Just as the year long trade war between the US and China was heating up, an conflict that threatened to send the Chinese yuan to lows not seen since late last year, Kyle Bass, one of the most notorious China bears on Wall Street, told Bloomberg on Tuesday that he’s closing his long-running yuan short.

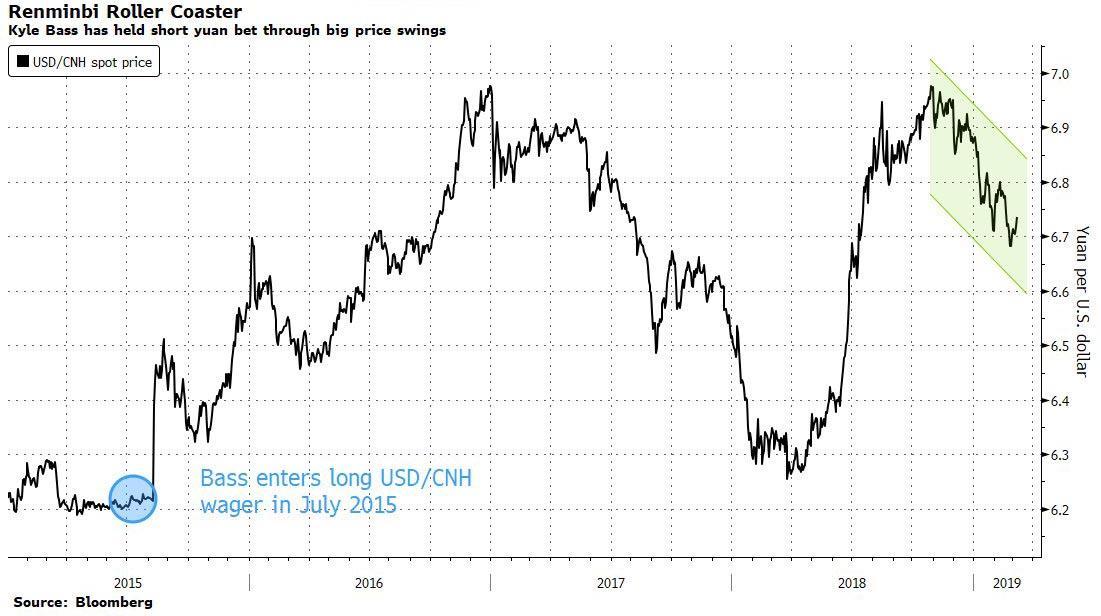

The nearly four-year wager alienated LPs and racked up losses for Bass’s firm until the yuan started weakening against the dollar late last year in recent years, but has been fairly successful over the life of the trade, as the following BBG chart shows.

As recently as March, Bass had suggested that he was doubling-down on the play.

To be clear, Bass isn’t closing out his short because he’s lost faith in the idea…but rather because he’s more interested in doing what he can to help the Trump Administration navigate the trade war, and apparently didn’t want to feel conflicted.

“We think that China represents 15% of global GDP, yet less than 1% of all cross-border currency settlement is in their currency. It’s important for us to realize that the joke is on us, if they were to open their capital account and let Chinese invest abroad, their currency would depreciate 40% in a day. I think we’re making the right moves here in taking a little bit of market pain to maintain our national security in the long run.

“Just so you can hear from me, I don’t have a vested interest in China’s currency any more. It’s such an important moment in time for US national security that most of my interest has been moving toward the political sphere.”

“If you can get over the fact that there’s no rule of law there, and they don’t respect human rights…then maybe you should invest money in China.”

Bass told BBG that his interest in China is moving “into the political sphere.” Bass put the trade on in 2015 after an August devaluation of the yuan rattled global equity markets. Bass argued that China would eventually deplete his foreign-exchange reserves trying to manage its currency, and would be forced to allow another sharp devaluation.

The offshore yuan has fallen 2.4% against the dollar this month amid the escalating trade tensions. On Monday, the US Trade Rep’s office released a list of $300 billion of Chinese-made products that could be slapped with tariffs. Though President Trump has also said he’d be open to meeting Chinese leader Xi Jinping at next months’ G-20 summit.

Bass gained instant Wall Street fame after betting against mortgage bonds during the financial crisis. However, some of his calls in the years since haven’t panned out. His bets against Japanese government bonds went sour as yields tumbled below zero.

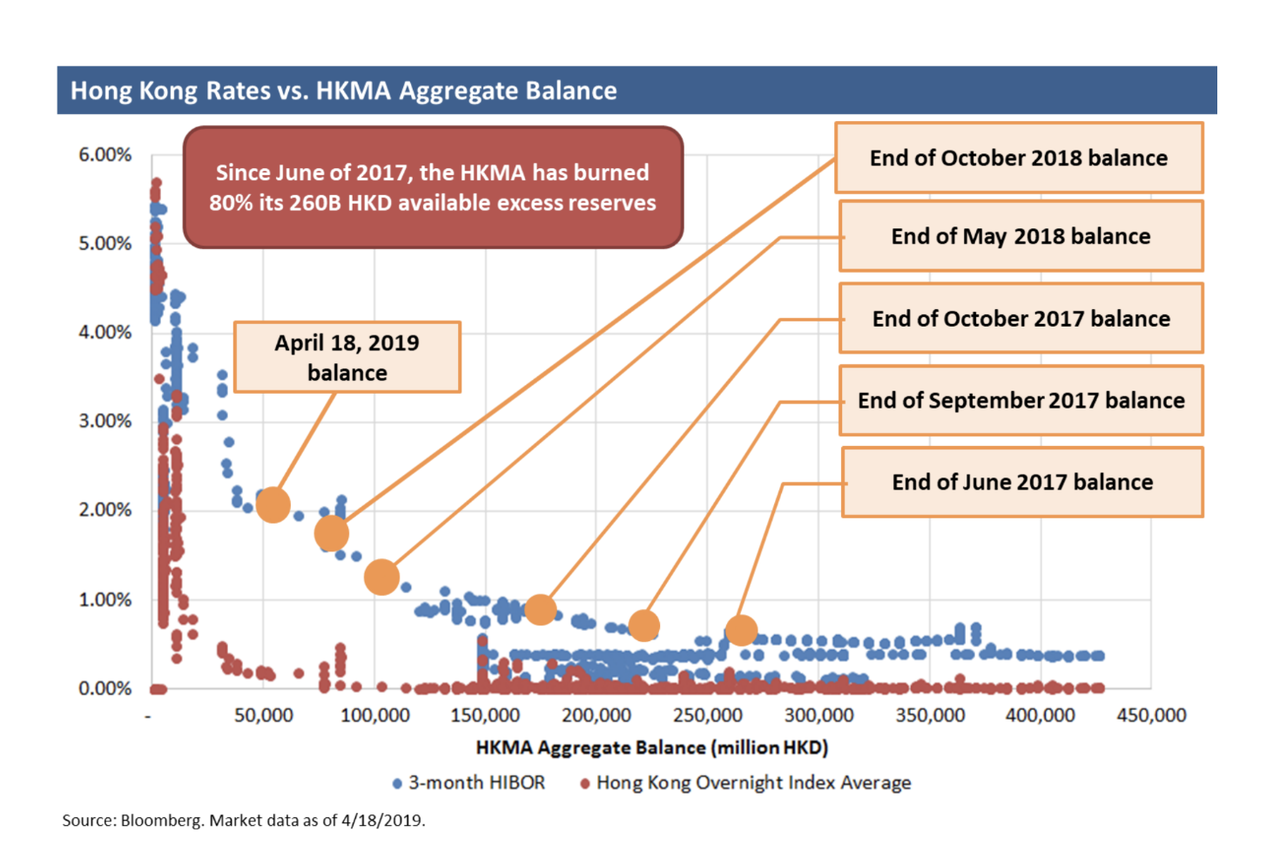

More recently, Bass published one of his first investor letters in three years, where he outlined a new bet against the Hong Kong dollar, which has been pegged to the greenback for 36 years. Bass argued that Hong Kong was on the cusp of a balance-of-payments crisis, and that it would soon be forced to abandon the peg, creating huge opportunities for short sellers willing to bet against the currency.

The Hong Kong Monetary Authority has spent 80% of its reserves over the past year or so, and if the monetary authority’s cash reserves drop to zero, Bass believes rates in Hong Kong will spike, threatening the banking system and forcing the HKMA to act. Hong Kong “currently sits atop one of the largest financial time bombs in history,” Bass said.

Bass reaffirmed that he has short positions against other southeast Asian currencies.

Listen to the full phone interview below:

via ZeroHedge News http://bit.ly/2VrBrww Tyler Durden