Well that was a week…

China remains best YTD followed by Europe and US the slight laggard…

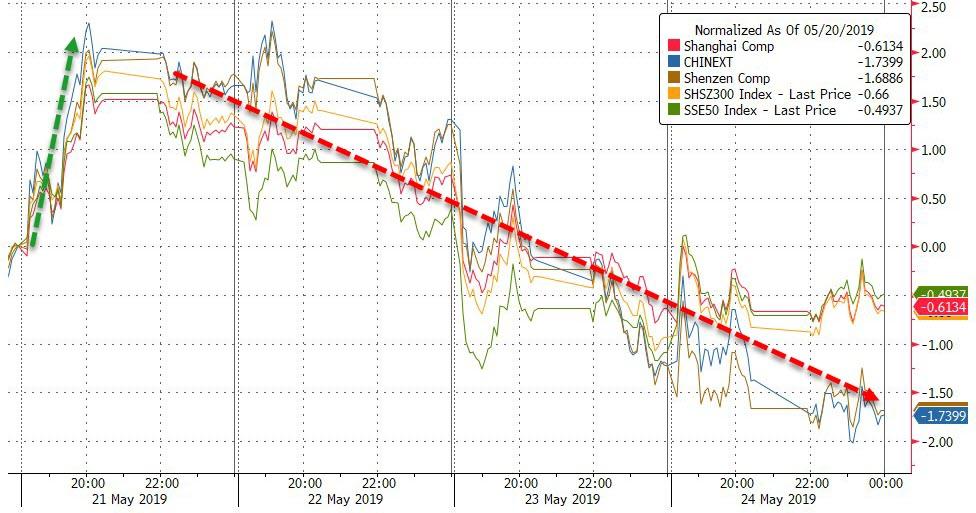

Chinese stocks were lower on the week with tech-heavy indices hit hardest…

European markets were all lower on the week, led by Italy…

US stocks were also down on the week as trade tensions escalated and morphed into growth scares… The Dow was least worst while Trannies and Nasdaq suffered most…

The Dow is down 5 weeks in a row – the longest losing streak since June 2011

“Most Shorted” Stocks had their 3rd weekly loss in a row – the biggest 3-week drop of the year – as Tuesaday’s short-squeeze couldn’t last…

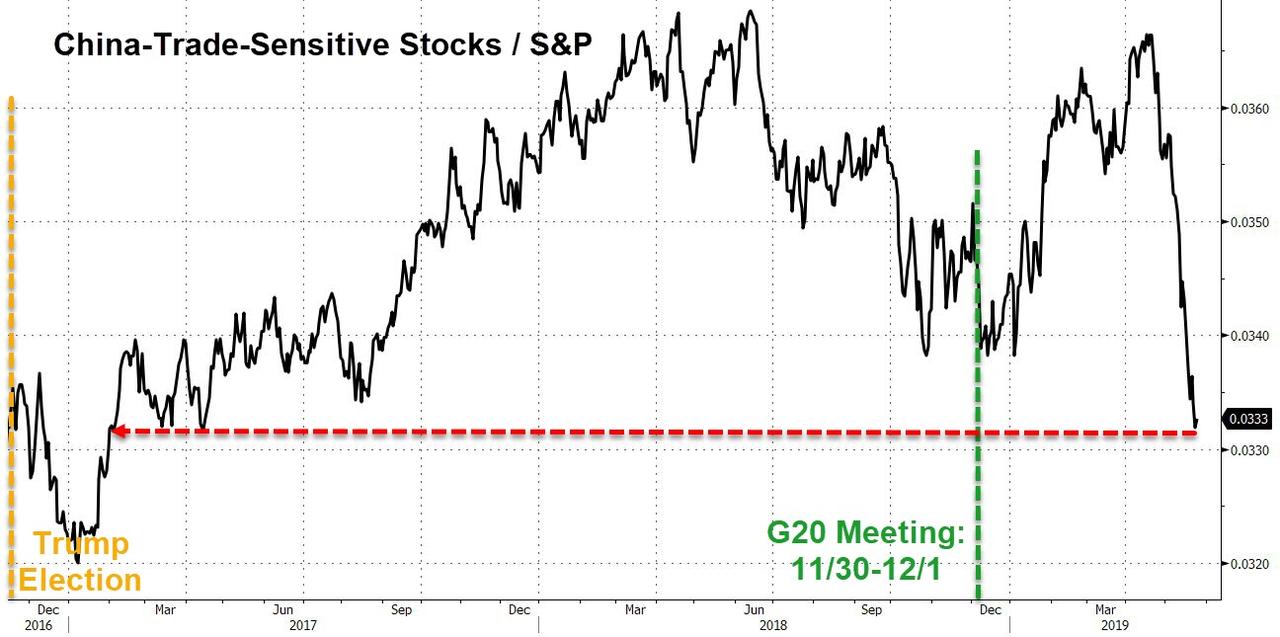

Hope of a Chinese trade deal has collapsed…

But the algos remain ever alert to a bounce on optimistic headlines (h/t @jsmauro13)

Semis suffered their worst week of the year (down 3 weeks in a row – tumbling over 16% in that time – the worst 3-week loss since Oct 2008)

Technology stocks overall were whacked…

Energy stocks are down 7 weeks in a row…

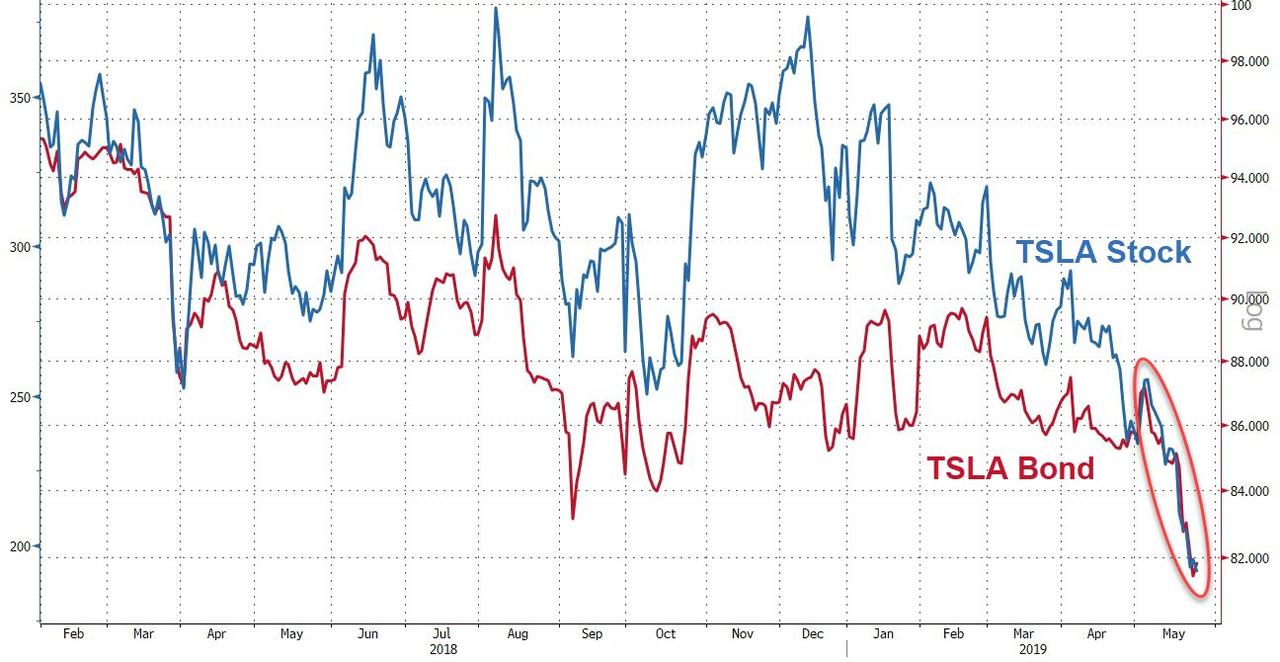

Musk had a bad week…

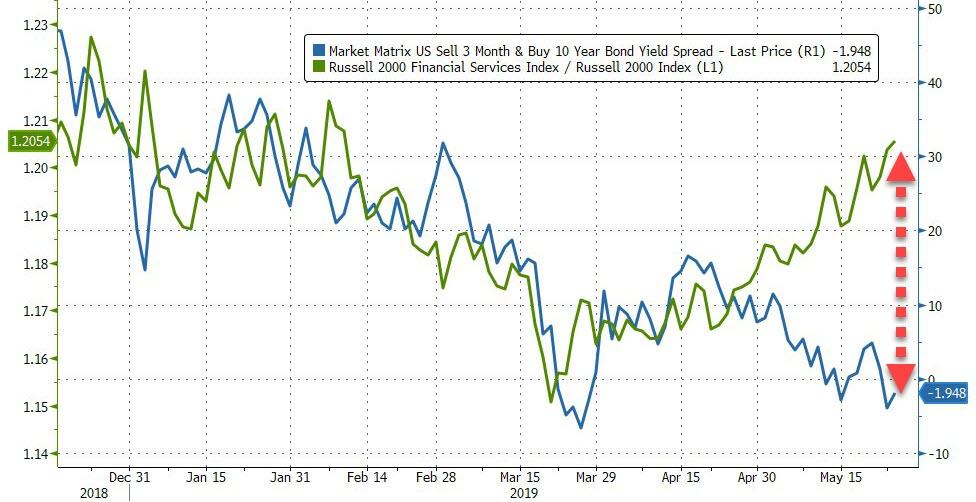

Banks outperformed the market this week, but don’t hold your breath…

Credit markets blew wider this week even as VIX ended the week almost unchanged…

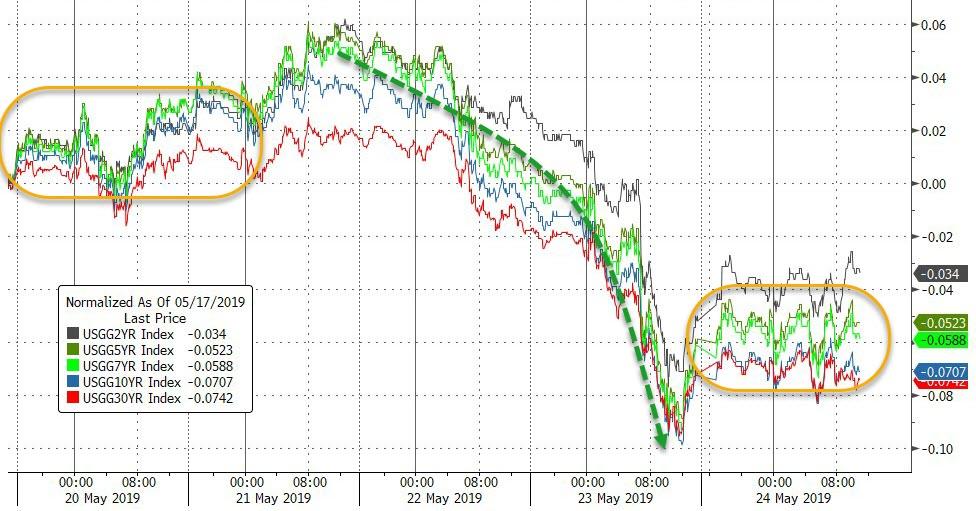

Treasury yields took a breather today (and a half day ahead of Memorial Day) after a breathless plunge midweek…

Slamming yields to multi-year lows…

10Y Yields are down 5 of the last 6 weeks to 2.32% – the lowest weekly close since Oct 2017…

The yield curve crashed back into inversion this week…

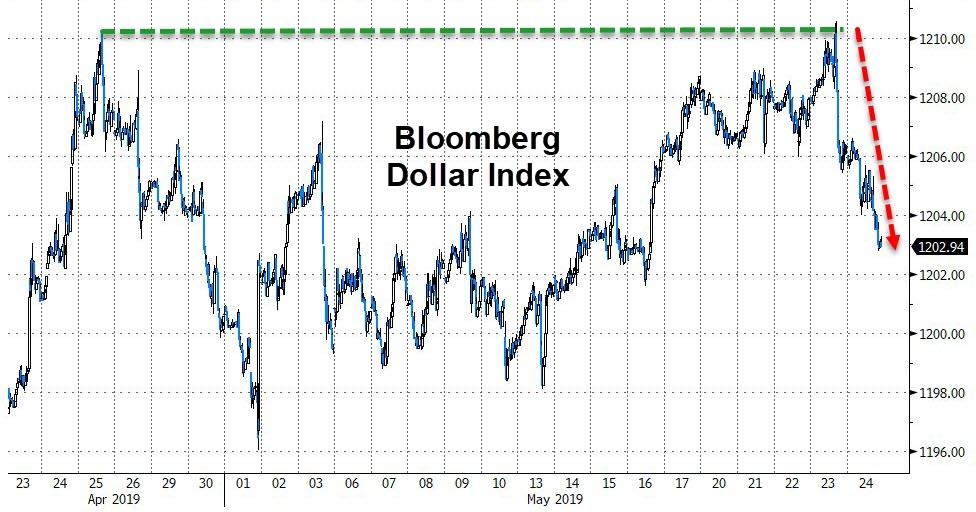

The Dollar Index slumped this week after a brief surge early yesterday to a new cycle high…

Cable had a volatile week of May/Brexit headlines but ended the week practically unchanged…

Litecoin soared over 15% today but Bitcoin and Bitcoin Cash also surged again on the week…

With Bitcoin back above $8000…

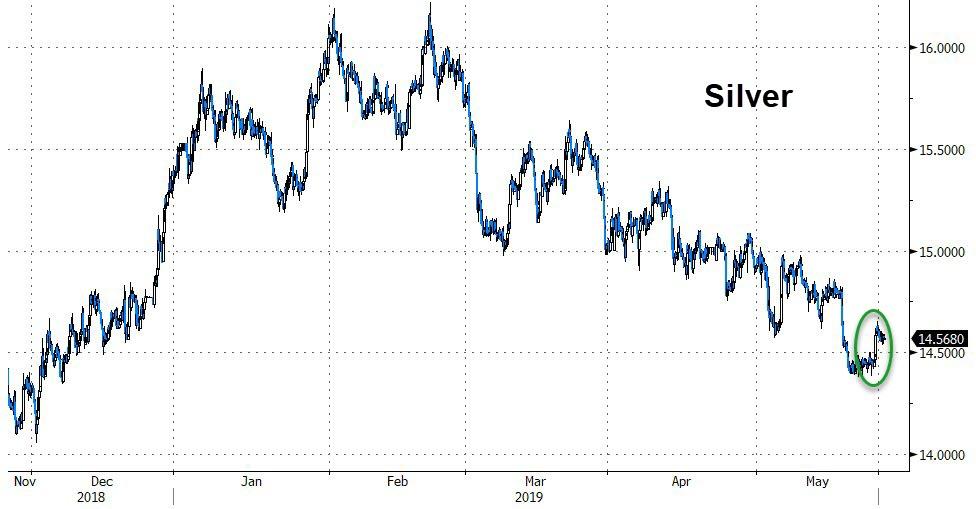

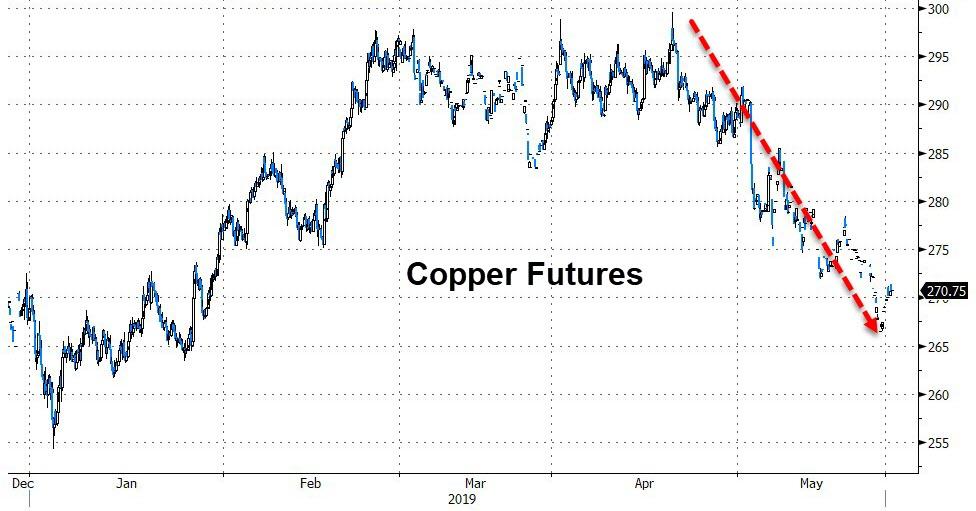

And ugly week for WTI crude (and copper) with PMs managing gains…

WTI broke below its 50- and 200-DMA, but bounced at the 100DMA for now…

Silver had its best week in 4 months…

Copper was clubbed like a baby seal…

Finally, The Fed has a problem – how’s it going to be able to support the market when investors are already pricing in 45bps of rate cuts for 2019…

It appears the market thinks the recession has already started…

Has the recession already started? Real retail sales peaked in Nov/2018; real PDI peaked in Dec/2018; IP peaked in Dec/2018; and HH employment peaked in Feb/2019. The 4 cornerstones of the economic cycle.

— David Rosenberg (@EconguyRosie) May 15, 2019

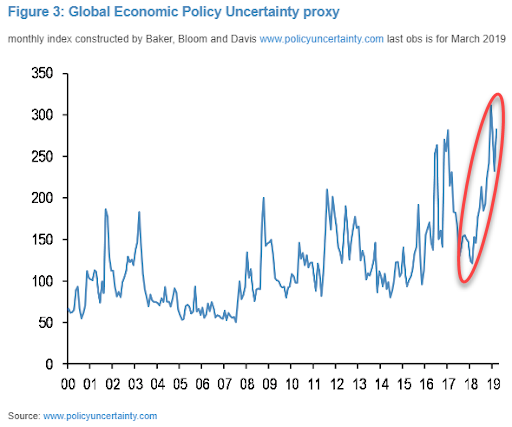

Global Economic Policy Uncertainty is back near record highs…

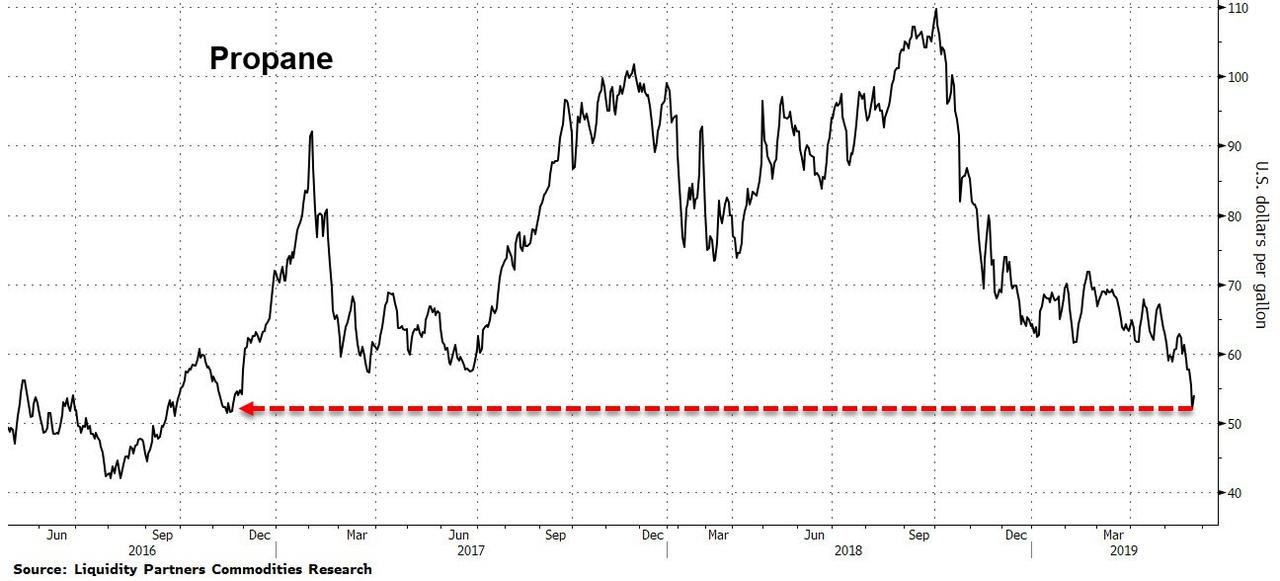

But there is a silver lining…It’s going to cost you less to refill the propane tank for your gas grill this Memorial Day weekend. Propane prices have plunged this month, reaching their lowest level in more than 2 1/2 years…

via ZeroHedge News http://bit.ly/30GgO3F Tyler Durden