“Bad news is good news” has been the mantra preached by any asset-gatherer or commission-taker for a decade at the first sign of a crack in the “any minute now, things are gonna be awesome again” narrative and the last week of chaotic dumps and pumps in global stocks has done nothing but reinforce this mistaken view.

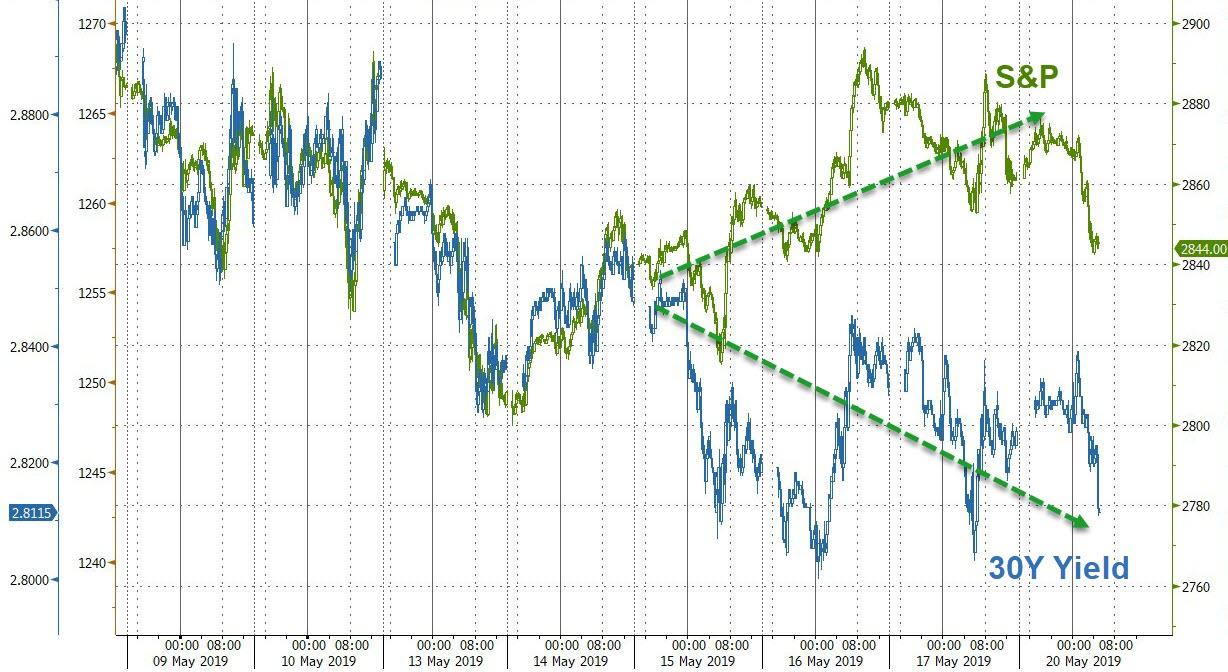

But while the industry pushes retail mom-and-pop to hold-the-bag (buy stocks, sell bonds) for the ever-accelerating exit of the elites from the stock markets, former fund manager and FX trader, Richard Breslow, points out in his note this morning that “…if you like stocks, then you have to also love bonds…”

Via Bloomberg,

The first question that sprung to mind was in response to reading that S&P 500 futures were higher at some point last night because of the surprise election result in Australia. It was, “Why?”. Now, had they waited just a little longer for the Japanese GDP beat, I could have lived with that. Even though, we were immediately informed, it wasn’t as strong as it looked.

It all reinforces one universal truth. For all of the ugly headlines and fierce wrangling among countries, the world remains deeply united. Joined at the hip of rewarding anything that will keep rates low and equity valuations attractive. Japanese stocks “eke out small gains” as market mulls stronger than expected economic numbers and trade worries. Australian shares soar as the Reserve Bank is now seen free to cut rates with the election behind it.

It will ultimately be proven to be a bad, though irresistible, mistake for policy makers to happily and actively encourage investors to view all news through the simple lens of what will be the path of official rate-setting. But it has proven to be a good investment strategy. Even if it makes it scarier when listening to discussions about yield-curve targeting.

Trade tensions ebb and flow. Numbers wax and wane. Politicians have love-hate relationships with their electorate that pollsters have yet to understand. But a commitment to lower for longer is the one constant in our life. Something to keep in mind as we are treated to a non-stop litany of Fed speakers all week long. And makes the electioneering to replace retiring ECB President Mario Draghi all the more interesting. Just what would happen if a hawkish candidate was chosen and followed through on their promises?

As the week gets underway, the dollar is starting to show some life. It is also right back into the teeth of resistance. We’ve seen this range trade before. This time feels different, though. Maybe it’s just that the possible outcomes from the European Parliament elections can no longer be ignored. Or a quick end to the trade standoff may be the only reasonable base-case scenario.

The dollar is trying to put itself into play, but this time it’s doing it in the context of high-yield spreads pushing back out and emerging markets not looking at all like the no-brainer trade it was assumed to be at the start of the year. The Swiss franc looks like it is getting renewed interest. Stocks always get the attention, but they may not be the ones telling the story that requires attention at the moment

via ZeroHedge News http://bit.ly/2WcQaQG Tyler Durden