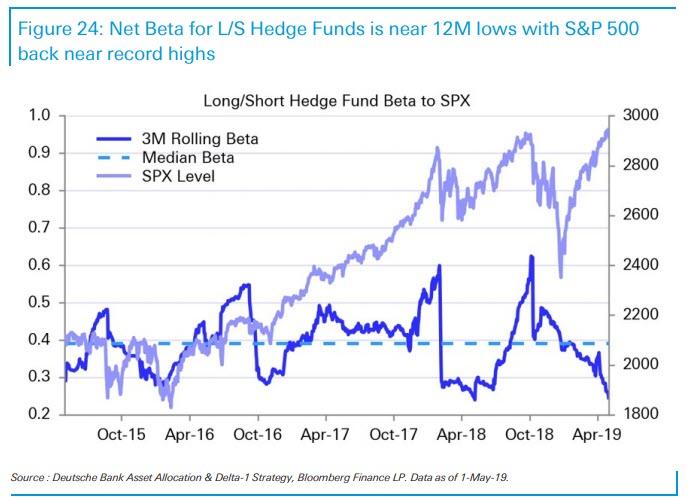

Not only is this the most hated, not to mention fake, bull market in history (thanks to some $15 trillion in central bank liquidity), it is also the most frustrating one: as the following chart from Deutsche Bank shows, even with the S&P back at all time highs, equity long short funds have absolutely no faith in the underlying drivers and their net beta exposure to US equities is the approaching a record low.

It’s not just carbon-based active investors that have no faith in continued levitation: trend-following CTAs and other systematic funds which buy or sell based on trigger prices, have also started to derisk in recent days…

… while Risk Parity funds are a long away from from peak equity exposure.

To a large degree this ongoing divergence in which stocks have continued to rise even as investors pull back, is the result of what Goldman’s David Kostin called a “disharmony of mixed economic data and Fed messaging” with the Goldman equity strategist noting that “equities struggled to digest the conflicting messages from strong payroll growth and a dovish FOMC statement with weak ISM prints and Chair Powell’s relatively hawkish press conference.”

To be sure, last week’s conflicting data has come on the heels of what many dubbed a renaissance in green shoots (largely the result of a massive credit injection and a fresh stimulus out of China), and follows what has largely been interpreted as favorable economic data, which together with continued record buybacks, has helped push the S&P 17% higher YTD

And yet, as Kostin writes, “beneath an equity market at record highs, thematic rotations indicate a still-cautious investor mindset.”

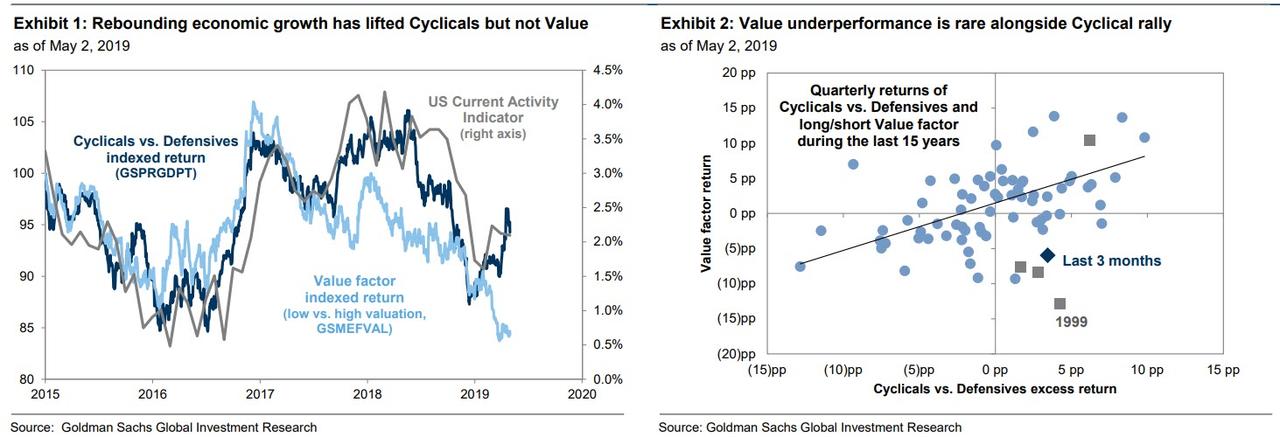

Which has also led Goldman’s clients to become increasingly confused, or as the strategist puts it – frustrated. Specifically, as Kostin explains, “the cyclical-led market rally has not coincided with a rotation to value stocks, leading some frustrated clients to ask why “catch up” trades are not working with the S&P 500 back at record highs.”

Call it the latest unexplained consequence of central planning: consider this example from Goldman:

in the past, environments of accelerating economic growth have typically supported the outperformance of both value stocks and cyclicals. In 2H 2016, for example, the Cyclical/Defensive pair rose by 18 percentage points and our sector-neutral, long/short Value factor rose by 17 pp. This year, in contrast, value stocks have lagged, as they have for most of the past two years (Ex. 1 and 2).

As Kostin notes, “the underperformance of value stocks is just one reflection of the ongoing market preference for growth and quality. In addition to cyclicals, a variety of “high quality” themes led the market as it rallied in 1Q 2019, including stocks with

strong balance sheets and firms with high pricing power. Likewise, the YTD outperformance of our basket of stocks with high revenue growth reflects an investor desire for idiosyncratic growth that is unusual in an environment of economic acceleration, which would normally erode the scarcity premium carried by such firms. The relative sluggishness of the typically high-beta Russell 2000 small-cap index is another manifestation. While the quality themes have generally traded sideways during the past month, growth stocks have continued to outperform. “

There are several reasons why Goldman believes there has been no rotation into value stocks: for one, although improved economic data and Fed dovishness helped allay investor concerns of a recession in the near term, most of Goldman’s clients “remain in a relatively cautious “late cycle” mindset. Economic data have improved, but the unemployment rate is 3.6% and the current economic cycle will match the longest on record next month.” Furthermore, the early 2019 slowdown in US corporate earnings growth “has likely also contributed to the underperformance of value, as has the exceptional combination of growth, profitability, and momentum displayed by the market-leading growth stocks.”

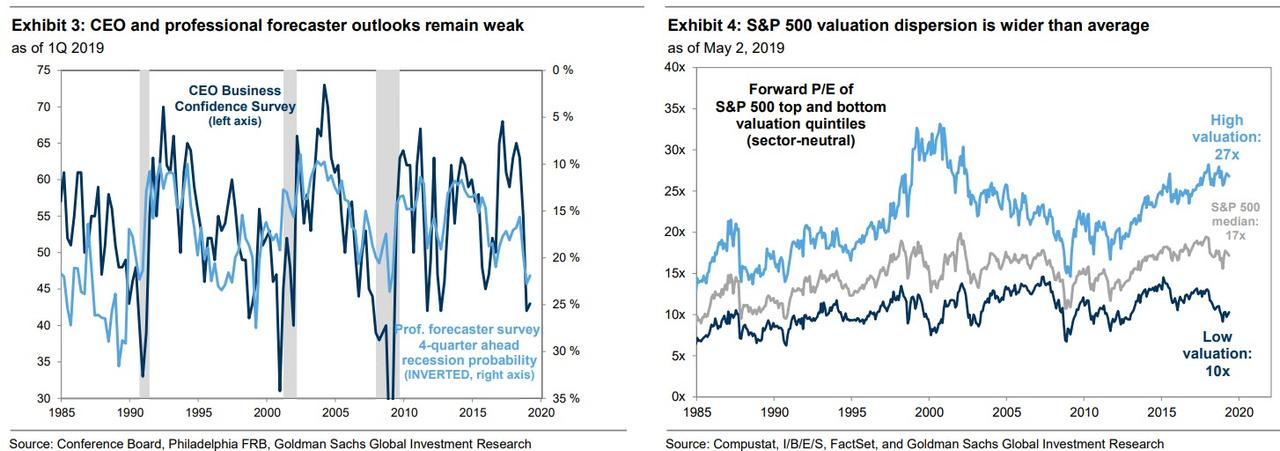

And speaking of late cycle, one can argue that the biggest concern most investor share is that the business cycle is long, long overdue for a recession. To be sure, the fed funds market shows a 50% likelihood of Fed rate cut by year-end. The CEO Business Confidence survey improved modestly in 1Q 2019 relative to 4Q 2018, but otherwise registers the lowest reading since 2012. And the Philly Fed’s Anxious Index shows that professional forecasters assign a 22% probability of recession within the next four quarters, the highest reading this cycle outside of the 23% print in 4Q 2018 (see Exhibit 3).

Confirming the ongoing investor boycott, Kostin points out several things we have repeatedly discussed: namely, that although investor equity positions have increased this year, they remain far from the highs of early 2018; US equity mutual funds and ETFs have experienced $38 billion of outflows YTD ; and VIX ETPs show record long volatility positions.

As a result of all this, Kostin writes that the bank’s clients and investors in general now have to decide which is most likely among three potential outcomes:

- economic growth fades, reversing the cyclical rally and likely supporting the continued outperformance of quality stocks;

- the outlook improves enough to ease late cycle concerns and spark a rotation to value and lower quality laggards;

- the combination of healthy but unspectacular economic growth and a patient Fed inclines investors to continue to reward firms with superior idiosyncratic growth profiles despite premium valuations.

For what it’s worth, Goldman says that it falls “in the third camp” as the bank’s economist s predict US GDP growth of 2.8% in full- year 2019 and expect that growth will remain modestly above-trend in the 2%-2.5% range through the end of 2021. As a result, “S&P 500 EPS growth should accelerate in 2H 2019, as expected by most analysts, but the consensus forecast of 12% EPS growth in 2020 looks overly optimistic (our top-down estimate is +4%).”

That said, last December Goldman predicted that there would be 4 rate hikes in 2019. Now it does not expect a rate hike until the very end of 2020 so take any Goldman forecast with a mountain of salt.

And speaking of trade recos from Goldman, the bank’s equity strategist urges clients to focus on dispersion, which “

today is close to the widest level this cycle and according to some measures the widest since the Tech Bubble. As a result, we would continue to focus on growth but avoid the stocks with the most extreme valuations.”

Putting this in practical terms, Goldman shows the chart below, which shows 42 stocks that rank in the top 20% of their S&P 500 sectors on sales and EPS growth but not in the top quintile on valuation, based on the combination of metrics we use to create our factors. These stocks trade at roughly the same median valuation as the typical S&P 500 stock with substantially faster expected EPS and sales growth through 2020. YTD the median stock on the list has outperformed the median S&P 500 stock 20% vs. 18%.

via ZeroHedge News http://bit.ly/2Y1B51o Tyler Durden