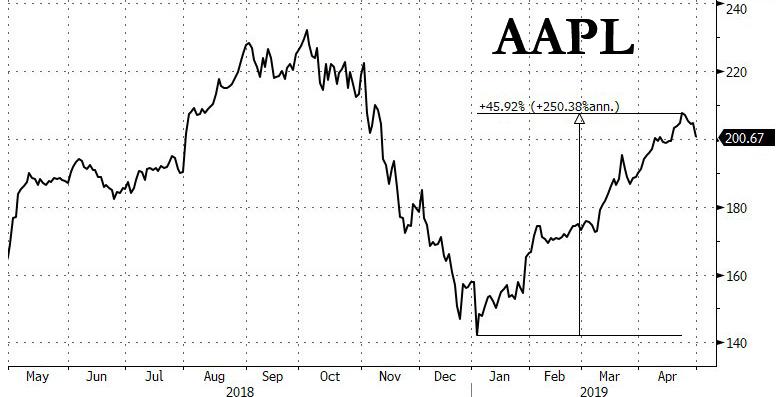

First, two quarters ago, Apple shocked investors when it said it would no longer disclose the number of iPhone it was selling – a clear signal that the selling was slowing dramatically. Shocked investors sold off the stocks… then BTFD with gusto sending AAPL sharply higher. A few months later, on January 3 2019, Apple once again shocked the market when it slashed its revenue guidance by8% for only the first time since this century (naturally, it blamed China). As AAPL stock tumbled, it reveberated across all capital markets, and even prompted a flash crash cascade in most yen and pound pairs. However, just like a quarter earlier, Apple’s “shock” was quickly overcome, and the after hours plunge actually marked the max pain for longs, and as the chart below shows, AAPL has soared 46%. And to think all it had to do was slash revenue guidance…

So with enough action to make an algos’ silicon head spin, everyone was asking just what disaster Apple would announce today to send its stock back to all time high?

Well, the stock is certainly spiking after hours, but this time there was no disaster, or even disappointment; in fact, the company just reported Q2 numbers that beat across the board, while the company guided above the consensus range for Q3, and also announced a new $75 billion stock repurchase authorization.

Here are the details:

- Q2 Revenue of $58.0BN, down from $61.1BN a year ago, but above the $57.49BN expected

- Q2 EPS of $2.46, down from $2.73 a year ago, but also above the $2.37 expected

- Q2 iPhone Revenue of $31.05BN, Exp. $30.50BN, down 17% Y/Y from $37.6BN

- Q2 China revenue $10.22BN, down 22% from $13.0BN Y/Y

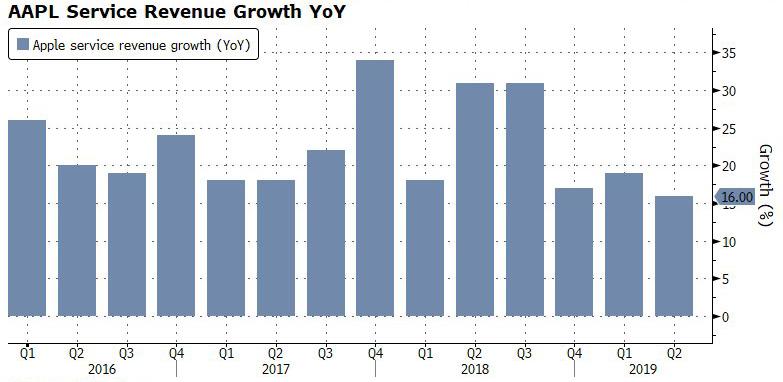

- Q2 Service Revenue $11.45BN, up 16% from $9.850BN

- Q2 Gross margin $21.82BN

The company also announced that it is boosting its dividend to 77c/share from 73c/share. In short, ok numbers, but nothing breaktaking, especially when one considers the company’s guidance cut last quarter.

But what the market was far more impressed by was the company’s Q3 guidance, where it now sees revenue between $52.5 and $54.5BN, solidly above the consensus estimate of $52.22BN, on gross margin of 37-38%, in line with the 38% expectation.

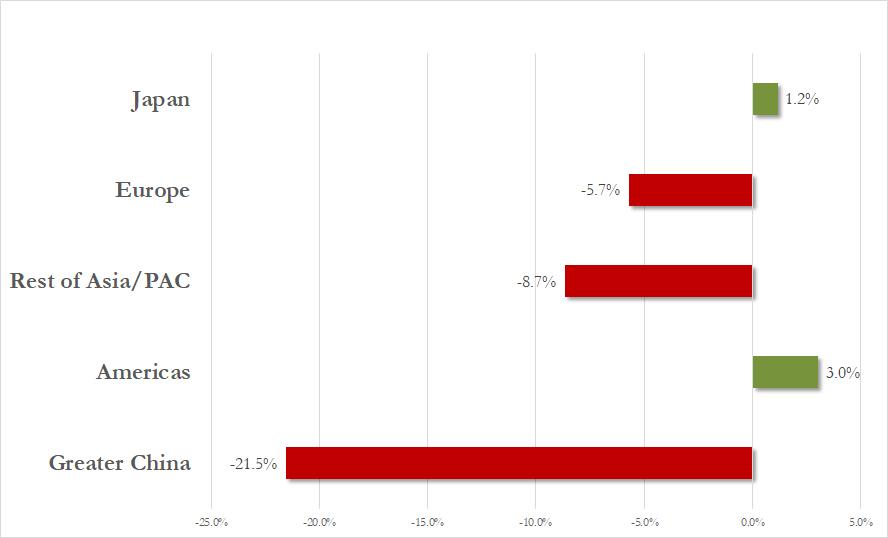

Breaking down the numbers in detail, it is perhaps not a surprise that China revenues crashed 22%. even as Europe and Rest of Asia were also disappointing; only Japan and the Americas posted a modest improvement.

Another potentially troubling development: while Service revenue grew to a new record high of $11.45BN, up from $10.9BN in Q1, this was only a 16% increase Y/Y in service revenue, a clear secular decline in service revenue growth. Which begs the question: is Apple, the “service company” also peaking soon?

To summarize: iPhone sales tumbled 17% but this was offset somewhat by the surge in service sales. How long this trade off will continue is the $1 trillion question.

To offset the ongoing China weakness and potential service revenue growth concerns, and to make buying the stock after hours easier, Apple went back to doing what it has done best under Tim Cook: not innovate of course, but buyback its stock: in Q2 the company announced an additional $75 billion in share repurchases.

via ZeroHedge News http://bit.ly/2DFf0hj Tyler Durden