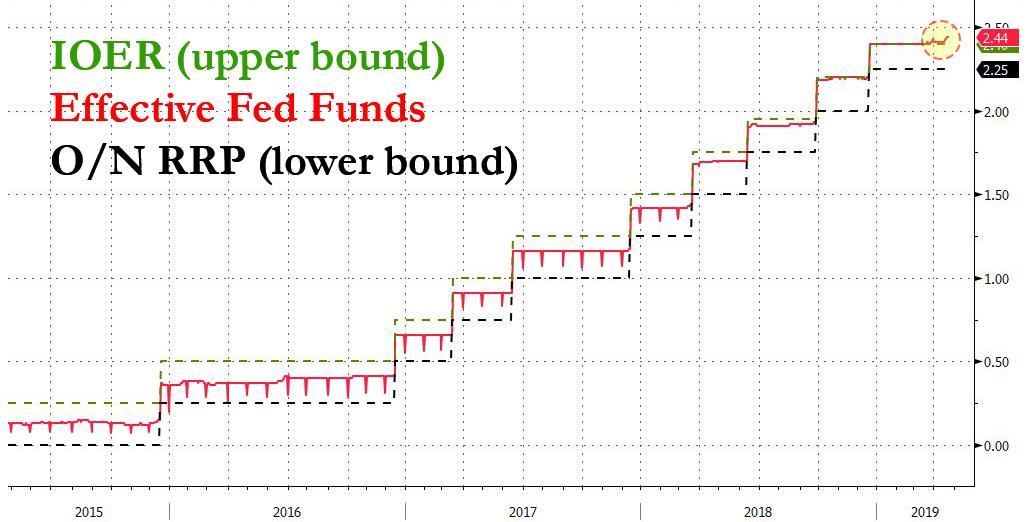

it may seem morbid, if not grotesque, to discuss the Fed cutting rates on the day when the S&P just hit a new all time high, but as a result of the previously discussed US bank liquidity and dollar shortage thesis, now also espoused by JPMorgan, and the coincident “funding-squeeze” dynamic, which as we have shown over the past week has expressed itself via the much-discussed “Fed Funds (Effective) trading through IOER” phenomenon…

… this is precisely the topic of the latest note from Nomura’s Charlie McElligott who writes this morning that with the Fed increasingly concerned about what even the big banks admit is a funding shortage in the US banking system (ironically enough, with over $1.4 trillion in excess reserves still sloshing in the system), Powell may have no choice but to cut rates aggressively, slash the IOER rate – perhaps as soon as this week – and eventually resume QE.

As if to validate McElligott’s point, amid increasing buzz of an imminent rate cut, the dollar keeps rising, and instead of tracking rate cut odds, which are now back to cycle highs, is instead tracking the excess EFF over IOER tick for tick as the clearest indicator of what is now perceived as a widespread liquidity shortage, and in doing so is escalating the recent turmoil across EMFX, as the US Dollar breaks out to fresh highs despite Friday’s worse than expected (below the surface) GDP print.

As discussed over the weekend, McElligott reminds readers that there is now “again a mounting belief in the market for a Fed “technical” IOER cut at some point into the Summer” – or even this week according to Morgan Stanley – as a necessity to “buy time” into still-tightening/shrinking excess reserves (especially since the Fed seemingly has been slow to move on a ”standing repo facility” alternative) prior to the Fed again expanding the balance sheet to add reserves again in the Fall via what the Nomura strategist calls the commencement of “QE Lite” (MBS reinvestments into USTs, most likely T-Bills to shorten the portfolio’s WAM and further steepen curve as an additional side benefit).

Additionally, with today’s core PCE Deflator data coming in even weaker than expected, and dropping to just 1.6% Y/Y, the lowest print since 2017, the pressure will be on Powell to be even more dovish at this week’s FOMC meeting grows according to McElligott, “especially ahead of the June Fed research conference in Chicago, focused on inflation and likely to advocate a “run labor hot” policy.”

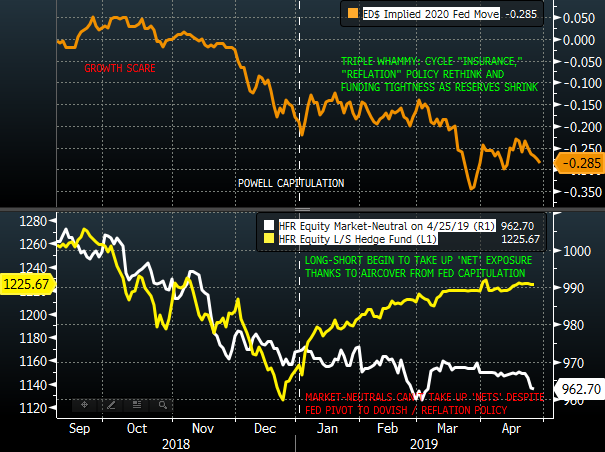

So despite a growing number of banks warning that the one thing that can break the market’s relentless levitation is a return to curve steepening, McElligott once again pounds the table on Steepeners (via curve caps), something he has been doing since last Summer, especially since the case “now only grows stronger as when the Fed does indeed “go,” they’ll go large – think 50bps out of the gates, and likely sooner than most expect, as they now have three cut “justifications”:

- cycle “insurance” (EVERYBODY talking the ’95-’96 weakening price-pressure analog, then again in ’98 on ‘external’ factors EM- and LTCM-)

- “reflation”-seeking policy rethink, and

- near-term Dollar funding dynamics as banking system reserves continue to shrink prior to the re-expansion of the BS in 4Q19

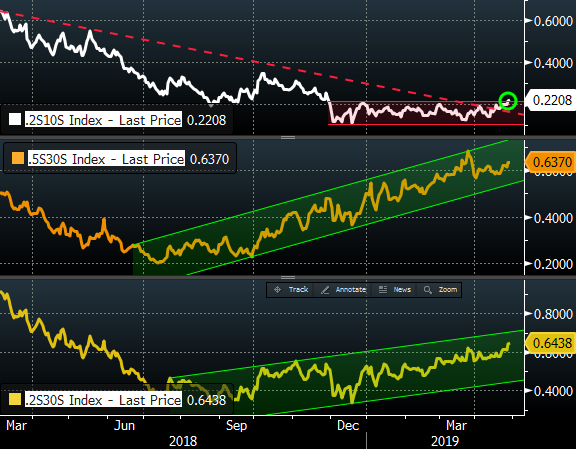

So how to trade an imminent rate cut, potentially as large as 50bps? As McElligott discussed last week, and echoing what Deutsche Bank’s Aleksandar Kocic said over the weekend, the 2s10s is likely then the better “trade location” now…

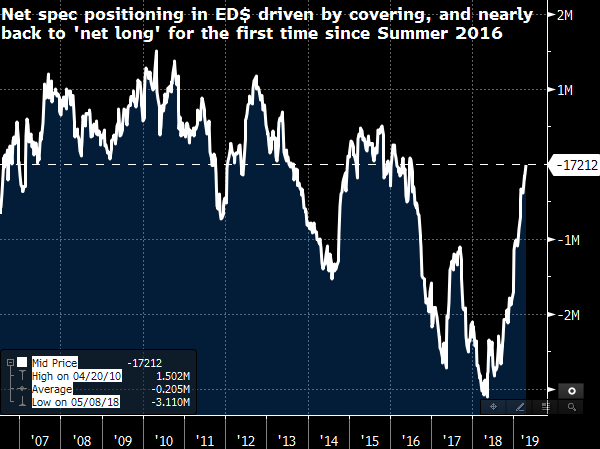

… as it has lagged the initially preferred expressions (5s30s, 2s30s which began steepening-out 2H18)—however simple ED$ Longs (Greens & Reds) / options “Upside” expressions continue to make sense…

… with Call Spreads offering attractive leverage.

Finally, and totally unrelated, McElligott points out the following “bonus chart” showing that market neutral hedge fund performance has been abysmal so far in 2019 as MNs can’t run enough “net” to capture the dovish Fed capitulation and rate-cut bets relative to long-shorts.

via ZeroHedge News http://bit.ly/2vuj3sl Tyler Durden