With less than 100 words and just two tweets, President Trump kicked out one of the most important legs of the delusional stool that has lifted the US stock market by the most in 32 years since the start of the year… and everything was going so well before that…

China was a bloodbath overnight…the biggest drop since Jan 2016

Catching down to Europe and US equity markets YTD…

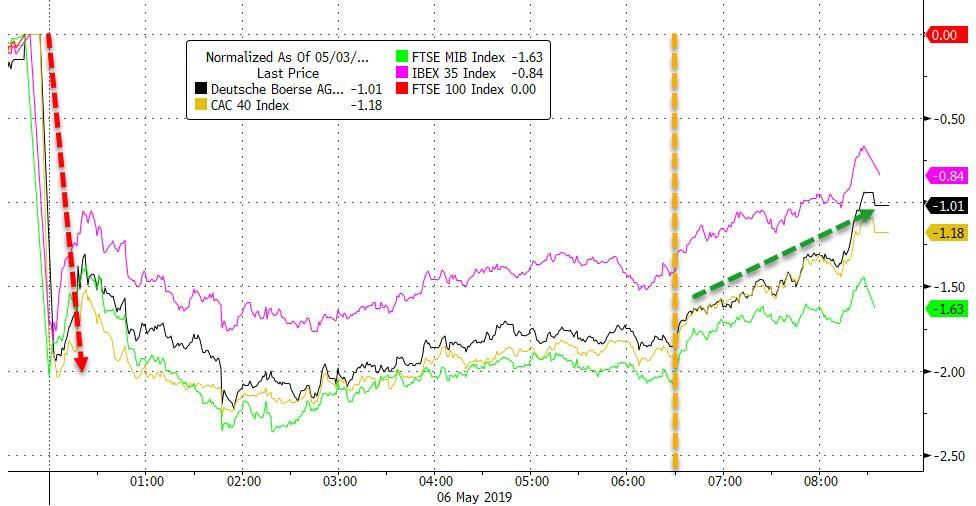

Europe tumbled at the open but the BTFD’ers stepped in to make things more reasonable (Spain led, Italy lagged)…

It was an ugly start last night as Dow futures crashed 500 points and Nasdaq down over 2.3%… but by the close of the cash markets, it was barely a fleshwound…

Small Caps ended the day green…

Don’t ever doubt the PPT pic.twitter.com/SEkiyt1hCC

— Hipster (@Hipster_Trader) May 6, 2019

All on the back of a giant short-squeeze…

And VIX was clubbed like a baby seal…

TICK data swung from its biggest selling program since Jan 28th to the biggest buying program since March 21st…(the biggest swing since the first day of 2019)…

Bonds were bid but yields rose all afternoon as stocks soared (though yields ended lower on the day)

The DXY Dollar Index ended the day marginally higher after a major roundtrip reversing at the US cash equity market open…

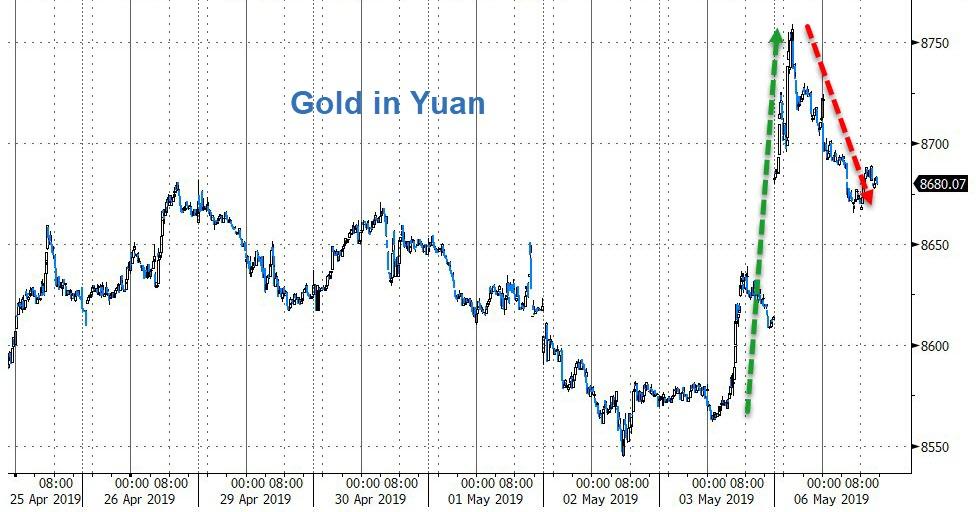

Yuan was smashed lower during the China session then miraculously bid for the rest of the day (still closed weaker against the dollar)

Gold and Silver were unch against the dollar but Crude and copper soared…

Gold spiked against the initially weak Yuan but the rest of the day was spent rebalancing Yuan…

And finally, while we have noted numerous times (too numerous to count) the decoupling between stock prices and any top-down or bottom-up fun-durr-mentals this year…

Schwab’s Jeff Kleintop has some bad news for all…

Longest losing streak in 20 year history for the global manufacturing PMI. pic.twitter.com/q0wIdMXZ8A

— Jeffrey Kleintop (@JeffreyKleintop) May 3, 2019

As Terreus Capital notes: “Green shoots? Global Manufacturing PMI slips to 50.3 – lowest since July 2016. This is longest losing streak in 20 year history for the global manufacturing PMI. New orders, new export orders, output, employment all well below their long run trends.”

via ZeroHedge News http://bit.ly/2LnkBz5 Tyler Durden