Quite a week…

Today’s markets action pic.twitter.com/dbqpiQ5GQv

— The_Real_Fly (@The_Real_Fly) May 17, 2019

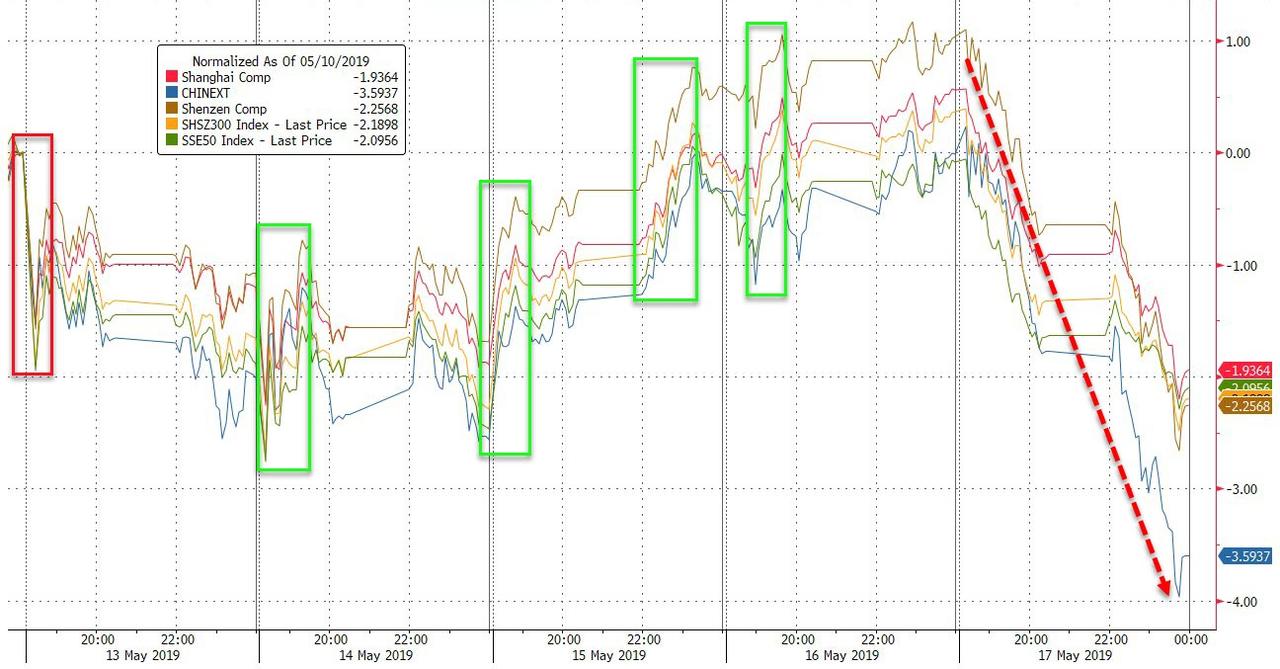

China was ugly overnight after defending any dip all week – have to make sure the stock market does not reflect weakness after the trade deal fell apart!!

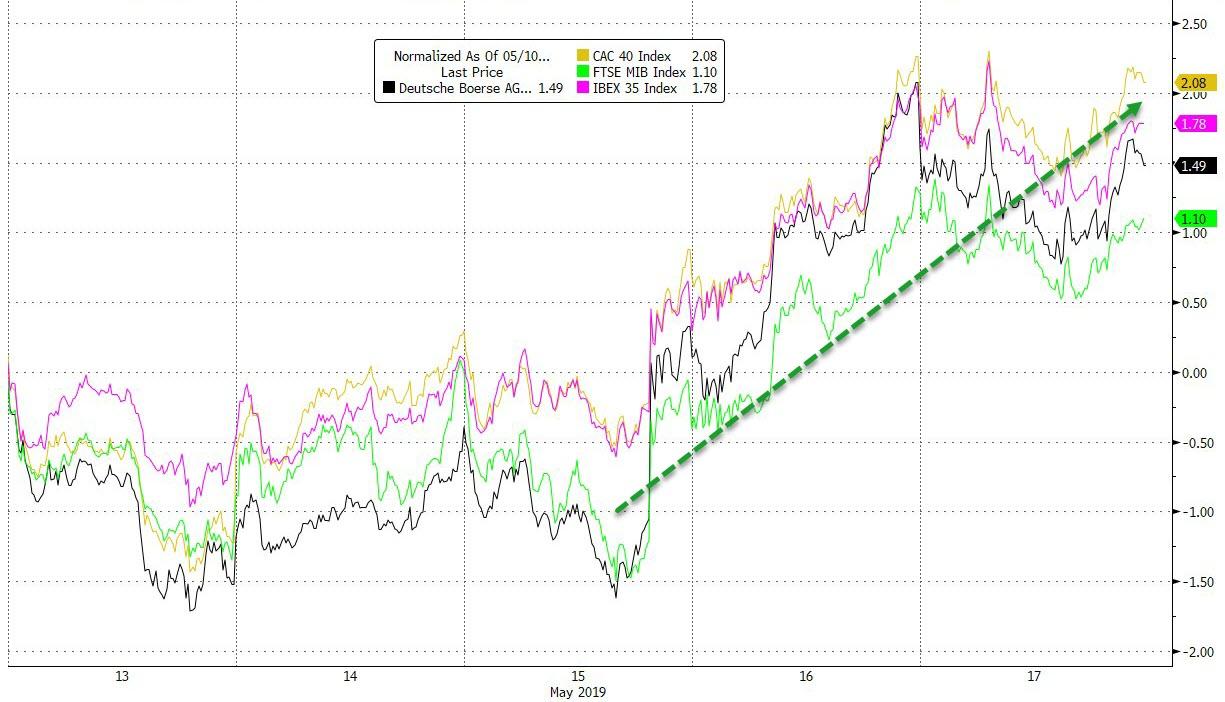

But Europe soared this week as US delayed auto tariffs…

China remains the best performer YTD, barely…

The late-day headlines from CNBC that “trade talks have stalled” – merely repeating what was said overnight numerous times – triggered the algos to dump after early gains (thanks to op-ex gamma hedging and US-Canada tariff headlines)…Small Caps were the week’s biggest laggard…

The Dow is down four weeks in a row – something it has not done since May 2016!!

The midweek ramp was all one big short-squeeze and the machines ran out of ammo today…

Another failed IPO today…

Trade deal hope was dashed this week…

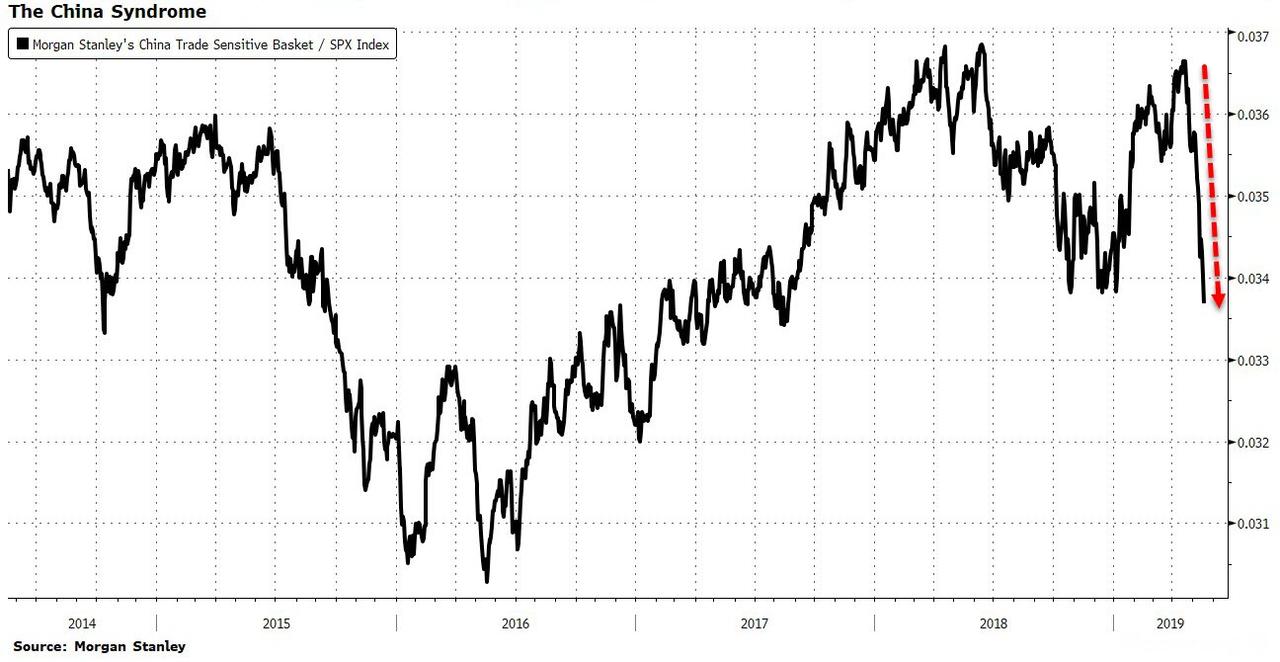

The ratio between Morgan Stanley’s China Trade Sensitive Basket and the S&P 500 has dropped to the lowest since U.S. President Trump and Chinese President Xi announced a truce at the G-20 meeting in Argentina in December.

Credit ended the week wider (despite ripping back midweek from Monday’s gap wider)…VIX was around unch…

Stocks and bonds decoupled this week (as stocks short-squeezed higher midweek)…

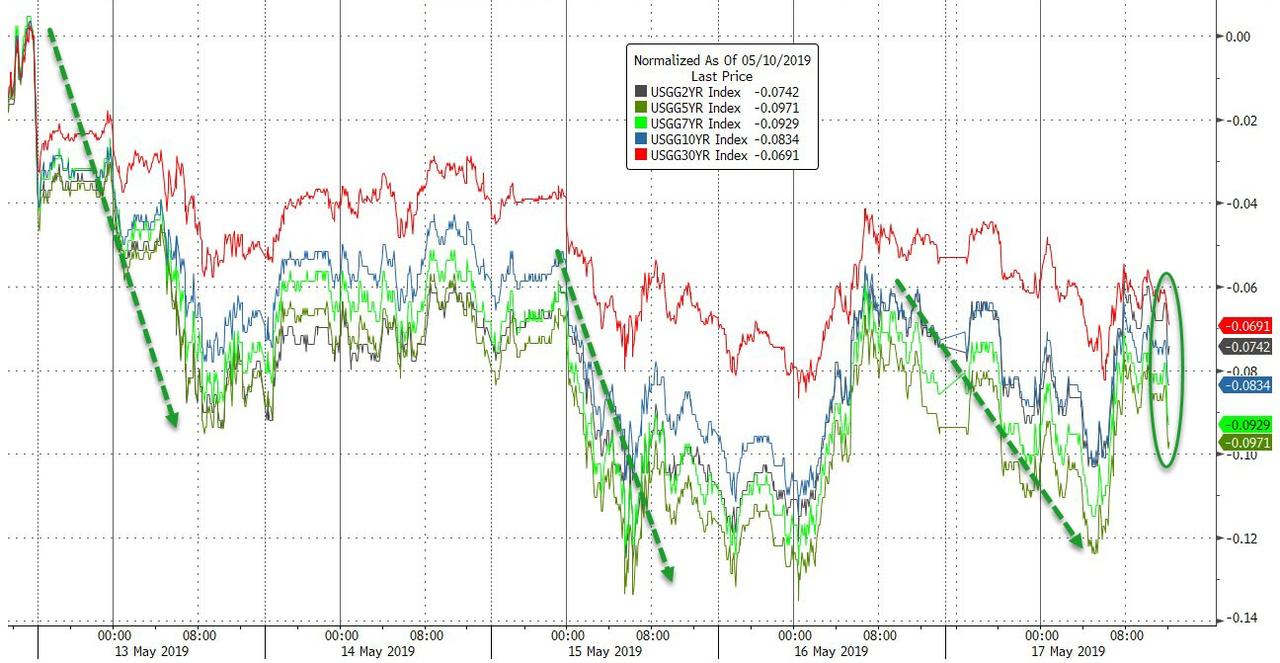

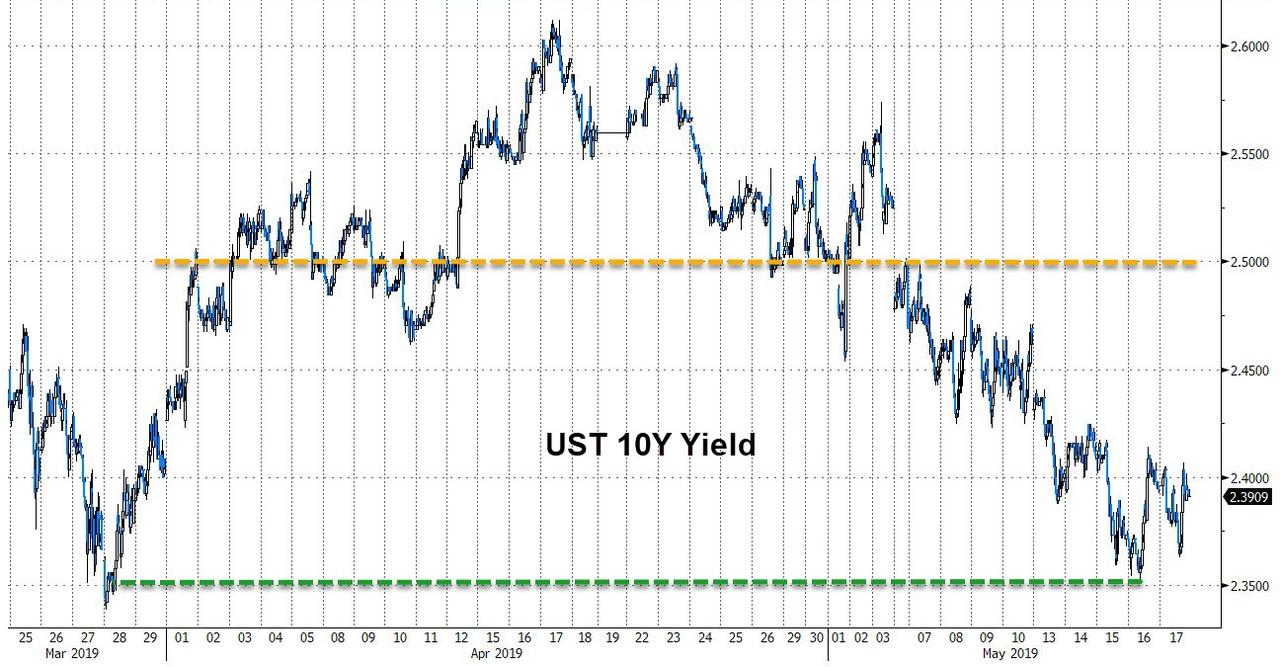

Treasury yields were bid on the week and accelerated lower in the last hour as repeated headlines of trade talks being stalled sparked more bond buying…

10Y Yields fell back close to YTD lows this week

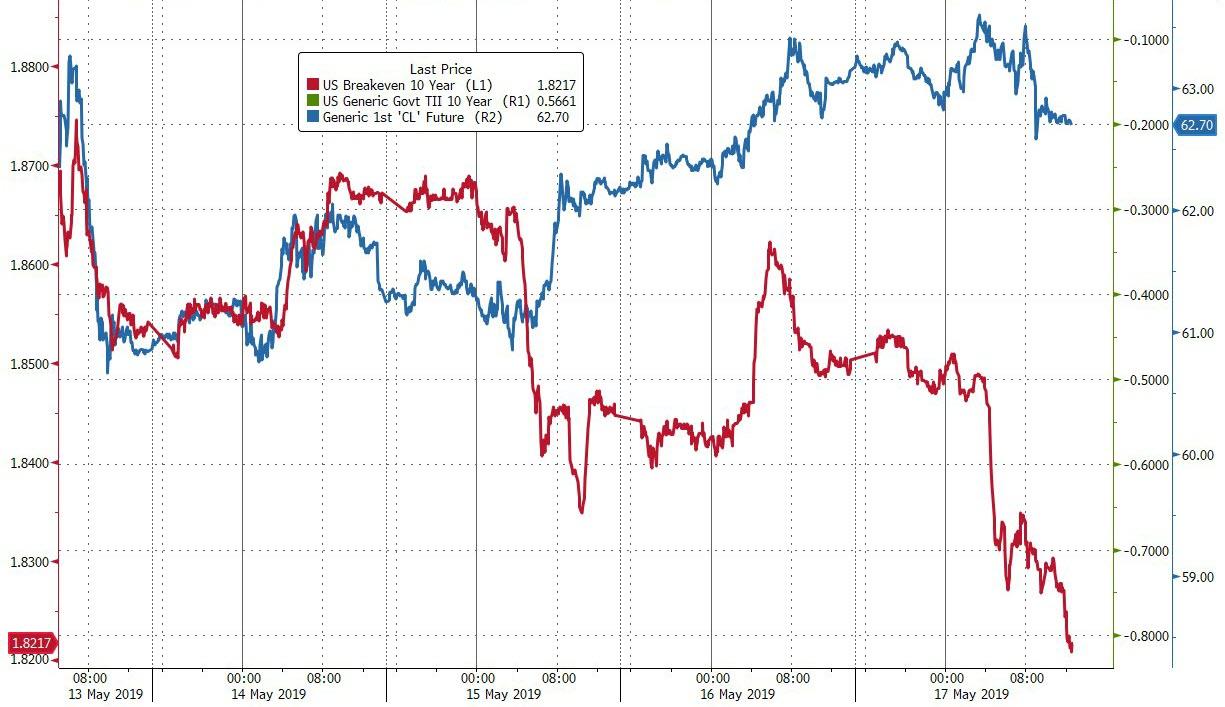

Notably crude and inflation breakevens decoupled late in the week…

The yield curve closed the week just above inversion…

But before we leave bond-land, both US and Europe priced in more dovishness from their respective central banks this week (41bps of cuts in 2019 for the Fed and 35bps of cuts for the ECB)…

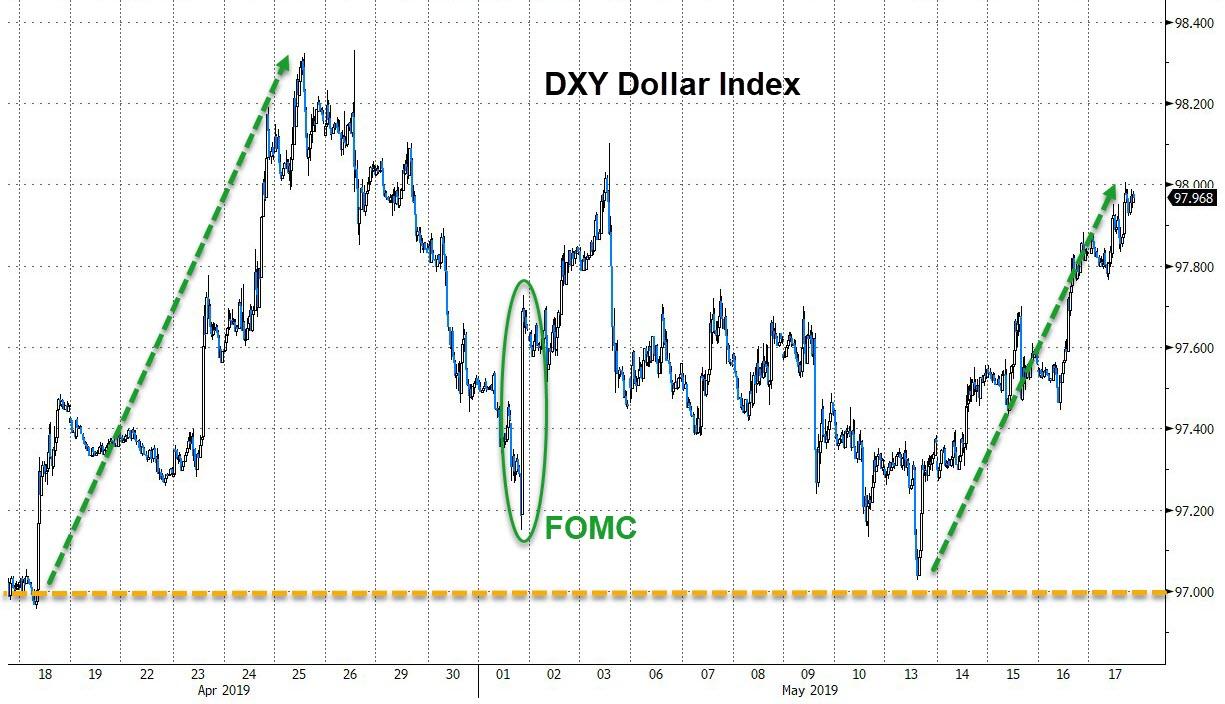

The Dollar Index rose on the week – its best week in over 2 months…

The last two weeks have seen offshore yuan collapse over 3.1% getting closer to 7.00 – the biggest 2-week plunge since Aug 2015’s devaluation

Cable was a disaster this week with GBPEUR down 10 days in a row – the longest losing streak in 19 years

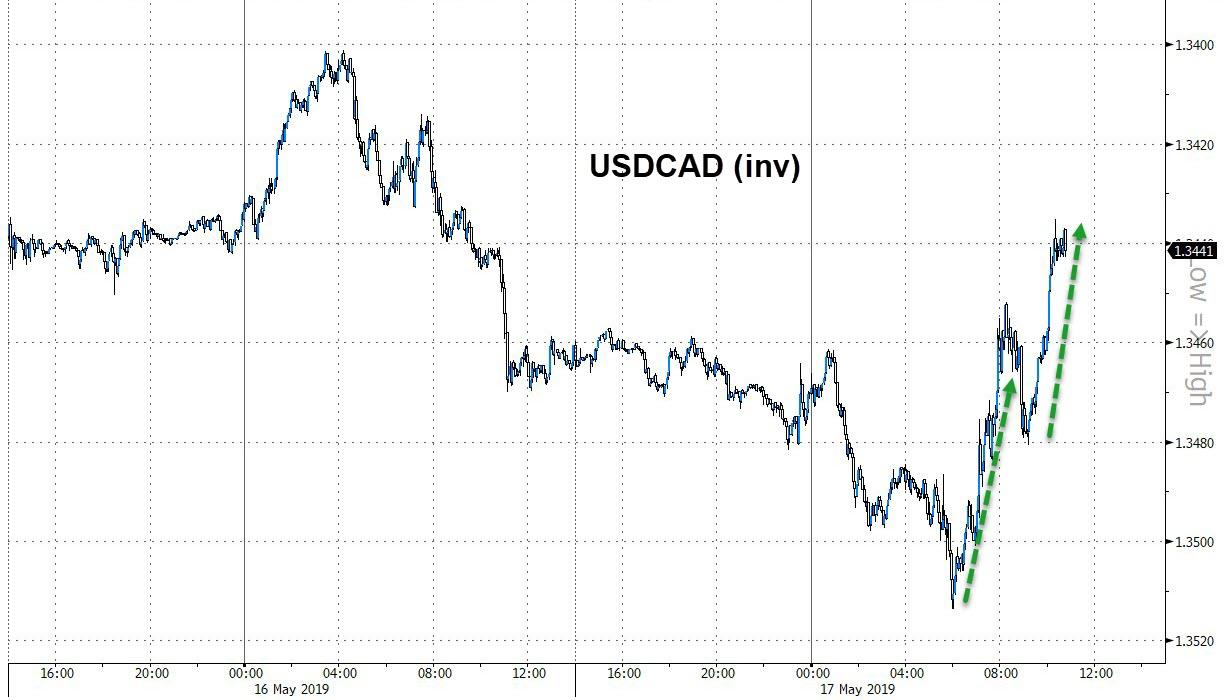

The Loonie rallied on the day after US dropped steel tariffs…

Emerging-market stocks fell for a second day and a gauge of EM currencies erased 2019 gains as China signaled its reluctance to resume trade talks with the United States

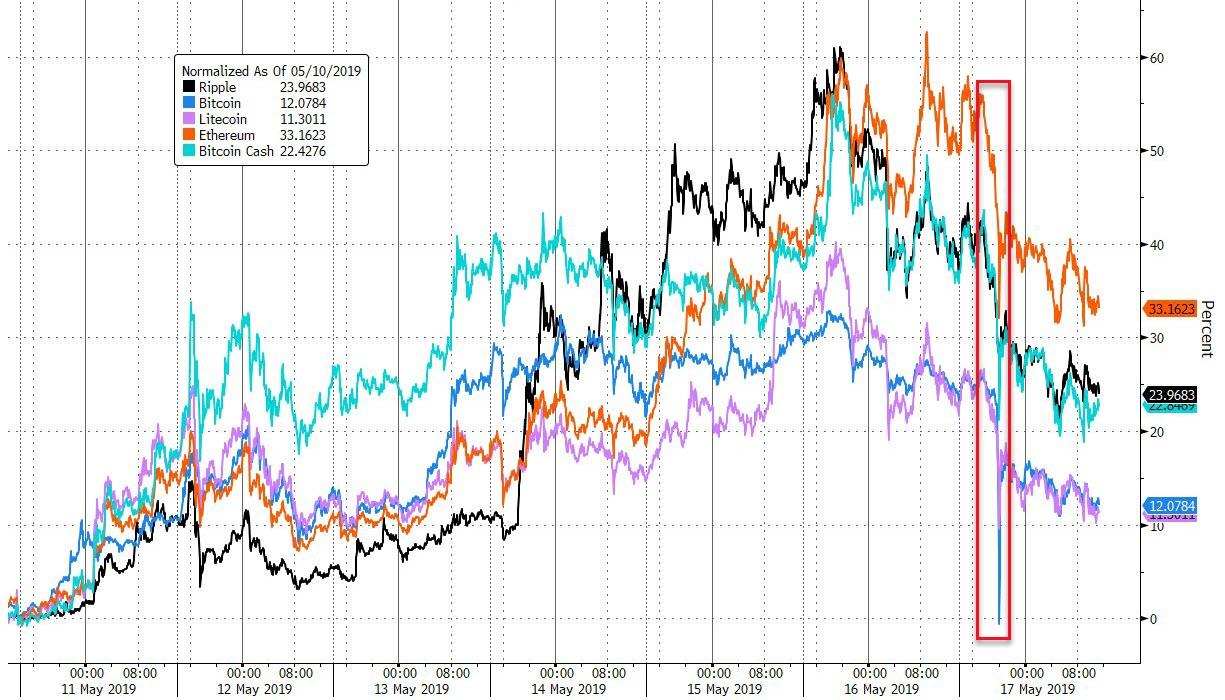

Cryptos had a violent week but ended significantly higher, led by a 33% rise in ethereum…

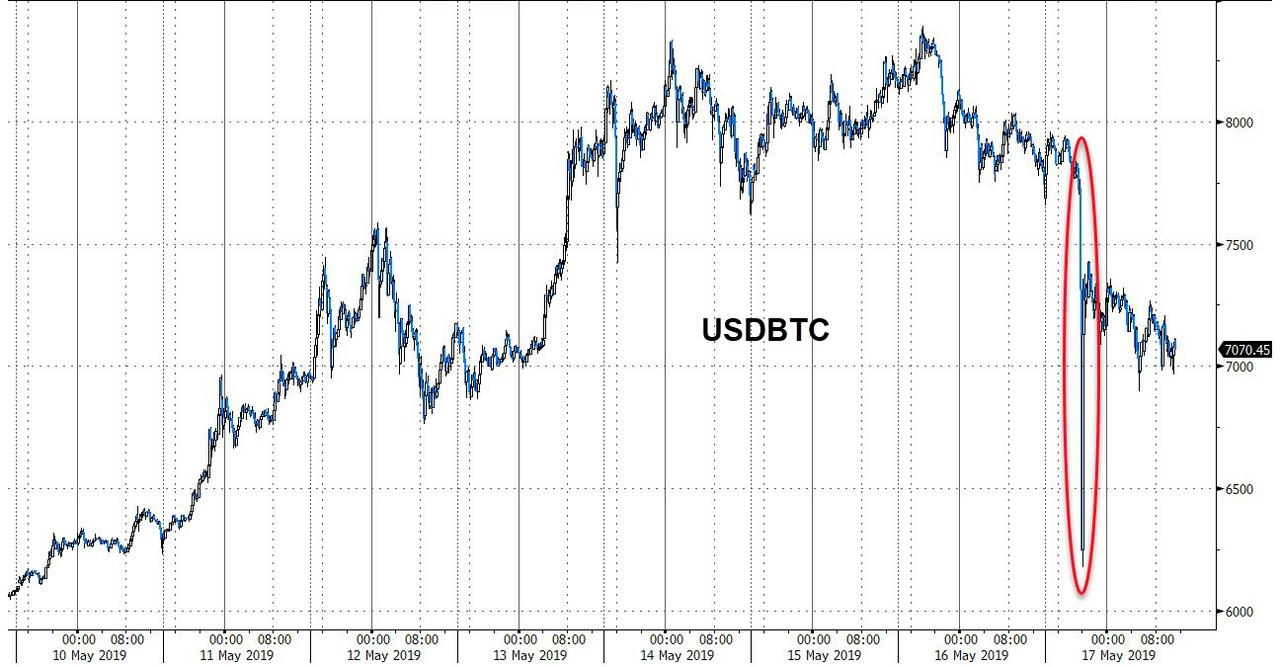

With Bitcoin reaching almost $8500 before crashing Friday…

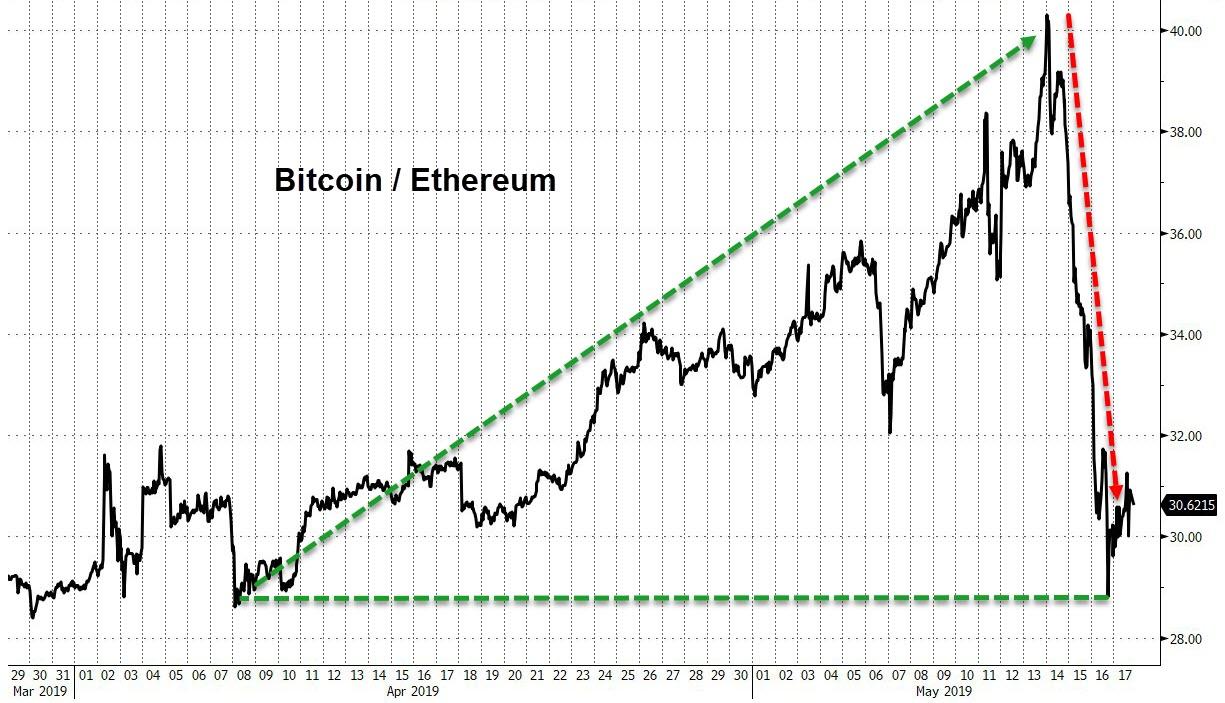

The dramatic outperformance of Ethereum in the last few days has erased all of Bitcoin’s outperformance over the last 6 weeks…

WTI rallied on the week (copper did not) despite a strong dollar and trade talks breakdown but silver was the biggest loser…

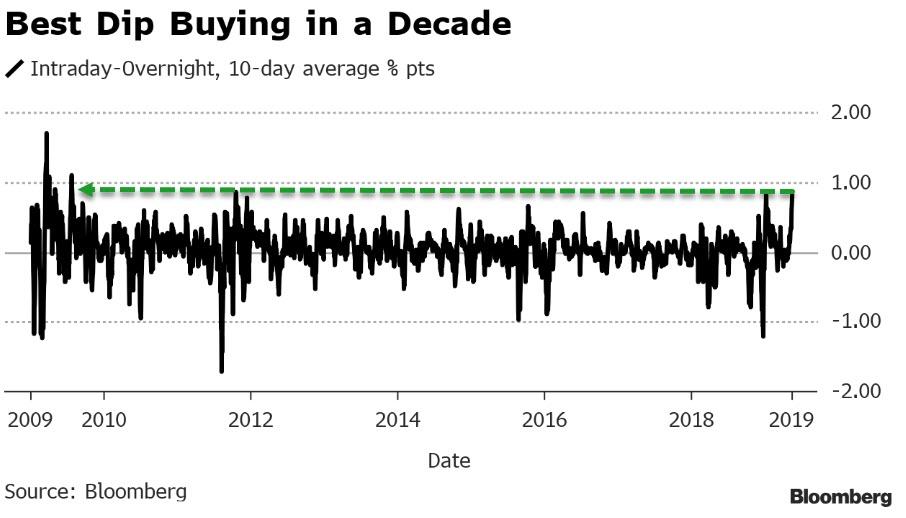

Finally, in case you thought something had change in recent days – despite the collapsing fun-durr-mentals and the death of trade talks – you were right. Bloomberg’s Luke Kawa notes that over the past 10 sessions (or since the trade war resurfaced) the S&P 500 has averaged a drop of 0.5% overnight and a gain of 0.3% during the day. That 0.8 percentage point average gap over the two-week stretch constitutes the biggest disparity between poor overnight retreats and intraday advances since July 2009.

In other words, as the US-China trade deal began to collapse confidence in the markets, ‘someone’ was panic-buying US equities during the day after ‘someone else’ was dumping them overnight at historically high levels.

With global money supply now collapsing, stock markets are gonna need more dip-buying to support this debacle…

via ZeroHedge News http://bit.ly/2ErH8Fp Tyler Durden