The sell off at the end of the year last year, despite being long gone from the memory of traders, did have one profound effect. It caused dealmakers to speed things up due to fears of the more than decade-long bull market finally coming to an end, according to Bloomberg.

So naturally, when 2019 gifted dealmakers with a market rebound, many of them rushed to peddle as many deals and arrangements as they could, especially deals that could test the limits of risk tolerance in a falling market. This has resulted in all types of shoddy deals in 2019 – from questionable IPOs, to private equity deals, to issuing junk bonds to pay dividends.

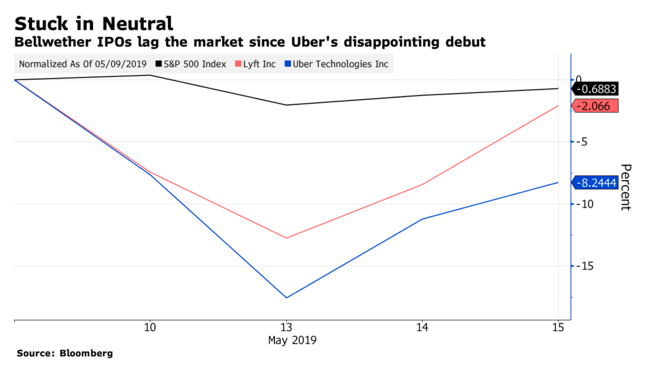

Junk bonds are “flying out of the door” in 2019. Companies that are deep in debt are borrowing even more now, while they can, to pay equity holders. And two of the most heralded IPOs in recent history, Uber and Lyft, both wound up turning into case studies for what happens when you try to stuff overpriced stock down the throats of retail investors.

Marshall Front, the chief investment officer at Front Barnett Associates said:

“At some point, people are going to get burned. People want to take their companies public because they don’t know what the next years hold, and there are people who think we’re close to the end of the cycle. If you’re an investment banker, what do you do? You keep dancing until the music stops.”

Back in October, bankers had suggested a $120 billion valuation for Uber, whose market cap now sits at half of that. Lyft’s market cap has also fallen by a third since its IPO, the timing of which “serves to further stoke the suspicions of those Wall Street observers who see a plot to transfer a private-market bubble into public hands.”

Credit markets have also reversed much of their late 2018 carnage, allowing for companies to pick up the pace of borrowing. Junk bond issuance is ahead of last year‘s pace and last week alone saw $12 billion priced – the busiest the market has been in 20 months. And good old investment grade issuances are also gaining steam, despite being down from a year ago. Back to back offerings this month from Bristol-Myers Squibb and IBM were each around $20 billion.

Private equity is also taking advantage of the market conditions to cut risk and realize gains. They have taken the opportunity to saddle companies they’ve invested in with more debt in order to pay themselves dividends. Leveraged loans for distributions to equity holders has reached its highest point in six months.

Sycamore Partners, for example, pulled $1 billion out of Staples last month through a recapitalization that increased the company’s interest expense by $130 million a year. Hellman & Friedman and Carlyle sold a junk bond to help pay for a $1.1 billion dividend from Pharmaceutical Product Development LLC. The bond sold was the largest of its kind since since 2017.

There have been very few instances where investors have extracted concessions from borrowers. One example, the buyout of NSO Group, found banks forced to offer debt at a steep discount to get it off their books, while ION Group dropped plans for a $250 million dividend that was going to be issued from a $2.2 billion leveraged loan sale.

And then there’s state oil giant Saudi Aramco, who borrowed $12 billion in an unprecedented sale, staging a massive comeback from a year ago when Wall Street turned a blind eye to the company after the assassination of journalist Jamal Khashoggi. In early trading, the bonds fell, calling into question bank’s claims that there was $100 billion worth of orders to buy the securities.

In the equity market, bankers have been working on unclogging a pipeline of IPO hopefuls. As of today, 89 offerings have raised $27.2 billion in the US, which is the fastest start for IPOs since 2014. Names like Beyond Meat and Pinterest have done well, while Uber and Lyft have been stark reminders of other flops, like Snapchat and Blue Apron.

Banks have even turned to unusual tactics to keep deals moving amid a backlog of filings for regulators as a result of the government shut down. Many recent IPOs skipped the process of price discovery and instead disclosed fixed IPO prices 20 days before the stock began trading. Seven companies set terms for IPOs while regulator offices were closed due to the government shut down. A majority of those names, including New Fortress Energy, fell below their listing prices.

But not all deals snuck through. Virgin Trains USA was withdrawn the same day it was expected to debut by bankers who had to pull the sale when they couldn’t get the $3.15 billion price tag they sought.

Front concluded:

“People see it like this: it’s been great until now, but the window is going to shut, the door is going to close, should we do something now because the next few years are a question mark? Wall Street gets a lot of money between now and then and they’ll be able to put medals on their chest and say ‘Look how we did’ until they didn’t anymore.”

via ZeroHedge News http://bit.ly/2VKRLNT Tyler Durden