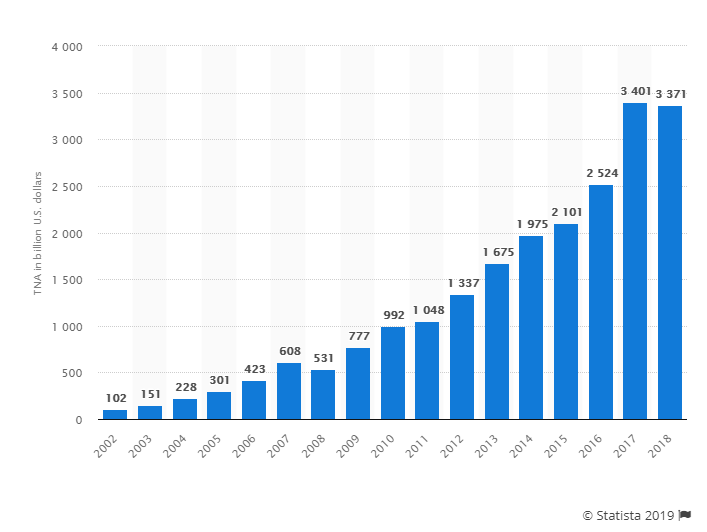

While ETFs have been widely cast as the ordinary investor’s best friend, with far lower fees and far greater liquidity than competing products, resulting in trillions in capital inflows (out of active investment strategies, leading to mass layoffs among asset managers) while the market is rising, they could also wind up “amplifying systemic risk” when liquidity is suddenly withdrawn.

According to Moody’s Investors Service, the now $3.9 trillion ETF industry could result in a toxic feedback loop of selling when market makers step away from supporting assets during market turmoil. Market makers are generally crucial in keeping the price of an ETF in line with its underlying value. For an example of what happens when this is no longer the case, see the ETFlash crash of August 2015, when massive dislocations among countless ETFs resulted in the broad halt of the overall stock market.

Less liquid asset classes are at risk for bearing the most pain in a volatile environment and the “systemic risk” theory about ETFs could wind up being tested soon, as volatility is again spiking thanks to President Trump’s ongoing trade war with China. For example, declining bond inventories of banks have increased the liquidity risk in corporate debt and their associated ETFs.

Analyst Fadi Abdel Massih said that: “Less liquid asset classes would bear the brunt of the pain. The theory might be in for a test as equities crater, with the S&P 500 Index down about 3.5% in the past four days and headed for its worst week of the year.”

He continued: “A stress event could diminish the amount of standing orders at various prices. Unexpected market liquidity shortfalls could be most pronounced within ETFs tracking inherently illiquid markets, such as high-yield credit, reducing the potential rewards for market makers. These ETF-specific risks, when coupled with an exogenous system-wide shock, could in turn amplify systemic risk, a credit negative for market participants.”

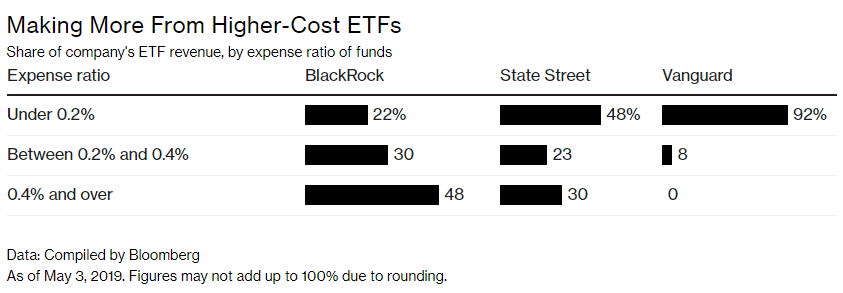

For now however, as long as market conditions remain stable and volatility artificially subdued, the ease of use continues to make ETFs the everyday investor’s favorite instrument. Additionally, banks and issuers like the generous fees they can collect on them.

Of course, the idea of collapsing ETF liquidity has been repeatedly raised in the past on both this website and elsewhere, starting notably with Howard Marks who in early 2015 asked “What Would Happen If ETF Holders Sold All At Once?“

Critics had previously focused on the mismatch between the ease of trading an ETF versus the illiquid nature of its underlying security. Moody’s believes that stress on the overall market could wind up “tripping up investors” that believe ETFs are more liquid than their holdings. They aren’t, of course, but the overall rising tide has masked this unpleasant fact, even as many have increasingly raised bets that an ETF-driven crash is imminent as discussed in “One Hedge Fund Manager Is Betting A Quarter Of His Money On A Credit ETF “Death Spiral.”

Specialists now handle most market-making for ETFs and will be “increasingly dominant” in helping run these instruments. Banks, who previously ran ETFs, have mostly stepped away as a result of greater regulation. For example, Goldman Sachs quit acting as an ETF lead market maker more than a year ago.

The changing of the guard for the middlemen between the ETF and their underlying assets has added risk. According to Moody’s, this risk “is further amplified because the majority of the market making is handled by new entrants with rapidly turning balance sheets.”

Which begs the obvious question: have ETFs become the portfolio insurance crash-catalyst of the modern day, and if so, when is the next Black Monday?

via ZeroHedge News http://bit.ly/2vTwDpw Tyler Durden