With the Turkish Lira soaring on Friday, on what in retrospect turned out to be massive, FX-draining commercial bank intervention in the currency market, some TRY bulls were hopeful that their endless, currency crushing anguish may have been finally over, if only for the time being. Alas, it was not meant to be, and the lira resumed its collapse on Monday, with the move sharply lower sparked by a Reuters report that Turkey is about to officially become a banana republic in which the central bank is used to prop up Erdogan’s “executive presidency” because according to the report, Turkey’s Treasury ministry is working on legislation to transfer the central bank’s 40 billion lira ($6.6 billion) in legal reserves to the government’s budget to shore it up.

In what appears to be a roundabout way of saying the central bank – which can print lira – will be used to fund the government, a critical step that without fails ends in hyperinflation, economic and currency collapse, the Reuters sources said that the budget is deeper in deficit than expected, and so the central bank’s help will be needed to plug it.

As Reuters notes, “legal reserves” are separate to foreign exchange reserves, and are what the central bank sets aside from profits by law to be used in extraordinary circumstances. At end-2018, they stood at 27.6 billion lira, according to the bank’s balance sheet data. A second source with knowledge of the matter said last year’s “legal reserves” combined with this year’s amounted to the 40-billion lira figure, which was cited by all three people who spoke to Reuters.

“The Turkish central bank has around 40 billion lira in legal reserves. The transfer of this amount to the 2019 central administration budget was seen as suitable. This step aims at improving and strengthening the budget,” the second source said. It remained unclear how much of the reserves would ultimately be transferred and what, if any, new requirements would apply to the central bank.

As Reuters adds, the transfer would mark the second recent move by Ankara to tap the central bank’s funds to boost its budget. In January, the bank transferred some 37 billion lira in profits to the Treasury three months earlier than scheduled.

“I do not remember the use of legal reserves before. This method came up to stop further deterioration of the budget,” the source said. “There needs to be a legislation to transfer the central bank’s legal reserves. The new legislation is planned to be presented to the parliament soon.” the source said.

As a reference, Turkey’s budget recorded a 36.2 billon lira deficit in the first quarter of 2019, and is expected to soar to 80.6 billion lira by year end, which means that not even the entire “legal reserve” fund will be sufficient to keep Turkey afloat.

Needless to say, the report spooked investors as it suggests that Turkey’s fiscal standing continues to deteriorate, and is fueling concerns that the government is using the central bank to finance its deficit.

As a result, the lira – which already was tumbling as part of a US-China trade fiasco – slumped back under below the psychologically important mark of 6 per dollar. It traded 2.44% weaker at 6.1288 against the dollar after touching a one-week high of 5.9571 on Friday.

Not helping the lira was a Bloomberg report that as of early Monday, companies bought around $300 million, as local firms took advantage of Friday’s bouts of lira strength as an opportunity to scoop up dollars for Turkish companies saddled with a $315 billion foreign-exchange debt pile.

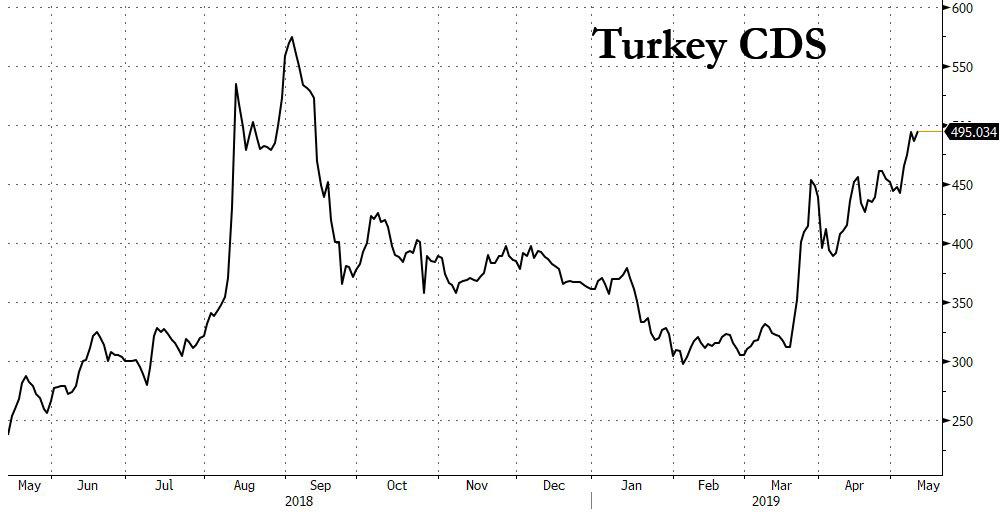

Putting Turkey’s unsustainable financial picture in context, as of February, the country’s non-financial companies’ hard-currency liabilities exceeded their foreign-exchange assets by $197 billion, equivalent to about a quarter of GDP, central bank data show. In other words, with every passing day, Turkey is getting closer to a dollar-denominated default, and its default risk is reflecting it: on Monday, Turkey CDS surged past 500 bps for the first time since September.

via ZeroHedge News http://bit.ly/2vWK9J3 Tyler Durden