WTI slid lower overnight amid signs of a sharp increase in U.S. crude inventories from API and concerns over the strength of economic growth in China, but rebounded back to pre-API level ahead of this morning’s official inventory data as the dollar tumbled.

Prices also slid as an attempted uprising against President Nicolas Maduro in OPEC member Venezuela appeared to fizzle.

“The market is currently witnessing the largest number of barrels subject to potential outage in many years, between Venezuela, Iran, Nigeria, Algeria and Libya,” said Leo Mariani, a KeyBanc Capital Markets Inc. analyst.

API

-

Crude +6.81 mm (+1.5mm exp)

-

Cushing +1.353mm

-

Gasoline -1.055mm (-1.5mm exp)

-

Distillates -2.058mm (-1mm exp)

DOE

-

Crude +9.93mm (+1.5mm exp) – highest since Nov 2018

-

Cushing +265k

-

Gasoline +917k (-1.5mm exp)

-

Distillates -1.307mm (-1mm exp)

US crude inventories rose for the 5th week in the last 6 with a 9.934mm build – the biggest since November. At the same time, the 10-week streak of draws in gasoline inventories is over as stocks rose 917k last week…

“Amid this host of bullish catalysts is one deepening pocket of weakness — U.S. oil stocks are swelling due to an upswing in crude inventories,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London.

“Glum alarm bells are ringing louder in the U.S.”

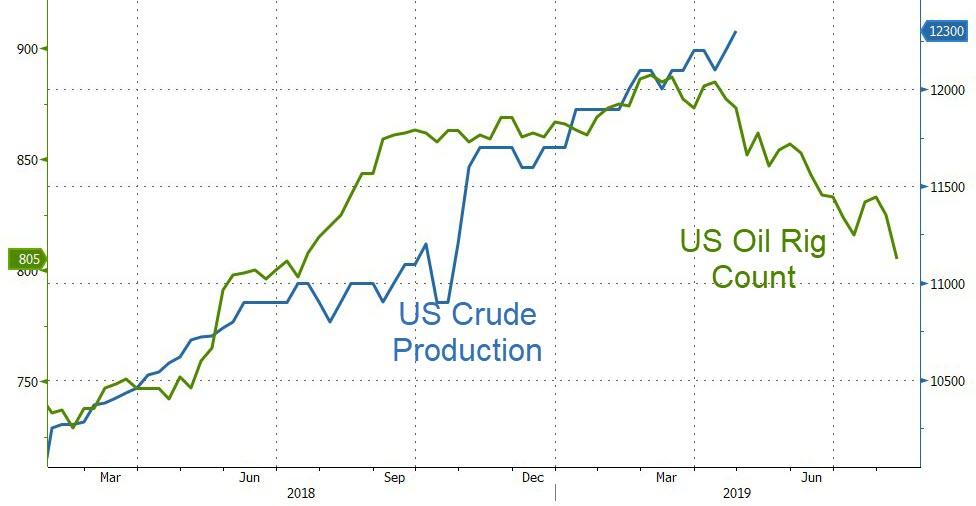

US Crude production rose to a new record high, bucking the lower rig count trend…

Notably, February crude output was 11.68 million barrels a day in the latest monthly report released Tuesday. As Bloomberg notes, that’s quite a bit lower than the 12 million in the EIA’s weekly figures for the month.

After erasing the post-API drop. the machines started to lose control into the DOE print and after the major build, WTI prices slipped lower…

via ZeroHedge News http://bit.ly/2USQM99 Tyler Durden