One day after we asked the question on every trader’s mind, namely “Why Stocks Stubbornly Refuse To Sell Off Despite The Escalating Trade War“, we got the answer on Thursday, and with sentiment turning dire overnight as increasingly more capitulate on the “extended trade war reality”, Charlie McElligott writes this morning that the now traditional pattern of de-risking on worsening macro inputs, then grinding back higher on mechanical factors – rinse, repeat – is finally broken, and as a result we are seeing the new de-risking flow drive US Equities index futures “spot” again back into a “negative Gamma” profile for dealers “as Commodities too are under significant pressure (WTI Crude -9.0% since Monday, Copper -3.5%)—while UST futures and ED$ Reds/Greens are again RIPPING higher as the Curve BULL STEEPENERS on perception of increased “Fed Cut” odds.”

Summarizing the above, the Nomura strategist unveils a “pretty simple logic equation”:

China / US trade war acceleration dynamic + Dollar strength (“USD Shortage” thesis picking-up new catalysts) + defiant “patient” Fed = further economic downside trajectory = DE-RISKING AHEAD OF THE GLOBAL GROWTH SLOWDOWN

And, as discussed earlier, this accelerating derisking means a flight out of risk and into safety, sending the 10Y yield to the lowest since 2017, and inverting the yield curve…

… as everyone jumps on “Duration” sensitive trades such as long USTs/Rates and long the “Slow-flation Risk Barbell” in Equities under what McElligott calls that guise of “end-of-cycle slowdown-” and “Slow-flation-” narratives, which are only being accelerated by the trade war’s ongoing/accelerating negative implications.

There is one potential, if substantial, caveat: with the market now having given up on the re-flation thesis, Nomura warns that if the fourth tranche of Tariffs is now the market’s “base case” — along with growing pressure on Beijing/PBoC to go all in on stimulus and easing, alongside the Fed’s own ongoing “inflation framework” review ramping-up, McElligott warns that “we would then have some serious REFLATIONARY CATALYSTS in place in the not-so-distant future (and in stark juxtaposition) against this “max length” in said “crowded” duration-linked trades.“

Or rather stagflationary, because the market would be pricing in a spike in prices just as economic growth forecasts are clobbered as a result of the parallel trade war.

Needless to say, this would be disastrous for risk assets, because there would be the “reflationary” pieces in-place for a Duration sell-off catalyst down the pipe (next 3-6m), which stands in stark contrast to popular trade positioning across both Rates and Equities—which, as Nomura notes, would “put at-risk of unwinding from these current ‘asymmetric’ levels.“

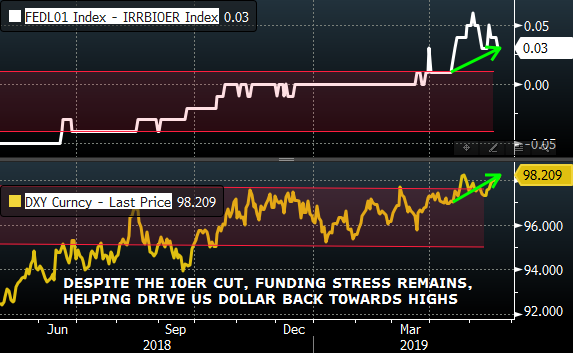

Of course, there is some time before that happens, and a bigger risk for the immediate future, is the ongoing dollar shortage, manifesting itself with the Fed’s loss of control over the short end, first profiled here one month ago, when we noted that the effective fed funds rate rose above the IOER for the first time… and has been above it ever since.

Commenting on this divergence, Nomura writes that “global trade is clearly now being dragged into the mud by a “vicious spiral”—of not just the actual tariff barriers and the lack of corporate visibility therein—but perhaps most importantly, the ongoing strength in US Dollar, which further undermines a global economy which is dependent upon trade and financed by US Dollar liquidity.” There are several factors that have resulted in the ongoing drop in dollar liquidity including

- US Fed Policy Rate (currently) at 11 year highs;

- ongoing Fed balance-sheet runoff / QT;

- increased Treasury issuance / deficit spending to pay for the tax cut / fiscal stimulus—all of which continues to feed tighter US Dollar liquidity & funding conditions—with USD strength recently being further accelerated by

- Yuan weakness vs USD as a potential Chinese policy tool to offset negative trade impacts of the tariffs, as well as

- a Fed which is clearly now digging its heels in and trying to remain “patient,” despite the STIRs market pushing-back towards two CUTS being priced-in over the next 12m (EDM9EDM0 back to ~-44bps despite yesterday’s initial “bear-flattening” post-Fed disappointment)

But the most convincing indication of the “dollar shortage” thesis is the continued inability by the Fed to “corner” the EFF, which remains well above the IOER.

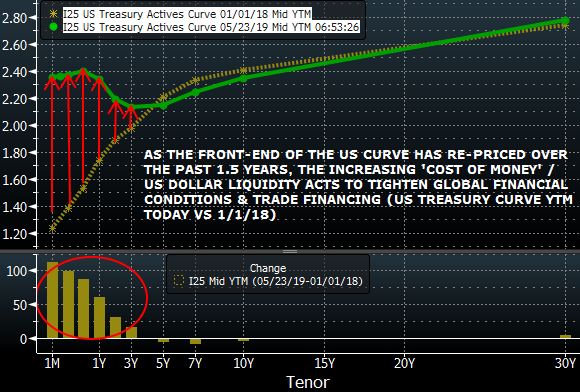

Meanwhile, the move higher in the front-end for the past 18 months also “speaks to higher USD money market rates, higher “cost of money”, and tighter global trade financing conditions.

This, alongside the latest Fed Minutes insistence that recent deflation is “transitory” and strong hint that tightening may return, has in turn reactivated the “drive economy off cliff” risk, which with the associated potential for the Fed to be forced into cuts, is what is behind the massive accumulated in US “Duration”-linked trade expressions (where even a small hint of stagflation would send all assets plunging).

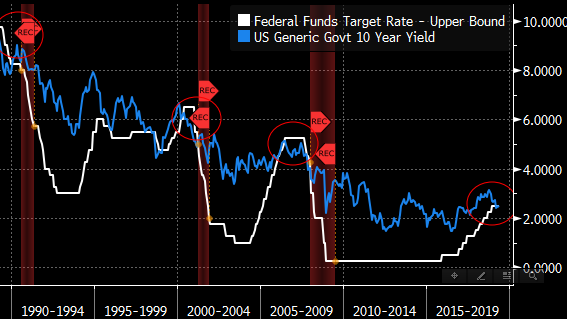

This is observed in what we noted earlier today, namely that for the first time, the 10Y yield traded 5bps inside the Effective Fed Funds rate, and which as we also discussed previously, has preceded recessions on average by 15 months in the last 7 business cycles. Or, as McElligott puts it, when the Fed Funds Target Rate trades above market pricing, “bad things can tend to happen.”

With all that in mind, Nomura asks what can possibly “go wrong” for the current groupthink consensual embrace of the “Slowflation” / “End-of-Cycle Slowdown” narrative, which is only being accelerated by the negative implications from the Trade War escalation? The answer is twofold:

1. Higher yields and a spike in inflation.

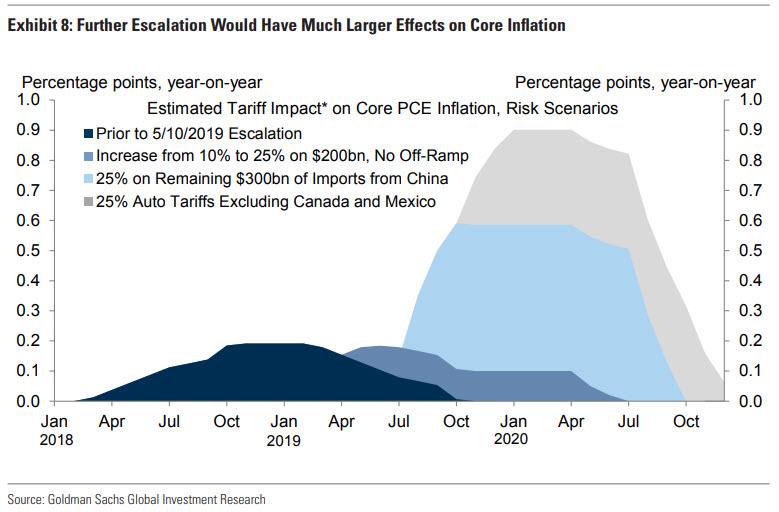

Although the market no longer anticipates higher prices, is a distinct possibility if Trump does launch the 4th tranche of tariffs which would cover all Chinese exports, and which – as Goldman calculated – would send US inflation surging.

Also worth noting, this is taking place when the PBoC and Chinese authorities are forced to “keep the pedal down” on their own easing and stimulus measures, while the Fed remains under obvious pressure regarding their inflation framework (and into the June Fed research symposium where “Reflation” will be back in the news rotation.”)

2. Crowded Positions

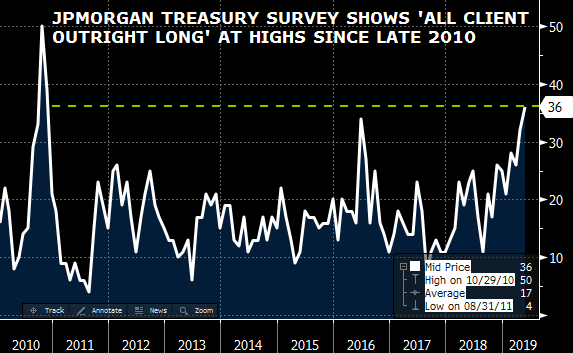

Here are the facts according to the latest JPM Treasury Client survey: 1) Outright Longs to highest level since Nov 29th, 2010; 2) • Net Longs highest since June 2016; 3) Active Client Outright Longs highest since June 2016.

Additionally, the Nomura risk-parity positioning model indicates that the allocation to Global DM bonds is the highest in at least 8 years, and a +3 sigma relative to history.

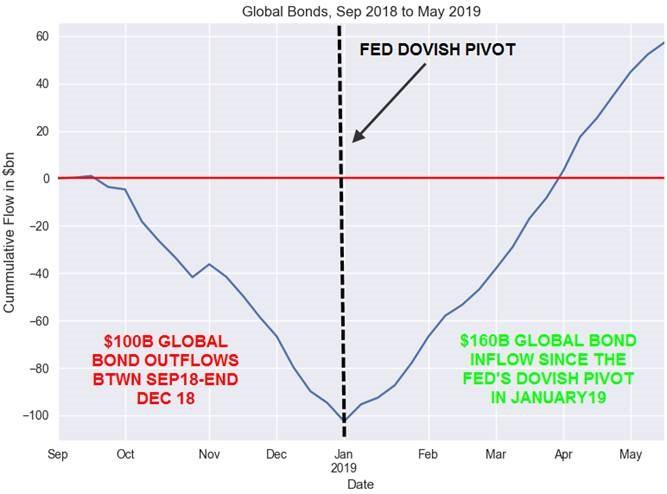

Any in/stagflationary spark reversing this massive inflow, comprising of over $160BN since the Fed’s “dovish pivot” (reversing a -$60B Global Bond Fund outflow in 4Q18), would lead to devastating consequences for the current consensus duration trade.

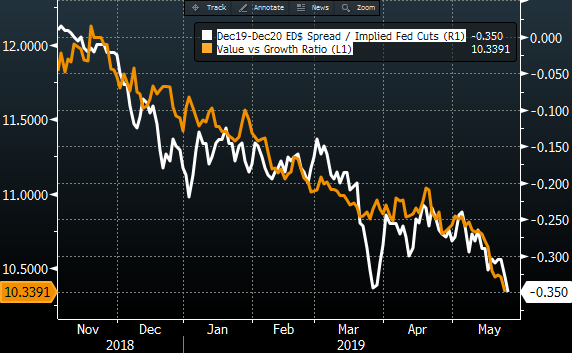

Meanwhile, on the equity side, the best proxy for the “slow-flation” narrative is the ratio of “Value (Cyclicals) vs Growth (Secular Growers / Tech)”, which continues to collapse as front-end rates Spreads invert on this same “end-of-cycle slowdown” forcing the Fed into an asymmetric policy bias.

What does all this mean in relatively simpler words? As McElligott summarizes, if one adds this “combustible mix” of 1) pile-into Duration on account of 2) slowing global growth implications of US / China trade war—while 3) Dollar is exploding higher on a funding squeeze and being perpetuated by Fed’s defiant “patient” tone on policy moves…. into the catalysts for a possible burst of inflation from the near certainty of the fourth tranche of Tariffs covering all Chinese exports, coupled with Chinese stimulus (either fiscal or monetary), and easing escalation thereafter/US inflation policy review increasingly ‘under pressure’, that’s when things could “get weird” fast.

And the punchline: traders looking-out beyond the next 3 to 6 months, have the pieces in place for a major “duration” sell-off which would see popular trades across Rates and Equities at risk of sloppy forced-unwind.

In short, some time in the second half beware the stagflationary risk-parity killer trade, where both stocks and bonds are sold off at the same time, where with trade war continuing, inflation makes a surprise appearance, crushing both duration and risk exposure at the same time, and potentially resulting in a stock and bond market cataclysm.

via ZeroHedge News http://bit.ly/2M52VIW Tyler Durden