There’s something about the timing of this Bitcoin rally that should have your attention. It’s happening in the wake of President Trump’s big push to remake the world economy along his lines.

It’s also happening as central banks stand exposed as having no answers for the continued deflation and collapse of money velocity a decade of QE and zero-bound (or negative) interest rates were supposed to cure.

Trump’s Trade and Tariff War will not solve this. He won’t address the real problems but rather blame China. And now he’s putting upward pressure on Bitcoin while the yuan is under serious pressure.

Because while Trump is out tweeting this morning about how bad it will be for China, he’s also moving to label anyone with a trade surplus with the U.S. a ‘currency manipulator.’

So, there is no escaping Trump’s ignorance on trade. And now he’s trapped.

So much for “trade wars are easy to win.”

Now that the trade war is in full flower because Trump doesn’t get basic economics things will get worse from here.

The major capital markets stare on in disbelief, hoping for a last minute miracle in China trade talks. They’ve priced in Trump folding at the last minute and he hasn’t done so. The big markets resist big moves because of both deep liquidity pools and investor normalcy bias.

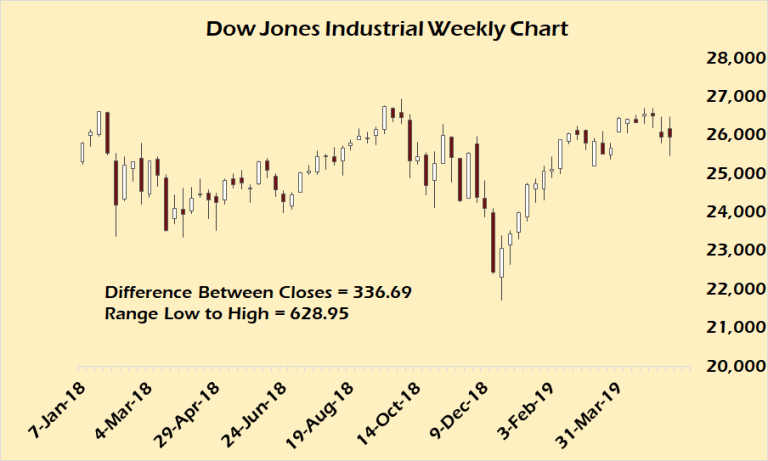

And, even then, volatility in the Dow Jones Industrials has more than doubled since the beginning of 2018 versus the previous two years, as I discussed in a post recently.

Last week’s 1000 point range in the Dow Jones wasn’t even a 2-sigma event over the past seventeen months since Trump began his “Easy” war to win.

The Dow’s Volatility Since Trump Opened his Trade War has Doubled

Bitcoin, on the other hand, doesn’t have deep pools of liquidity. As I talked about in my weekly article for Money and Markets,

The signs are everywhere that a dollar short squeeze is only just barely being held in check right now. And Bitcoin will respond positively to seeing its meager liquidity overwhelmed by people trying to avoid a big fall in their local currency.

For all of the hype about the size of Bitcoin’s “market cap,” this still remains an incredibly illiquid market. Most coins are simply not for sale. A lot of these well-designed alt-coins don’t have a lot of available supply for trading.

In some ways it makes Bitcoin the biggest penny stock in the world. Couple that with the fact that you don’t need a full “share” to trade it but can trade fractional bits of coins means that the supply of buyers in a rally can easily overwhelm the supply of available coins.

It doesn’t take a lot of money to move the Bitcoin market $1000, especially during the early stages of a massive bout of capital flight due to an incipient short squeeze in the U.S. dollar.

Every time Trump tweets anymore Bitcoin jumps $200.

But the real question is why Bitcoin and not something else, like gold? Bitcoin is rallying hard while gold languishes at $1300.

Because Bitcoin, though similar to gold, performs a different market function than gold. It and other alt-coins are the last mostly unregulated assets that can move freely around the world.

Gold isn’t. In fact, gold is highly regulated through the use of futures, ETFs, etc. That has been the plan for Bitcoin from the beginning, to create paper bitcoins that exert powerful downward pressure on the price through the creation of synthetic supply.

Moreover, digital gold can move freely but that is a pittance compared to the total gold market. It’s also cumbersome and expensive, period. You cannot compare moving money via Bitcoin for, at most, 1-2% versus moving in and out of gold.

Then compare that to something like DASH or even Litecoin and you’re looking at negligible costs.

And still, then, all gold accounts are KYC and AML compliant. Those still wanting any amount of financial privacy have bitcoin and other cryptocurrencies as alternatives.

Gold today, unfortunately, only helps protect those that don’t want to move physically but still see a real problem on the horizon. They can hedge their currency bets while not blowing up their entire life.

And gold will have its day once the central banks are fully exposed as frauds and need a bailout themselves. But I’m mostly convinced cryptocurrencies will perform better in the long run because they can be used as a smooth substitute for national currencies.

The rising Bitcoin and Gold price are proof that the national currencies like the U.S. dollar, Chinese yuan and euro are struggling with massive debt obligations dragging them down.

Why else would ECB president Mario Draghi be out there saying “a euro is a euro.”

Watch again: Mario Draghi answers a student’s question on cryptocurrencies #ECBYouthDialogue #GenerationEuro pic.twitter.com/5VmHr3sxNw

— European Central Bank (@ecb) May 8, 2019

Draghi is right that at the present time cryptocurrencies are not a significant portion of the transaction market. Bitcoin itself may never be a transactional currency. I would argue, and have argued, that it will be a reserve asset while other coins/token could serve as liquid mediums of exchange.

But at the same time it is insane for him to not acknowledge the massive appreciation (85% corrections or not) of Bitcoin versus the ‘currency’ he manages.

You could substitute the word “gold” into this clip and it would be the same. It is the standard Central Banker lie.

The value of a currency is not in its price but in the value you can get in return for it in any exchange. Versus actual goods that value steadily drops. It doesn’t happen linearly, but it does happen.

And I hate to break it to Mario but in that most important function for money the euro has been, like all debt-based currencies managed by central banks, an abject failure.

And he, as head of the ECB, is in the most vulnerable position among the central bankers, managing the largest and most leveraged balance sheet to foreign capital flows at the present time.

Watching Bitcoin rally as people gear up to do business outside of Trump’s trade and tariff war will only send money velocity in national currencies down further.

With this jolt above $7000, Bitcoin’s rally is far more than just a simple short-covering rally. This is something more fundamental. And it bears watching closely.

The proof will be in not just rising price, but also rising blockchain activity. You can get a crude look at what’s happening for the top 28 cryptos here. Men like Draghi are not worried about these numbers yet, but they will be when they are an order of magnitude higher and happening in the real world and not just on exchanges.

* * *

Support for Gold Goats ‘n Guns can happen in a variety of ways if you are so inclined. From Patreon to Paypal or by your browsing habits through the Brave browser where you can tip your favorite websites (like this one)for the work they provide.

via ZeroHedge News http://bit.ly/2VpAG7v Tyler Durden