Submitted by Emad Mostaque of Three Body Capital

What keeps us up at night?

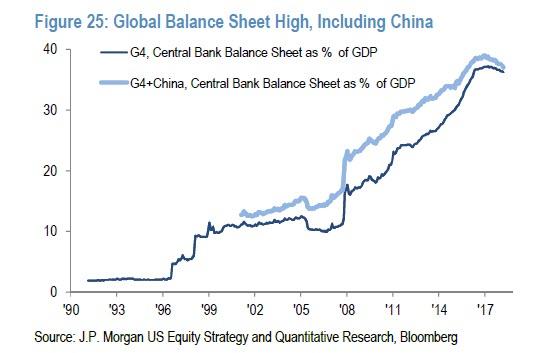

One question keeps us up at night. Where did all that new money go? Accounting for US$20tn of central bank liquidity is by no means easy, but we have a hunch about where an outsized re-allocation of capital might have landed.

Private markets.

Coincidental with the post crisis ‘recovery’ was a material shift in the market’s perception of private equity and venture capital. What was previously a secluded corner of finance, restricted to the mahogany paneled offices of Blackstone and KKR, became THE destination for the cool kids of finance. Hedge funds were out. Private Equity was in. This trend perfectly coincided with the meteoric rise of the tech startup in the popular imagination. While central bank balance sheets ballooned, an esoteric asset class combining PE and VC was lifted on the tide.

Based on data from Preqin dating from 2012-2018, the industry hit peak private equity mania in 2016, with a whopping 1,936 PE funds closing their rounds that year, raising a total of US$487bn in funds. In 2018, the average assets raised per fund is at an all time high of US$362m. While public markets were being distorted by QE, accelerated by ETFs and central bank buying (with the Bank of Japan owning Japanese Equities equivalent to 77.5% of Japan’s ETF market at last count), capital poured forth into private markets.

To better understand the extent of the mania in the PE/VC world as a result of the huge liquidity surplus created by the various forms of QE, consider the success of first-time PE and VC funds in raising assets without a track record. In 2018, 32 first-time PE managers raised a total of US$8.7bn. In the VC space, 2018 saw 58 first-time VC managers raising US$6bn, versus 51 managers raising US$4.1bn in 2017. On a per-fund basis, assets raised per fund increased from US$80m in 2017 to US$103m in 2018.

A mountain in the road.

The PE/VC model offered the promise of lower volatility (thanks to lockups and the exclusion of retail investors), lower correlations and higher returns. In recent years, several factors have converged to challenge this thesis.

A preponderance of new funds entering the market in the past decade means too much cash bidding up too few worthwhile assets, eroding potential returns. Welcome to the new equilibrium. The pressure to generate returns and distributions has real consequences. Even in Asia, the most promising region for PE/VC, average returns cannot fully compensate investors for the lack of liquidity.

Private investments were meant to be largely uncorrelated with the stock market, but that has not been the case. Adjusting for liquidity and risk, the ‘Public Market Equivalent’ (PME) ratio for PE and VC funds still largely tracks the S&P 500, less the anguish of seeing a mark-to-market that can be realised by panic selling, saving investors from themselves and forcing them to ride out a cycle. And where opportunities for buyouts should have materialised in public markets, these too have evaporated thanks to the abundance of liquidity. Public market stock buybacks have accelerated, leading to a rise in public – and private – market valuations.

A false sense of security.

GPs want big deals and they want them now, so returns can be crystallised and reported to investors. But there aren’t many more mega deals to be done in the short-term. Distress is getting much harder to locate in scale and contrary to what FOMO-stricken investors want to believe, managers are admitting the easy times are coming to an end.

It’s showing in their numbers. ‘Dry Powder’ – capital committed but not yet spent – has built up over the years. If dealmaking continues to remain this challenging, unused capital from younger 3-5 year vintages will continue to weigh on fund performance. The situation is no different in Asia, where managers, having plucked the low-hanging fruit in China, are discovering that having a pool of cash only gets you to the start line.

The alternative to doing nothing is doing something. Thus, capital is recklessly deployed so it doesn’t need to be returned investors unused. The result is a game of hot potato as deals are passed around the secondary market to new investors who want to get in on the action.

Where secondary markets were previously used as an emergency exit for deals gone wrong, they have now become actively traded, providing liquidity to managers serving as a means for investors to receive distributions from their locked-up investments. The result is the vibrant and active market for private assets that we see today.

From 2013 onwards, secondary market transactions helped drive net cashflows for investors to a positive. The result was that the proverbial ‘J-curve’, which involved investors taking heavy cash outflows and paying in commitments in the early years of their PE investments, was quickly smoothed out by early distributions and raising DPI (Distributions/Paid In Capital) ratios. This has further lulled LPs into a false sense of security that the asset class has been de-risked.

So where did all the money go?

Total private capital fundraising, including PE, VC, real assets, private debt, infrastructure and natural resources grew by just under US$5tn between 2012 and 2018. That represents about 50% of the total change in the big 4 central bank balance sheets over the same period. Add that to the buybacks conducted and dividends paid out, plus the expansion of balance sheets outside these sectors, including households and a cryptocurrency boom/bust cycle, and we get to the inevitable conclusion – all of the money that was printed has been dished out, leveraged up and possibly leveraged up again.

Here’s the kicker – a sizeable chunk of incremental new assets is locked up in typical 10+1+1+1 year structures that are illiquid, with legally binding capital commitments. We find ourselves in a situation where fundamentals don’t hold. Spare cash (likely debt proceeds) has piled up and is looking for a new home. And leverage, previously visible on balance sheets, has gone into hiding. Like a giant black hole, we know it’s there, but making it visible to everyone else is a much bigger undertaking, as we’ve recently seen with M87.

At least there isn’t a mark-to-market for private assets. But just wait till these assets need a quoted price to be sold: ebullient markets have been going for long enough to forget what a ‘liquidity premium’ truly means. Meanwhile, life goes on, investors go on, in search of returns, in a market whose correlations are rising, taking ever-greater risks until one day something gives way and asset classes converge.

To make things worse, managers are also trying to make subscriptions to private capital funds easier – including ‘subscription loans’ to cover capital commitments. Estimates cited by JP Morgan Asset Management point to US$350-400bn of outstanding subscription loans, more than 30% of the disclosed PE/VC dry powder balances, suggesting that estimates are inflated.

What happens if the dry powder is pledged on borrowings? What happens when managers call for capital but nothing comes? How much real equity is in those reserves, as opposed to banking credit? Could these awkward questions close the vicious circle between private capital and the banking system and expose us all to systemic risk?

‘Equity’ might actually be ‘debt’. Recent data published by S&P Global Market Intelligence’s LCD news flags US leveraged loan issuance clocking in at -40% YTD, leading to Collateralised Loan Obligation (CLO) managers – hungry for assets – approaching PE firms to push for dividend recapitalisations. In other words, people aren’t borrowing, business isn’t good, so lenders are asking PE managers to borrow MORE to pay more dividends out, extracting cash from their investments and replacing it with debt.

Borrowing for the sake of borrowing was never a good idea in the first place. Giving away money for the sake of borrowing is on a whole new level.

It’s complicated.

We’ve barely scratched the surface of correlation and causality. Charting the fault lines and defining an investment strategy around them will take much more time. But at least we have an idea of where the vulnerabilities lie. Private markets, commonly believed to be free of the ‘noise’ of public trading and focused on fundamentals instead of stock market momentum, aren’t as straightforward as we’ve been led to believe.

It’s a great time to be starting a hedge fund. By deploying capital prudently and with conviction, there will be opportunities – driven by our underlying investment themes with real-world implications – to make outsized returns, especially on the short side. This is because eventually, the only route back to a balanced, investable market is to go ‘cold turkey’ via the cauterising effect of higher interest rates. There is going to be pain either way – better it be voluntary and controllable. The alternative is permanent zombification.

via ZeroHedge News http://bit.ly/2GLHOFE Tyler Durden