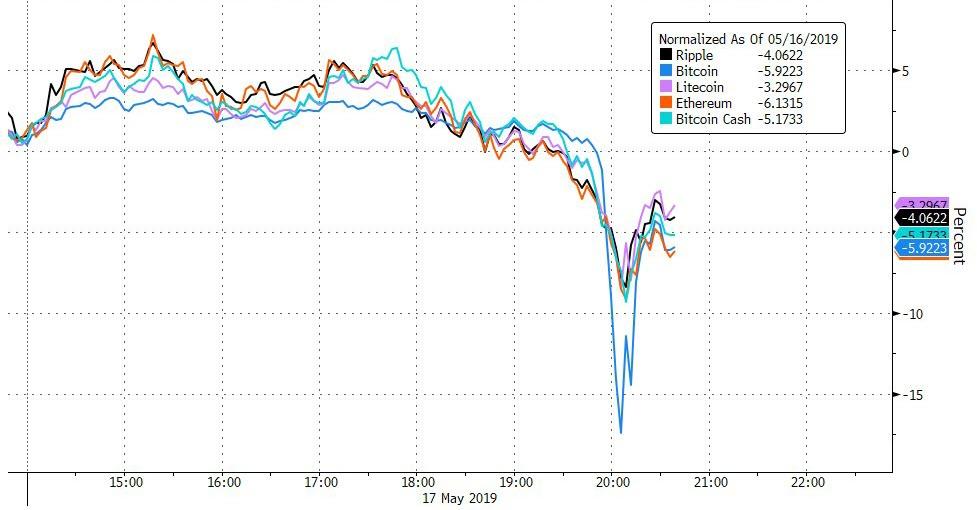

Shortly before 11pm EDT on Thursday night, we reported that cryptos suddenly jerked lower with Bitcoin flash-crashing over 15%, sliding as low as $6,395 on Bitmex XBTUSD perpetual swap – the most liquid bitcoin contract globally – before bouncing back.

The insta-crash, which took place in a news vacuum and without an immediate catalyst, looked technical and positioning-led on the derivatives side. Courtesy of our cryptocurrency derivative expert friends at Skew, below is a breakdown of what happen in those minutes that send Bitcoin over $1000 lower.

To start with, 5,000 bitcoin went through on European physical exchange Bitstamp between 3.45 a.m and 4.15 a.m (London time, UTC +1) crashing the price down to $6,178 on the exchange.

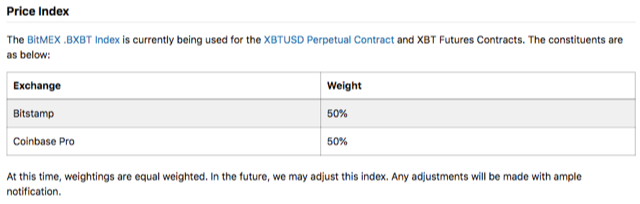

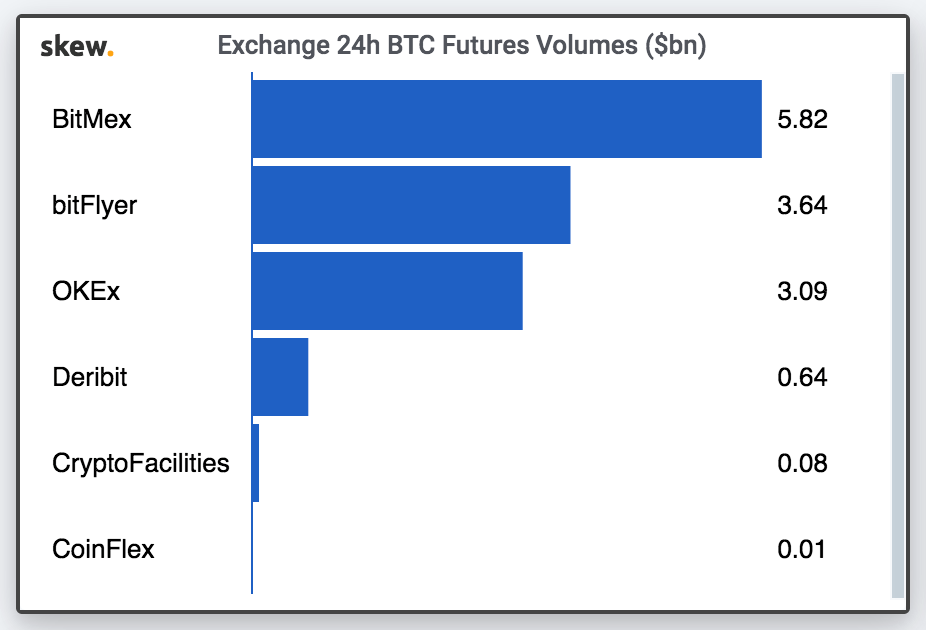

This $35 million volume shouldn’t have been too much of a deal in itself – Kraken had a similar event a few weeks back on the 25th of April – but Bitstamp accounts for 50% of the bitcoin index at Bitmex – the largest bitcoin derivatives exchange. This index is being used to trigger liquidations of the bitcoin XBTUSD perpetual swap contract – the most liquid derivatives instrument where trading occurs on margin and which traded $5bln+ daily over the last week.

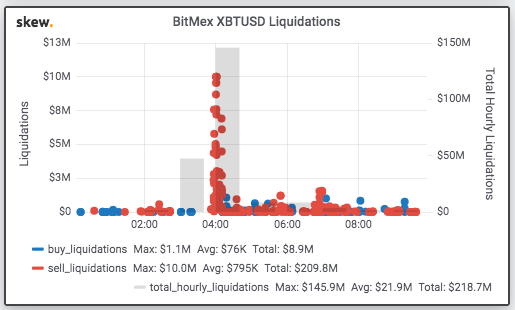

As a result, more than $200mln of sell liquidations occurred which took the market down with it

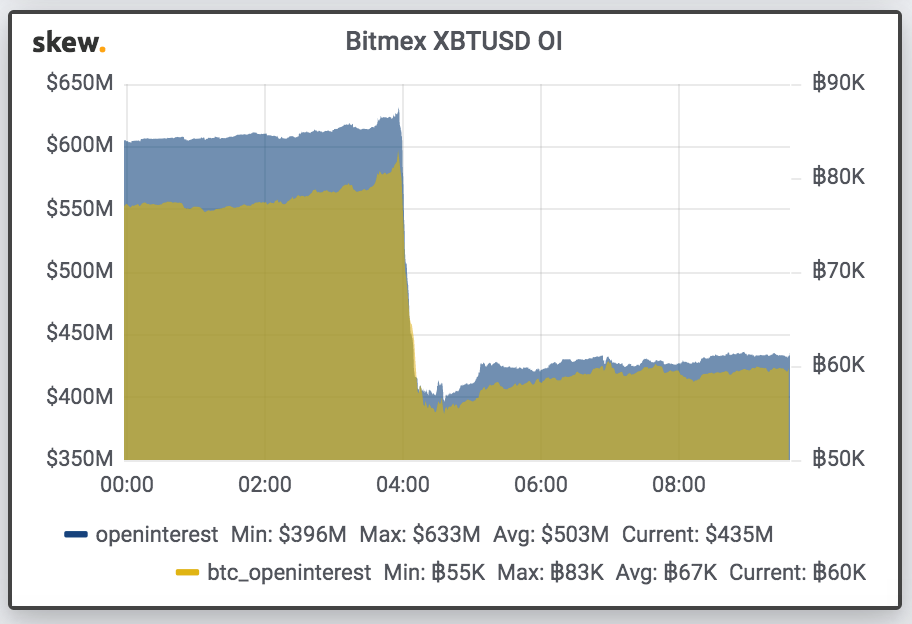

As the crash accelerated, overleveraged positions got cleared, resulting in open interest down by a third from $630mln to $400mln

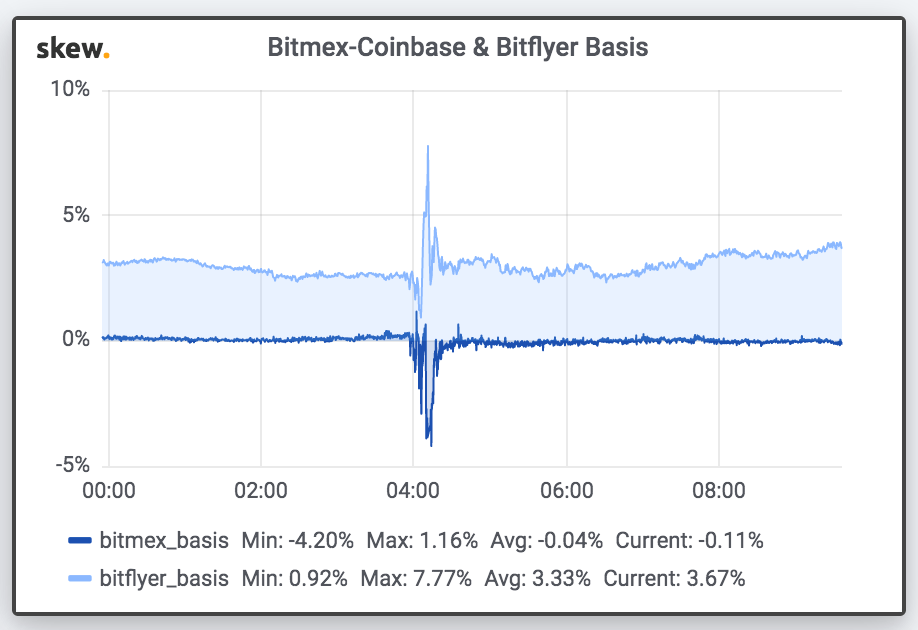

The Basis (Bitmex XBTUSD – Coinbase BTCUSD) instantly plunged to – 5% – very unusual to see the bitmex perp decoupling to such an extent.

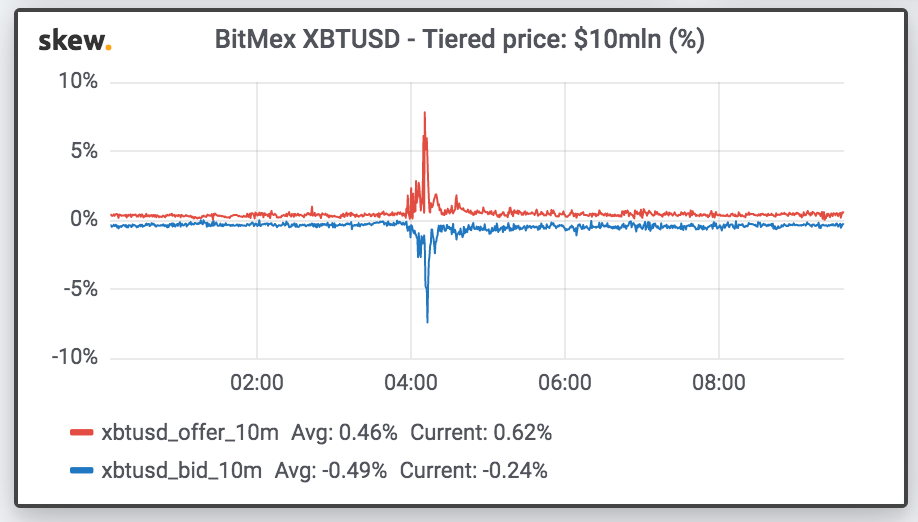

Liquidity – measured by bid offer spread of $10mln in the XBTUSD order book – evaporated for a moment.

Overall, Sk3w concludes that “this was the first serious alert since bull market restarted on the 2nd of April. It’s also another serious session for bitcoin with > $12bln going through on the futures side in last 24h.“

d

via ZeroHedge News http://bit.ly/2VvJdFC Tyler Durden