With employment and economic growth data shining even as inflation disappoints, and the gap between the market and The Fed remaining vast in terms of next actions, today’s FOMC statement (and press conference) is expected to be as ‘patient’ as possible with Powell desperately sticking to his script.

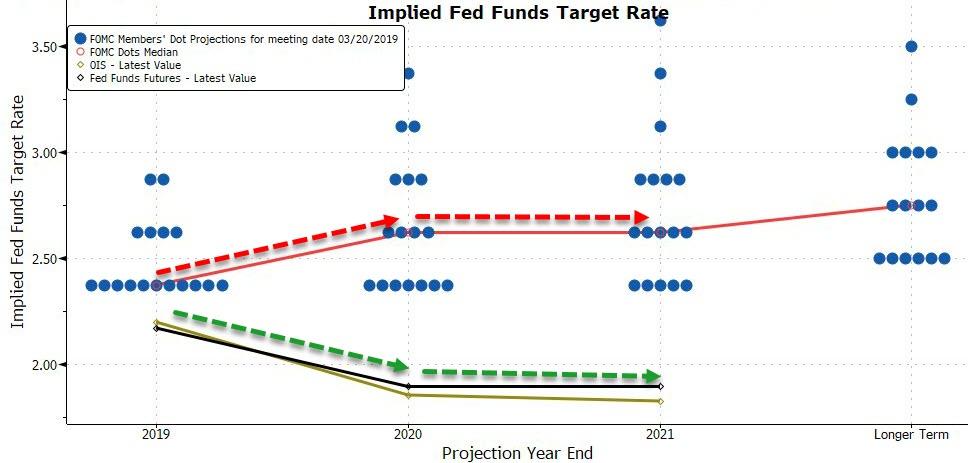

The market is pricing in 32bps of rate cuts for 2019 and more for 2020…

Since the last FOMC meeting (March 20th) confirmed The Fed’s dovish tilt, stocks have soared, gold has dropped, and the dollar and bonds have gained modestly…

At the same time, the yield curve has flattened notably…

And today is expected to confirm no change whatsoever, and no new economic projections, the main event will likely be Powell’s press conference.

Here are Bloomberg’s Key Takeaways from the FOMC decision:

-

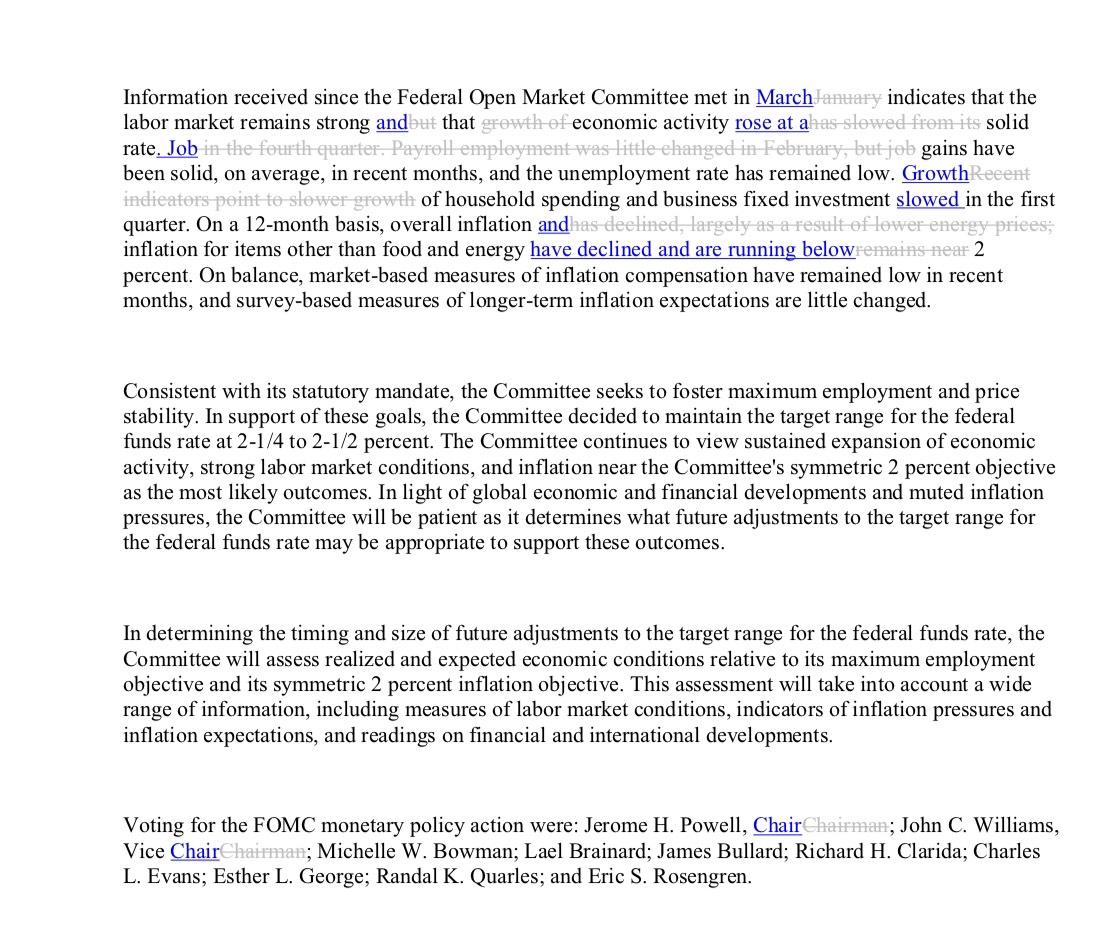

For third straight meeting, the Fed leaves federal funds target range unchanged at 2.25 percent to 2.5 percent, as forecast; it repeats language pledging to be “patient” on rate changes amid global economic and financial developments, muted inflation pressures.

-

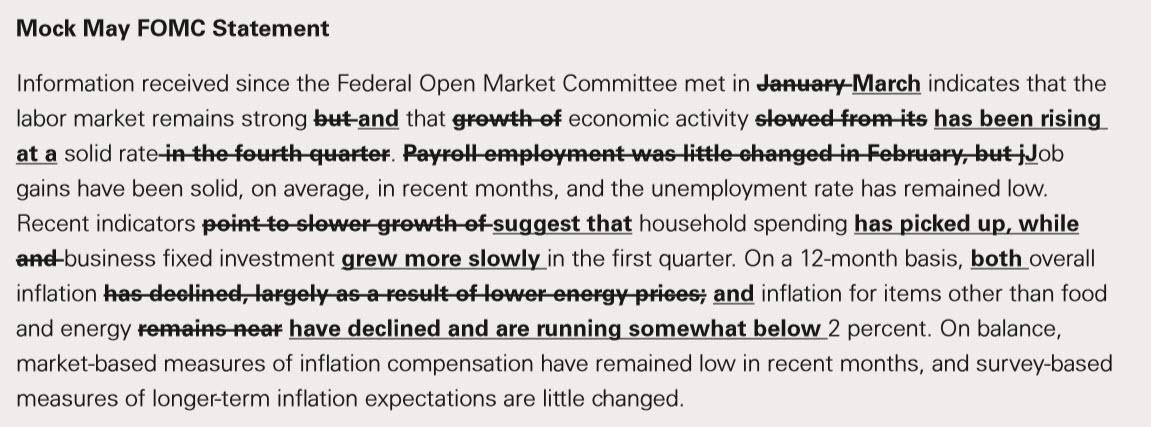

The FOMC adjusts its language on the economy, characterizing economic growth and job gains as “solid” while saying consumer spending, business investment slowed in the first quarter; the Fed acknowledges both overall and core inflation have declined and are running below 2 percent.

-

The statement shows central bank still reluctant to signal a policy bias in either direction, despite Trump’s call for an interest-rate cut — something projected by financial markets.

-

The decision is unanimous at 10-0; there have been no FOMC dissents since Powell became chairman in February 2018.

No comment whatsoever on markets or valuations amid this asymmetrical dovish bias.

Most notably with Fed funds are trading above interest on excess reserves, The Fed cut IOER by 5bps to 2.35% hoping to push banks to lend rather than parking cash at the central bank.

This is the third time in a year that the Fed has adjusted the gap between IOER and fed funds; the Fed cites a desire to foster trading in federal funds “well within the FOMC’s target range.”

To be clear, the IOER cut tends to imply the relative increasing scarcity of reserves amid the balance sheet runoff.

Bespoke Investment Group macro strategist George Pearkes weighs in:

Focus will be on the change in tone around inflation language and “slowed” first quarter numbers but to me that seems to be a justification for the “patience” rather than a forecast given multiple FOMC members have commented on upside data surprise ahead of the blackout.

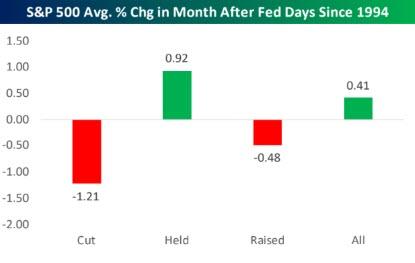

As Bloomberg notes, a Fed hold could be music to the stock market’s ears. Bespoke Investment Group notes that the S&P 500 Index’s forward one-month returns after Fed meetings since 1994 have been best when the central bank has stood pat.

* * *

Redline below…

Which looks a lot like Goldman’s…

via ZeroHedge News http://bit.ly/2LuXX8n Tyler Durden