Reuters’s John Kemp warns global air freight volumes are falling across the world at “some of the fastest rates since the end the great recession” in an ominous sign that the global synchronized slowdown is gaining momentum.

Kemp says various forms of freight rates (air, land, and or sea) have a much shorter lag than traditional macroeconomic statistics, which means they’re a “good barometer of the economy’s health.”

Air freight carries high-value cargo and reacts instantly to changes in demand, making it an excellent forward leading indicator for global economic activity.

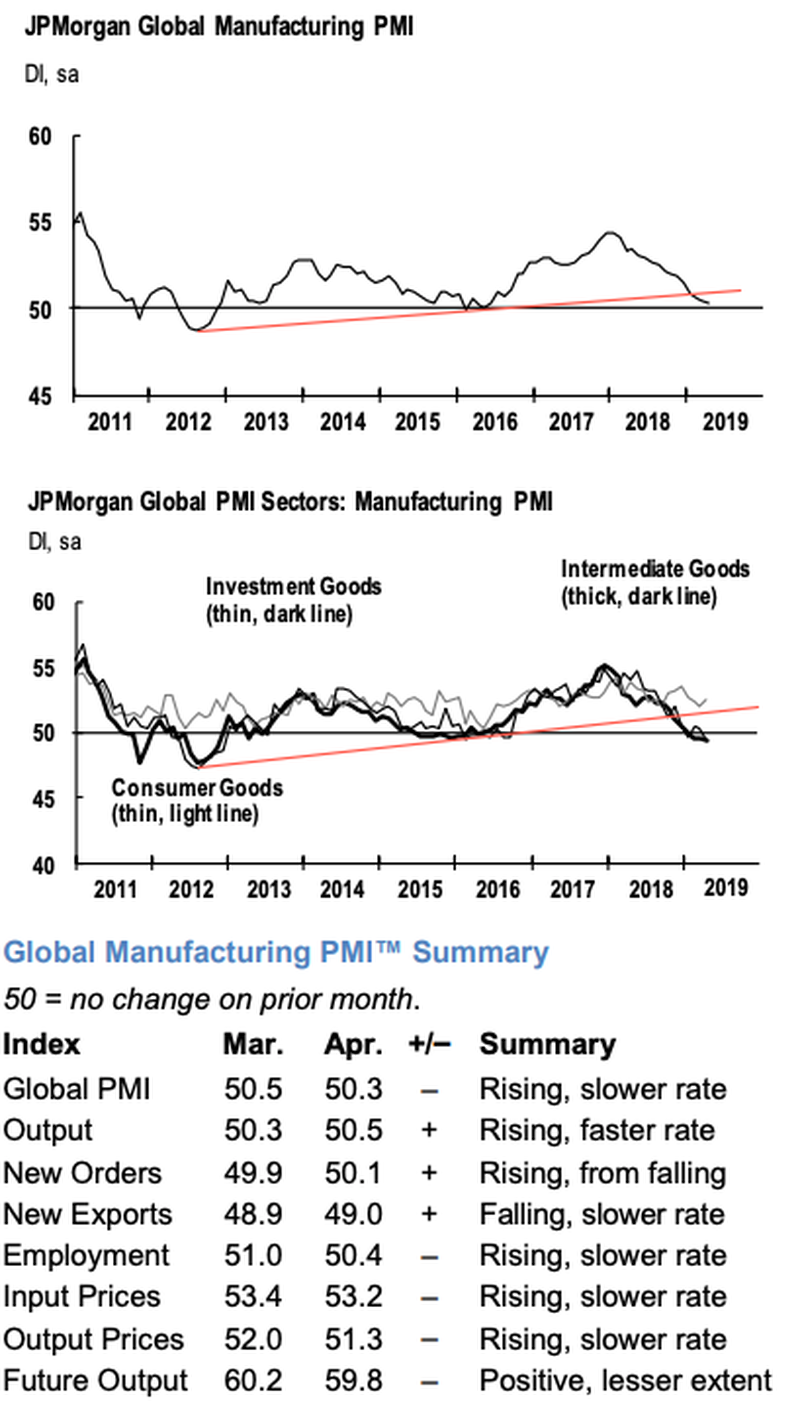

Kemp’s Global Air Freight chartbook shows freight volumes are declining at major airports across the world, a sign that global manufacturing has yet to bottom (we also outlined this in a report on J.P.Morgan Global Manufacturing PMI continues to plunge).

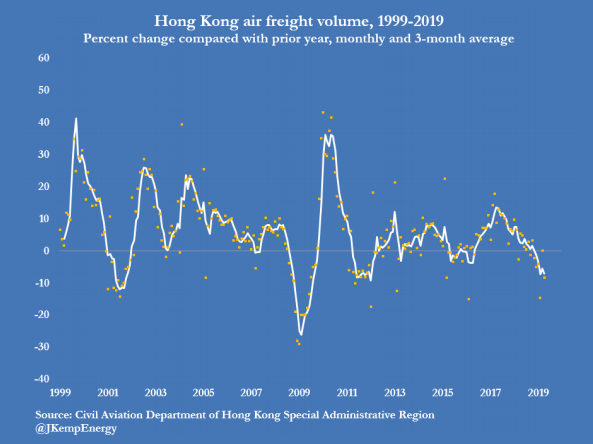

The first chart shows Hong Kong International Airport air freight volumes dropped 7% between February and April compared with the same period last year.

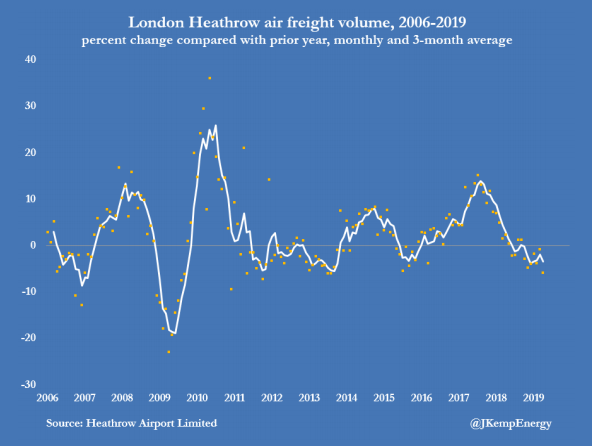

London’s Heathrow Airport reported volume declined 3% over the same period, and growth rates plunged to two-year lows.

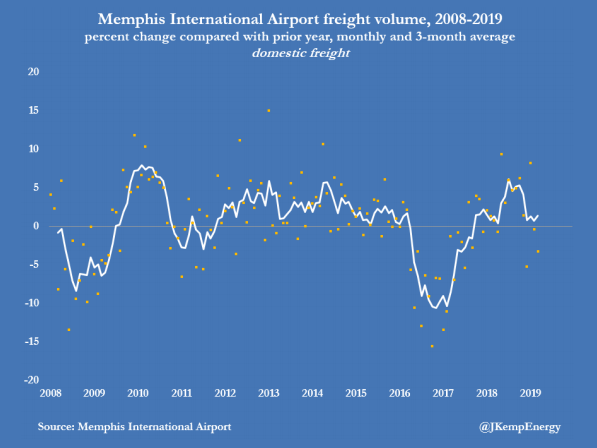

At Memphis International Airport, volume was up 1% in 1Q19, but that was down from a 5% growth rate in summer 2018.

Memphis had 1% growth in domestic freight shipments, but international freight slipped 1%, which is consistent with U.S. importers pulling forward to beat deadlines for tariffs on Chinese goods.

Last month, we reported CPB Netherlands Bureau for Economic Policy Analysis revealed world trade volume dropped 1.8% in the three months to January compared to the preceding three months.

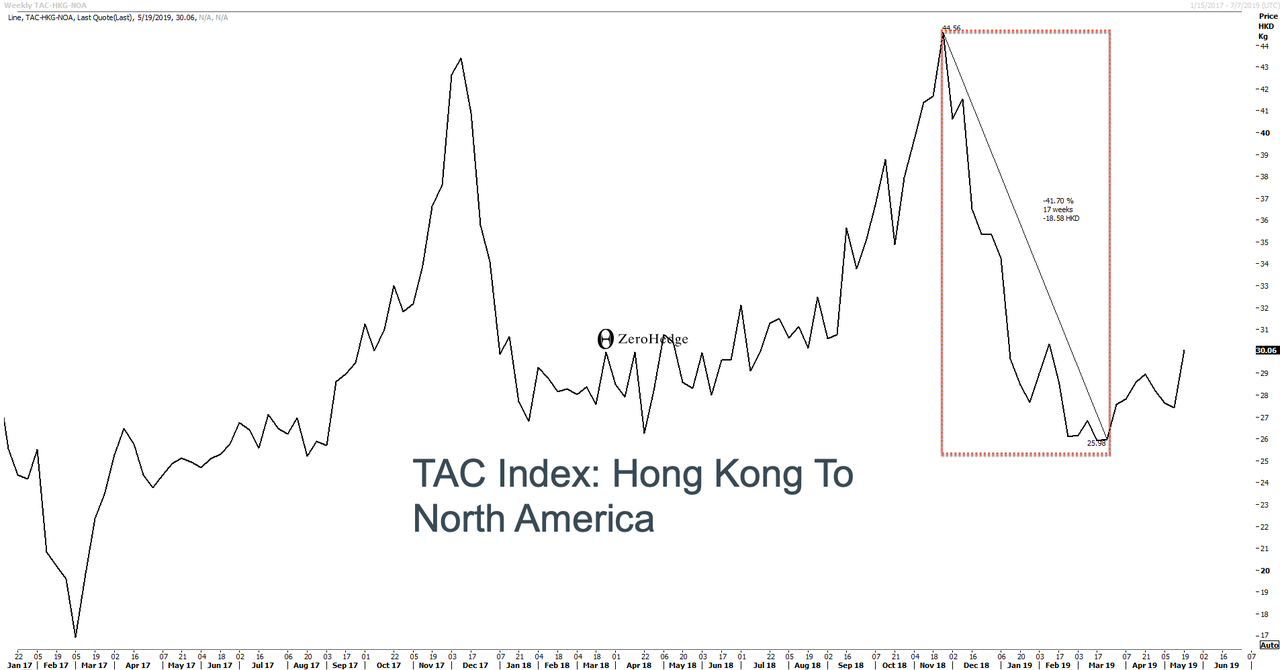

Specifically, TAC Indices, the premier provider of Air Cargo rates around the world, shows Hong Kong to North America air freight rate in Hong Kong dollars versus per kilogram collapsed -42% from November into early April (a total of 17 weeks of declines).

The epicenter of the slowdown is concentrated on routes to and from Asia. Air freight volumes are also slowing to and from North America and to and from Europe.

“Conditions facing the industry remain challenging,” according to the International Air Transport Association’s (IATA) monthly freight report. “The air freight segment continues to encounter various headwinds to growth.”

“Growth (in air freight) is likely to remain subdued over the coming few months at least,” IATA reported.

The acceleration of the trade war between the U.S. and China could spark a world trade recession. Washington imposed a 25% tariff rate on $200 billion of goods imported from China last Friday. In a tit-for-tat trade war, China slapped a 25% tariff rate on $60 billion of U.S. goods on Monday.

Air freight tends to come under pressure by mid-cycle slowdowns as well as end-of-cycle recessions, said Kemp.

The current slowdown is similar to previous mid-cycle downturns in 2015/16, 2012/13 and 2011/12, as well as the end-cycle Dot Com bust in 2001/02.

Air freight volume declines confirm the global synchronized slowdown is nowhere close to a trough, as the further escalation in the trade war will likely lead to a further reduction in global growth in the 2H, not a rebound like many on Wall Street believe.

via ZeroHedge News http://bit.ly/2HyLqLN Tyler Durden