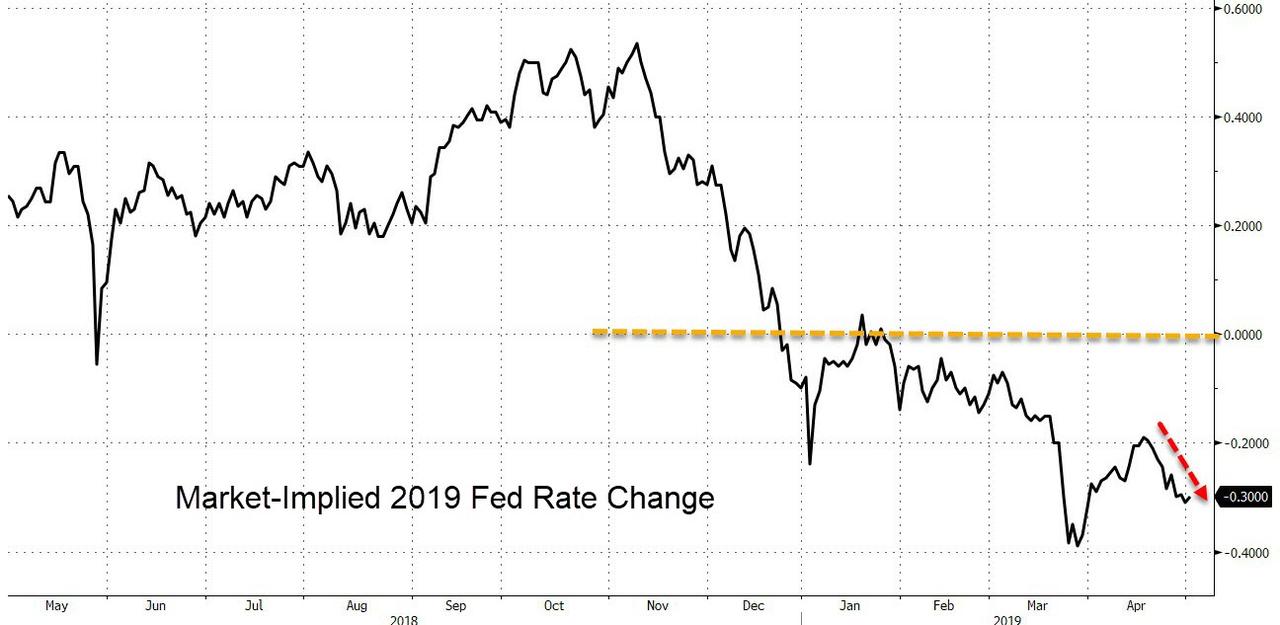

In just over an hour, the FOMC will leave its rates unchanged.

As RanSquawk notes, the Fed will not publish new economic projections at this meeting (the next SEP is released in June), although the market will be closely watching whether the Fed outlines conditions that might compel the Committee to discuss lowering rates. There are some risks that the Fed might tweak its statement to reflect stronger growth and softer inflation since the last meeting, although the market has already priced in a “goldilocks” environment.

There is also a small possibility the Fed could lower its IOER rate, which has been trading 4 basis points below the Effective Fed Funds rate and is in need of adjustment. Overall, the Committee’s tone is likely to remain one of patience and data dependence.

And that is what Goldman Sachs expects also, noting that with patience the watchword for now, the FOMC will keep the target range for the policy rate unchanged at 2.25-2.5% at its May meeting next week.

We see only a one-third chance of an adjustment to IOER if fed funds stays at 2.44%, though the odds would rise if fed funds ticks higher. Markets are likely to look further ahead, listening for clues about both the possibility of rate cuts if inflation declines further or growth falters, and the latest developments in the Fed’s framework debate in advance of the Chicago conference on June 4-5.

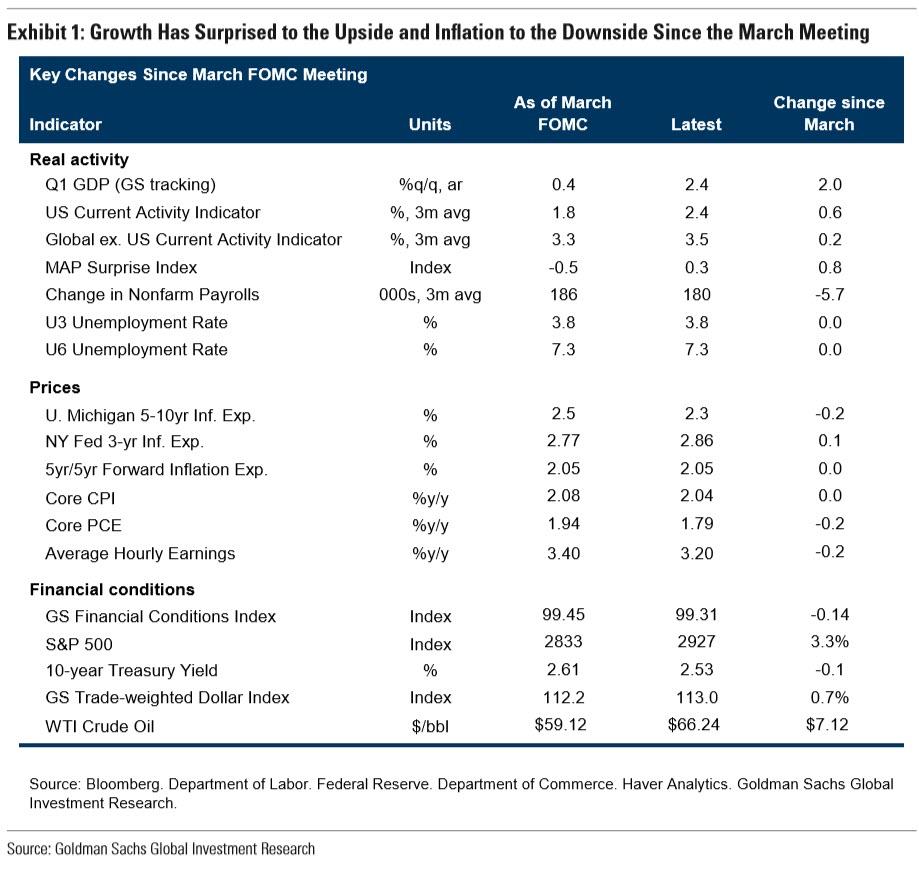

Since the Fed last met in March, the growth picture has improved but inflation has fallen short of expectations. Exhibit 1 summarizes changes in the economic and financial data since March 20.

Our Q1 GDP tracking estimate has risen 2pp to 2.4%, reflecting the positive surprises over the last month captured by the large improvement in our MAP index. The outlook for the rest of the year has also continued to brighten as our financial conditions index eased further.

In contrast, core PCE inflation has declined from 1.94% to 1.79%, and we expect it to decline further to 1.64% in the March report to be released next Monday, a 0.3pp drop from the rate at the last meeting. The University of Michigan survey measure of longer-run inflation expectations also fell 0.2pp over the last month.

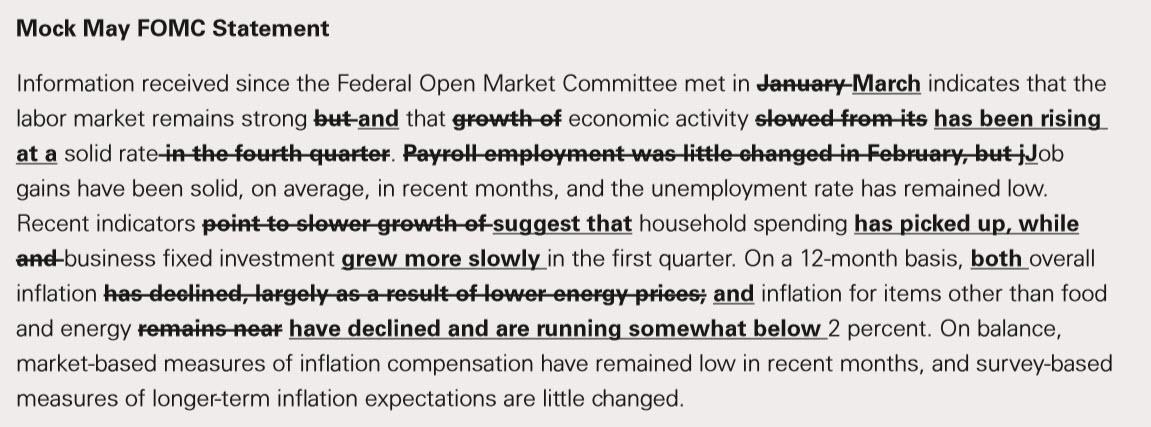

The May FOMC statement will likely reflect the better growth and softer inflation data. We expect the statement to characterize both growth and job creation as “solid” and acknowledge the rebound in retail sales by noting that household spending “has picked up.” Headline and core PCE inflation have both declined to a level below 2% since the last meeting, and we expect the statement to acknowledge this. The box below shows the revisions we expect to the first paragraph of the statement.

One possible dovish surprise to our expectations is a downgrade to the description of survey-based measures of longer-term inflation expectations in acknowledgement of the decline in the Michigan survey to 2.3%, assuming it holds in the final print on Friday. As we noted in our latest FOMC Chatterbox, a number of Fed officials have recently expressed concern about inflation expectations drifting lower. A downgrade is not our base case, however, because the Committee looks at a range of survey measures and the other three noted in the March minutes—from the Blue Chip survey, the Survey of Primary Dealers, and the Survey of Market Participants—have been roughly stable.

We do not expect any changes beyond the opening paragraph. While downside risks have abated, we do not think the Committee is ready to revisit its intention to remain “patient” yet.

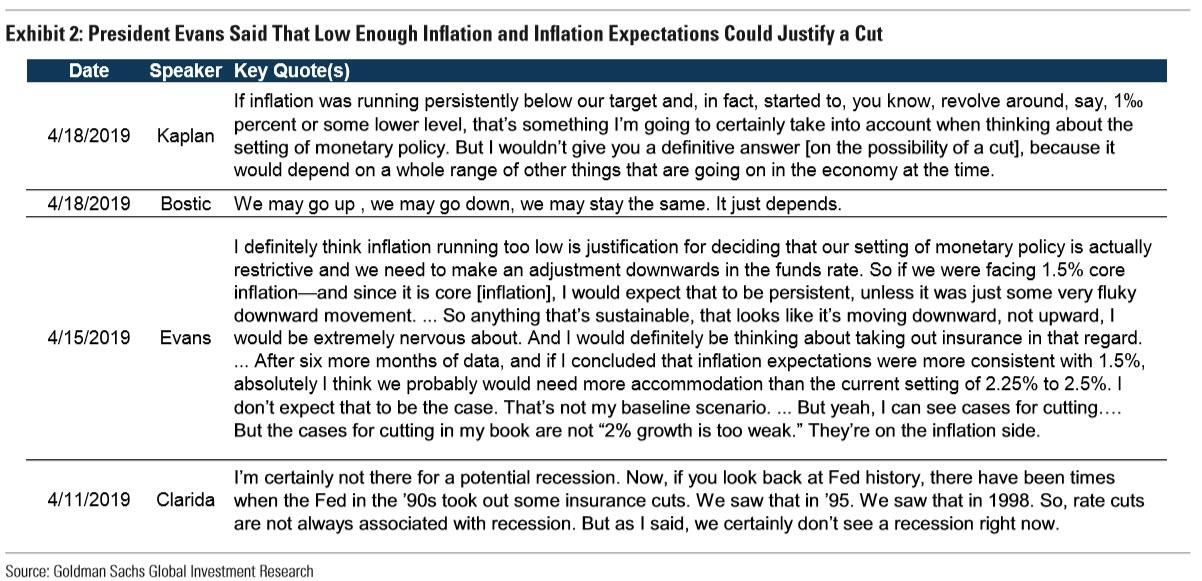

Market participants will listen for clues about longer-run issues in Chairman Powell’s press conference. On some issues currently in focus in financial markets—in particular the eventual target composition of the Fed’s balance sheet and the possibility of adding a repo facility—we think it is premature to expect new information. Two other key issues—the threshold for rate cuts and the latest thinking in the Fed’s framework debate—are likely to come up during the press conference.

The first issue, a possible “recalibration” rate cut, has received growing attention following recent comments from Fed officials. Most notably, Chicago Fed President Charles Evans said that if core inflation fell sustainably to 1.5% and if he thought inflation expectations were more consistent with 1.5% inflation, he would think about “taking out insurance” by cutting rates. Chairman Powell will likely be asked about such a scenario, and while he will probably be less specific than Evans, he might agree that in principle a sufficiently low level of inflation and inflation expectations could justify a cut.

Our view remains that the next move is more likely to be a hike than a cut, with the next rate increase coming after the election in 2020Q4, followed by another hike in 2021. We continue to see a recalibration cut as unlikely for several reasons.

First, we expect core inflation to bottom out in March at 1.64%, above the threshold Evans cited. Base effects should provide a further bounce in August, so that any dip below 1.5% in coming months would likely prove short-lived.

Second, Fed officials would likely worry about the risks that a rate cut could appear political or unnerve markets, which might mistake a cut in response to low inflation for serious concern about the growth outlook.

Third, we suspect a cut in response to modestly lower spot inflation would be quite divisive on the Committee. Without a meaningful further decline in inflation expectations, many participants would likely object.

Additionally, the Fed’s framework review, is also increasingly in focus with the Chicago conference on the subject on June 4-5 approaching. Our best guess remains that the review will end in the adoption of a fuzzy version of average inflation targeting. We expect any comments from Chair Powell to lean in that direction while also giving some attention to “makeup” policies, namely price level targeting.

via ZeroHedge News http://bit.ly/2ISLlFF Tyler Durden