There was a time when in the years following the financial crisis, every Friday the FDIC would report of one or more small and not small banks failing, as their liabilities exceeded their assets, who were taken over by larger peers with a taxpayer subsidy to cover the shortfall. And while this weekly event, also known as “FDIC Failure Friday” has faded from the US for now, it has made a grand appearance in China.

China’s financial regulators said on Friday the country’s banking and insurance regulator and the central bank, will take control of the small, troubled inner Mongolia-based Baoshang Bank due to the serious credit risks it poses. The regulator’s control of Baoshang will last for a year starting on Friday, the People’s Bank of China (PBOC) and China Banking and Insurance Regulatory Commission (CBIRC) said on their websites.

China Construction Bank (CCB) will be entrusted to handle the business operations of the small lender, based in the industrial city of Baotou, the statement said.

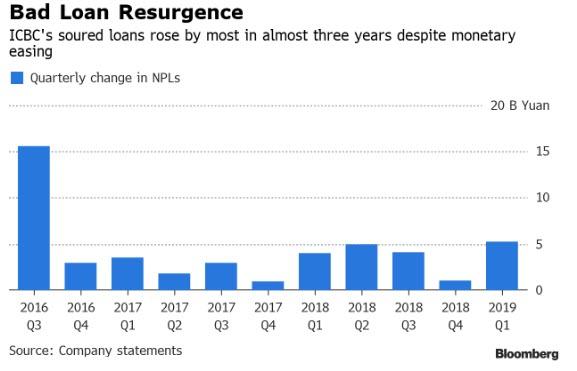

Such a takeover by national authorities is extremely rare, and takes place amid gathering concerns among regulators and financial analysts about a renewed surge in bad debts…

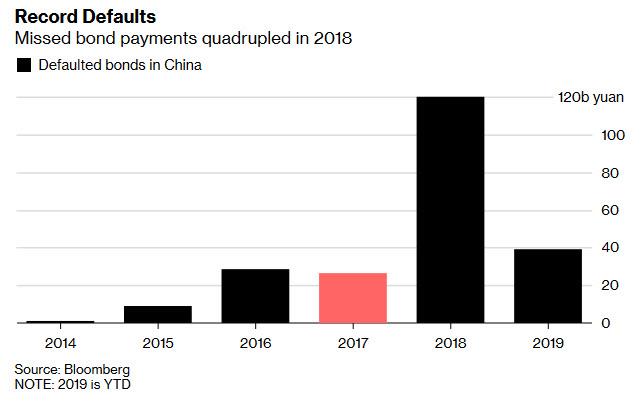

… a record pace of corporate defaults, amounting to 39.2 billion yuan of domestic bond defaults in the first four months of the year, 3.4 times the total for the same period of 2018…

… and the deteriorating health of small-scale banks in rural areas and small cities as China’s economy slows and enormous debts come due.

“It’s a rare move for the Chinese central government to take over a bank,” said Shujin Chen, an analyst with Huatai Securities.

Moody’s analyst Yulia Wan told the WSJ that regulators likely decided to take over Baoshang to limit any fallout to businesses in Inner Mongolia. “The move is to reduce the risk of a shock to the local economy,” said said, adding that the Baoshang takeover appeared to be the first time that national authorities seized control of a bank since Chinese lenders started listing on stock markets in the 1990s. In the past when banks came under pressure, local authorities would pull together funds from local state-owned firms and investors, or have another bank stage a takeover.

As Reuters adds, this extremely rare takeover – the first in nearly three decades – comes at a time when the PBOC has aggressively eased financial standards and cut reserve ratios for smaller banks to avoid just this outcome, and highlights the long struggle of some smaller regional lenders in China, which suffer from deteriorating asset qualities, inadequate capital buffers, and poor internal controls and corporate governance

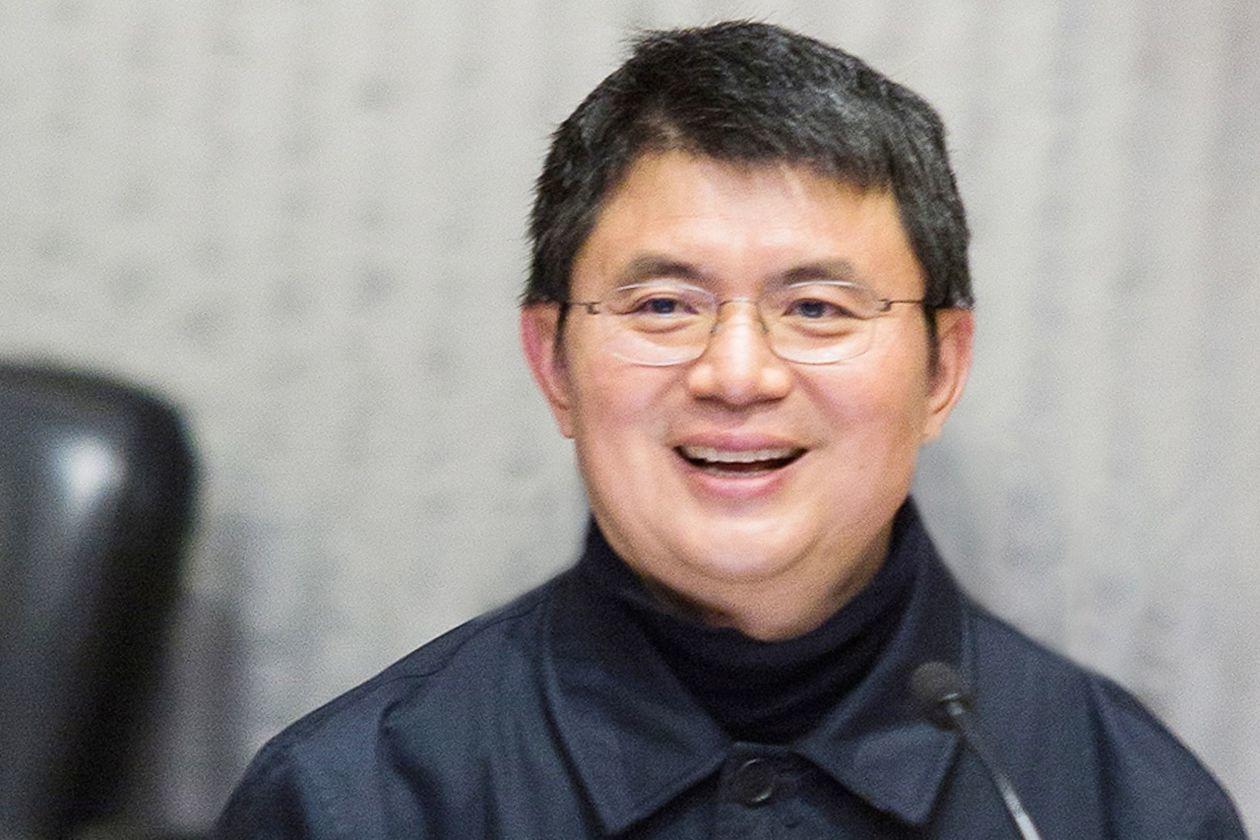

Baoshang Bank rose to prominence after its key stakeholder Tomorrow Holdings was targeted in a government crackdown on systemic risks posed by financial conglomerates. The bank was also linked to financier Xiao Jianhua, according to the WSJ. Xiao left Hong Kong and crossed the border into mainland China in early 2017, according to statements from Hong Kong police and his company, and he hasn’t been heard from since.

Later that year, Baoshang “unexpectedly” reported a capital shortage. Chinese ratings agency Dagong Global Credit Rating Co. then revised its outlook on Baoshang to negative, questioning the lender’s ability to repay borrowings. They were right.

There is concern the Baosheng takeover “will add to the vulnerability of country’s financial system amid the economic slowdown.”

While it has been generally described as a “small” bank, Baoshang had a total of 156.5 billion yuan ($22.68 billion) of outstanding loans by the end of 2016, a 65% jump from the end of 2014, according to the bank’s last filing on its assets and liabilities on its website. What is absolutely bizarre, however, is that the bank’s “official” non-performing loan ratio then was only 1.68% as of December 2016. That, in itself, would never have been sufficient to force a takeover, and suggests that not only was the bank’s real bad debt ratio much higher, but that China continues to chronically under-represent the true state of its NPLs to avoid bank runs.

The last time Baoshang disclosed financial data was in the third quarter of 2017. Then it had 576 billion yuan in assets and 543 billion yuan in liabilities, with a net profit of 3.2 billion yuan. Based on those 2017 numbers, analyst Long Chen with consulting firm Gavekal Dragonomics estimated that Baoshang back then was ranked around the 50th largest bank in the nation.

Naturally, to avoid a panic bank run among other smaller, less capitalized banks, the CBIRC said that principal and interest on personal saving accounts in the bank will be fully guaranteed, and the business operations of Baoshang bank will not be affected by the takeover.

The takeover of the bank is the first in decades, and takes place amid China’s crackdown on systemic financial risks, which in February 2018 resulted in the take over of former roll-up giant and conglomerate Anbang Insurance, which in 2015-2016 made eyebrow-raising investments in overseas property, including the Waldorf Astoria hotel in New York. Anbang’s chairman, Wu Xiaohui, was sentenced to 18 years in prison later that year after being convicted of fraud and abuse of power. Wu expressed remorse, according to the court that sentenced him, but he also said he doubted he violated any laws. He hasn’t made a public statement since.

The question now is whether bank investors, having seen first hand for the first time in nearly 30 years, that a Chinese bank can fail (and be taken over by the state), will jog at a leisurely pace, or not so leisurely, to their own local bank and pull out their deposits in a cool, calm and collected manner… or not so cool, calm and collected. If so, the trade with between the US and China will have a clear winner in the very near future.

via ZeroHedge News http://bit.ly/2WrkLd6 Tyler Durden