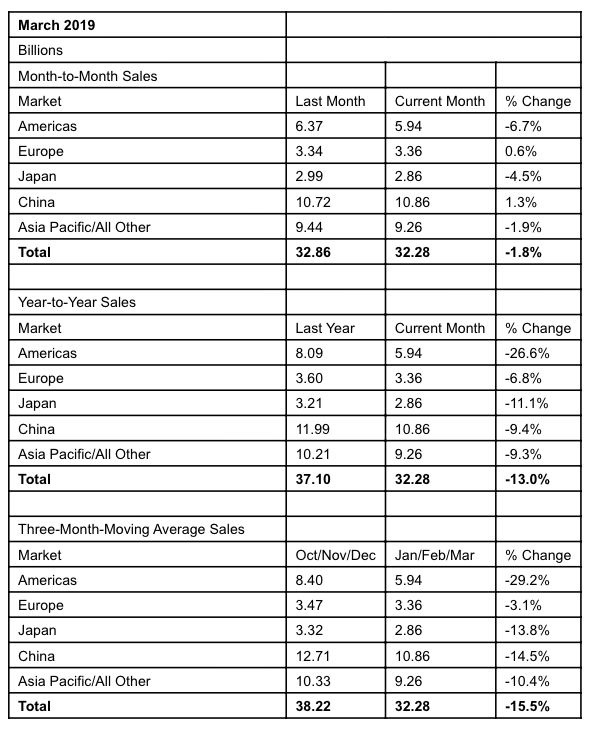

The Semiconductor Industry Association (SIA) published a new report Monday that shows worldwide sales of semiconductors totaled $96.8 billion during 1Q19, a 15.5% plunge over 4Q18 and a 13% drop YoY.

Global sales for March 2019 were $32.3 billion, a 2% decline from February and 13% drop YoY.

“Global semiconductor sales slowed during the first quarter of 2019, falling short of the previous quarter and Q1 of last year by double-digit percentages,” said John Neuffer, SIA president and CEO.

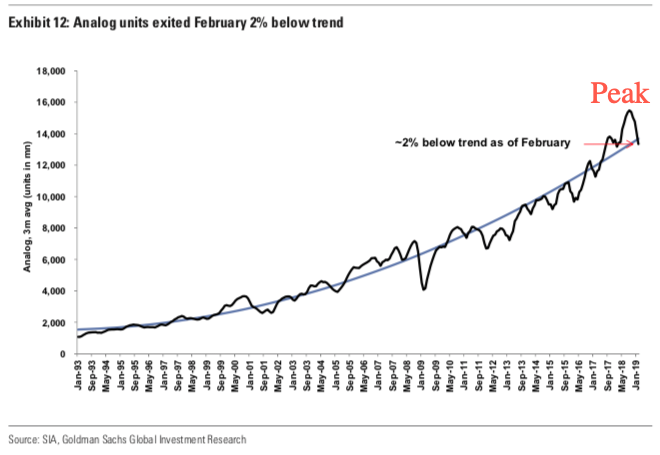

“Sales in March decreased on a year-to-year basis across all major regional markets and semiconductor product categories, consistent with the cyclical trend the global market has experienced recently.”

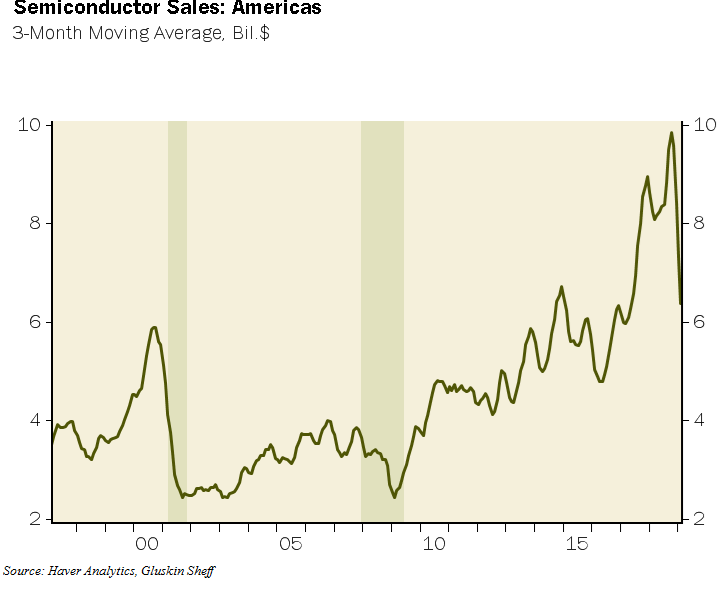

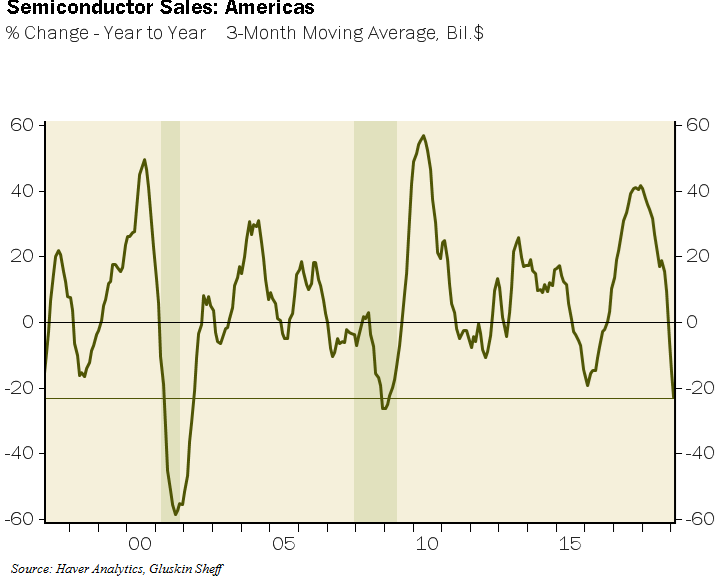

Regionally, sales increased in March on an MoM basis in China (1.3%) and Europe (0.60%), but declined in the Asia Pacific (-1.9%), Japan (-4.5%), and the Americas (-6.7%). On a YoY basis in March, sales plunged in Europe (-6.8%), Asia Pacific (-9.3%), China (-9.4%), Japan (-11.1%), and the Americas (-26.6%).

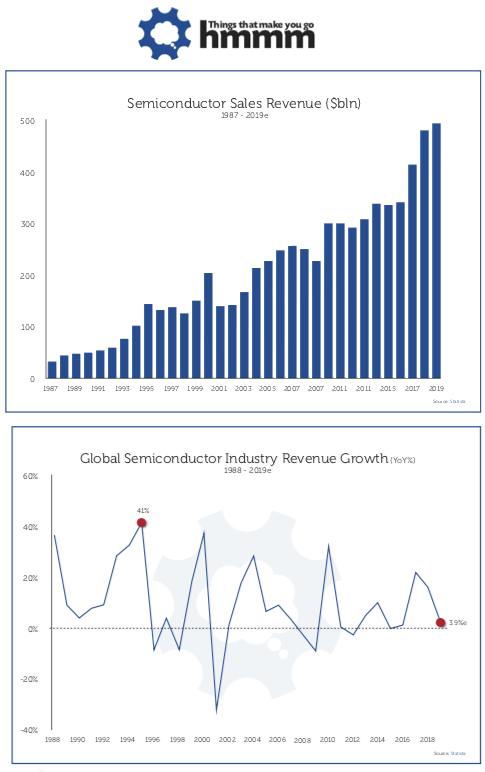

In a separate report by ‘Things That Make You Go Hmmm‘ – the YoY percentage growth of global semiconductor revenues has dramatically slowed from 41% in 1994 to less than 4% estimated for 2019. This is a dramatic projected slowdown from last year’s 15.9% print, which tells us that the semiconductor ‘supercycle’ has stalled.

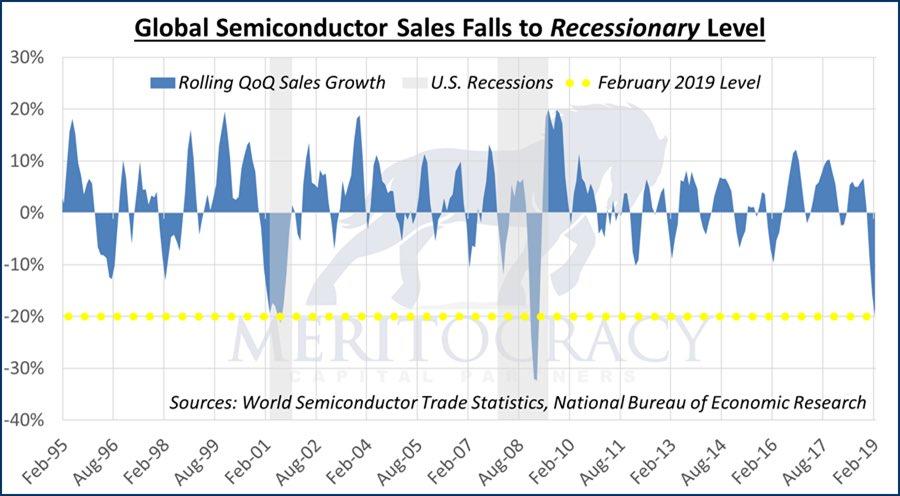

Meritocracy Capital shows that global semiconductor sales have just crashed to a recessionary level.

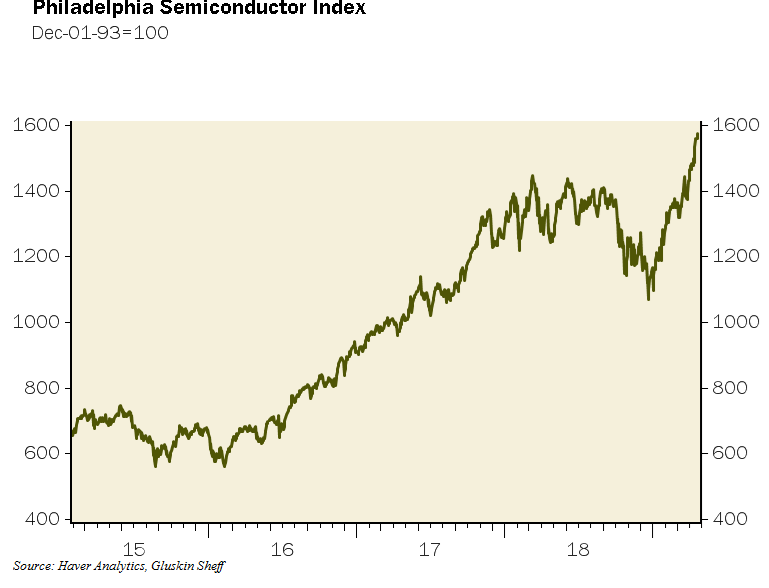

David Rosenberg, Gluskin Sheff’s Chief Economist & Strategist, recently tweeted that “SOX index has soared 36% this year, doubling the performance of the overall market even with a massive decline in sales, both domestically (-23% YoY) to the lowest level in two years and globally as well (-11%). Whoever said logic had to prevail?”

Fred Hickey, the editor of the monthly publication ‘The High-Tech Strategist’, tweeted that the global semiconductor industry is deteriorating, the probability of a 2H19 rebound in sales is questionable.

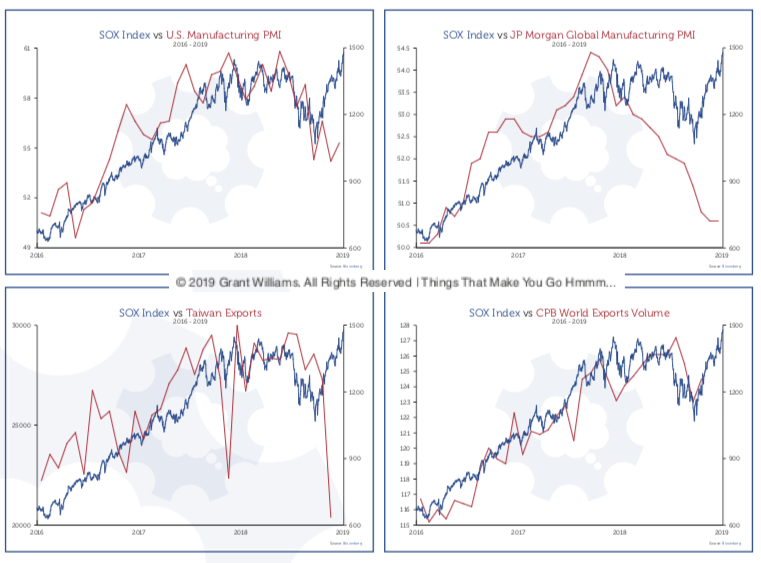

Grant Williams from ‘Things That Make You Go Hmmm’ — overlayed the Philadelphia Semiconductor Index (SOX) with the Global Manufacturing PMI, the US PMI, Global Export Volume and Taiwanese exports. Showing just how disconnected SOX is from reality.

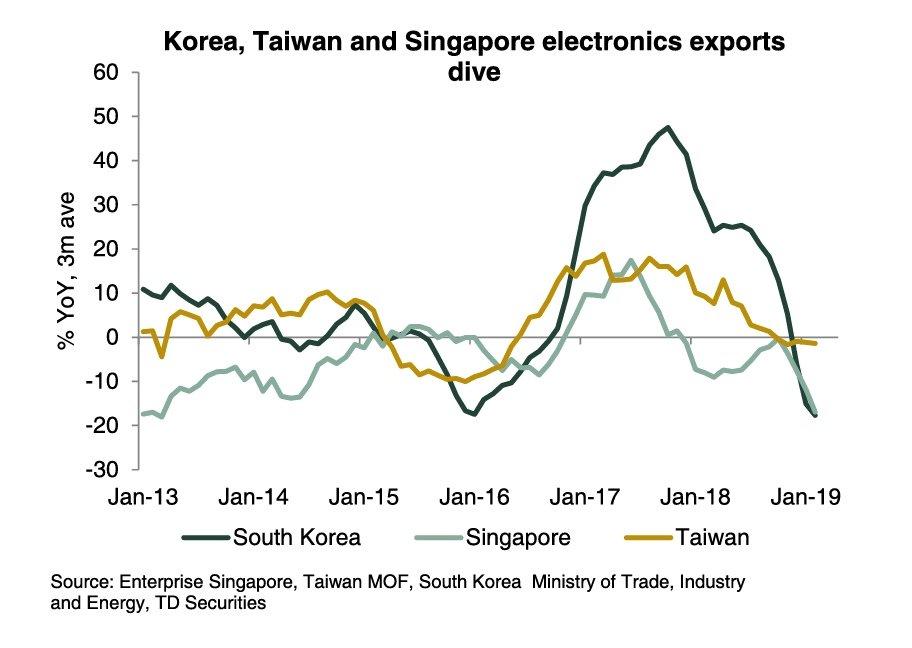

TD Securities shows Korea, Taiwan, and Singapore electronics exports continue to dive.

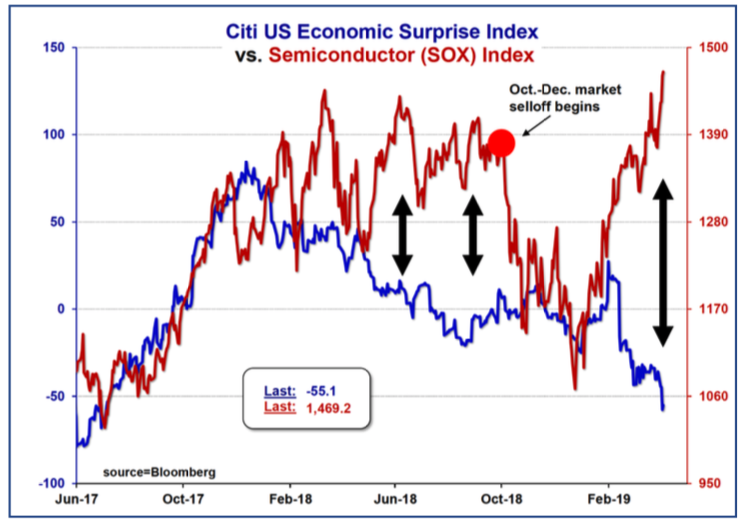

Last but not least, Citigroup US Economic Surprise Index against the SOX shows the jaws have opened…

via ZeroHedge News http://bit.ly/2GTgG7V Tyler Durden