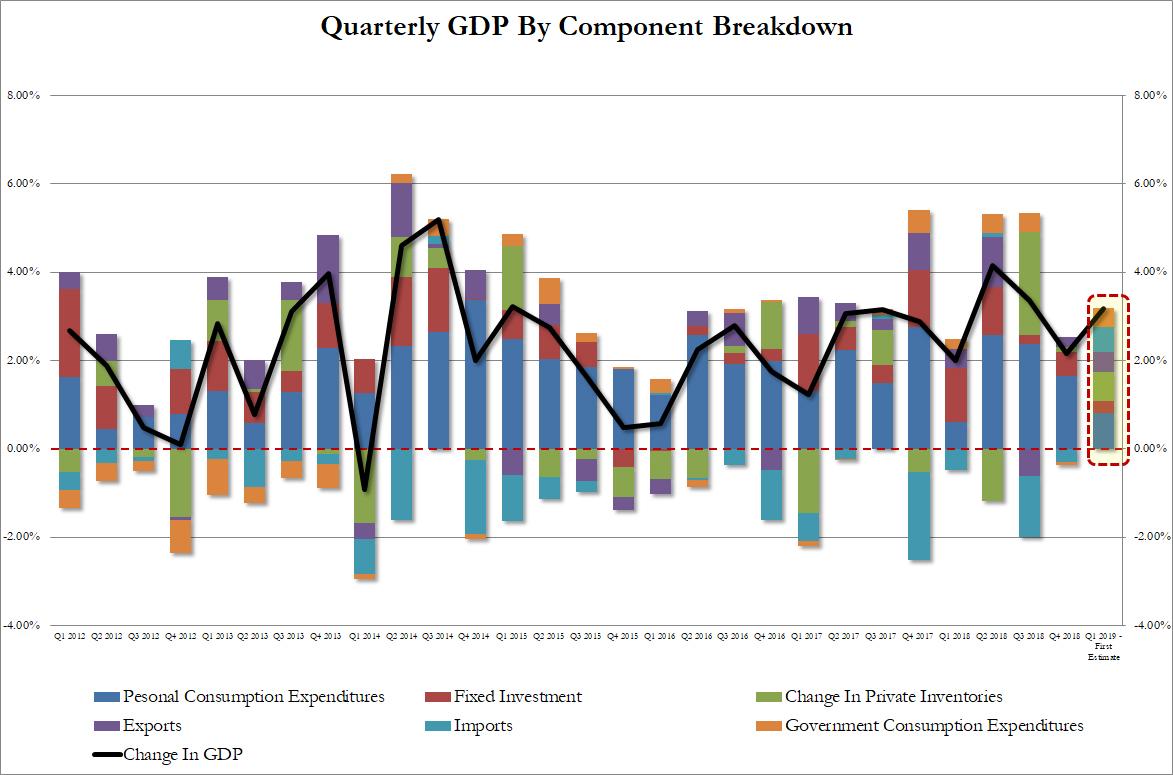

That was the great news: the not so great news – the number was driven entirely by “one-time items” such as a surge in inventories and a far smaller trade deficit, pushing net trade sharply higher, neither of which is sustainable; meanwhile both consumption and fixed investment dipped from Q4, with PCE and CapEx adding just 1.1%, or about a third, of the bottom line GDP number.

Specifically, the breakdown of contribution to the bottom line GDP was as follows:

- Personal Consumption: 0.82%

- Fixed Investment: 0.27%

- Change in inventories: 0.65%

- Net Trade: 1.03%

- Government consumption: 0.41%

And visually:

Developing

via ZeroHedge News http://bit.ly/2UXYTWR Tyler Durden