After Trump revealed late on Friday that the US would proceed with raising 25% tariffs on the remaining roughly $300 billion in Chinese exports, the next major development as we noted earlier today…

Next market-moving headline: US announces tariffs on $300BN of remaining Chinese exports

— zerohedge (@zerohedge) May 13, 2019

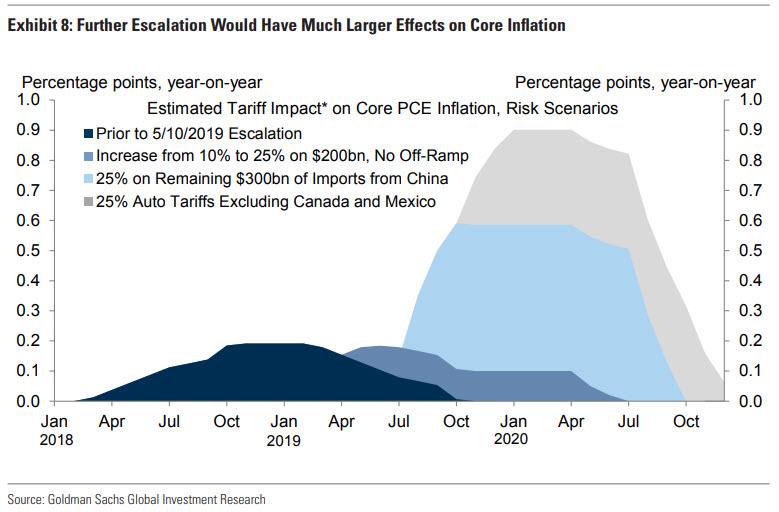

… was the official triggering of such tariffs, which as Goldman calculated over the weekend, threatens to send inflation sharply higher and lead to another round of aggressive Chinese escalation, which would likely result in tumbling stocks.

But before that happens, the office of the US Trade Representative, Robert Lighthizer, was expected to file a request for public comments and hold a hearing on the $300 billion in new proposed 25% tariffs. That’s precisely what happened late on Monday, when the USTR announced this hearing would take place June 17, and provided the following information:

In accordance with the direction of the President, the U.S. Trade Representative (Trade Representative) proposes a modification of the action being taken in this Section 301 investigation of the acts, policies, and practices of the Government of China related to technology transfer, intellectual property, and innovation. The proposed modification is to take further action in the form of an additional ad valorem duty of up to 25 percent on products of China with an annual trade value of approximately $300 billion. The products subject to this proposed modification are classified in the HTSUS subheadings set out in the Annex to this notice. The Office of the U.S. Trade Representative (USTR) is seeking public comment and will hold a public hearing regarding this proposed modification.

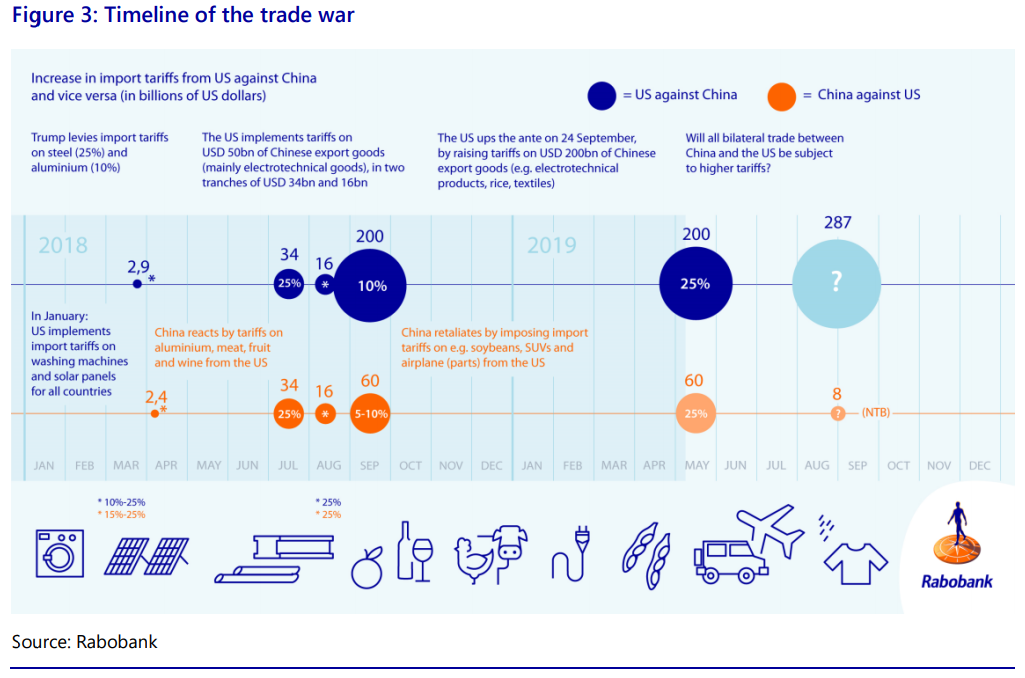

As a reminder, the US has already pulled the trigger on 3 specific tranches of tariff actions against China, summarized in the following diagram from Rabobank:

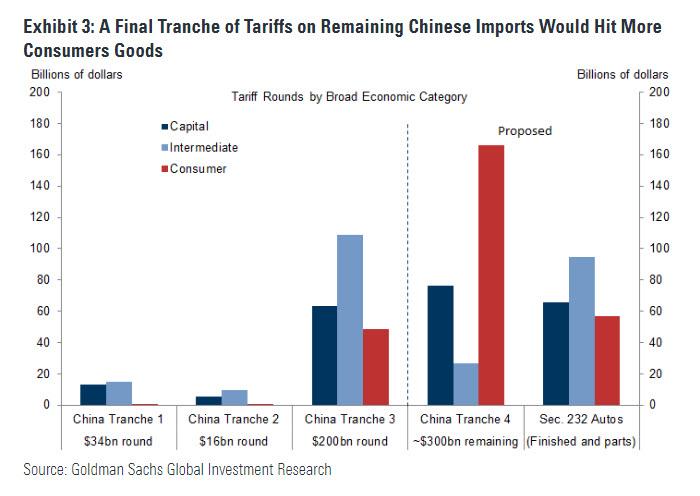

The proposed action would be the 4th and Final Tariff Tranche (shown above the in the light blue bubble with the question market), and would target primarily consumer goods.

Specifically, the proposed action would take the place of “an additional ad valorem duty of up to 25 percent on products of China covered in the list of 3,805 full and partial tariff subheadings set out in the Annex to this notice. The proposed product list has an approximate annual trade value of $300 billion. The proposed product list covers essentially all products not currently covered by action in this investigation. The proposed product list excludes pharmaceuticals, certain pharmaceutical inputs, select medical goods, rare earth materials, and critical minerals. Product exclusions granted by the Trade Representative on prior tranches from this investigation will not be affected.

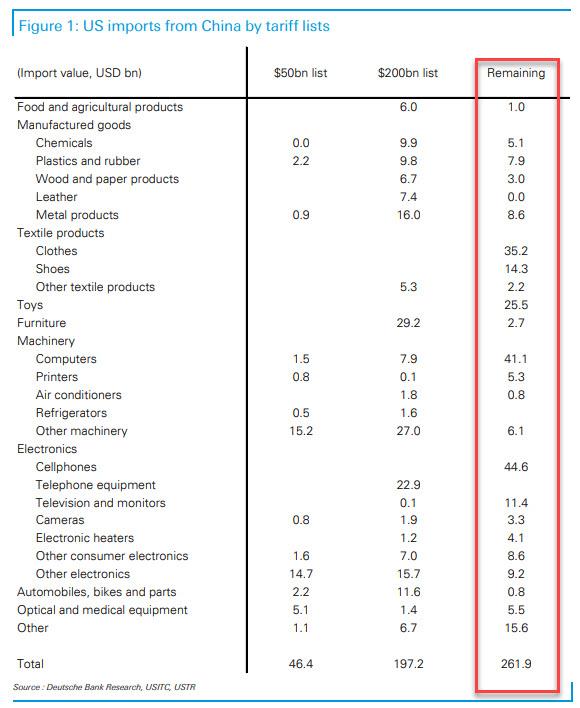

For those who are pressed for time to read through the entire list, Deutsche Bank explained earlier that the remaining Chinese exports are significantly different from the other Chinese exports, as they include mostly consumer goods such as smartphones, computers, and textiles, and US consumers are more dependent on China for these goods. These are shown in the red box below:

Additionally, Goldman economists noted that imports from China account for a much larger share of total imports in the categories covered by Tranche 4 than in prior rounds. For example, computers, cell phones, and toys are some of the largest categories in Tranche 4, and China accounts for 80% or more of total US imports of each product group. This, according to Goldman chief economist Jan Hatzius, “could make it harder for US importers to source from other countries not affected by the new tariffs.”

The full USTR document is below (pdf link).

via ZeroHedge News http://bit.ly/2w2kKgR Tyler Durden