S&P futures were lower on Wednesday as investors sought safety in bonds, the Japanese yen and Swiss franc in muted trade amid renewed worries over the U.S.-China spat after reports Washington is considering cutting off the flow of American technology to as many as five Chinese companies including Hangzhou Hikvision Digital Technology, the world’s largest supplier of video surveillance products, expanding the US crackdown on China beyond Huawei to include world leaders in video surveillance. The dollar and 10Y yield were unchanged ahead of today’s FOMC Minutes.

Tuesday’s brief relief over Washington’s temporary relaxation of curbs against Huawei evaporated after reports that the White House is considering further sanctions on Chinese video surveillance firm Hikvision. As Reuters notes, fears of another blacklisting reinforced worries that U.S. President Donald Trump is looking beyond sealing a trade deal with China to a potentially bigger battle aimed at curbing Beijing’s technology ambitions.

“I think the debate is just starting about what the implications of all this could be if it escalates. It’s my biggest concern,” said Simon Webber, lead portfolio manager on the global & international equities team at Schroders. “If we get retaliation, if we start deconstructing supply chains, if we get countries asking whether they can rely on products and services overseas, then we’ll have much more uncertainty and a much more worrying environment,” said Webber.

Despite the return of trade fears, Europe’s Stoxx 600 reversed earlier losses as technology and personal-goods shares advanced, after earlier declining with Chinese equities amid fears of a new front in the trade war. Qualcomm tumbled after a the company lost a landmark anti-trust case, wiping out half of the company’s post-AAPL settlement gains.

Asian stocks edged modestly higher, led by utility and technology firms, after falling on Tuesday. Markets in the region were mixed, with India climbing and Japan slipping, its Topix gauge down 0.3%, driven by Takeda and Keyence. China’s Shanghai Composite also retreated 0.5%, with Kweichow Moutai and PetroChina among the biggest drags. The S&P BSE Sensex Index rose 0.7%, as large financial firms contributed the most to the rally. The latest Trump threat dampened Australia’s post-election optimism slightly, but stocks still hovered near the 11-year highs scaled on Monday. Australia’s stocks index is the only major global bourse to notch up gains since Trump ramped up his battle with Beijing on May 6, largely due to the election euphoria, while South Korea’s KOSPI is the biggest loser.

“Some in the markets will continue to cling on to hopes of the United States and China reaching an agreement at the upcoming G20 meeting,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui DS Asset Management. “But the ongoing trade conflict looks to be a protracted one, and its potentially negative impact on various economies is becoming a running concern.”

As Bloomberg notes, stock and bond markets have been fluctuating as investors try to size up how much damage the trade war will bring to global economic growth and supply chains, while the Trump administration considers adding video equipment to its growing blacklist of sales to China. With traders in wait-and-see mode, the VIX has been retreating and on Tuesday touched its lowest level in almost three weeks.

“There is a broad expectation for a growth slowdown and the trade tensions are really adding to these kinds of worries,” Jingyi Pan, Singapore-based market strategist at IG Ltd., told Bloomberg TV. “A lot of this may not have followed through to the economic data.”

In FX, amid a modest risk-off sentiment, investors sought havens in the Swiss franc, Japanese yen and German government bonds. The yen strengthened away from two-week lows against the dollar, rising 0.1% to 110.39 yen, while the Swiss franc was higher against the euro and the dollar. Moves across all financial markets were largely muted, though, as many investors preferred to keep to the sidelines. The standout was the pound, which was down 0.2% at $1.2650, its lowest since January amid a deepening crisis over the UK’s exit from the EU after Prime Minister Theresa May’s final gambit failed dramatically.

In emerging markets, stocks extended their advance from the lowest level since January and currencies climbed as traders wait for minutes of the Federal Reserve’s last policy meeting. Russia’s ruble climbed the most among peers and bond yields fell before a regular weekly debt sale. The rand erased early declines after Deputy President David Mabuza asked for his swearing-in as lawmaker to be postponed in what’s seen as President Cyril Ramaphosa making good on promises to clean up his government. South Korea’s won also reversed losses after authorities warned traders that the currency’s recent decline is excessive. They will hold an emergency meeting to discuss the won’s weakness. With the market focusing on Fed minutes, Credit Agricole strategist Dariusz Kowalczyk remains “cautious about EM exposure given that, while most negative news on the U.S.–China front is out, the trajectory of the relationship remains negative and it is difficult to see an offsetting global factor.”

Meanwhile, the Turkish lira languished at the other end of the spectrum, posting the biggest drop among a handful of decliners, as tension between the U.S. and Turkey showed no sign of abating. The currency is also is paying the price for its pre-election efforts to tinker with the markets.

In overnight geopolitics, US state Department said it is seeing signs Syria could be renewing its use of chemical weapons including alleged chlorine attack on May 19th, while it added that US and its allies will respond quickly and appropriately if Syria government uses chemical weapons. Meanwhile, Saudi Arabia’s Cabinet said the country will do what it can to avoid any war following the condemnation of Iranian actions in the region, while it affirmed commitment to achieving balance in oil market and working towards its stability.

The main event on today’s calendar are the FOMC minutes from the most recent Federal Reserve policy meeting. In a Bloomberg interview, St. Louis Fed president and uber dove, James Bullard, said the central bank may have “slightly overdone it” by raising interest rates in December, though it’s premature to talk about a rate cut. Maybe in another 100 points lower in the S&P it won’t be that premature.

In commodities, WTI futures were down 0.6% at $62.567 per barrel after API data showed that U.S. crude stockpiles rose unexpectedly last week. Oil was also pressured by Saudi Arabia reiterating that it would aim to keep the market balanced and try to reduce tensions in the Middle East.

Expected economic releases include mortgage applications and FOMC minutes. Analog Devices, CIBC, Lowe’s, and Target are among companies reporting earnings.

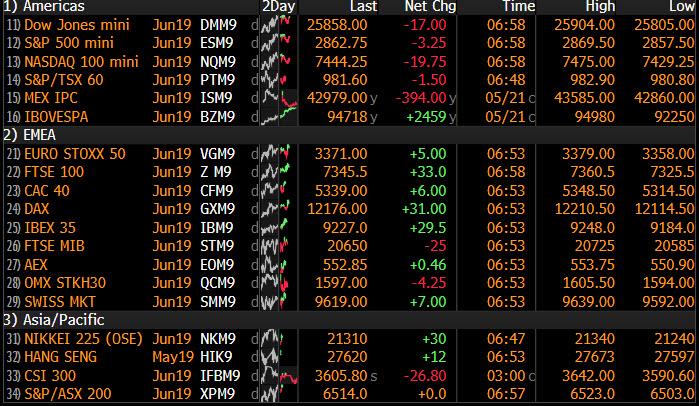

Market Snapshot

- S&P 500 futures down 0.2% to 2,861.00

- STOXX Europe 600 down 0.03% to 379.40

- MXAP up 0.1% to 154.00

- MXAPJ up 0.2% to 505.31

- Nikkei up 0.05% to 21,283.37

- Topix down 0.3% to 1,546.21

- Hang Seng Index up 0.2% to 27,705.94

- Shanghai Composite down 0.5% to 2,891.71

- Sensex up 0.6% to 39,220.90

- Australia S&P/ASX 200 up 0.2% to 6,510.71

- Kospi up 0.2% to 2,064.86

- German 10Y yield fell 1.1 bps to -0.074%

- Euro up 0.02% to $1.1163

- Italian 10Y yield fell 5.6 bps to 2.271%

- Spanish 10Y yield fell 0.8 bps to 0.866%

- Brent futures down 0.7% to $71.71/bbl

- Gold spot little changed at $1,274.45

- U.S. Dollar Index little changed at 98.02

Top Overnight News from Bloomberg

- The U.S. is considering cutting off the flow of vital American technology to as many as five Chinese companies including Hangzhou Hikvision Digital Technology Co., widening the dragnet beyond Huawei to include world leaders in video surveillance

- U.S. central bankers may have “slightly overdone it” by raising interest rates in December, though it’s premature to talk about a rate cut, said Federal Reserve Bank of St. Louis President James Bullard

- Theresa May is facing pressure to abandon her Brexit deal and quit as British prime minister within days, according to people familiar with the matter. Several senior government officials said they were shocked that the premier’s new offer intended to win votes in Parliament for her deal had been so badly received so quickly

- South Korea became the latest Asian central bank to step up defense of its currency as the U.S.-China trade war took a toll after it warned traders that the won’s recent decline is excessive

Asian equity markets were indecisive as the momentum from Wall St, where all majors gained as Huawei’s reprieve inspired the trade sensitive sectors, somewhat dissipated as markets await the next developments in the US-China trade saga and upcoming FOMC minutes. ASX 200 (+0.2%) and Nikkei 225 (U/C) were mixed for most the session with Australia subdued by weakness in mining related stocks as well as financials, while the Japanese benchmark was kept afloat by recent currency weakness and after varied data releases including better than expected Machine Orders. Hang Seng (+0.2%) and Shanghai Comp. (-0.5%) diverged with the mainland cautious amid ongoing trade uncertainty and with Hangzhou Hikvision heavily pressured after reports that the Trump administration is considering restrictions on the Co. This has also weighed on other tech names, although losses in the broader market were stemmed after a liquidity injection by the PBoC and with the central bank seeking to further reduce borrowing costs for small businesses. Finally, 10yr JGBs initially softened amid gains in Japanese stocks and with participants sidelined ahead of a 20yr auction later, although prices then recovered on strong auction results in which the b/c rose to its highest on record.

Top Asian News

- Citic, Baidu Are Said to Seek Up to $1 Billion for Online Bank

- Asia’s Worst Currency Is in Taiwan as Foreign Funds Depart

- Korea Warns Currency Traders as Won’s Sudden Decline Takes Toll

- Turkey Burns Bridges With Markets as Costs of Lira Defense Mount

Choppy trade for European indices [Eurostoxx 50 +0.3%] following on from an indecisive Asia-Pac session as the region awaits further impetus in regard to trade talks ahead of tonight’s FOMC Minutes. European equities are now mostly higher as equities gained traction ahead of US’ market entrance. UK’s FTSE 100 (+0.5%) outperforms its peers as exporters are bolstered by the Brexit-dented Pound. Sectors are posting broad-based gains, whilst energy stocks bear the brunt of the falling prices in the complex. In terms of individual movers, Royal Mail (+6.2%) spiked higher on the back of optimistic earnings coupled with a dividend cut to fund a turnaround, whilst Spanish listed DIA (+5.4%) continues to benefit from Santander’s care package, which was announced yesterday. Meanwhile, Babcock (-8.4%) shares plummeted after the Co. noted that the upcoming FY earnings are to be impacted by a number of significant factors. Looking at analysis from Nomura Quant, the report notes that CTAs have dissolved long positions in a majority of regions and are now roughly neutral in the FTSE 100, Nikkei 225, Hang Seng and TAIEX, with bearish positions limited to the KOSPI and TOPIX, albeit bullish stances are ongoing for the DAX and NIFTY 50. Apart for the DAX, CTAs have a low equity exposure, “so the risk of a drop in share prices from systematic cutting of existing long positions looks limited” says Nomura.

Top European News

- Merkel Was Lobbied for a Top EU Job at Romanian Summit in May

- UBS Is Poised to Settle Tax Case With Italy for $110 Million

- U.K. Inflation Climbs Above Target on Energy Costs, Air Fares

- Draghi Says Euro Zone Must Overcome Impasse on Risk Sharing

In FX, the Sterling’s slump continues, with Cable breaching another technically significant level at 1.2670 after a 360°-plus turnaround from 1.2800+ knee-jerk highs on Tuesday when UK PM May unveiled her new Brexit blueprint with the carrots of a 2nd referendum and temporary EU customs union, while Eur/Gbp has now surpassed strong chart resistance ahead of 0.8800 in the form of the 200 DMA (0.8793) on the way to a 0.8815 high and the cross is on course to extend a run of consecutive rallies to 13 sessions. The marked turnaround in sentiment comes amidst widespread uproar over the latest WA proposal and even more rebellion against the PM, especially from the 1922 faction that is set to meet at 4 pm and could launch a confidence vote as soon as today. Back to the pilloried Pound, 1.2650 could offer symbolic support vs the Dollar ahead of a Fib at 1.2638, if option expiry interest between 1.2665-70 in 500 mn fails to stem the tide, while 0.8840 may cap losses against the single currency. Note, UK inflation data has been largely ignored, but for the record CPI was slightly softer than forecast and PPI input prices well below consensus.

- DXY – The index remains toppy above 98.000 after several attempts and failures to clear chart hurdles ahead of the 2019 highs, with the Greenback sitting tight and rangebound vs G10 counterparts in advance of the FOMC minutes, bar Sterling as noted above.

- AUD/CAD/NZD – The non-US Dollars have clawed back some of their recent losses with the Aussie back within touching distance of 0.6900, Kiwi pivoting 0.6500 and Loonie straddling 1.3400. All eyes on the aforementioned account of the Fed’s recent policy meet, but Canadian retail sales data could provide the Cad with some independent impetus beforehand.

- CHF/EUR/JPY – All treading water vs the Usd as the Franc hovers just above 1.0100 and Euro trades mostly above 1.1150 following yesterday’s brief probe below, but the topside capped ahead of decent expiries at 1.1180 (1.5 bn). Meanwhile, the Yen is meandering between 110.37-62 after reported offers from Japanese corporates and asset managers, and with Fib resistance noted at 110.71 also keeping the headline pair contained.

- EM – The Rand is on the rebound regardless of softer than anticipated SA inflation data, with Usd/Zar near the bottom end of a 14.4400-3500 range ahead of Thursday’s SARB policy meeting amidst perceptions that the tone will remain hawkish even though there are grounds for a reassessment of projections signalling a hike by the end of 2019. Conversely, the Lira is still struggling and testing support at 6.1000 vs the Buck amidst reports that Russia and Turkey are ready to fulfil S-400 order commitments irrespective of US protestations.

In commodities, WTI and Brent futures are on the backfoot after the API reported a surprise build in US crude inventories (+2.4mln vs. Exp. -0.6mln), marking a 5th consecutive week of builds reported by the institute. Brent futures current reside below the USD 71.50/bbl level whilst WTI futures fluctuates on either side of USD 62.50 with PVM highlighting “critical” support levels at 62.54 and 62.31 which, if breached, could cause a decline in prices towards the 61.63/22 area, according to the analysts. Participants will be looking ahead to the more widely looked at EIA crude inventory report with headline crude stocks expected to decline by just over 2.5mln barrel. Elsewhere, precious metals are relatively tentative and awaiting any US/China update ahead of the FOMC Minutes release later today (preview available in the Research Suite). Meanwhile, copper prices are sliding as the Buck gains more ground against a backdrop of a trade war between the world’s two largest economies. Despite this, mining giant Antofagasta expects the copper market to tighten this year and note a positive outlook for the red metal in 2019 and beyond. Spot copper declined through USD 2.7/lb to touch levels last seen in late January.

US Event Calendar

- 10am: Fed’s Williams Hosts Economic Press Briefing

- 10:10am: Fed’s Bostic Makes Opening Remarks at Dallas Fed Conference

- 2pm: FOMC Meeting Minutes

DB’s Jim Reid concludes the overnight wrap

While the direction of travel for the trade negotiations still feels decidedly negative in the medium-term, markets had their fourth up day in six yesterday. Momentum was helped by news that the Commerce Department has granted a relief period for certain US broadband companies and wireless customers using Huawei equipment. The NASDAQ recouped +1.08% and about two-thirds of Monday’s decline, while the semi-conductor index rose +2.13% – and therefore retraced about half of Monday’s decline. The S&P 500 and DOW also rose +0.86% and +0.77%, respectively, despite retail names struggling following some disappointing results out of Kohl’s (-12.36%) and JC Penney (-7.39%) with both citing the trade spat as a problem for their business.

The move for the wider equity markets saw the VIX fall back below 15 (-1.4pts) though and back to the lowest since May 3rd – the last business day before Mr Trump’s out of the blue first Trade escalation Tweet. It was a broadly similar story in Europe where the STOXX 600 rose +0.47% and the DAX +0.78%. In credit HY spreads were 3-4bps tighter in the US and Europe while in bond markets we saw 10y Bunds touch the lofty heights of -0.063% (+2.3bps) and Treasuries hit 2.426% (+1.1bps). The 2s10s curve did however fall -2.4bps to 16.8bps as the front-end sold off a little more. In commodities gold pulled back -0.25% while a better day for risk also helped EM equities and FX to climb +1.27% and +0.19% respectively.

On the trade front, things were relatively calm yesterday but is again dominating the headlines this morning. The CNH did strengthen yesterday for a second consecutive session for the first time since before the recent trade fracas erupted. While the US’s 90-day reprieve for Huawei was positive, it was noteworthy that President Trump directly linked the Huawei decisions with trade policy, saying that he deferred an initial decision until the trade talks stalled. Chinese state-media editor Hu Xijin said on twitter that the US’s “irrational behaviors” are making Chinese policymakers “wonder if Washington is in a rush to reach a trade deal. Conclusion of the Chinese: drag it out. Americans are about to have a nervous breakdown.” While the market largely ignored the comments, the rhetoric certainly isn’t calming down.

Overnight the New York Times reported that the Trump administration was considering curtailing the flow of American technology to China’s top maker of video surveillance gear, Hikvision. The stock fell as much -9.6% before recovering to trade -4.4% lower. Bloomberg reported that the Trump administration is also considering blacklisting Zhejiang Dahua Technology Co. The stock traded down as much as -8.9% before recovering to trade -4.8% lower.

Markets are largely up in Asia though with the Nikkei (+0.22%), Hang Seng (+0.30%) and Kospi (+0.31%) all up while Chinese markets are trading flattish with the CSI (+0.05%), Shanghai Comp (-0.02%) and Shenzhen Comp (-0.04%). Elsewhere, futures on the S&P 500 are also trading flat (+0.05%) and the Chinese onshore yuan is down -0.11% to 6.9096. In terms of overnight data releases, Japan’s adjusted April trade balance came at -JPY 110.9bn (vs. -JPY 37.5bn expected) as exports declined (at -2.4% yoy vs. -1.6% yoy expected) while imports jumped (at +6.4% yoy vs. +4.5% yoy expected). Overnight BoJ board member Yutaka Harada, a consistent dissenter on BoJ policy, said that a sales tax rise set for October could tip the economy into recession and weigh on prices, delaying progress toward the central bank’s 2% inflation target.

There was volatility in the pound yesterday as Prime Minister May presented a fourth, and likely final, gambit to get her WA deal passed, and the reaction was not positive. The pound initially rallied as much as +0.69% on the pre-speech headlines (especially around potential 2nd referendum language), but it ultimately retraced to end -0.19% weaker after the adverse reaction by MPs became clear.Her ten-point plan included a new provision to let Parliament vote for the option of a second referendum if they backed her deal first, which was a new concession. Though she added some new language about the Irish border, a potential vote on a new customs agreement and lots of other details, her core deal was basically unchanged. The move comes ahead of the week of June 3, effectively making this maneuver the last opportunity for May to reach a solution. The parliamentary math is pretty straightforward in that May needs to gain support from at least a portion of Labour MPs while retaining the backing of her Conservative caucus. As it turned out, we later found out that she has so far failed to get Labour’s support and has lost the backing of many within the Tory party. Jeremy Corbyn came out directly against the proposal and several prominent Tory MPs who supported the WA previously came out in opposition to it. Meanwhile, The Sun has reported overnight that senior backbenchers on the Tory 1922 committee’s executive will mount new bid to force a confidence vote in PM May. Bloomberg also reported overnight that PM May is facing pressure to abandon her Brexit deal and quit as British prime minister within days.

Looking forward, DB’s Oliver Harvey remains pessimistic on the pound. His latest update ( here ) was published before yesterday’s news, but still outlines the likely avenues moving forward. If anything, the latest developments reinforce his bearish bias. Any more negative responses to the new proposed deal and Prime Minister May could resign as soon as this week and attention will shift to the likely Conservative leader contest. That will probably yield a hard-Brexit supporting PM, which in turn will incrementally raise the odds of a hard Brexit. Separately, Chancellor Hammond spoke at the CBI’s (a business lobby) annual dinner last night, where he warned against a no-deal Brexit. He also focused on fiscal responsibility, possibly with an eye toward influencing a potential incoming leadership team, saying “we must not undo a decade of hard work (and must) resist the ever-present temptation to write checks the country cannot afford.”

Three regional Fed presidents spoke publicly yesterday, but the only truly interesting remark came from Boston Fed President Rosengren, who said that an average inflation targeting regime “would not change the Fed’s inflation target over the cycle.” That’s the latest comment in tacit support of an average inflation targeting regime, though the bar for the Fed to radically change policy at its upcoming policy review is high. Rosengren’s comment was especially interesting since he is one of the more hawkish members of the committee. Away from that, his comments repeated the Fed’s recent mantra about transitory inflation, there being no need to change policy, and for inflation to gradually return to the 2% target over time. Chicago Fed President Evans and Atlanta Fed President Bostic mostly delivered similar remarks. Elsewhere, Fed’s Bullard (voter) said overnight that the US policy makers may have “slightly overdone it” by raising interest rates in December, while adding that it’s premature to talk about a rate cut. However, he flagged the idea that “a quarter point in an environment where the U.S. economy is surprising to the upside again in 2019 …. would probably send a signal that we are serious about hitting the 2% inflation target”. On the US-China trade war he said that “For this to actually affect Fed policy, these tariffs would have to stay on for quite a while, something like six months; at the end of six months if there was still no prospect of a resolution then I think that is the point it would start to weigh on Fed policy.”

Staying with the Fed, this evening we’ll get the FOMC minutes from the meeting earlier this month. Usually there would be a reasonable amount of focus on the minutes however, given the trade developments since then it’s likely that the they will be somewhat discounted as being stale. That being said the inflation debate will still be relevant and as a reminder Powell noted that several “transitory” factors had been weighing on inflation of late. Our US economists noted that subsequent Fedspeak since Powell’s press conference suggest that there is a solid contingent of officials that agree with this cut of the data, though some find persistently below target inflation as troublesome, regardless of the causes. Therefore, it will be interesting to see how the debate plays out, especially in light of concerns around inflation expectations and the Fed’s policy framework review.

In other news, it was another quiet day for data releases yesterday. In the US existing home sales in April were reported as declining -0.4% mom compared to expectations for a +2.7% rise. In Europe consumer confidence improved 0.8pts to -6.5 in May – however it wasn’t clear if this captured the trade escalation period – while in the UK the May CBI survey showed weakness in both domestic and export orders, as well as subdued inflationary pressures.

Looking at the day ahead now, this morning we’ll get the April inflation data docket in the UK where the consensus expects a small increase in the annual core CPI reading from +1.8% to +1.9% yoy. We’ll also get the March house price index reading for the UK along with April public sector net borrowing data. In the US it’s quiet until we get to the FOMC meeting minutes this evening. Away from that we’re also expecting comments from the Fed’s Williams and Barker this afternoon, while the ECB’s Draghi, Visco and Praet are all due to speak this morning. Draghi is making the welcome address at the ECB colloquium in honour of Peter Praet so it’s unlikely that we’ll get anything particularly market moving.

via ZeroHedge News http://bit.ly/2HvIzVa Tyler Durden