In an announcement that will no doubt be interpreted as broadly bullish for the unstoppable US equity rally, WeWork (or rather, “the We Company”, as its CEO has promised to rebrand it) said Monday that it is planning a public offering in the near future, and that it had already filed its registration paperwork with the SEC back in December.

It’s the clearest indication yet that Lyft’s post-IPO troubles (the stock is trading more than 30% below its IPO price, and has inspired a flurry of lawsuits) haven’t deterred other companies that boast both growing revenues and growing losses.

In a stunning acknowledgement of just how parlous WeWork’s business model is, a person close to the company reportedly told Axios that it could become the second most-shorted stock, behind Tesla.

Critics of the company have pointed out several overarching flaws in its business model: For one, it’s heavily indebted, and Moody’s last year suspended its rating due to a ‘lack of information’, with its bonds frequently trading at a double-digit spread to Treasuries.

With this heavy debt load, the company would be poised to toppled into bankruptcy during an economic downturn due to the fundamental dislocation between its long-term debt obligations and its short-term leases (though the company insists that it’s working to sign up more long-term clients like IBM). And let’s not forget the allegations of self-dealing by the company’s CEO that have been raised in the business press.

Even Soft Bank, the global marginal buyer when it comes to investing in overhyped Silicon Valley startups, cut back on plans for an investment in WeWork, eventually committing just $2 billion to the company, well short of the $16 billion it had initially been eyeing.

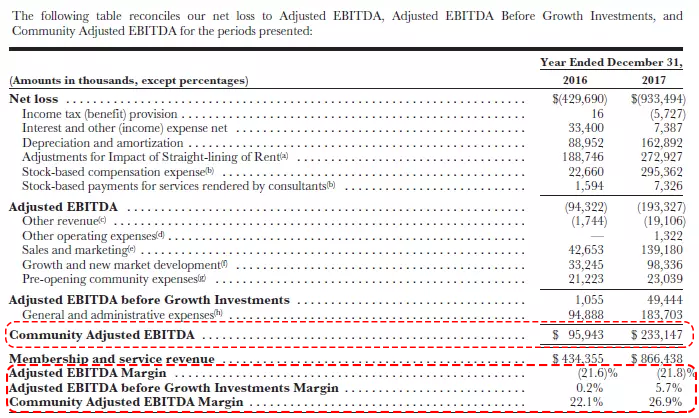

As we’ve pointed out time and time again, WeWork has relied on accounting gimmicks to try and win over bond investors. As we have reportedly pointed out, thanks to its reliance on “community-adjusted EBITDA”, WeWork’s EBITDA is, basically, whatever you want it to be.

Here, for the first time we saw not just one adjustment to adjusted EBITDA, but an adjustment to the adjustment to the adjustment, and it was called “Community Adjusted EBITDA”, which by the miracles of non-GAAP “accounting”, pushed the company’s EBITDA from negative $193 million in 2017 to positive $233 million.

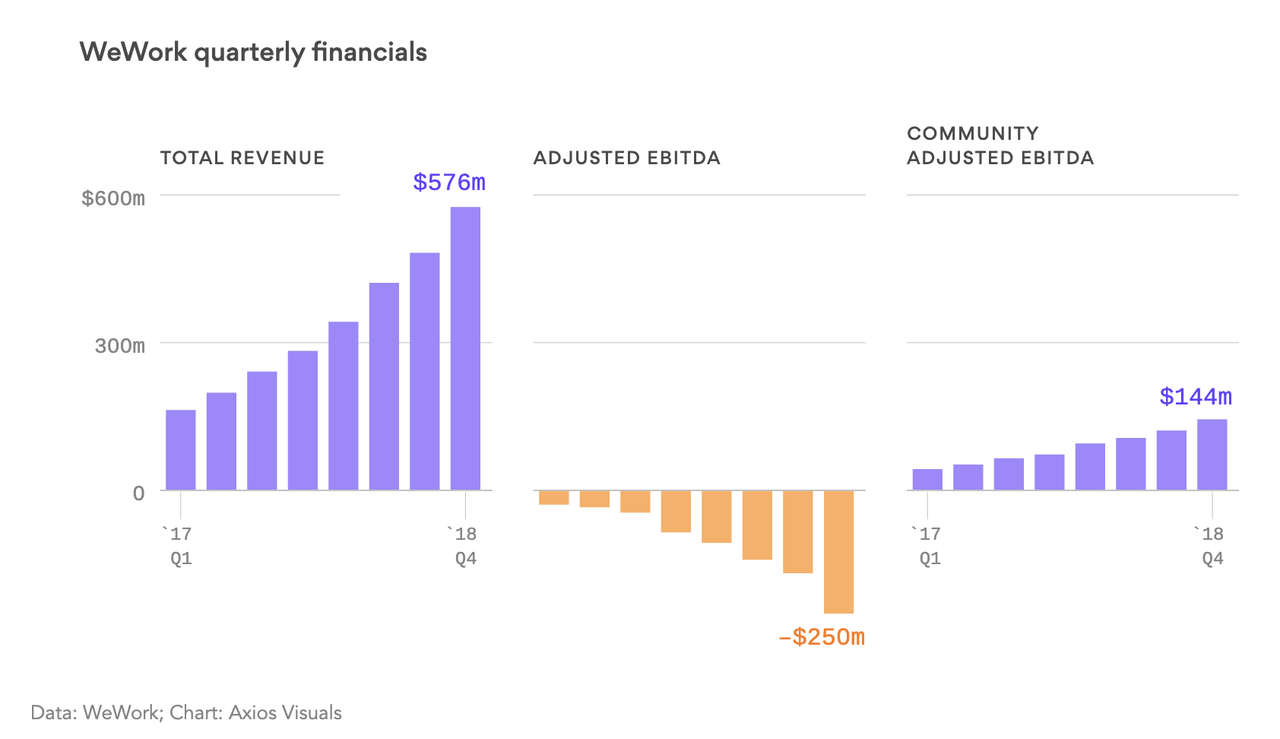

According to an investor presentation from last year, the company revealed that it doubled both revenues and losses last year (well, unless you go by the ‘Community Adjusted EBITDA’ figure).

Looks like a sound business model to us.

via ZeroHedge News http://bit.ly/2XWXaxZ Tyler Durden