An escalating Sino-American trade war is creating turmoil in rural America.

JPMorgan told clients Tuesday, the American agriculture complex is on the verge of disaster, with farmers caught in the crossfire of an escalating trade war, reported the Financial Times.

“Overall, this is a perfect storm for US farmers,” JPMorgan analyst Ann Duignan warned investors.

With a farm crisis currently underway, Duignan downgraded John Deere’s stock to underweight, citing fundamentals in the Midwest are “rapidly deteriorating.”

And his downgrade was well-timed after Deere’s earnings overnight, as Bloomberg reports that Deere & Co. is no longer “cautiously optimistic” as it has been for so long.

The machinery giant reported lower-than-expected earnings and cut its annual guidance as its farmer customers shun major purchases amid uncertainty about demand for their products.

“Ongoing concerns about export-market access, near-term demand for commodities such as soybeans, and a delayed planting season in much of North America are causing farmers to become much more cautious about making major purchases,” Chief Executive Officer Sam Allen said in a statement Friday.

And shares are tumbling…

Farmers are facing tremendous headwinds, including worsening trade war, collapsing soybean exports, global oversupply conditions, and crop yield losses in the Midwest due to flooding.

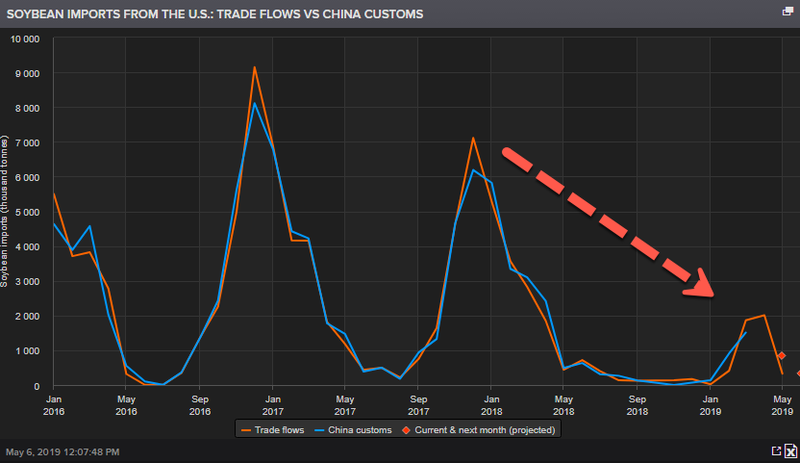

“As a result of tariffs and excess global supply, US soybean export inspections are down 27%” YoY, Duignan wrote. She added that the Chinese are shunning US farmers and are purchasing crops from South America.

Refinitiv trade flows indicate the trade war has cut over 80% of US soybean exports to China so far this market year (September-August).

Domestically, “the Midwest is off to a very slow start in 2019/20,” Duignan wrote. The growing season is “off to a bad start,” and soybeans are far behind in “planting progress” compared with 2018, she said.

After promising over the weekend to “never surrender to external pressure,” Beijing defied President Trump’s demands that it not resort to retaliatory tariffs and announced plans to slap new levies on $60 billion in US goods.

China’s retaliatory tariff rate increase comes after the White House raised tariffs on some $200 billion in Chinese goods to 25% from 10% on Friday.

In more bad news, China might completely stop purchasing agricultural products from the US. There are currently 7.4 million metric tons of beans that have not yet been shipped to China, according to the US Department of Agriculture data. China could easily cancel the orders, or if the beans are en route, Chinese ports could refuse to take the cargo, a Bloomberg headline said.

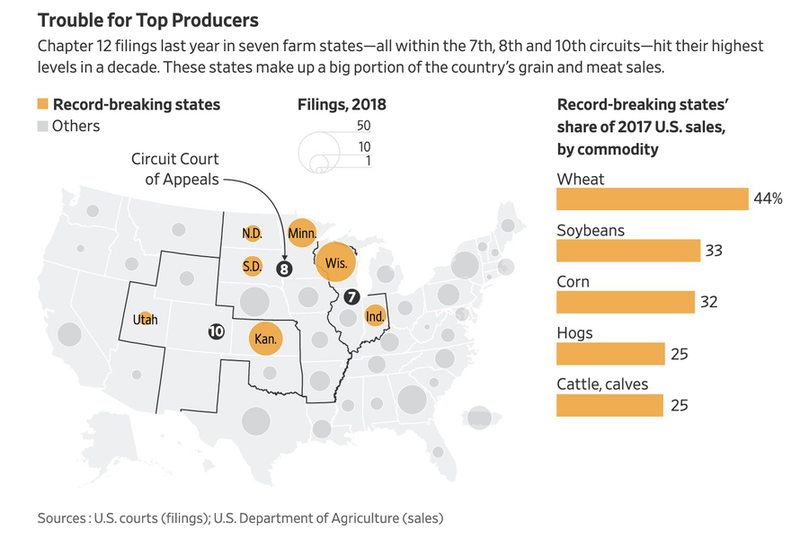

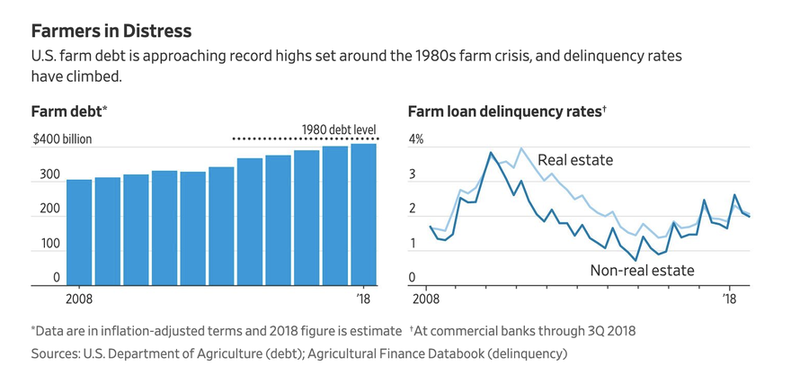

This all comes at a time when farmers are defaulting and missing payments at alarming rates, forcing regional banks to restructure and refinance existing loans.

Several months ago, we showed the number of farmers filing for bankruptcy climbed to its highest level in a decade.

Because of the unfriendly environment, the level of farm debt is approaching highs not seen since the farm crisis of the early 1980s.

The deepening trade war has led Trump to pledge $15 billion worth of agricultural product purchases from American farmers through the Commodity Credit Corp., a federal agency given authority during the Great Depression to stabilize prices.

Farmers are some of Trump’s key supporters, they’ve been big advocates of getting a better trade deal with Beijing, but now many are running out of patience as the Midwest goes bankrupt – triggering JPM to write a gloomy note to investors of the next farm crisis.

via ZeroHedge News http://bit.ly/2EgXsZc Tyler Durden