Authored by Marc Orsley of PrismFP

- Oil sell off coming at the most inopportune time with PMI’s melting

- If oil sell off persists, US growth is going to contract and that is why Fed cut pricing is reasonable

Back after a couple days on the road and would have to say I missed watershed price action.

I have constantly seen over the past few years the market underestimating the effects of a meaningful rise or fall in crude oil prices. First in 2014 when most economists thought falling oil would be a stimulus (wrong, collapsing production killed growth and the petrodollar) and then in 2017-2018 when rising oil helped provide the market with an inflationary impulse when most were stuck in a lowflation mindset (inflation rose and put the Fed into a consistent hiking cycle).

This week, crude oil has fallen over 7% and it’s safe to say the bull market WTI has been in since December, is now over.

I find the 7% collapse in crude this week more than interesting. What is the read through here that prices are collapsing in the face of multiple bullish elements such as:

- The highest geopolitical risk regime we have seen in a while in the Mid-East with US-Iran precariously close to military escalation

- Venezuela continuing to languish with continued production shrinkage

- Saudi Energy Minister al-Falih saying its possible to rollover the OPEC production cuts in 2H

- US production, which has been on a secular two year ascent, has now shifted lower

- Entering the peak seasonal demand/summer driving period

- OMO 2020 product demand starting to gain momentum (this is the marine sulfur output story where cargo ships will need a higher quality of crude to omit less sulfur).

If all that supply disruption and disruption potential is not able sustain WTI over $60, we must make the read through that global demand, and thus global growth, is weak. That is the important signaling here. That was confirmed by the IEA last week who cut global oil demand from 1.4m bpd to 1.3m bps and the IEA’a Atkinson who indicated that that lower oil demand growth outlook was “modest” and there was “no demand shock.”

The breakdown in WTI could not be coming at a more inopportune moment. Regular readers will know that I focus less on lagging indicators such as the unemployment rate and more on forward indicators such as PMI’s. Doing so has allowed to accurately project the current economic environment we are in today. Thus, this week’s atrocious PMI data is signaling further weakness to say the least.

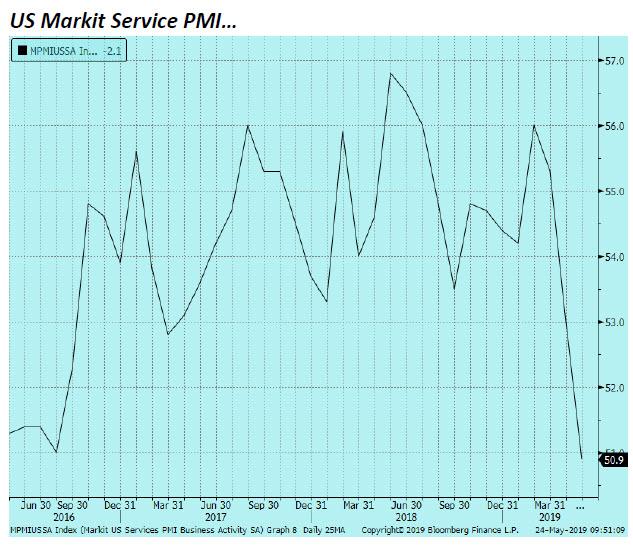

Here is my rub though, while the US Markit PMI is not the gold standard (NAPM still is), at 50.6; this index is perilously close to falling into contraction. That data was collected pre-WTI breakdown. I can assure you that falling crude prices will only add to the malaise and that means we should assume manufacturing PMI’s in the US will fall into contraction territory relatively soon.

Do not underestimate how much oil and all the “downstream” industries means to the US economy. At roughly 12m barrels/day of production, the US is now by far the largest crude producer in the world (Saudi’s are currently producing around 10m barrels/day).

To be clear, this is not a big call on oil prices. It is just to say that if WTI remains sub-$60 and/or continues to fall; US growth will further deteriorate especially as trade wars persist too long.

You may say well manufacturing makes up roughly 15% of the US economy but as we also saw yesterday; US Markit Service PMI hit the lowest level since the summer of 2016. Therefore, there are signs that manufacturing/export led weakness caused by trade wars is bleeding through to the larger economy. There is a clear slowdown occurring, and the S&P 500 and the Unemployment rate are a bit of false signals (or lagging ones)

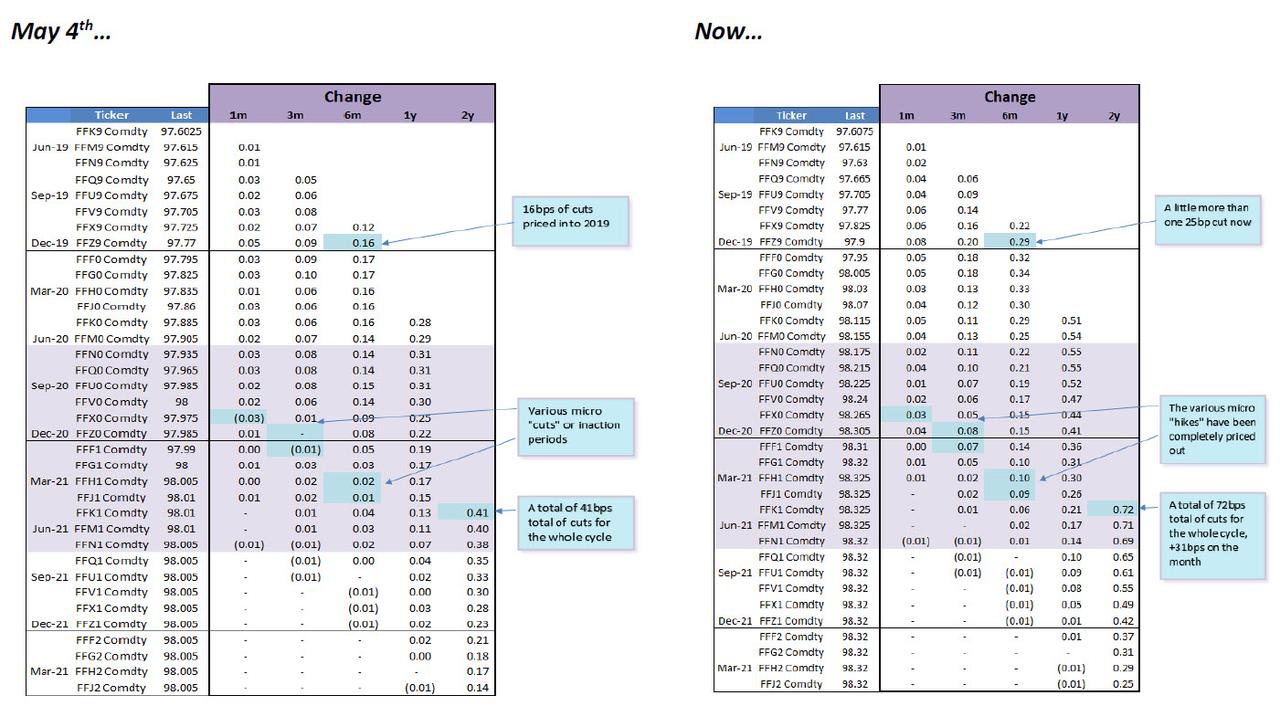

This is why it is perfectly reasonable to price in Fed cuts with S&P’s still within 5% of the all-time highs and the Unemployment rate at all-time lows. Growth is soft and it is about to get softer if crude oil does not recover. With almost 70% of a chance of a Fed cut by September, I continue to think that is not the play here. The wiser position is to play the terminal amount of cuts which has risen from 40bps when I first showed the underpricing earlier this month to now 72bps.

In a world where the Fed has become obsessed with inflation, the move this week in oil is crushing inflation expectations.

This inflation expectation decline is one big reason (I have about 8 others if you want to go over it) why Fed cut pricing will persist and likely grow in the face of still sky high equity prices and a tight labor market. The Fed has two mandates and their main focus/obsession, inflation, is now falling out of bed.

via ZeroHedge News http://bit.ly/2X4RvGi Tyler Durden