China reported weaker growth in retail sales for April last week, implying that consumers are now beginning to dial back their spending habits on everyday products. Clothing sales declined for the first time since 2009, also shows how consumers are pulling back on luxury clothing brands amid a deepening trade war and a slowing economy.

Bloomberg says consumers from Shanghai to Beijing have been on a Gucci binge since the trade disputes began last summer. The Chinese account for a little more than a third of all global luxury goods consumption.

The elevated level of luxury goods consumption in China has been a 15-year impulse, is expected to slow in the near term, due to a structural decline in the economy.

Even as the trade war sparked a further slowdown, Chinese demand for luxury clothing surged early this year. That was supported by government intervention through reductions in import tariffs on big-name luxury brands, which made them more affordable to consumers.

But over the last month, several factors have emerged that could slow demand for luxury clothing.

Although luxury goods weren’t included in the latest trade war escalation by the US, the risk of uncertainties surrounding trade can be enough to damage consumer confidence and lead to slower sales.

The recent drop in the yuan against the euro and dollar is more bad news for consumers’ purchasing power of Europen luxury goods.

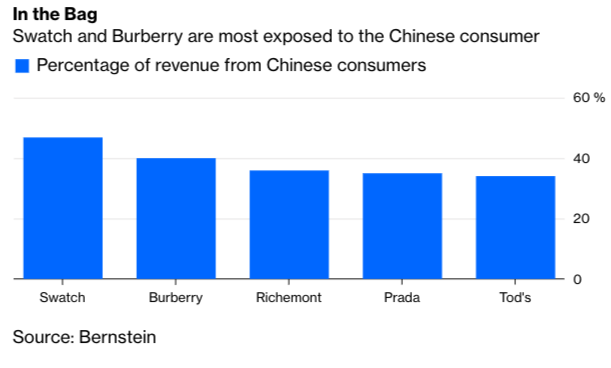

Bloomberg shows that Swatch and Burberry have the most significant percentage of revenues exposed to the Chinese consumer, 47% and 40%, respectively.

The Bloomberg Intelligence index of top luxury companies in China shows a modest rebound from January, but the price has not made a new high since April. Since the deepening of the trade war in early May, the index has declined 4%, risks a complete reversal if tensions continue to increase through the summer.

Mario Ortelli, a managing partner of luxury adviser Ortelli & Co, told Bloomberg that Chinese consumers buying expensive handbags in Paris, or even taking a trip to Europe in the first place, is only when they feel wealthier and not plagued by global uncertainties surrounding trade.

What’s clear is that demand for top luxury brands could find one of its largest buyers [the Chinese] pulling back in consumption as soon as this summer, another ominous sign that a 2H19 rebound in China is more of a myth.

via ZeroHedge News http://bit.ly/2Eq8U4O Tyler Durden