Authored by Sven Henrich via NorthmanTrader.com,

And then The Never Ending Market Rally ended. With a tweet no less and $VIX exploded 82% higher just days after $VIX futures net short positioning reached an all time high. Knuckleheads.

Look, technicals matter greatly, but so do sentiment, the political, macro, and central banks, and the structural. It’s a complex web that can be very confusing and is challenging for market participants. Navigating it all is very tricky and I want to use this edition of the Weekly Market Brief to offer a reality check on markets but also share some key technical lessons as an educational tool to help others in making sense of everything we see unfold and how to identify short and long exposure risk/reward.

First some reality check points:

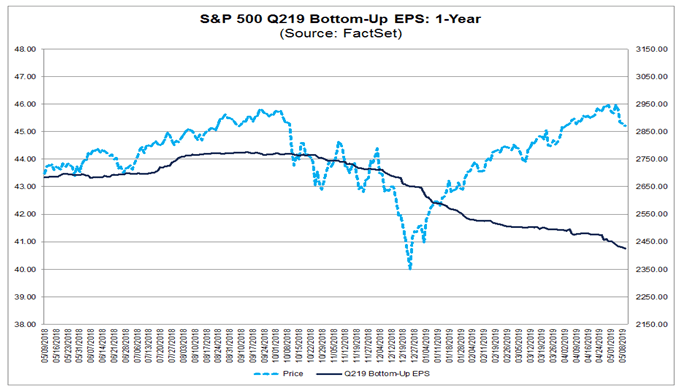

To re-iterate: The 2019 rally has not been driven by earnings growth:

Not even close. If anything earnings growth was barely flat in Q1 and is regressive for Q2.

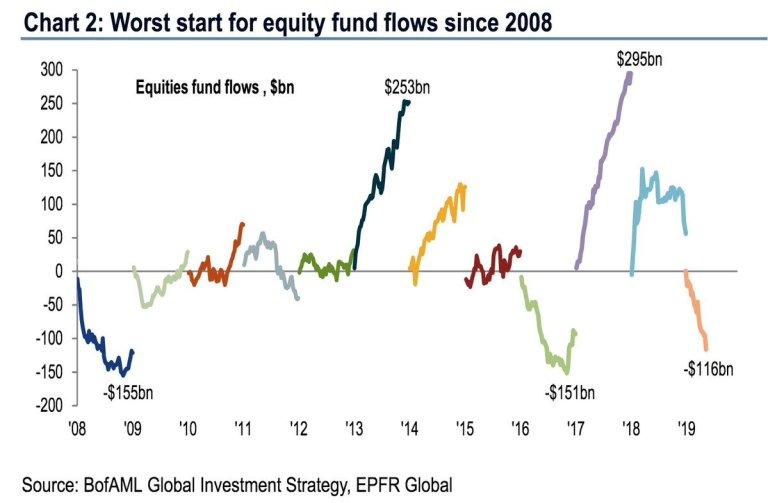

The rally has also not been driven by fund flaws:

I repeat: The 2019 rally has been inflated by 3 main pillars that have exacerbated the move beyond the technical oversold readings off of the December lows:

- The central bank pivot with the Fed caving 180 degrees and serving again the Fed put on a platter.

-

Record buybacks courtesy US tax cuts which have shown to be a largest source of equity demand in Q1.

-

Political jawboning on the side of the administration constantly aiming to tout a China deal and eager to influence markets at any sign of trouble or downside.

Let’s all acknowledge a simple key truth there: Without these three pillars markets would not be anywhere near these levels, and wouldn’t have reached all time highs so soon following the December crushing. Bulls may want raise price targets ever higher, as they always do, but any honest bull would acknowledge that without these 3 pillars of artificial support we wouldn’t be anywhere near current price levels. Price became exaggerated to the upside.

This last week we saw one of these pillars sway to the side and immediately markets got into trouble. For all of 2019 markets were promised (via constant jawboning) an imminent China deal.

It was either all BS or a bad misjudgment of reality:

¯\_(ツ)_/¯ pic.twitter.com/9VVr1qG6ZA

— Sven Henrich (@NorthmanTrader) May 10, 2019

Now there is no deal and no apparent path to a deal. New tariffs are going into effect, and once that reality was sinking in damage control was needed and it came:

So you know$SPX $VIX pic.twitter.com/mxs34r3eCT

— Sven Henrich (@NorthmanTrader) May 10, 2019

It’s self evident and it is seen in the price action. Markets are reacting to all of this.

But for everything there is an underlying technical foundation.

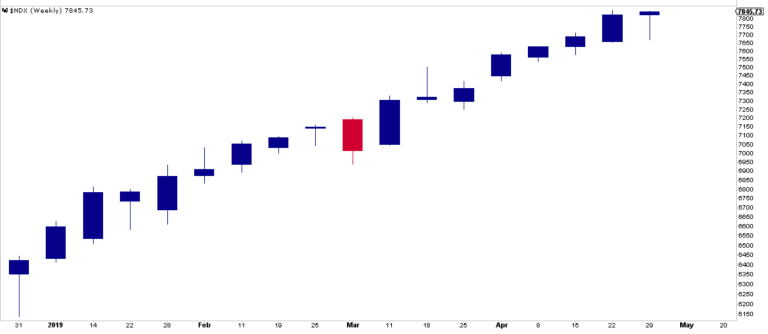

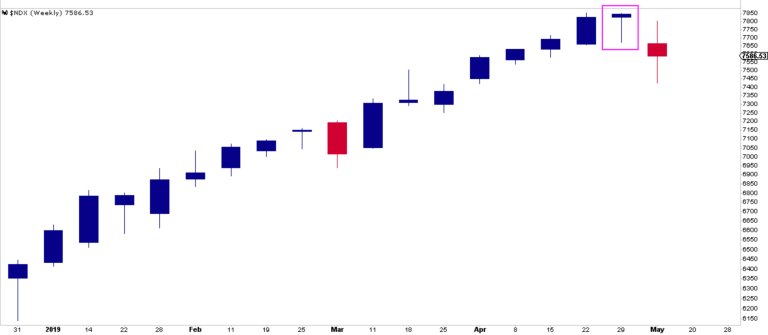

Example: In last week’s video I highlighted the weekly hanging man pattern candle portending downside to come:

And it did:

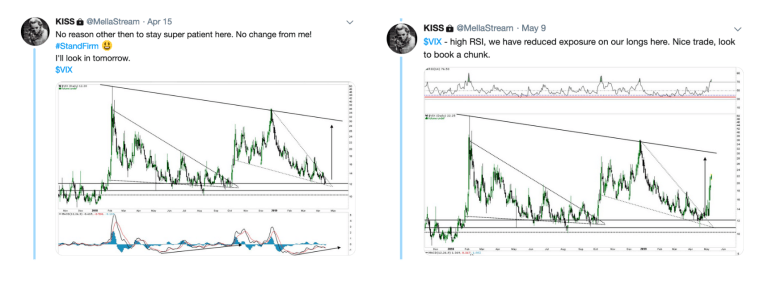

We’ve been talking about wedge structures suggesting pattern breaks and a volatility breakout to come:

And It did.

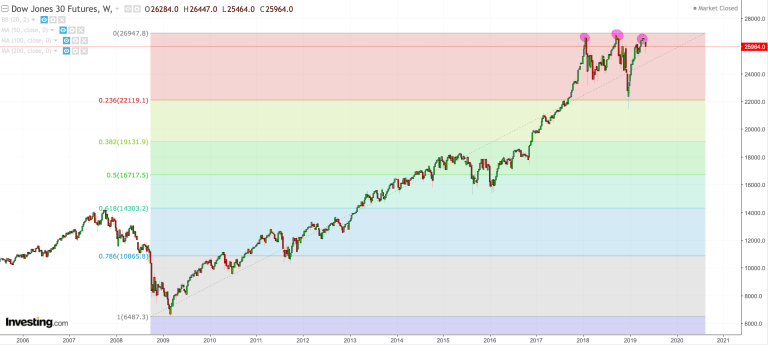

Here’s another reality check: New highs, they’re gone. And without new highs, and in context with major wedge breaks, markets are suddenly confronted with the prospect of major topping patterns:

But no major moving averages have broken yet, in fact no major technical correction has, as of now, taken place. Last week’s pullback was aggressive and it was fast and, as a reality, produced short term oversold readings, hence upside risk continue to exist as well.

How to blend and balance this complex market environment of technicals and structures with the influencing pillars of politics, policy and macro is a challenging task that requires constant attention and analysis.

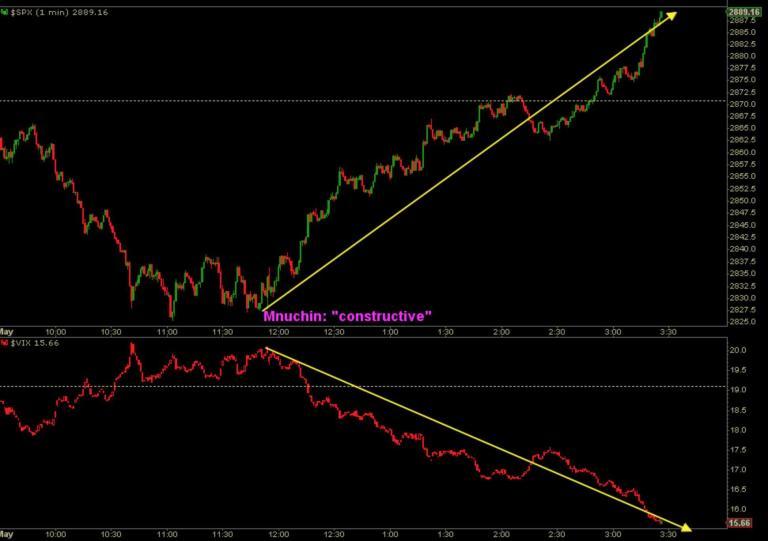

Take for example the massive Friday ramp and volatility crush off the lows following the Mnuchin “constructive” comment here producing another magic risk free Friday:

As absurd as the ramp appeared to many participants given the political backdrop it actually had a very solid technical foundation. Headlines can be triggers, but technicals paint their path and our task is to identify these paths and navigate through them as best possible be it on the long side or the short side.

And this is what this week’s technical video is all about in addition to a big picture update:

* * *

To get notified of future videos feel free to subscribe to our YouTube Channel.

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News http://bit.ly/2Yoqiyq Tyler Durden