Back on January 9, when the S&P500 was just inches away from its Christmas Day bear market lows, we asked a simple question: is the Shanghai Accord 2.0 coming? Now, with the S&P back at all time highs, China unleashing a historic torrent of new credit after launching monetary and fiscal easing that shocked even the most cynical China skeptics and sent Chinese stocks soaring, and every central bank in the world reversing in the Fed’s footsteps and scrambling to cut rates as the global race to the currency bottom entered what may be its final lap, we have the answer.

Or do we?

For those who are rightfully confused, because while there are countless similarities between the “2016 scenario” and current markets, there are also some very specific differences, here is a great recap of the similarities and differences, excerpted from the latest weekend note by One River asset management’s CIO, Eric Peters:

Deja Vu

“Everyone’s thinking it’s 2016 all over again,” said the CIO. A global growth scare, equity weakness, dollar strength and commodity declines prompted central bankers to hash out the Shanghai accord in early 2016 that dramatically reversed these trends. “They’ve seen China ease this year, the Fed pivot, equities rebound,” he said. By late-April in 2016, the S&P 500 had jumped 17% from the Jan 2016 lows (this year it rallied +20%), and by late-April 2016, Chinese stocks rose +16% (this year +40%). “They’ve looked at this and said green light, risk on.”

“Pulling out the 2016 playbook, people piled into reflation trades,” continued the same CIO. “Short dollar trades, crap beats quality, dash for trash, EM equities and FX, commodities.” By late-April 2016, oil had surged +70% from the Jan 2016 lows (this year +50%), copper rallied +20% then (this year +18%). The dollar index had fallen -6% in 2016 (but this year DXY is up +1%), gold surged +23% (but this year flat). “The dollar and gold are saying 2019 is different from 2016, and if that’s right, people need to exit their reflation trades.”

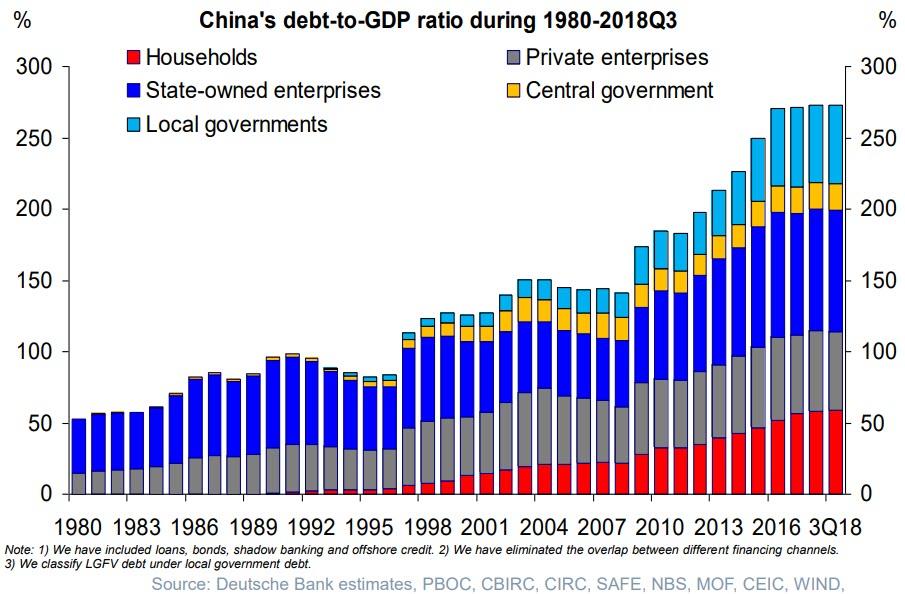

“China doesn’t appear to have the stomach for a massive stimulus above what they’ve already done,” said the CIO. “At a certain level, the efficiency of each additional dollar of credit you pump into a system declines to the point where new debt is almost entirely used to service old debt.” By late-April 2016, emerging market equities had rallied 28% from the Jan lows (this year just +17%), and Baltic Dry shipping rates surged 160% (+26%). “This year’s response lacks the oomph of the 2016 rally, which was itself weaker than the 2009 explosion.”

All this can be seen in the feeble rebound in China’s Credit Impulse which despite the record injection of credit in Q1, has barely pushed off its all time lows.

RMS:

“As long as we’re negotiating, it seems good for stocks,” said the investor. On Mar 1st, 2018, Trump announced 25% steel tariffs and said, ‘Trade wars are good and easy to win.’ From those levels, the S&P 500 has traded both 10% higher and lower and is now at a record. In the meantime, the administration put our CEOs on notice that China is not a great link in their global supply chains. “We want a US exodus from China, but at a pace that doesn’t sink the ship. If you’re on a lifeboat on the Titanic, you give yourself some distance before it goes down.”

“The challenge we face is that in the process of our politicians attempting to disentangle the US from China, our financiers are sending them widow and orphan money,” said the investor. The April 1st MSCI inclusion of Chinese bonds into its index is the latest example of moves that will passively shift $150bln-$200bln+ a year in US retirement savings to China. “Without these flows, Beijing has a real problem. They need Wall Street’s help. They’re no longer running a current account surplus. And Washington is going after their trade surplus.”

“The lure of China has proved irresistible,” he said. “But when you climb aboard, remember their rules are different. Take Alipay, the world’s largest payment platform. Jack Ma woke up one morning and told Alibaba shareholders he was taking it.” That was in 2011, at an estimated $2bln value. There was no lawsuit. No recourse. It’s now worth $150bln. “When people buy BABA stock today, they don’t even own Alibaba. They own an American Depository Receipt (ADR) on a Cayman company with rights to Alibaba cash flows. Good luck with that.”

via ZeroHedge News http://bit.ly/2UOl653 Tyler Durden