The “Rick Astley” Market keeps on rocking and rolling…

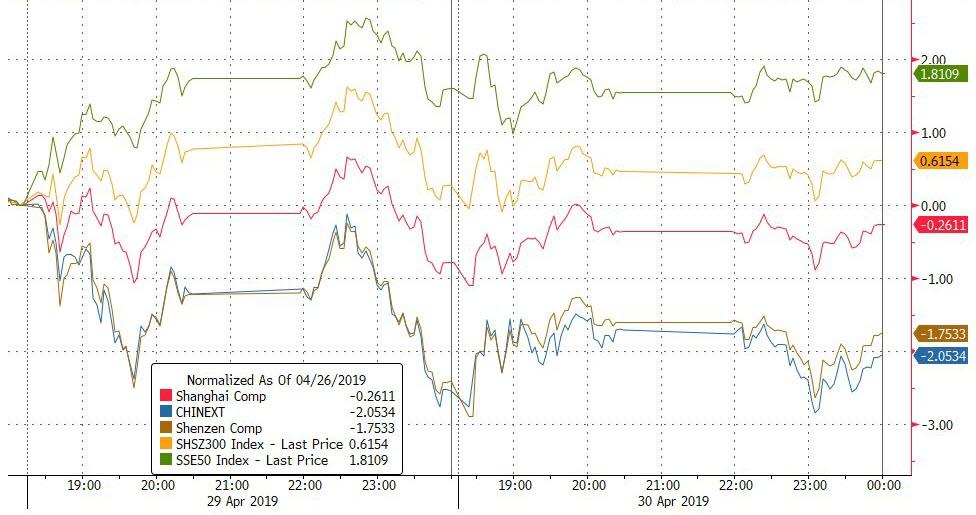

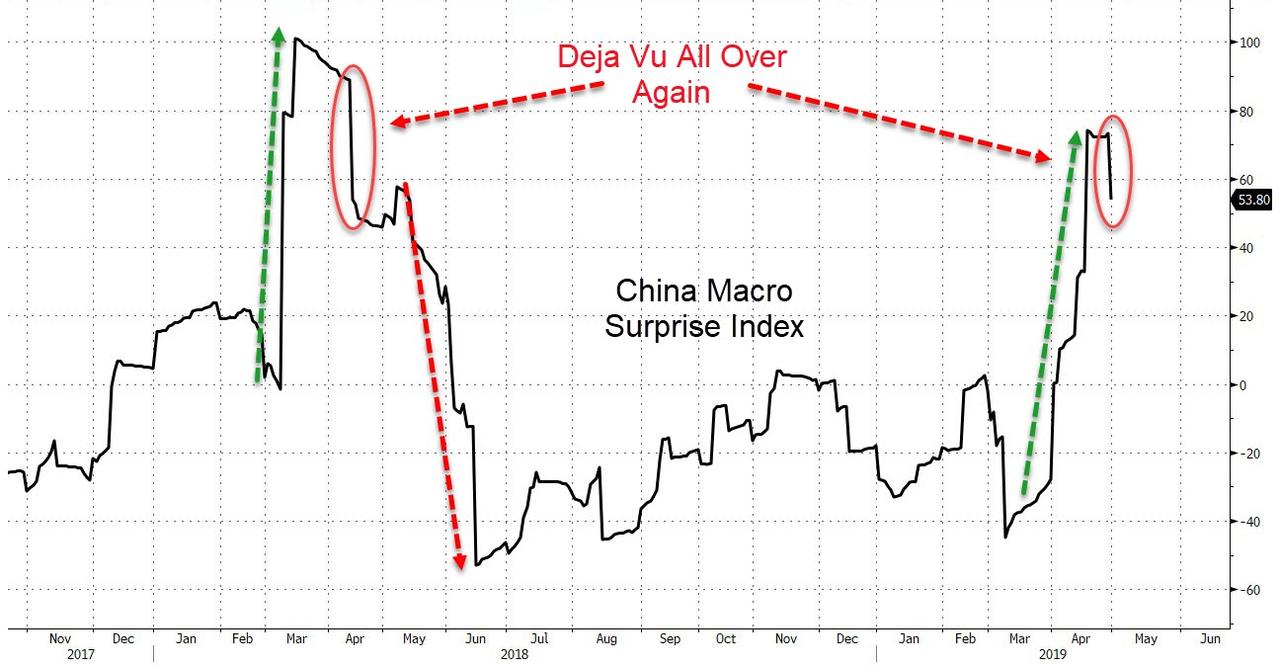

Despite weak China PMI overnight, China stocks trod water

Spain surged after yesterday’s early dip…

BTW – it’s not just US markets that entirely decoupled from fun-durr-mentals…

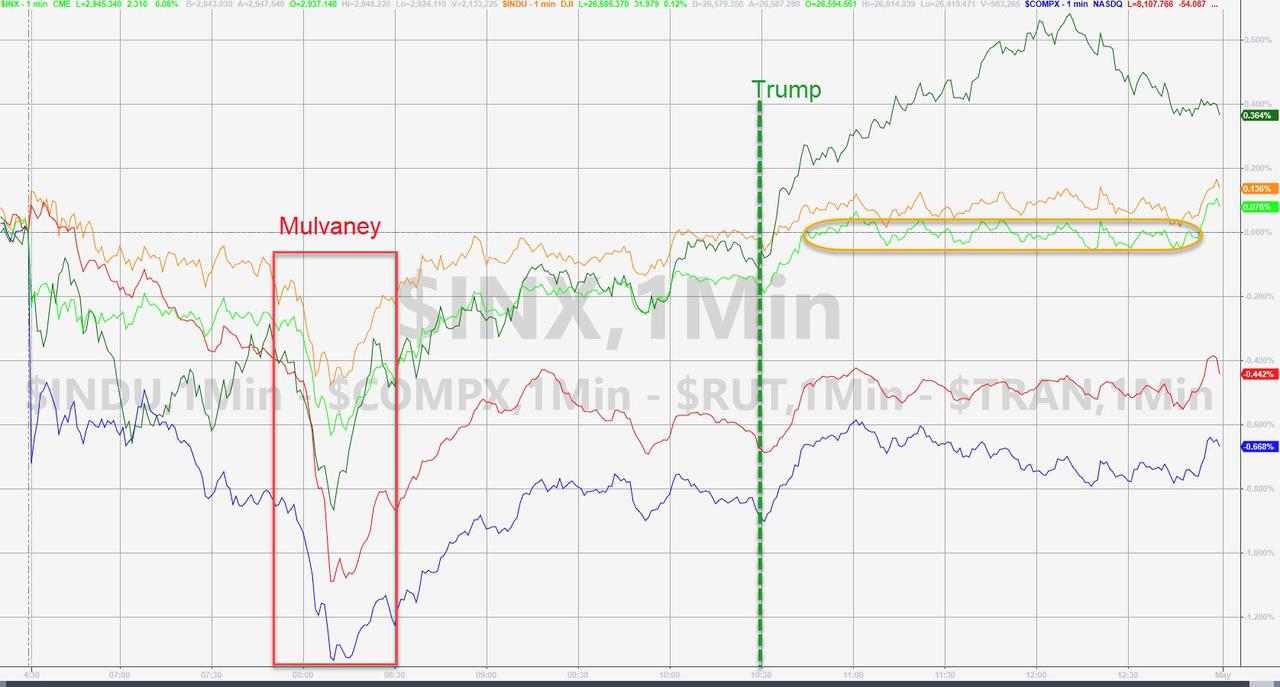

US Stocks lumped into the EU close (after Mulvaney spooked stocks with China trade deal headlines) and then ripped back, extending gains after Trump raised the idea of The Fed slashing rates and QE… S&P was glued to unchanged all afternoon…

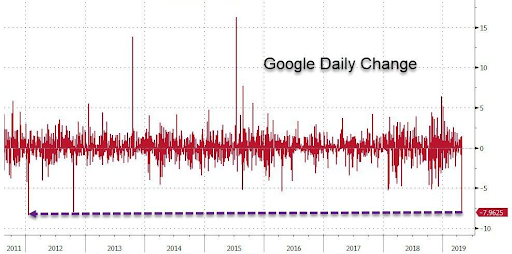

GOOGL spooked Nasdaq futures (as did weak China PMI and Mulvaney)…

With investors having hugged their margin clerks for months, hoping to chase outsized returns during what many have dubbed a melt up, today they are hugging the toilet bowel instead as the year’s hottest trade in stocks is suffering a huge market-value loss over the previously noted Google ad revenue meltdown.

Led by an earnings-driven sell-off at Alphabet, FAANGs are on track to lose more than $100 billion in combined capitalization, and are set to suffer their second-biggest market cap drop of this year.

The culprit of course was Alphabet, which dropped 8.3% after its its ad revenue growth posted a sharp slowdown, resulting in a $68.3 billion market cap loss. The rest of the drop was due to Apple, whose 2.1% drop resulted in nearly $20 billion wiped out, and came just ahead of Apple’s own results, due after the market closes. When the FAANGs last saw $100 billion erased from their valuations, it was after Apple cut its outlook in January, which wiped almost $70 billion from the iPhone maker’s valuation.

This was GOOGL’s biggest drop since Jan 2012

VIX and Stocks continue to decouple – Call-buying or protection bid?

Treasuries were bid, erasing yesterday’s losses…

10Y Yield roundtripped 5bps intraday, fading back to 2.50% by the close…

The Dollar Index slipped for the 4th day in a row ahead of the FOMC meeting..

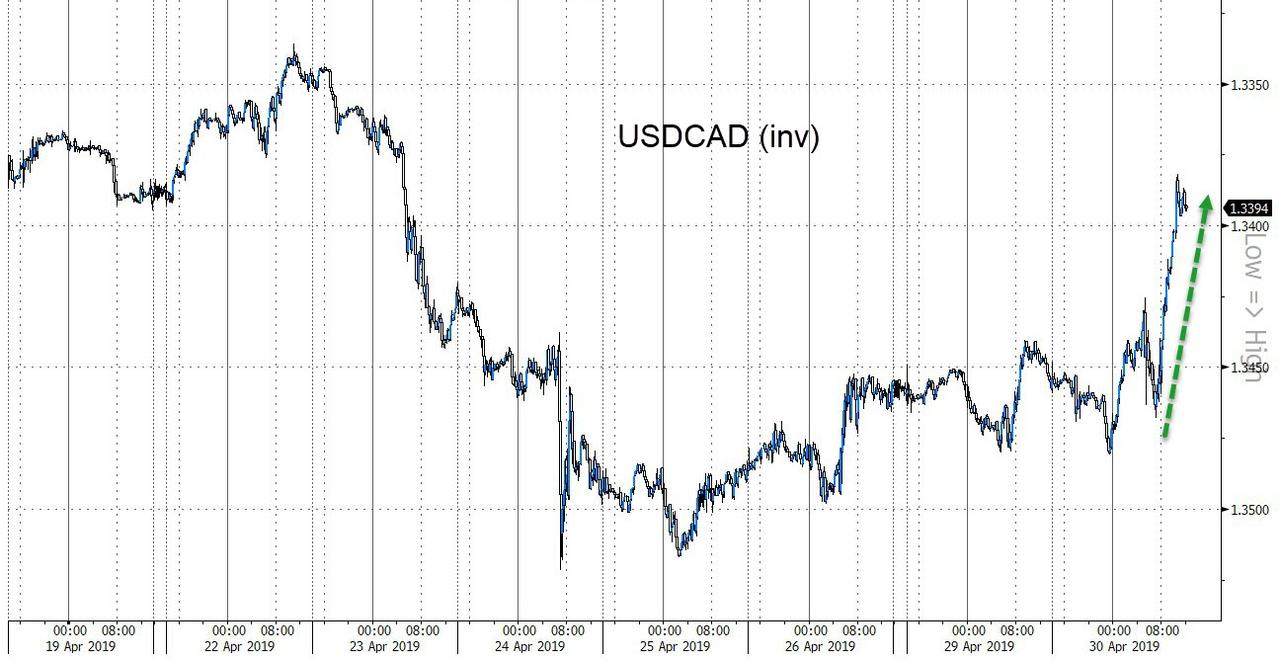

The Loonie strengthened despite a dismal miss on GDP

Good day for cryptos today…

Commodities all rose on the day, as the dollar dipped, led by WTI…

Green Shoots, shot?

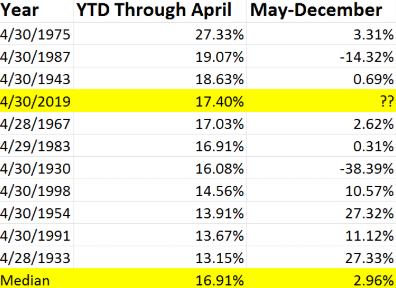

Finally, the S&P 500 is up 17.4% in 2019, making it the fourth best start to a year in history.

However, that may be a bearish signal. Because historically when the January-April return exceeds 15%, the performance for the rest of the year is paltry at best and, at times, a disaster.

via ZeroHedge News http://bit.ly/2WhsoQe Tyler Durden