The last three days have seen dip-buyers return to the US equity markets after last week’s definite regime-change to rip-sellers.. but now, as Nomura’s Charlie McElligott explains below, that new BTFD regime dead cat bounce may be over.

Like a broken record, McElligott details, the Equities story is once-again about index futs / ETF options Greeks & VIX term structure.

Yesterday saw further extension of the short squeeze (High Short Interest basket +3.0% in 2d vs SPX +1.3%)…

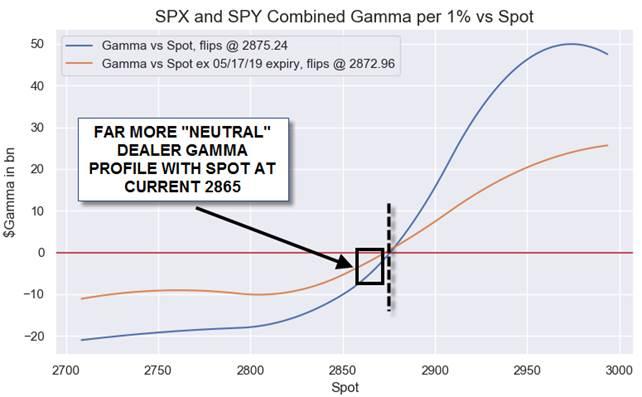

Exacerbated on the index level by dealer “short Gamma” into yesterday’s trade (relative to spot at the time), which drove overshoots both lower- (the sloppy move down to 2815) and ultimately higher- (the rip into close ~2860) in a manic futures trade.

Today, we are seeing more gravitational pull higher to the big OpEx strikes (below) which actually align with a “neutral” dealer Gamma profile (thus, expecting a stickier range today).

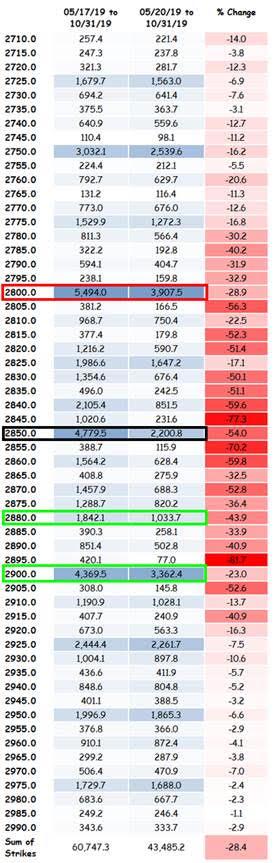

SPX futures into OpEx see the most likely ‘pin’ at the 2850 level ($4.8B of Gamma at that strike), although with potential “pull” up to the 2880 level ($1.8B) as the most realistic course of action (a complete and total freak-out would see a move to 2900, with $4.4B Gamma)

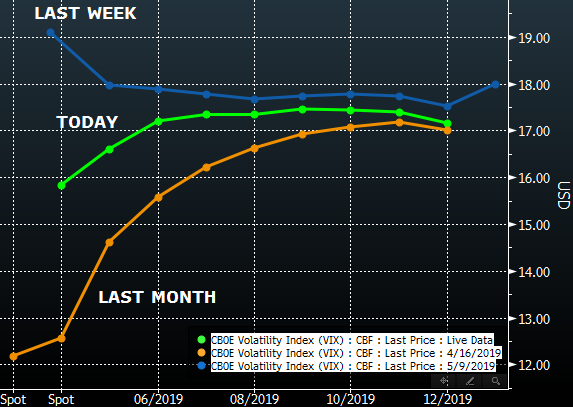

VIX futures term structure is now back in contango / no longer inverted (although still a ‘kink’ out there), which means that systematic roll-down will begin / have already begun rebuilding “Short Vega” positions.

Best TACTICAL profile continues to look like Short Vega, Short Vol of Vol (demand for tails continues to fade from a very extended level, with downside coming in faster), Long Gamma.

So the question is – is the gamma squeeze over? or do we “freak out” – in Charlie’s words – to 2900 in S&P Futs before sellers can take back control?

via ZeroHedge News http://bit.ly/2Jpq8nk Tyler Durden